Contents:

- Brief Project Description

- Project Update

- Project Impact and Target Audiences

- Progress on Objectives, Key Activities

- Communications and Marketing

- What's Next?

- Community Support

- Relevant Links/Resources

Brief Project Description

Mifos was awarded as a grantee in Jan 2024 to investigate the relevance of ILP to Digital Public Infrastructure (DPI).

This project was undertaken as two complimentary stages, with the first stage being a research assessment (based on interviews of experts) into the relevance or how to achieve relevance of ILP within the financial sector and DPI specifically. Secondly, a design effort to understand how to modify existing technologies to become more relevant and how these could be demonstrated.

Our mid-term progress report published in March 2024 gave an early insight into the interview progress

Project Update

The project has now concluded both its interview/research and design activities and we are delighted to share with the community what we have discovered and our proposed next steps.

Interview and Research

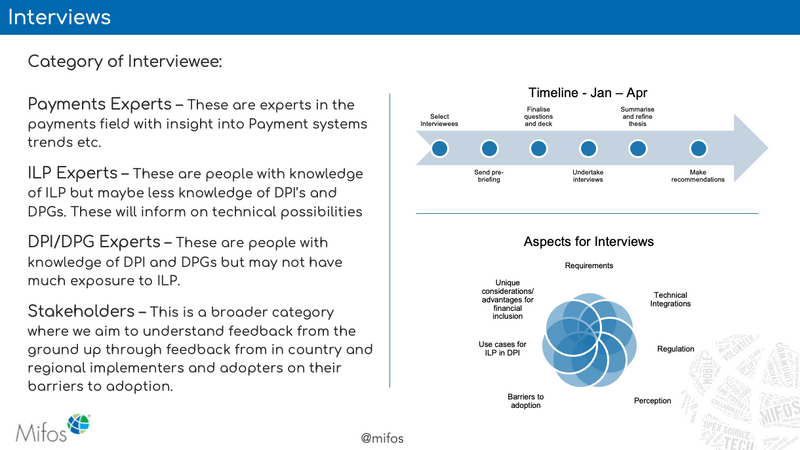

During the interview and research stages we followed an approach where over a period of four months we refined question sets around hypotheses and interviewed over 23 experts from different fields around their views of ILP and DPI and the possible inclusion of ILP within DPI.

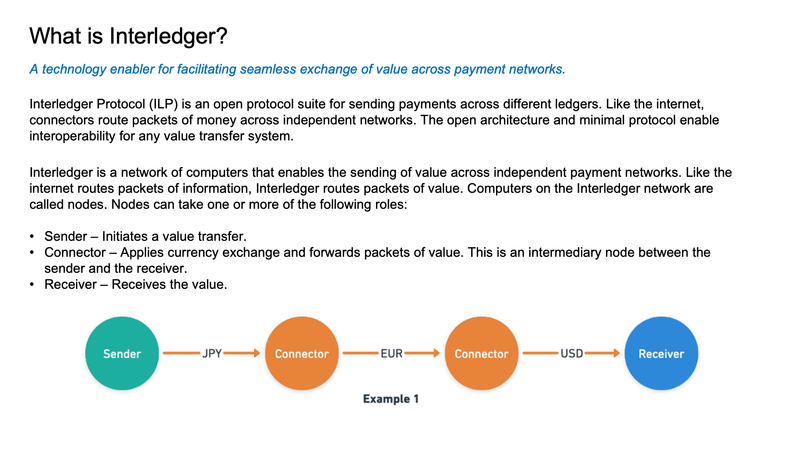

One of the key gaps we identified early on was the lack of sufficiently detailed materials for explaining the ILP and how it fits into existing payment conversations and conventions.

For some stakeholders, especially payment specialists, we also needed to explain more about the DPG and DPI concepts.

These discussions led to the need for more detailed presentations and explanations of the utility of ILP, the relationship between ILP and other technologies like Stream protocol, Rafiki, payment pointers and Open Payments. Alongside this was the need to explain Digital Public Goods, how DPGs are different but potentially leveraged by the concept of DPI, and the notion of the payment aspects of financial inclusion as separate from other agenda items in global banking and payments.

