By Casey Ariel Dike’, Founder & CEO of Blaze Group, Contractor for the Interledger Foundation

At AFROTECH 2025, one session in particular stopped me in my tracks.

At a conference of more than 30,000 attendees, backed by some of the biggest names in banking and tech alike, it wasn’t a financial institution that stood out to me in its foreshadowing of the future of money. It was a technology company.

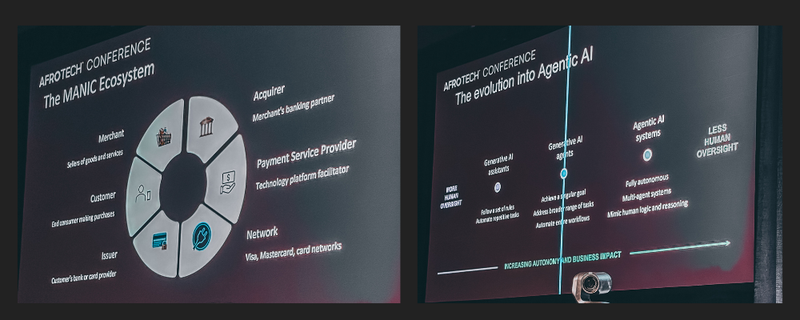

During his keynote, Jackson Aimiuwu of Amazon Web Services (AWS) walked the audience through a 3,000-year history of payments, threading stories of merchants and buyers through time: from barter commerce to monetary coins, from paper money and promissory notes to the credit era, from e-commerce (the dawn of the digital age) to the mobile commerce that defines today’s world of wallets, omnichannel sales, and global shoppers.

Jackson didn’t stop our imaginative journey there. He took us forward — predicting that we are on the brink of the next major transformation: The Agentic Commerce Revolution.

As he described it, AI agents will soon perform the tasks traditional banking rails handle today. They will run the decisioning, settlements, and operations of trade between buyers and sellers autonomously, intelligently, and instantaneously.

Having lived outside the United States — from Cape Town to Nairobi, and traveling across many parts of the globe — I fully agree with Jackson’s outlook. I’ve seen autonomous finance already deeply woven into capital systems beyond the U.S., where behavioral credit scoring gives more people access to credit than FICO scores ever have. Connecting that innovation all the way through to the disbursement of capital isn’t far-fetched.

And it’s no surprise that it was a tech company, not a bank, leading the conversation about the agentic future of finance.

I truly believe the most pivotal disruption in finance, particularly the work of cementing capital access as a human right, will come from outside the traditional banking system.

The world has seen this before. In 2007, Safaricom (a telecommunications company) launched M-PESA in Kenya. Today, less than two decades later, more than 59% of Kenya’s GDP flows through M-PESA. This is what happens when innovation is laser-focused on access rather than mere compliance.

Jackson also shared striking data: of the $96 trillion circulated globally each day, $8.3 trillion is cash. This means that 90% of the world’s money already moves digitally. That reality places us squarely at a tipping point.

AI represents a massive catalyst for digital financial inclusion — if shaped by the right dreamers. Yet this connection hasn’t fully clicked in many financial innovation circles led by executives and banking incumbents. The most imaginative applications aren’t emerging from boardrooms; they’re coming from dorm rooms.

At AFROTECH, I met Daksh Khanna, a Gen Z founder building CashBFF, an AI-powered text-messaging platform that turns financial coaching into friendly, human conversations. It’s simple. It’s intimate. And it speaks the language of his generation. His work is a glimpse of what’s possible when empathy, access, and automation meet.

There’s enormous room for the finance industry to be more imaginative about what AI can mean for democratizing payments. But maybe that imagination doesn’t need to come from us, the well-seasoned practitioners. Maybe it’s time we let Gen Z drive the magic and keep our eyes on the non-bank visionaries solving problems that banks have struggled to fix for decades.

The Agentic Financial Revolution isn’t coming. It’s already unfolding. And it’s being powered by people who believe that access should define how money moves through the world, not institutions.

It has me inspired. I’m excited to witness the disruption in real time.

About the Author

Casey Ariel Dike’ is the Founder and CEO of Blaze Group®, a finance innovation studio offering tools and frameworks that help overlooked communities own, protect, and scale their economic power. With a background in global corporate banking, Casey now focuses on reshaping capital access through financial education, fintech literacy, and equitable product design. She serves as a Strategic Lead for the Interledger Foundation, expanding their reach across financial institutions, colleges, and fintech communities concentrated in underbanked regions.

LINKS:

- Company Website: blazegroup.io

- Personal Website: iamcaseyariel.com

- Instagram: instagram.com/blazegroup.io

- Company LinkedIn: linkedin.com/company/blazegroup

- Personal LinkedIn: linkedin.com/in/iamcaseyariel

Top comments (0)