Image 1: ThitsaWorks' technical team at a retreat in Bangkok

Project Description

ThitsaWorks, in collaboration with the Mexican Association of Credit Unions of the Social Sector (AMUCSS) and The People's Clearinghouse (PCH), is implementing an inclusive and instant payments network at the subnational level for credit union members across Mexico. This project builds upon ThitsaWorks' initial Research and Development Phase of ThitsaNet, an innovative payment network designed for the unbanked and underbanked in Myanmar.

ThitsaNet consists of two key components:

Thitsa Payment Portal: This portal connects microfinance institutions lacking core banking systems or API capabilities to a real-time payment platform, serving as a bridge to interoperability.

ThitsaX Connector: A network of interconnected Interledger connectors that enable cross-ledger transactions. Leveraging the Interledger Protocol, these ThitsaX nodes route and process payments across different payment systems, facilitating the transfer of value between diverse ledgers and networks.

This innovative approach, initially developed for Myanmar, is now being adapted and expanded for the Mexican credit union sector, demonstrating the versatility and scalability of the ThitsaNet concept.

For more detailed information on the initial phase of ThitsaNet, please refer to our previous reports.

Project Scope and Objectives

The primary focus of this project is to implement a comprehensive, real-time payment network at the subnational level for credit union members across Mexico, in collaboration with AMUCSS and PCH. The key objectives include:

Deploy a payment hub for AMUCSS and support the integration of community banks with this hub.

Customize and deploy the Thitsa Payment Portal (TPP) to meet the specific requirements of Mexican credit unions without back-end systems to integrate into instant payment networks.

Expand TPP capabilities to include account-to-account payments, tailored to the needs of community banks in Mexico.

Enable instant domestic payments within Mexico and prepare for future cross-border remittances through interoperability with the Rafiki Payments Platform via a Cross Network Provider (CNP).

New Development

ThitsaWorks is pleased to report significant progress in expanding the application of ThitsaNet beyond its initial scope. In addition to our ongoing work with the People's Clearinghouse for deploying the payment hub and customizing the Thitsa Payment Portal in Mexico, we are now embarking on an exciting new venture in South East Asia.

We are thrilled to announce that we are working with a mobile money provider and three microfinance institutions (MFIs) to initiate a pilot. This pilot aims to digitize microfinance loan repayments and disbursements, marking a significant step towards financial inclusion in the region.

The key objectives of this pilot include:

Development and deployment of ThitsaX Connectors, which will act as intermediaries to enable secure and seamless transactions across diverse payment networks.

Integration between the mobile financial services provider and participating MFIs.

Demonstration of the feasibility and benefits of digitizing loan repayments and disbursements for microfinance clients.

This initiative leverages the ThitsaX Connector component of ThitsaNet, showcasing its versatility and potential for creating an inclusive and efficient financial ecosystem. By bridging the gap between mobile money services and microfinance institutions, we aim to enhance financial accessibility and reduce transaction costs for underserved populations.

This pilot represents a significant milestone in our journey to expand the reach and impact of ThitsaNet, contributing to our vision of creating more inclusive financial systems across diverse markets.

Project Update

ThitsaWorks has made significant progress in implementing an inclusive and instant payments network for credit unions in Mexico. Key milestones and challenges include:

Deployment of Payment Infrastructure:

Successfully deployed a payment hub in People's Clearinghouse's hosting environment.

Conducted a Design Workshop with PCH and Interledger Foundation to finalize the hub's design, which extended the timeline by a few weeks but ensured alignment with stakeholder needs.

Provided comprehensive documentation and training to the PCH team, facilitating knowledge transfer and capacity building.

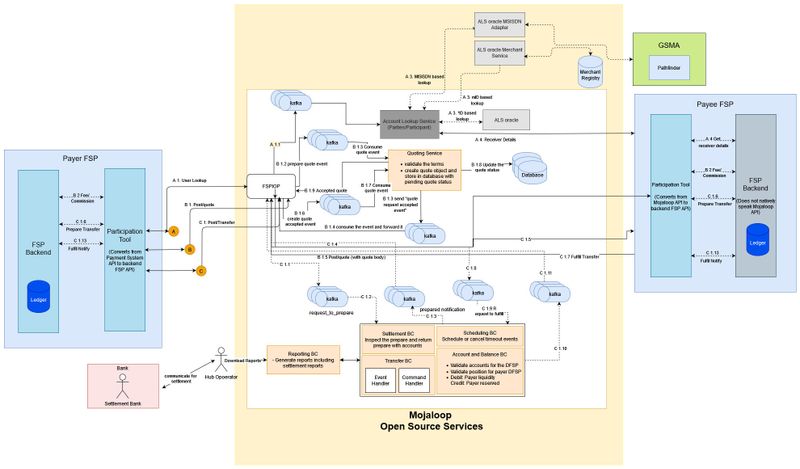

Figrue 1: System architecture of payment system updated based on agreed design decison

Thitsa Payment Portal (TPP) Development:

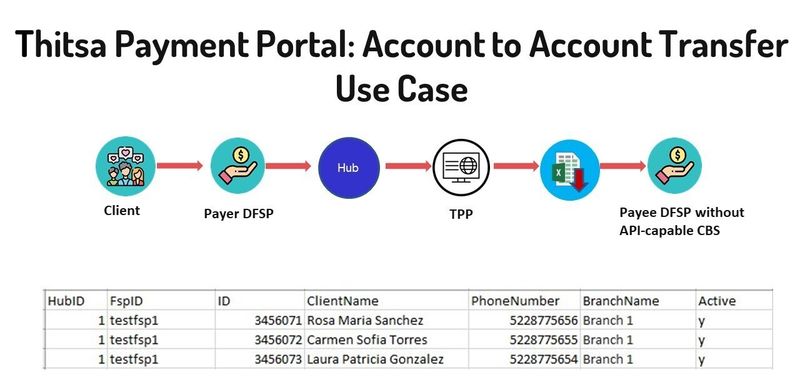

Adapting TPP for Account-to-Account payment use case, tailored for domestic transactions between Mexican community banks.

Integration with the payment hub in the development environment is complete, with plans to link to the PCH staging environment pending approval.

Scheduled completion of this crucial functionality by July, marking a significant milestone in the project.

Figure 2: Account-to-Account transfer use case for community banks in Mexico

Environment Setup and Cost Optimization:

Established a staging environment on PCH's server.

Proposed an innovative cost-saving measure through automatic server hibernation during inactive periods, demonstrating our commitment to efficient resource utilization.

DFSP Onboarding and Integration:

Initiated discussions for onboarding two Digital Financial Service Providers (DFSPs) through core connectors and one via TPP.

Collaborating with PCH to integrate the core banking system with the hub.

Planned onboarding of SMB Contigo Microfinance for end-to-end transaction testing.

Challenges:

The project experienced slight delays in deploying the hub and TPP due to extended design decision-making and customization requirements.

The ongoing cost analysis for the proposed server hibernation approach has created a dependency for integration testing of the Thitsa Payment Portal (TPP). Currently, the staging environment is on hold until cost details are finalized, which has temporarily delayed the integration testing process.

Despite these challenges, the project remains on track to significantly enhance financial inclusion across Mexico's credit union sector. The ThitsaWorks team's adaptability, focus on stakeholder collaboration, and close cooperation with the PCH team have been crucial in navigating these hurdles while maintaining progress towards our objectives.

Key Activities & Outputs

We are pleased to report the following progress on key activities in supporting PCH to implement an inclusive and instant payments network.

Infrastructure Setup:

Deployed and configured a production-grade Mojaloop Hub in People's Clearinghouse's (PCH) hosting environment. (Completed)

Implemented Operational Systems/Modules for streamlined end-to-end testing. (Completed)

Designed and developed Alias Oracle (Alias Directory) for Account Lookup Service (ALS). (Completed)

Thitsa Payment Portal (TPP) Development:

Customization of TPP for Account-to-Account payment use case. (In progress, expected completion in July)

Identified necessary fields for account-to-account template based on Mexican regulatory standards. (Completed)

Conducted integration testing between TPP and the hub in the testing environment. (Completed)

System Integration and Testing:

Error message mapping. (Completed)

Collaborating with PCH to integrate IsisPlus CBS APIs with Lightweight Core Connector (LCC) for system demonstration. (In progress)

Capacity Building:

- Conducted Hub Deployment Training, TPP Overview, and Operational Knowledge Sharing sessions. (Completed)

DFSP Onboarding:

Working closely with the PCH team for DFSP selection. (One DFSP identified)

Initiated integration with IsisPlus CBS, owned by Red Oaxaca. (In progress)

Plan to onboard SMB Contigo Microfinance for transaction demonstrations. (Planned)

Ongoing discussions with SINEFI CBS for potential involvement. (In progress)

Stakeholder Engagement:

- PCH consulting with AMUCSS stakeholders on TPP use case and potential DFSP candidates. (In progress)

System Architecture:

- Updated system architecture based on agreed design decisions. (Completed)

We continue to adapt our approach based on stakeholder feedback and technical requirements, ensuring the project meets the needs of credit union members across Mexico.

Image 2: ThitsaWorks' technical team at technical deep dive for ThitsaNet

Project Impact & Target Audience(s)

This project aims to create a significant impact on financial inclusion in Mexico, primarily targeting members (clients) of the Mexican Association of Credit Unions of the Social Sector A.C. (AMUCSS). The focus is on improving financial services in rural areas, where access to modern banking infrastructure is often limited.