This highlights a key point: there are several non-overlapping communities of practice involved to enable a clear understanding, which holds back conceptual alignment.

In our introductory materials, or “explainers” we highlighted the alignments for financial inclusion and included explainers of ILP, Digital Public Goods and the DPI principles. For example:

From these interview discussions we were able to see trends across multiple participants. The following is a summary of some of the key observations, made by more than one participant, and paraphrased for clarity:

Integrating the ILP vision into the current financial systems is still being determined.

"I would agree that we are seeing federated approaches to payment schemes surface, particularly around trans-national payments. That is, the participants aren’t part of the same physical switch. The implication is that a federated approach like that proposed by the ILF could work, with the right sort of legal and regulatory arrangements." - Payment Scheme Expert

"I am a payment expert but still need help figuring out how this works in real life, and the ILP founders need to prepare participants for a setup like this by explaining how it differs from existing systems. Saying ILP payment is just like sending an Email is not compelling in comparison to cause an email is not settled, and if not received, the user can send it again, and acknowledgement is optional. However, payment must be decided following some scheme or bilateral arrangement, so there are a lot of logistical scheme-type arrangements in the background that would be required to make this work.” -Payment Expert

A whitepaper should be considered as a means of articulating the ILP more clearly to the payment community. To extend this analysis, some of the key points to cover in the whitepaper would be:

- How ILP changes today’s payment scheme models and nonetheless fits into regulatory frameworks;

- How ILP-based cross-border and cross-currency payment systems will specifically address settlement in line with existing regulations;

- How ILP-based payments could operate in line with a concept of CBDCs or tokenized currencies in different ledgers;

- How, if a multilateral settlement model is adopted, this will be different from a payment-centralized switching model that is widely used the market;

- How ILP solves what gaps in the current payment systems, why it is essential given trends in market; and,

- Which process will the ILP community and foundation follow to promote acceptance of a standard protocol in the payment industry.

Build examples in market to demonstrate value and acceptance

- ILP must find a real-world business model and business case to solve. In general, Rafiki seems to be one way of exploring this path (sometimes referred to as a “test net”) and more use cases should be added until it identifies an actionable market gap. Rafiki will also need to adapt to fit into the current payment regulation and legislative framework.

- The most attractive use cases will be from small organizations excluded from the current payment ecosystem. In particular, the ability to send international remittance funds or to build a low cost merchant C2B network at the local level are important use cases. This strategy could be aimed at lowering the entry barrier for smaller non-bank financial services businesses that do not directly participate in today’s national and cross-border payment schemes.

“I’ve always thought that the ILF should use the deployment of Mojaloop switches to enable a wider set of ILP enabled entities that would be extensions to the Mojaloop switch concept for smaller institutions.”

- Examples of this can be seen in the work being undertaken in Mexico where through work funded by the Interledger Foundation [1] Thitsaworks is partnering with the Mexican Association of Credit Unions of the Social Sector (AMUCSS) on The Peoples Clearing House (PCH) Initiative to develop an inclusive and instant payments network for credit unions’ members, who are currently excluded from the national instant payments system.

Identify key allies and opportunities like CBDCs, DFI, DPGs, and Finternet; work on standards alignment

- Key payment providers and networks like SWIFT, Visa and Mastercard may view ILP as threatening their existing networks. Hence, they will likely reject the ILP idea on several grounds, including the instability of a well-established and trusted payment network/models and currency risks introduced by new bilateral settlement frameworks.

-

New payment industry players, unencumbered by the current ecosystem, have a unique opportunity to embrace ILP and leverage it as a gateway to foster their market entry.

“I see an industry and market acceptance of ILP at this point to be a significant huddle for your initiative; hence, I suggest you explore certifying this as an ISO standard or any notable certification relevant to the payment network industry.”

Central Bank Digital Currencies (CBDCs) potentially offer a route to use ILP as a bridging mechanism for commercial bank money, central bank money, and CBDCs. This is a strategy of aiming for where payment systems need to go in the next ten years rather than trying to participate in the current path of upgrades to the ISO20022 payment networks.

