On June 10, Medellín once again solidified its position as a Latin American leader in digital innovation and transformation, hosting the Antioquia Fintech Forum 2025. The event, organized by MeF (Mujeres en Fintech) and led by the Medellín Chamber of Commerce with the support of the Mayor’s Office of Medellín and other strategic ecosystem allies, brought together top leaders, innovators, and key players from Colombia’s financial and tech ecosystems. It marked a significant milestone in the country’s digital evolution.

The mission was clear: bring fintech solutions to Colombia’s regions and foster their adoption across users, businesses, and institutions. The forum blended forward-looking insights, financial infrastructure analysis, inclusion-driven experiences, and a critical look at the role of women in the sector.

From the Chamber of Commerce auditorium, we explored the present and future of fintech with a regional, inclusive, and disruptive lens. With over $600 billion in digital transactions and a projected market of $3–4 trillion, the discussion centered on understanding where the digital economy is headed.

👩 Panel: The Role of Women in Colombia’s Fintech Ecosystem

The event kicked off with the launch of a national report on Women in Fintech, presented by three prominent Colombian leaders:

- Pamela Hollmann – CEO of ACERTIJO GESTION EMPRESARIAL and co-founder of #MeF

- Maria Fernanda Galeano Rojo – Secretary of Economic Development, Mayor’s Office of Medellín - Alcaldía de Medellín.

- María del Mar Palau – Executive President, Chamber of Commerce of Cali - Cámara de Comercio de Cali.

The report surveyed over 100 C-level executives and revealed data that calls for urgent action:

- Only 4% of startups in LATAM are founded exclusively by women.

- Just 0.2% of VC capital reaches all-women teams.

- Women have lower default rates but significantly less access to formal credit.

Key findings included:

- Exponential growth: Colombia now has ~394 fintech companies, a +387% increase since 2017.

- Regional concentration: LATAM has over 3,000 fintechs across 26 countries, with Brazil, Mexico, and Colombia accounting for 57% of the total.

- Leadership profiles: Most women in executive roles are aged 35–44, with 10+ years of experience, and 60% hold a master's degree, indicating strength but also a notable generational gap.

- Talent pipeline: Only 3% of female leaders have <1 year of experience.

- Entrepreneurial drive: 45.5% of respondents have founded a fintech, significantly above the LATAM average (7–11%), yet they still face challenges in VC fundraising.

- Representation vs. power: Despite a high female workforce presence (over 50%), only 19% of companies report having over 10% of women in strategic roles.

- Networks matter: 71% participate in formal networks, and 37.6% in informal ones, highlighting the power of structured community.

- Well-being matters: 71.9% consider mental health spaces the most valuable form of support.

- Visibility fuels growth: 36% say media visibility is key for career advancement.

- Access to capital remains the most significant challenge, highlighting the need for funds tailored to women-led ventures.

- Global benchmarks: In Spain, women represent 45% of the fintech workforce, with an average age of 37 years, supported by early mentorship practices.

- Data transparency: Regularly publishing diversity and performance data can build trust and attract investment.

The panel made one thing clear: investing with a gender lens isn’t charity, it’s innovative business. According to UN Women, companies in emerging markets with diverse workforces report a 13% higher internal rate of return (IRR).

🚀 Fintech Beyond Earth: Space Currency & Low Earth Orbit Economies

One of the most anticipated talks came from Ivan Rodriguez, CEO of Glocal Advantage and a board member at NASA’s Space Center Houston. His session, "Space Currency and How Technology is Transforming Global Finance", blended science fiction with real-world strategy.

Key insights:

- Low Earth Orbit Economy: Space stations are now leasing modules and office space for business operations.

- Tokenization of Space Assets: From Satellites to Asteroid Rights.

- New financial dynamics: Including interplanetary insurance, latency issues, and infrastructure adapted for off-world contexts.

💡 If we’re building financial systems for the Moon and Mars, how can we not achieve inclusion and efficiency here on Earth?

💳 Payment Infrastructure: Is Colombia Ready for Bre-B?

A highly technical panel led by Camilo Zea, CEO of PRONUS S.A.S, introduced Bre-B, a next-generation real-time payments architecture based on international standards like ISO 20022, already adopted in Brazil, India, and China.