The target audience encompasses a diverse range of individuals, including:

Rural communities across Mexico

People of different genders, ethnicities, and colors

Individuals with disabilities

Marginalized groups previously underserved by traditional financial institutions

By implementing an inclusive and instant payments network at the subnational level, this project aligns with the Interledger Foundation's mission to create a more inclusive financial system. The payment platform, once operational, will enable:

Faster and more efficient transactions between credit union members

Increased access to financial services for underserved populations

Greater financial autonomy for rural communities

The project supports the Interledger Foundation's goals by:

Utilizing open-source technology (Thitsa Payment Portal) to facilitate interoperability

Enhancing cross-ledger transactions through the use of Interledger Protocol

Promoting financial inclusion by connecting institutions without advanced core banking systems to real-time payment platforms

As the payment platform goes live, it will significantly enhance financial inclusion across Mexico, providing previously underserved communities with access to modern, efficient financial services. This initiative represents a crucial step towards creating a more equitable financial ecosystem in the country.

Monitoring & Project Evaluation

ThitsaWorks employs a comprehensive approach to monitor and manage project activities:

Project Management: We use Trello's Kanban Board to manage and visualize project-related tasks, ensuring clear tracking of progress and deadlines.

Communication Channels: Slack and email serve as our primary communication channels, facilitating quick and efficient information exchange among team members and stakeholders.

Regular Check-ins: Weekly meetings between ThitsaWorks and People's Clearinghouse (PCH) management teams provide visibility on ongoing activities and allow for timely input and guidance.

Collaborative Workstreams: ThitsaWorks and PCH teams meet under various workstreams as needed, sometimes on a daily basis, to address specific project aspects.

Despite these measures, the project experienced slight delays in deploying the hub and Thitsa Payment Portal. Extra time was required to finalize design decisions and customize the portal for the new Account-to-Account payment use case. The project's progress also depends on the consultation with stakeholders regarding the use case, which is being led by the PCH Team. However, we are on track to complete the implementation of this new scenario and onboard a Digital Financial Service Provider (DFSP) by the end of the project.

Progress highlights include:

Initiation of integration with LCC and IsisPlus, with transaction demonstrations expected by August.

Development of necessary APIs by IsisPlus for both payer and payee sides, including a user interface for community banks.

Ongoing integration of the middleware layer.

Capacity-building sessions for the PCH team to ensure knowledge transfer throughout the process.

Moving forward, we will continue to leverage our project management tools and communication strategies to mitigate risks and ensure timely completion of project milestones.

Communications and Marketing

ThitsaWorks, with support from the Interledger Foundation's Communications and Program Teams, has announced the project and collaboration with People's Clearinghouse (PCH) on social media. [LinkedIn: https://www.linkedin.com/posts/thitsaworks_interledger-foundation-grant-awarded-to-thitsaworks-activity-7207214383708459009-ntyj]. We invite you to engage with our LinkedIn post to help amplify the message. In partnership with PCH, we plan to present the project at the Interledger Summit 2024.

We are proud to be part of this journey and eager to share it with a wider audience. We recently met with the Interledger Foundation's Communications Team and Channel V Media to share our story. We are committed to providing project updates at various events to keep the community informed and foster collaboration.

What’s Next?

In the remaining months, in partnership with PCH, we plan to:

Complete TPP implementation with Acount-to-Account payment use case.

Onboard one DFSP through TPP and two more through middleware layer integration.Support PCH in technical improvements based on Cross Network Provider and SPEI integration requirements.

Conduct end-to-end transaction tests with SMB Contigo Microfinance after integration.

Community Support

ThitsaWorks is actively engaging with the Interledger community:

Sharing project updates and progress through various channels.

Planning to participate in the Interledger Summit 2024 to present the project and implementation status.

Seeking community feedback once TPP is released as open source.

We are eager to meet community members, share conversations, and learn their stories at the Interledger Summit 2024. Last year's experience at the Summit was truly inspiring and motivating, as we learned about innovative developments within the community.

Additional Comments

ThitsaWorks is expanding the application of ThitsaNet beyond its initial scope in Mexico. The company has initiated a pilot project in South East Asia, collaborating with a mobile money provider and three microfinance institutions (MFIs). This pilot aims to digitize microfinance loan repayments and disbursements, focusing on financial inclusion in the region.

Key objectives of the pilot include:

Developing and deploying ThitsaX Connectors for secure transactions across diverse payment networks.

Integrating mobile financial services with participating MFIs.

Demonstrating the benefits of digitizing loan processes for microfinance clients.

This initiative showcases the versatility of the ThitsaX Connector component and its potential for creating inclusive financial ecosystems. By connecting mobile money services with microfinance institutions, ThitsaWorks aims to enhance financial accessibility and reduce transaction costs for underserved populations.

This pilot marks a significant milestone in ThitsaWorks' journey to expand ThitsaNet's reach and impact, contributing to their vision of creating more inclusive financial systems across diverse markets.

We would like to express our sincere gratitude to the Interledger Foundation for providing us with this opportunity to be part of this transformative journey in creating more inclusive financial systems globally.

Relevant Links/Resources (optional)

Website: www.thitsaworks.com

LinkedIn: www.linkedin.com/company/thitsaworks/

Mail: info@thitsaworks.com

Facebook: https://www.facebook.com/Thitsaworks?mibextid=LQQJ4d

Twitter: https://twitter.com/thitsaworks?t=jTSukYU2D6in-P1tzYyh6g&s=09

Top comments (0)