Design Analysis

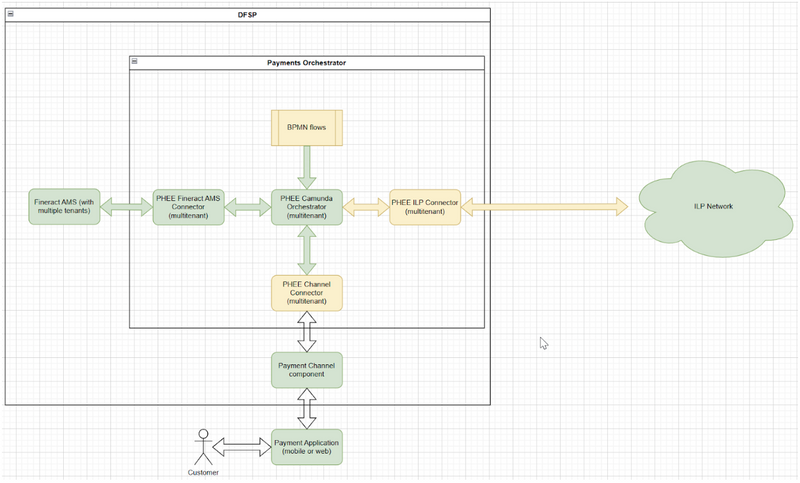

Based on the feedback we obtained and some of the initial hypotheses we had we then went on to explore the design considerations on a number of potential DPI architectures that would include ILP/ILF components.

- The first design idea stayed with the current design of Rafiki and proposes to Instantiate an ILP network with fineract and Payment Hub EE using the Rafiki software. This can be designed for in-country or regional payment schemes that are foundationally aligned with the current technology stack at ILF. Trusted intermediaries could connect a Rafiki based network to a Mojaloop based payment scheme.

- Based on input from experts, we also explored the possibility of integrating crypto currency wallets, including central bank digital currencies, and the potential for tokenized currency transactions.

- Finally, the technical analysis looked at the potential for including the ILP within a Digital Public Infrastructure as a Service (DaaS).

Technical Exploration Areas and Goals

The initial project scope explored integrating the Interledger Protocol (ILP) to the Digital Public Infrastructure (DPI) initiative. The following high-level concepts were included in the investigations:

- In-country Interledger Protocol (ILP) implementation

- Regional multi-country ILP payment schemes

- Integrating crypto wallets into payment schemes using ILP

- Tokenized currency transactions

- ILP as a component of Digital Public Infrastructure as a Service (DaaS)

The architecture team looked at each of these concepts, identified the underlying architectural needs, and developed high-level designs to guide further exploration and refinement. A key goal throughout all of these was determining how ILP can contribute to the technical goals of implementing DPI, to support ILF’s alignment with the concepts of DPI.

ILP's Current Coverage of the Banking Ecosystem’s Requirements

The ILP protocol itself is designed to provide capabilities to send money across different payment networks or ledgers. Its main strengths include:

- Micropayments: ILP is well-suited for micropayments due to its packet-based architecture, making it efficient for small-value transactions.

- Cross-border Payments: ILP significantly simplifies cross-border transactions by eliminating intermediaries and reducing friction.

- Interoperability: ILP's core strength is enabling seamless transactions across diverse ledgers and payment networks.

- Messaging Trust and Security: ILP utilizes conditional transfers, ensuring payments are secure and only completed when conditions are met.

We think that these areas are well aligned with the concepts of DPI and the current track of their developments could be useful for the ecosystem in the long run.

Areas for Further Exploration/Improvement

The ILP protocol is not directly designed around fulfilling the following requirements:

- Peer Discovery, Identification and Trust: While ILP enables peering relationships via ILDCP, it lacks a specific peer discovery method. This presents an area for potential improvement to enhance network formation and security.

- Clearing/Settlement: According to the documentation these areas are not directly addressed by ILP. They rely on existing financial infrastructure or additional integrations to handle clearing and settlements.

