Brief Project Description

Paysys Labs, a leading fintech company known for its innovative digital payment and financial service solutions, is partnering with Allied Bank Limited (ABL) to transform the remittance landscape in Pakistan. Banks in Pakistan currently face challenges such as high costs and delays in cross-border payments, which impact customer satisfaction.

The RafikiRemit project aims to revolutionize cross-border payments by integrating Allied Bank Limited (ABL) into the global Interledger Payment (ILP) network through the implementation of Open Connect Middleware by Paysys Labs. This will establish ABL's node on the ILP network, allowing customer accounts to function as digital wallets within the ILP ecosystem.

This arrangement will enable ABL to offer faster, more cost-effective remittance services, enhancing customer experience and expanding financial inclusion in Pakistan.

Project Update

Our project is progressing as planned and remains on track with the proposed timeline. So far, we have successfully submitted the following information for establishing a strong foundation for project alignment, communication, and stakeholder engagement.

- Project Charter

- Stakeholder Map

- Initial Project Timeline

In the next phase, we delivered the following documents which outlined key user needs, remittance service flows, and regulatory compliance obligations for RafikiRemit.

- Customer Needs and Remittance Service Flows for the customers in Pakistan

- Regulatory Compliance Plan (KYC-AML-CFT for Inward Remittances to Pakistan)

- Technical Specification Document & Architecture

A key milestone achieved has been the clear articulation of both the customer needs and compliance scope early in the project, which has helped streamline cross-functional collaboration.

We are now entering the next stage, focused on design, development and testing-related deliverables.

Project Impact & Target Audience(s)

Paysys Labs currently operates as a key technology service provider in Pakistan's financial industry, servicing over 20 banks across the country. Our deep involvement in the market has enabled us to thoroughly assess and understand the financial needs of our audience, particularly those of Allied Bank Limited (ABL), which has approximately 9.5 million customers, including a sizable portion from low-income and underserved communities.

Regarding ABL's remittance statistics, ABL currently manages over 600,000 accounts specifically opened for this purpose. The number is even higher if we include regular accounts that also receive remittances. Of the 600,000 accounts, approximately 79% belong to male customers, 20.95% to female customers, and 0.05% to transgender customers. Notably, around 17% of these accounts are held in rural areas, specifically within underserved communities.

Customer Needs

Through extensive market research and direct engagement with stakeholders, we have identified significant challenges faced by Pakistan's customer base, particularly in the remittance landscape. The current cross border payment processes are plagued by high costs and delays impact disproportionately impacting vulnerable groups. For instance, ABL's remittance statistics indicate that some of their transactions involve the underserved communities, further highlighting the need for a more efficient solution.

Integrating Allied Bank Limited (ABL) into the Interledger Network is crucial in realizing our vision. This integration will address key challenges in the remittance sector, such as high costs and delays, by offering a more efficient and cost-effective payment solution. This aligns with our mission and the State Bank of Pakistan's goals to enhance remittance flows and improve financial accessibility across Pakistan. Through these efforts, we aim to foster a more interconnected financial ecosystem, promote greater financial inclusion, and support economic empowerment across diverse communities.

Progress on Objectives, Key Activities

Our use case is around implementing a node of ILP Test network which enables ABL’s consumer accounts to become available as Wallets on the global ILP network. This enables the ABL account holders to receive remittances from other registered and regulated financial institutions on ILP network.

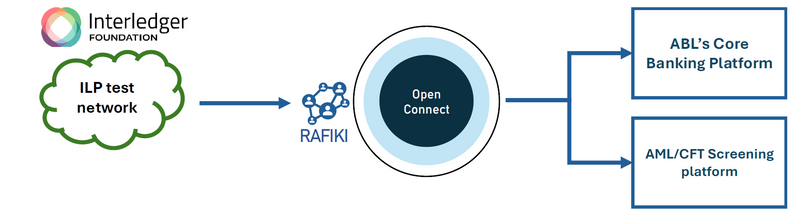

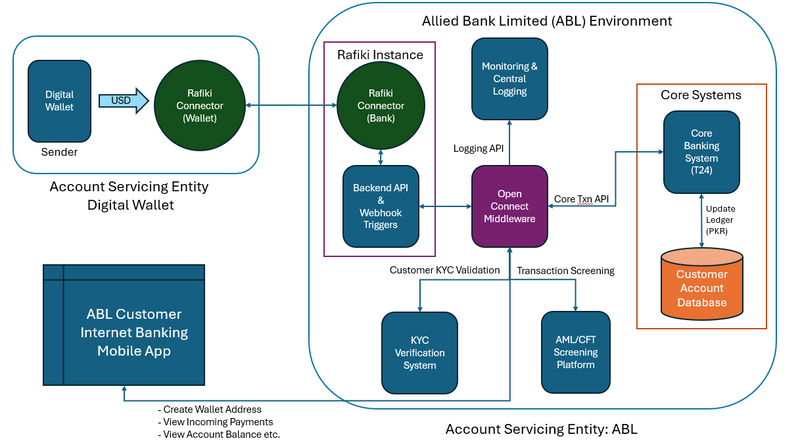

The envisaged high-level architecture of Rafiki integration with ABL’s systems involves the Rafiki Instance connecting to the ILP network and interfacing with ABL’s core banking through the Open Connect middleware, which also integrates with the bank’s compliance systems.

This Architecture diagram shows the components and interaction between them.

Components

- Digital Wallet (used by Sender)

Sender will be using Digital wallet that is integrated with ILP and initiate cross-border payments to ABL customers in Pakistan.

