Project Update - Grantee Final Report

Progress on key activities and Objectives

Our key activities in the last phase was to;

- Publish our research report - technical designs, regulatory landscape, market recommendations.

- Building a prototype of the OTC escrow service.

- Testing the OTC escrow system with selected members.

Research Findings

Research Methodology: We conducted this research in two ways;

Quantitative and Qualitative research: We began by carrying out online research about the different markets and the kind of payment processors that existed in the markets of interest. We also reviewed existing literature on money transfer systems and their features, analyzed market trends and user preferences. We then followed up the desk research with visits to several countries which included the following Nigeria, Kenya, Ghana, Ethiopia, South Africa and Tanzania in order to collect data directly from the market players and analyze how a new system would interact with the existing payment infrastructure and trading processes. Some of the important elements included the following:

1. The currency trading environment

The first point of action was visiting the currency traders in order to understand how they carried out their transactions. This involved looking at the transaction methods and analyzing the issues they faced while transacting. This information provided was important because it would inform the UI/UX design of the OTC escrow.

During our research with the traders, We discovered that most of them preferred to carry out their transactions over whatsapp. They would create group chats with other trusted parties for communication and transaction monitoring. The trading group chats are used to source liquidity, process orders, track payments and facilitate interactions between the buyers and sellers. Whatsapp is the preferred channel due to its existing scale regarding its user base and ease of use. It works well in facilitating communication between the OTC desks, traders and customers however the medium lacks one fundamental feature, which is the lack of an escrow system that would enable counterparties to secure themselves from the risks associated with remote transactions. Due to this gap, countless traders have been affected by losses during the transaction process due to trading with risky counterparties. Some of these losses have been due to scams, thefts and issues with the banking system. This gap is mainly due to the fact that traders need to trust each other in order for a transaction to be completed, and when counterparties are new to each other, a transaction can take a very long time to be executed because of the lack of trust as none of the traders want to send money first.

Traders will have many queries such as whether or not the counterparty has the required assets to carry out the transaction or whether they will complete their end of the bargain after they have received the funds. This is made even more difficult when parties are trading assets between different banking systems because of the delays caused by the interbanking network and lack of visibility into the counterparties account or asset base.

2. The banking infrastructure

The banking infrastructure plays a very important role in the way transactions are executed between parties. This is because traders prefer transactions to be completed in the shortest time possible.

The ability to execute quick transactions are determined by the banking infrastructure in the country due to several reasons.

2.1 Instant settlements - instant settlement is one of the major factors that contributes to market behavior when it comes to OTC trades and trader interaction. This is because when instant settlement is available, it enables the market to work more efficiently and the volume of trades increases. It also allows longer trading hours as there is no limit imposed due to a central bank working window.

2.2 Transaction limits - Its also noted that some banks have a transaction limit with a specific time frame. These limits vary depending on the account type, payment method and currency required.

2.3 Mobile banking- has revolutionized the banking industry, particularly in regions with limited access to traditional banking infrastructures like Africa. It heavily relies on the availability of mobile networks and smartphones and the services are typically provided through dedicated mobile banking apps, mobile web browsers, or USSD codes, allowing customers to access their accounts and conduct transactions using their mobile devices which allows users to easily transfer funds, initiate various types of transactions.

2.4 Identify potential partners - We had engagements with several people in different spaces including regulatory, payments , banking and government policy makers. Some of these included Xago bank, Agnostic pay and Fitspa Uganda.

Findings

Our research findings were split into two main categories, technological and regulatory because these areas were found to have the biggest impact on any further developments on the protocol.

1. Technological

1.1 Theoretical Analysis: The first thing we analyzed was the ILP stack, we reviewed the languages used to deploy it and its readiness for implementation within our technology stack.

In order to do this, we reviewed the available online resources which included the documentation and videos from the different ILF properties and communities, as well as engaging with different members of the community through meetings and public forums. This enabled us to gain a clear picture of how the ILP could be used to achieve our objectives. During our research we established that the following:

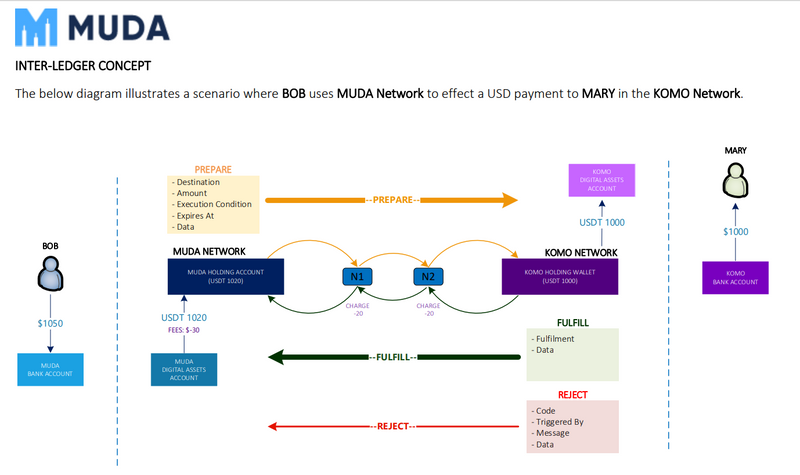

ILP is a specification that the foundation developed to deliver interoperability between different ledgers and it is currently at version 4.