- Regulatory Compliance: ILP is a relatively new protocol, and regulatory frameworks are still evolving. While most of the protocol definitions are clearly well-designed and would likely pass any regulatory audit, it still requires effort to actually prove compliance.

- User Experience: While ILP is user-friendly, broader user adoption requires further simplification and especially education around ILP concepts.

We think that these areas are required by DPI and some of them might be good candidates for implementation as part of or as an extension of ILP.

Participant Types

The team identified what kind of participants of an ILP network should be supported. We aimed for both adaptability by the current banking ecosystem and further growth for fulfilling DPI’s vision. Do note that these roles don't directly relate to the ILP, but are commonly required in real-life scenarios.

Currently required roles:

- Account management participants: this is a basic role, the participant handles accounts for customers.

- Payments processing participants: this is another basic role, the participant handles payment transactions for customers.

- Clearing and settlement services provide participants: the third basic role, the participant handles clearing and settlement for participants.

Suggested future role:

- Participant registry provider participants: this new role doesn’t allow participation in the payment flows directly, but would help with discovering, identifying and authenticating other trusted participants.

Of these roles the following common DFSP types should be assembled, that could be directly adapted by the current banking ecosystem:

- DFSP with account management and payment processing capabilities: this type represents currently existing customer-facing financial institutions, like retail banks. In order to participate in the ecosystem they would need clearing and settlement + participant registry as external services.

- DFSP with its own clearing and settlement scheme setup and a trusted participants registry: this type represents currently existing central banks or clearing houses in a country or in a larger region. They need to implement a clearing and settlement scheme + they need to provide a participant registry, in addition to the payment processing capabilities.

There were ideas of other possible setups, but we decided that if these two types exist as building blocks, we can simulate all the original ideas.

Participant Registries

A fundamental challenge in any decentralized network, including ILP-based systems, is establishing trust among participants. While clearing houses often rely on legal contracts, a formal participant registry based on Public Key Infrastructure (PKI) offers a more technologically robust and scalable solution.

Clearing and Settlement Solutions

Addressing clearing and settlement within the ILP ecosystem presents a range of possibilities:

-

Leveraging Existing Schemes: One option is to integrate ILP with established clearing and settlement mechanisms. This could involve:

- Mojaloop: Utilizing Mojaloop's interoperability layer to facilitate clearing and settlement across diverse payment systems.

- TigerBeetle-Based Solutions: Exploring the use of high-performance, scalable database solutions like TigerBeetle, which can be customized for clearing and settlement needs.

- Other Existing Schemes: Integrating with any other suitable clearing and settlement system, depending on the specific requirements and context of the ILP implementation.

-

Evolving ILP for Trust-Based Settlement: An alternative path is to focus on enhancing the trust mechanisms within ILP itself. This could involve:

- Strengthening Participant Registries: Implementing robust participant registries based on PKI (Public Key Infrastructure) and other security measures to establish high levels of trust among participants.

- Exploring Direct Settlement on ILP: As trust in the ILP network increases, it might become feasible to explore direct settlement on the Interledger, potentially reducing or even eliminating the need for traditional clearing and settlement processes.

The ILP team is not currently prioritizing the development of a native clearing and settlement solution. Therefore, the most pragmatic approach is to explore the integration of ILP with existing schemes while simultaneously working towards increasing the trust and security within the ILP network to potentially enable direct settlement in the future.

Project Impact & Target Audience(s)

The impact of the project is to provide a way for ILP to be considered as part of DPI and through this align with the significant interest and momentum in this and the DPI as a Service movements. This would offer an opportunity for increased adoption and therefore aiding financial inclusion.

Within the project we took the opportunity to discuss this alignment with a number of expert parties and have concluded that through the next steps and recommendations this would be achievable.

We also highlight how significant awareness on ILP outside of the existing traditional technical communities needs to be undertaken and we have demonstrated a start to how this can be achieved. See later section of our report on communications and marketing for more details on these.

Progress on Objectives, Key Activities

Aligning to the DPI Concepts

Broadly the goals were

- Identifying the next steps for ensuring that Interledger Foundation tech is a part of Digital Public Infrastructure considerations for implementers.