Challenges discussed:

- Only 40% of Colombians have access to formal credit.

- Transactions are not settled in real-time, but in cycles through the central bank.

- The current system is tied to a “closed club” of traditional banks.

In contrast, Brazil’s Pix processes $5 trillion annually, with full interoperability and instant support for P2P and P2M payments. Bre-B aims to position Colombia as a transparent, inclusive payments hub with immediate settlement capabilities.

📈 Panel: Digital Financial Solutions for Individuals and Businesses

The panel on “Fintech Financial Solutions for Individuals and Companies” focused on the challenges and opportunities surrounding digital credit solutions in Colombia.

Moderated by:

- Andrés Arias, Manager of the Digital Business Cluster at the Medellín Chamber of Commerce for Antioquia.

Panelists:

- Cristian Castillo, Head of Sales, DataCrédito Experian

- Mariana Galeano, Business Lead, Finaktiva

- Mónica Saavedra, Co-Founder & Head of Products, Plurali

This session brought together key voices from the digital finance space to analyze how fintech is reshaping access to capital. While there was consensus on the sector’s role in democratizing credit, speakers emphasized the structural barriers that persist, as well as the high transactional costs associated with micro-investments.

The discussion also covered how alternative data and personalized scoring models are enabling new financing products tailored for unbanked or underbanked populations. The panel emphasized the importance of collaborative models between traditional institutions and emerging fintech players in sustainably bridging these gaps.

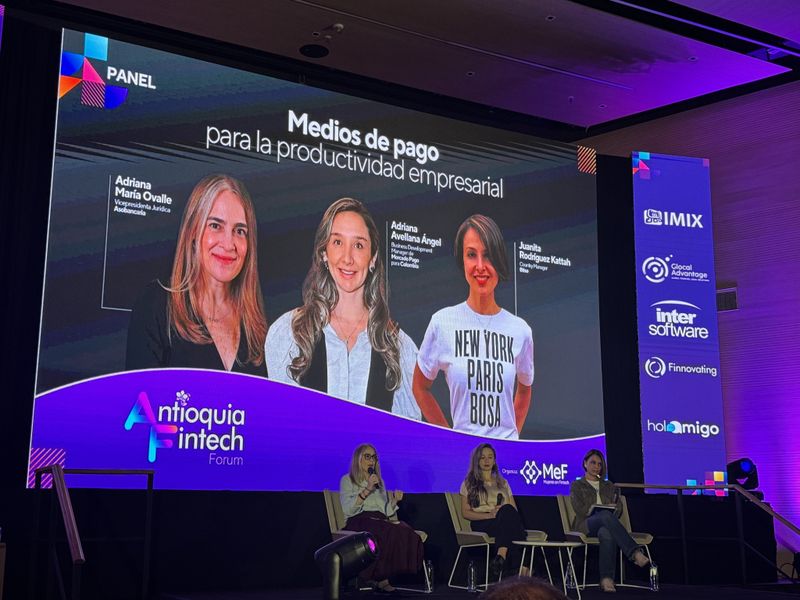

📈 Payment Systems for Business Productivity Panelists:

This panel examined the evolution of digital payment systems to meet the increasing demands for efficiency, transparency, and trust in Colombia’s business sector.

Panelists:

- Adriana María Ovalle, Vice President of Legal Affairs, Asobancaria

- Adriana Avellana Ángel, Business Development Manager, Mercado Pago Colombia

- Juanita Rodríguez Kattah, Country Manager, Bitso

From regulatory frameworks and legal infrastructure for interoperable payments to advancements in crypto, digital wallets, and instant payments, panelists shared real-world insights on driving adoption across enterprises.

They addressed key challenges such as:

- The fragmentation of the payments ecosystem

- The urgent need to adopt international standards like ISO 20022

- And the positive impact of payment digitalization on the productivity and formalization of SMEs

Closing Reflections

The Antioquia Fintech Forum 2025 was more than just a conference—it was a manifesto for financial innovation. A call to imagine new financial futures, build inclusive technological infrastructure, and place gender equity at the heart of sector growth.

From low-Earth orbit economies to the last unbanked pocket on Earth, this event demonstrated that Colombia has the talent, vision, and commitment to lead the next chapter in Latin America’s fintech revolution.

Top comments (0)