We found that the specification was available however that was lack of a standard that different ledger providers could work with for easy adoption.

The current tech stack as defined focuses on secure transfer of messages / transactions from one entity to another in four layers.

- Application

- Transport - security is key here

- ILP Layer this is what requires standardized implementation

- Ledgers - any ledger systems

1.2 Practical Analysis: The next step in our research process was to practically test the protocol by creating test parameters and implementing a light node that would be able to establish a connection between two parties and thereafter carry out a transaction using the implemented connection.

In order to validate our theories regarding our proposed designs, we had to find a testing counterparty that would be able to connect to our implementation of the ILP. We had several engagements with different members of the ILP community, however we failed to find a counterparty that had the right infrastructure to connect with us and carry out the required tests which included, depositing of funds, funds transfer, account credit and debit, escrow initiation, conditional release and different notification request scenarios.

We looked at several implementations such as Rafiki money and Ripple but they did not clearly demonstrate how they would work with other external ledgers. Their implementations created dependencies on their networks which we wanted to avoid in order to have a truly resilient escrow system.

2. Regulatory

We analyzed the Regulatory landscape in different countries due the fact that many of the ones we visited have different regulatory frameworks for remittance and currency exchange services. We wanted to ensure that our solution complied with the applicable laws and regulations in order to avoid penalties and reputational risks. To do this, the system would have robust compliance policies and procedures to prevent money laundering, terrorist financing, and other illicit activities.

2.1 The Regulatory Landscape

2.1.1 Nigeria: Nigeria's regulatory environment for fintech is relatively new and rapidly evolving, as the country seeks to modernize its financial sector and promote innovation. The regulatory framework is overseen by several institutions, including the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (SEC), and the Nigerian Communications Commission (NCC).The CBN has been particularly active in regulating fintech, issuing guidelines and regulations to ensure the safety and soundness of the financial system and protect consumers. For example, in October 2019, the CBN issued guidelines for the licensing and regulation of payment service providers (PSPs), which includes rules on capital requirements, risk management, and customer protection.In addition to regulating payment service providers, the CBN has also established a sandbox framework to encourage innovation in the financial sector. The sandbox allows fintech companies to test new products and services in a controlled environment, without having to comply with all the usual regulatory requirements. This can help foster innovation while still ensuring consumer protection.Overall, the regulatory environment in Nigeria is generally supportive of new payment technologies, but it is also focused on ensuring the safety and stability of the financial system. Fintech companies operating in Nigeria should be prepared to comply with a range of regulations and guidelines, and work closely with the relevant regulatory bodies to ensure that their products and services are compliant.The kind of license that would be required to enable the ILP escrow system would be Payment Solution Service Provider (PSSP) License: This license is required for companies that provide payment solutions, including mobile payments, internet payments, and other electronic payment options.Switching and Processing License: This license is required for companies that operate as payment switches or processors, providing connectivity between payment systems and financial institutions.In addition to these licenses, the CBN has also established a sandbox framework to allow fintech companies to test new products and services without having to comply with all the usual regulatory requirements. The sandbox is available to companies that have not yet been granted a license, as well as to licensed companies that are testing new products or services.

2.1.2 Kenya: In Kenya, the regulatory environment for fintech and payment solutions is relatively advanced and supportive of innovation. The Central Bank of Kenya (CBK) is responsible for regulating financial institutions and has established a licensing regime for fintech companies. Fintech companies that offer payment solutions are required to obtain licenses from the CBK, and there are different types of licenses depending on the nature of the company's operations. For example, companies that operate mobile money services are required to obtain a Mobile Network Operator (MNO) license from the Communications Authority of Kenya (CA).

2.1.3 Uganda: In Uganda, the regulatory environment for fintech and payment solutions is also evolving, with the Bank of Uganda (BoU) playing a key role in overseeing financial institutions. Fintech companies that offer payment solutions are required to obtain licenses from the BoU, and there are different types of licenses depending on the nature of the company's operations. For example, companies that offer mobile money services are required to obtain an Electronic Money Issuer (EMI) license.

2.1.4 Ghana: In Ghana, the regulatory environment for fintech and payment solutions is overseen by the Bank of Ghana (BoG), which is responsible for licensing and regulating financial institutions. Fintech companies that offer payment solutions are required to obtain licenses from the BoG, and there are different types of licenses depending on the nature of the company's operations. For example, companies that operate mobile money services are required to obtain an Electronic Money Issuer (EMI) license.

2.1.5 Democratic Republic of Congo (DRC): In the DRC, the regulatory environment for fintech and payment solutions is relatively new and developing. The Central Bank of Congo (BCC) is responsible for regulating financial institutions, but the regulatory framework for fintech is still being established. Fintech companies that offer payment solutions are required to obtain licenses from the BCC, but the specific requirements and regulations associated with these licenses are still being developed.