- Advance the use of Interledger (ILP) within the concept of Digital Public Infrastructure (DPI)

- Explore in argument & technical design how to modify existing DPGs (Digital Public Goods) such as Mifos PaymentHUB for creating a solution applicable in a real world scenario.

- Propose modifications to the ILP or other parts of the ILF tech stack to align it further with DPI and financial inclusion therein.

Analysis of Existing Alignment of ILF with DPI

For a technology to be considered as DPI ready or appropriate for inclusion in the DPI playbook or the DaaS Concept, it likely needs to meet the following conditions:

- Clear value to the building blocks concept

- Alignment with the principles of DPI

- Proven in market in a way that demonstrates alignment

For the ILF, we assessed the alignment based on our interviews, market understanding, and then suggest ways to overcome objections.

Clear Value to the Building Block Concept

The ILF technologies certainly provide value, however, given the strong design alignment to a traditional Payment Switch in the DPI concept, getting alignment will require additional advocacy.

Key trends in banking and payments may help to align the ILF with the future of payments, especially with regard to DPIs and DPGs. The building block concept was first raised by the Digital Public Goods Alliance GovStack Community of Practice (DPGA GovStack CoP)[2] and suggest a future where the ILF technologies, in particular the ILP and the Open Payments concepts will have a significant role in other DPGs.

Payment systems are going through a tumultuous period with new fraud and risk and new systems and models. Globally these trend lines also include CBDCs, and as noted previously in this paper, the concept of an “Interledger of Payments”.

The bottom line is that for the ILF technologies to be a building block, they have to be seen as relevant to the conversation on multiple value alignments and have some traction in the market.

Alignment with the principles of DPI:

Alternative approach: Finternet aligns with DPI and ILP could align with Finternet

Recently the Bank of International Settlements (BIS), which is the Central Bank of Central Banks released a working paper that echoes many of the driving reasons for the invention of the ILP and its goals to enable anyone to make payments with anyone anywhere.

To build a financial system fit for the future, we need to agree on the vision we want to achieve. In this paper, we propose the concept of the “Finternet”: multiple financial ecosystems interconnected with each other, much like the internet, designed to empower individuals and businesses by placing them at the centre of their financial lives. It would lower barriers between different financial services and systems, drastically reducing the complex clearing and messaging chains and other frictions that hinder today’s financial system. According to our vision, individuals and businesses would be able to transfer any financial asset they like, in any amount, at any time, using any device, to anyone else, anywhere in the world. Financial transactions would be cheap, secure and near-instantaneous. And they would be available to anyone, ensuring financial inclusion by meeting the needs of currently underserved segments of the population. Compared with what is available today, the Finternet would offer broader access, better risk management, increased information availability and lower transaction costs. New, personalised financial services would emerge, fostering more “complete” markets and improving welfare. [3]

We confirmed that the Center for DPI seeks to align with this notion, which directly is analogous to the concepts of Discovery and Fulfillment envisioned in DPI components. This is an opportunity for the ILF to re-introduce and re-align with new writings and thinking, as the ILP is “like an internet for payments”. Staying abreast of the developments in this space is important for the ILF.

Design exploration for ILP within DPI

Through the design approach outlined we undertook design activities that explored how ILP could be supplemented to meet the requirements for integration in DPI.

Much more detail on these designs can be found in our full report however the following 3 design architectures have emerged