- Rafiki Instance

The Rafiki Instance dispatches various types of webhook events based on the status of each payment, enabling real-time updates and system responsiveness. Additionally, its Admin API plays a key role in generating wallet addresses for ABL customers, linking them to their respective bank accounts for seamless ILP-based remittances.

- Open Connect Middleware

Paysys Open Connect Middleware acts as a bridge between ABL’s systems and external entities, ensuring seamless integration and communication. This component would also handle the webhook events dispatched by Rafiki Instance.

- AML/CFT Screening Platform

This system monitors transactions to ensure compliance with Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations. Once a transaction successfully passes these checks, the Open Connect Middleware forwards the crediting instructions to the ABL Core Banking System, which then credits the amount to the ABL customer’s account.

- ABL Core Banking System

The ABL Core Banking System (T24) is responsible for executing all core banking operations. Once it receives the credit instructions from the Open Connect Middleware, it processes the transaction and credits the corresponding amount to the ABL customer’s account.

- ABL Internet Banking (used by Receiver/ABL Customer)

ABL account holders can use their existing Internet Banking platform to generate a wallet address linked to their bank account number (IBAN). Once a remittance is received via the Interledger Protocol (ILP), the credited transaction will appear in their account, and they can view the complete transaction history through their Internet Banking interface.

- KYC Verification System

This system verifies customer identities in line with Know Your Customer (KYC) regulations while the customer is creating a new account in ABL.

Compliance Requirements

When a sender initiates the request, The bank ABL must run Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) checks through its screening platform. Once the transaction passes this process, the funds in PKR are credited to the ABL customer’s bank account.

For this part our technical team is working on the solution to implement Two-phase transfer to hold the payments until the AML/CFT checks are performed or if a bank personnel needs any additional documentation from customer for verification purpose.

Regulatory Context in Pakistan

State Bank of Pakistan (SBP) regulates the policies for Know-Your-Customer (KYC), Anti-Money-Laundering (AML), Combating the Financing of Terrorism (CFT), foreign exchange reporting and incentives for home remittances.

1. SBP AML/CFT & CPF Regulations

Banks and authorized dealers are required to conduct customer due diligence, risk rating, sanctions screening, and reporting. They must keep transaction records for at least ten years and file Suspicious Transaction Reports (STRs) and Currency Transaction Reports (CTRs) with Pakistan’s Financial Monitoring Unit (FMU). Additionally, all cross-border wire transfers must include complete originator and beneficiary information; transfers lacking these details must be refused or held by the beneficiary institution.

2. Pakistan Remittance Initiative (PRI)

A joint program by the State Bank of Pakistan (SBP) and the Government mandates fast, low-cost, and transparent remittance services through formal channels. Banks are incentivized with fee reimbursements and performance bonuses if they deliver credit promptly and submit claim data on time. The initiative also encourages the use of International Bank Account Numbers (IBAN), straight-through processing, and simplified branchless-banking "Home Remittance Accounts."

3. SBP Foreign-Exchange Manual and Exchange-Policy Circulars

Authorized dealers can freely receive home remittances, convert them to Pakistani Rupees (PKR), and credit beneficiaries within 48–96 hours, depending on branch location. They must use accurate purpose codes, provide transaction-level reporting, and conduct enhanced due diligence for unusually large or inconsistent inflows.

4. Governance and Organizational Responsibilities

Allied Bank Limited (ABL) is fully accountable to the State Bank of Pakistan (SBP) for all Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) obligations, as funds settle across its books. ABL approves each sending-side counterparty, manages transaction monitoring, and files all regulatory reports, including Suspicious Transaction Reports (STRs), Currency Transaction Reports (CTRs), and PRI returns.

5. Beneficiary KYC and Account Controls in Pakistan

All beneficiaries are existing Allied Bank Limited (ABL) account holders, so SBP-compliant Know Your Customer (KYC) procedures—including photo Computerized National Identity Card (CNIC), biometric verification, address, and source-of-income declaration—are already completed. RafikiRemit middleware checks account status before assigning an ILP payment pointer, automatically excluding dormant, frozen, or sanctioned accounts. Beneficiary names are screened nightly against domestic proscribed-persons lists, with any positive match resulting in immediate account freeze as per SBP’s Targeted Financial Sanctions guidelines.

Communications and Marketing

The announcement of our partnership and the RafikiRemit project has been well received by the community. We, at Paysys Labs, published an article on our official LinkedIn page, which generated significant engagement and positive feedback: Paysys Labs LinkedIn Post. Additionally, Fintech News Pakistan, a prominent industry publication with over 27,000 followers, featured our collaboration in a dedicated post: Fintech News Pakistan LinkedIn Post. Also we posted the updates on our website Rafiki Remit Advancing Seamless Remittances in Pakistan

These communications have helped raise awareness about the project, and the response from the fintech community has been enthusiastic, reflecting strong interest and support for our initiative.

What’s Next?

During the remainder of our funded grant period, our focus will be on delivering the next set of core project components. These include the following deliverables:

- Integration Diagram for Digital Wallet, Paysys Open Connect Middleware and ABL Core Banking System

- Security Framework and Protocols, and best practices

- UI/UX Prototypes for core features

- Testing Reports, Bug Reports

- Logging Framework

These deliverables will be submitted progressively, in line with our project timeline. Our next formal progress report is scheduled for submission by November 14, 2025.

Community Support

We appreciate the ongoing support from the Interledger community and our partners. To stay updated on our progress, insights, and future initiatives, we invite you to follow Paysys Labs on LinkedIn: Paysys Labs LinkedIn. Your engagement and feedback are valuable as we continue to advance our mission and foster innovation in the fintech sector.

Top comments (0)