2.1.6 Tanzania: In Tanzania, the regulatory environment for fintech and payment solutions is overseen by the Bank of Tanzania (BoT), which is responsible for licensing and regulating financial institutions. Fintech companies that offer payment solutions are required to obtain licenses from the BoT, and there are different types of licenses depending on the nature of the company's operations. For example, companies that offer mobile money services are required to obtain an Electronic Money Issuer (EMI) license.

2.1.7 South Africa: In South Africa, the regulatory regime for financial services with respect to cross border payments and money remittance are somewhat similar to Kenya's.

These are:

i. The Financial Markets Act, 2012 (FMA), in respect of financial markets, exchanges, etc

ii. The Banks Act, 1990 (the “Banks Act”), in respect of banking and deposit-taking activities, and the concept of “e-money”

iii. The National Payment Systems Act, 1998 (NPSA) in respect of payment services

iv. The Currency and Exchanges Act, 1933 (the “Currency and Exchanges Act”) and the regulations under the Currency and Exchanges Act, 1933 (the “Exchange Control Regulations”) in respect of cross-border capital flows and currency controls generally.

2.2 Where does ILP fall within the landscape, what would be required in order to deploy an integrated solution?

For a company planning to utilize Interledger Technology to facilitate payments, it may need to obtain a Payment Solution Service Provider (PSSP) License from the Central Bank. This license is required for companies that provide payment solutions, including mobile payments, internet payments, and other electronic payment options. The PSSP license regulates companies that engage in payment processing activities and intermediation, regardless of the technology used. The license covers activities related to payment initiation, payment processing, funds transfer, and payment gateway services. That being said, it's important to note that the regulatory environment in the listed countries for fintech and payment solutions is rapidly evolving, and specific licensing requirements may vary depending on the nature and scale of the company's operations. It's recommended that interested parties consult with the central or a qualified legal professional for detailed information on licensing requirements.

Conclusion

Based on our research findings we found the interledger protocol concept to be quite useful when deployed at scale and we believe that it would be a good fit not only for our specific use case but also for the larger fintech landscape as a whole. The community is developing rapidly and the available educational resources online are quite mature which is quite helpful when getting into the space as a beginner. However due to the difficulty we faced finding a suitable counterparty when we were trying to implement a prototype, we believe more work needs to be done around enabling this part of the ecosystem because it may prove to be a major stumbling block for early stage projects that are trying to figure out the technology.

We suggest the following as a plausible next step:

1. Test Tools development: We would suggest that we start off by developing a test kit that would be used by the community to test their implementation because this has been a major pain point for us. This will have the impact of fostering rapid innovation on the protocol.

2. Standardization toolkit: We would implement a service that the community could use to integrate with the ILP in a format that would eliminating bi-lateral implementations and having a generic standard for;

- How ledger providers would integrate with other ledger

providers

- How settlement would work in practice

- How pre-funding or post-funding would work

Project Impact & Target Audience(s)

Our major target market are the Cross-border Traders. These people face unique challenges related to trust, currency conversions, and regulatory compliance etc. Our OTC escrow system will simplify and secure cross-border transactions, providing assurance to buyers and sellers in different countries in Africa.

And because the current systems are based on trust between known parties, if one of the trusted parties does not fulfil the requirements then the chain breaks down.

The OTC Escrow system will address these challenges through;

1. Creating some level of trust and security in transactions by providing a neutral third-party intermediary that holds funds until predefined conditions are met. This reduces the risk of fraud, non-payment, and dispute resolution, fostering confidence among buyers and sellers.

2. Financial Inclusion: By offering an alternative payment and transaction mechanism, the OTC escrow system will contribute to financial inclusion. It allows individuals and businesses without access to traditional banking services to participate in secure and regulated transactions.

3. Dispute Resolution: The escrow process in an OTC system provides a mechanism for resolving disputes in a transparent and unbiased manner. It helps mitigate conflicts that may arise between buyers and sellers, reducing the need for costly legal proceedings.

Communications and Marketing

We participated in several physical and online events to seek opportunities for collaboration with potential local and overseas partners. Plus also engaged different people with in the ILP network.

What’s Next?

- Develop our proposed design for the OTC escrow and launch a pilot with some of our partners to collect data that will inform us on what would be required to enable it on a large scale successfully.

- Plan and draft the business plan and Technology Plan.

Community Support

We still call upon any volunteers from the interledger community to test out our prototype.

Additional Comments

Reach out directly to us:

website: www.muda.tech

twitter: https://twitter.com/mudatech_

Financial Services Grantees, Sprint Update:

https://docs.google.com/presentation/d/1Xpse2ZEBWlo4wT9TG3beygzek0FnKOf_IQokQAx9Pks/edit#slide=id.p2

Financial Services Grantees, Sprint Check-in & Exchange April 2023:

https://docs.google.com/presentation/d/1FK-gEprI5YumJubMiJHWZa2xcEY8LKnq-zrtes0fT1g/edit#slide=id.p2

Top comments (0)