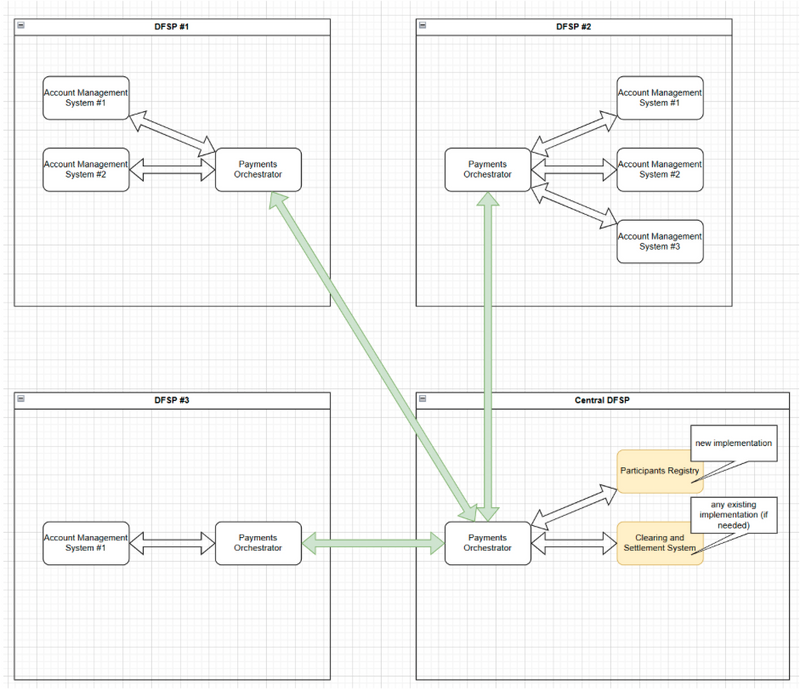

One DFSP with account management and payments processing capabilities

Multiple DFSPs connecting to each other with one central entity

- This diagram shows how the previous building blocks can be connected to each other, with 1 DFSP being responsible for providing the participants registry and the clearing and settlement schemas, utilizing any technology for these purposes.

- This diagram focuses on the scenarios when there is only one currency involved in the transactions among the participants. This is intentional - the next diagram shows a possible setup for multi-currency exchange arrangements.

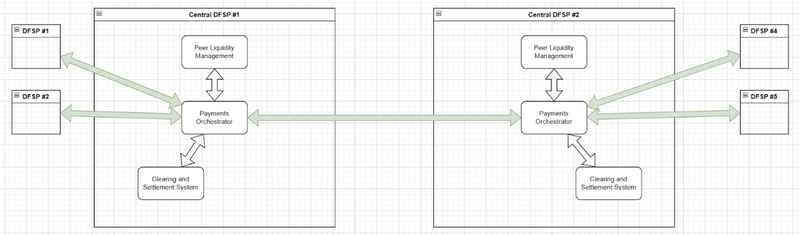

Multiple DFSPs connecting to each other via central entities

- This diagram shows how ILP can be used to establish connections between entities using different currencies. The recommendation is to use some dedicated central DFSPs that can do the currency exchange when required. Other connections are not prohibited, but if they exist, it makes it very difficult to have the required legal and technical framework in place to actually do the clearing and settlement process. In practice this removes some of the flexibility of ILP, but it greatly improves adaptability for real-world scenarios.

We discuss in next steps below our recommendations on how these designs are progressed in the development of a test and demonstration platform linked with existing DPG’s PHEE, Fineract, MifosX, Mojaloop as well as potential inclusion in DPI as a Service offerings such as that aimed for by Mifos Gazelle.

Communications and Marketing

During the project we had the opportunity to promote the work we were doing and awareness of ILP and its application within DPI at a number of events/channels:

MOSIP Connect, Ethiopia.

This conference, besides its focus on Identity systems, had several sessions about Digital Public Infrastructure led by Pramod Varma and other members of the DPI movement. Representatives from a number of global organizations, including the World Bank, ILO, and BMGF were present. Both Godfrey Kutumela and James Dailey had conversations with dozens of people and we took this opportunity to understand their knowledge of ILF and their views on how this could align to DPI. We also shared our understanding to promote the alignment of ILP with current efforts.

Probably with the exception of those involved in the Linux Foundation’s Open Wallet project, no one at the conference had heard of the ILF or the ILP. Participating in the IEEE standards group, which met on the sidelines to discuss the MOSIP derived standard, suggested a path forward for the ILF in gaining some level of formal acceptance.

Mojaloop Open Source Community Meeting, 25 - 28 March, Nairobi, Kenya.

This is the official meeting of the Mojaloop community members to report back on the quarterly roadmap execution and also plan for the next quarter. More importantly it also brings along adopters who could provide valuable insight into their requirements. Godfrey Kutumela attended on behalf of Mifos and took the opportunity to have a number of discussions regarding the potential for ILP use in DPI with various stakeholders including Mojaloop technical and product teams, Africanenda advocates, ILF technical team members present, bank representatives and regulatory authorities.

From the discussions Godfrey had, there was a lack of awareness on the ILF work on promotion of open payments, especially its integration into Mojaloop, where it uses interledger protocol v2 for payment interlock. ILF work has some good ties with this community and should consider presenting in future meetings to raise awareness and promote cross-collaborations.

ID4Africa, 22 - 25 May, Cape Town, South Africa.

The ID4Africa Annual General Meeting (AGM) is the African identity and global ID4D community gathering in person under one roof to jointly explore how digital identity and aligned services can advance socio-economic development in Africa. Godfrey Kutumela represented Mifos in this conference and managed to speak with stakeholders from the OpenSPP, MOSIP, World Bank, UNICEF, UNDP, Alan Turing Institute, governments and various private sector companies in the Identity ecosystem.

There was no prior knowledge of ILF work from the people we interviewed with exception of UNDP and Secure Identity Alliance who indirectly connected with it mostly from the W3C open payments standard.

Interledger Salon, 15 March, Online.

Ed Cable was invited and participated in the Interledger Salon on Financial Inclusion. This event was attended by a community both within ILP and outside members. It was also replayed in a later podcast. During this event Ed was able to bring to life to the attendees the importance of ILP and how it can play an important role in increasing financial inclusion as part of a DPI.

Community over Code EU, 3-5 June. Bratislava.

This event is run by the Apache Software Foundation (ASF) and had over 150 attendees from across the globe. Both David Higgins and Ed Cable attended this event. The focus of the attendees was mainly technical. During this event David Higgins presented on how DPI could ensure Financial Inclusion. Within this talk we promoted the work we had undertaken on the project and also highlighted the possible steps forward that were being highlighted by the Design activities. This enabled us to have many discussions with the attendees present.

Social Media Promotion.

We have also taken time to promote our work with Interledger through our LinkedIn Social media cross tagging with

#financialinclusion #DPG #DPI #payments

to promote the linkage.

What’s Next?

So based on what we have explored we see the following Recommendations covering both Technical/Design activities as well as more strategic integration and positioning activities needed for ILP to increase adoption through alignment with DPI.

Our recommendations follow a three-pronged approach to ensure alignment at principle, technology, as well as practical level. All three in coordination will ensure the necessary relevance and participation across the sector and broader DPI movement, articulation, alignment and integration with emergent technical standards for implementing, integration, and interoperability and practical understand for adoption and adaptability into the greenfield and brownfield implementations of DPI at the country and regional level.

Principle Alignment - Institutional Collaboration to increase recognition of ILP within spaces it needs to be adopted

The ILF is remarkably well aligned at the level of Principles, but is almost entirely unknown outside of a cadre of supporters and advocates. If it wants to move beyond being a technical solution favored by some to mainstream adoption within DPI and payments systems it needs to consider and action upon the following:

- ILF should consider taking its story to various entities as discussed in the paper and focus more on the conceptual alignments. For example, it could promulgate a policy statement and follow with a public campaign (including announcements) that speak the same language as those entities highlighted in this report: CDPI, DPGA, etc. Promoting the alignment could pay off with far greater awareness and reach. Essentially, ILF has a market awareness and relevance gap it should solve.

- The ILF should prioritize widening its view with regard to attending international development conferences and being involved in working group level activities around DPI, DPG, G2P Connect, GovStack and similar efforts globally. Gaining traction in an actual market implementation will appeal to many policy makers and should be a priority in this theme as well.

- As the conversation continues to evolve in venues and conferences relevant to the ILF, as the concepts of ledger transactions gain prominence, as the concept of Digital Public Infrastructure foundationally includes payments, the ILF should be more vocal outside of its own community in attending the events, promoting the roles it can plan and seek more alignment.

- A White Paper should be written and promulgated. See details in the observations section. This will remove one of the barriers for new entrants we observed that unless you are ingrained in the community it can be confusing how ILP, Rafiki, Open Payments align and are implemented in payment scenarios

- Engagement with regulatory bodies such as the Bank for International Settlements will be useful for early feedback on how the concept is aligned or misaligned with their work on promoting and enabling cross-border payments with cooperation and collaborations.

Stay aligned with new efforts and thinking around “internet of payments” and Finternet alignment with DPI. This is an opportunity that could be quickly lost if we do not capitalize on the expression of the role of a protocol like ILP detailed in this paper. This should be considered an immediate call for action for the ILF.

Technology connections

Creating technology is insufficient to gaining market adoption and will not succeed without advocacy from both top down and bottom up.

- Existing payment switches could include ILP but ILP will not be adopted without additional developer advocacy and clarity. The Mojaloop connection is a starting point but additional switches or payment processors need to be introduced at a technical level, as to the benefits of using ILP. We recommend through the steps outlined in the Design activities this could be achieved through integration with Payment Hub EE and Fineract/ MifosX as examples of payment processor systems.

- Mojaloop is currently the exemplar for switch integration. However this is really underplayed and doesn't go as far as it could to expound the benefits of ILP. Therefore, ILF may want to request that Mojaloop establish a dedicated design team to ensure that the use of ILP is strategically aligned.

- Developer conferences for international remittances, money conferences, and financial service conferences with a focus on technology innovation are just table stakes for key technology evangelists.

- Consider taking tech components and approaches through additional standards bodies including IEEE or ISO. As has been seen with ISO20022 such an approach although a longer term strategy could lead to significant scope for adoption.

Practical Adoption - Demonstration projects / tech efforts

More demonstration of the technology in action and how it fits within institutional regulatory frameworks is needed.

- Articulate how the ILF envisions country level implementations. We are seeing increased demand for this type of material as we are engaged in country level discussions. This is currently a gap in the documentation that the ILF has. Creation of such materials which should appear on the websites and in other public materials would be a relatively quick win for the ILF.

- There should be a guidance document or perhaps a Regulatory Sandbox statement that would allow ILF technologies to play in meaningful discussions.

- Development of high-level explainers - as noted in the Project Methodology section, high-level explainers would be a critical education tool in helping equip country-level implementers and governments to understand the value of ILP and the suitability demonstrated in the use cases below.

- To increase adoption it is essential that the potential use cases within payments and DPI for ILP technologies can be seen quickly and touched and felt by potential implementers. To that end we recommend the development of demonstrations for these use cases as outlined in our design discussion section. These should be hosted in an environment that can be used for such demos or training. We would recommend these phases are focussed around existing DPG and DaaS solutions such as MifosX/Apache Fineract and Mifos Payment Hub-EE linking to these DPG’s would be key for inclusion in a DPI in the future. Integration with a DaaS such as Mifos Gazelle (a project already working on Fineract/Mifos X/PH-EE and Mojaloop and looking to expand with other integrations in its DPI deployment model) would offer a way of ILP clearly demonstrating its part in DPI and hence increasing adoption.

Community Support

We have welcomed the support of the ILF community during the project. It has been key to us understanding in more depth how ILP and Rafiki works and the possibilities for it within DPI and linking to existing DPGs. We would welcome this participation continuing as we look at moving forwards into future phases of the project and would welcome anyone with an interest in this aspect to contact us at dpi@mifos.org

Relevant Links/Resources

[1] https://community.interledger.org/interledger/interledger-foundation-grant-awarded-to-thitsaworks-to-enable-collaboration-for-digital-financial-inclusion-3l4k

[2] https://digitalpublicgoods.net/DPI-DPG-BB-Definitions.pdf

[3] Finternet: the financial system for the future, BIS Working Papers No 1178, Agustín Carstens and Nandan Nilekanil. April 2024. https://www.bis.org/publ/work1178.pdf

Top comments (2)

This is a fantastic report!

Thank you @chrislarry and thanks for yours and the whole Interledger Communities support in this project.