Brief Project Description

RafikiRemit is a collaborative initiative between Paysys Labs and Allied Bank Limited (ABL) to modernize Pakistan’s cross-border remittance ecosystem. By integrating with the Interledger Protocol (ILP) through the Rafiki node, the project enables instant, low-cost, and transparent international money transfers.

The solution replaces legacy banking delays of 3–7 days and high transaction fees of 5–10% with a real-time, cost-effective remittance experience. Built on a microservices architecture, RafikiRemit comprises three key components:

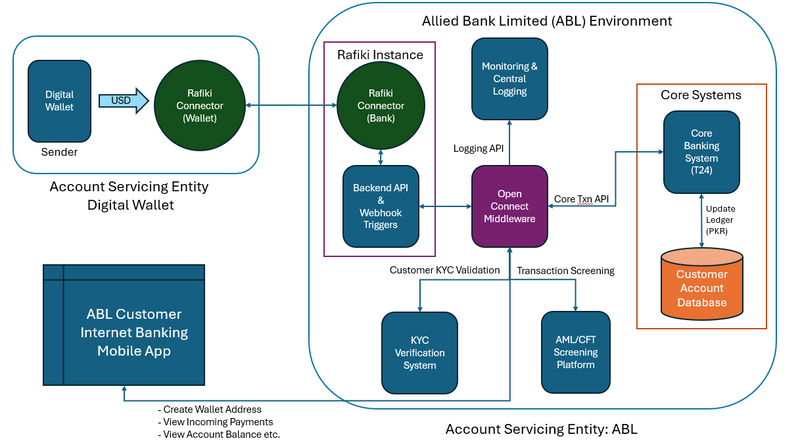

- ABL Core Banking Service (CBS) – manages accounts, transactions, and webhook processing.

- OpenConnect Middleware (OC) – functions as the secure API gateway and request router.

- Wallet Service – provides the digital interface for customers to view balances and share payment pointers.

Architectural Overview

The RafikiRemit system is built on a modern microservices architecture, consisting of three distinct services that work in concert to deliver comprehensive remittance capabilities. Each service operates independently on its own port, ensuring scalability, maintainability, and fault isolation.

Project Update

Our project has continued to progress as planned and remains on track with the proposed timeline. The previous report, which can be viewed here, primarily focused on the initial stages of the project and the groundwork we established.

Since then, we have successfully completed several key documentation, planning, and technical milestones that form the foundation for RafikiRemit’s implementation.

Completed Documentation and Development

- Project Charter

- Stakeholder Map

- Initial Project Timeline

- Customer Needs and Remittance Service Flows for customers in Pakistan

- Regulatory Compliance Plan (KYC, AML, and CFT for Inward Remittances to Pakistan)

- Technical Specification Document and System Architecture

- Risk Assessment Report

- Security Framework

- Implemented core features to demonstrate the incoming remittance flow in Pakistan

Following these submissions, the development phase has also concluded successfully. All three core services are complete and fully integrated with the Rafiki ILP network.

- Core Banking Service (CBS): Handles incoming payment webhooks and updates account balances in under 500 milliseconds.

- OpenConnect Middleware (OC): Authenticates and routes requests with sub-200 millisecond latency.

- Wallet Service: Provides a responsive web-based interface enabling real-time balance viewing and transaction visibility.

Deployment Status

- On-premises deployment completed successfully

- End-to-end testing validated integration across CBS, OC, and Rafiki ILP

- System confirmed stable, secure, and ready for limited production

Video Demonstration

A recorded end-to-end walkthrough is available: View Video

Project Impact, Challenges & Target Audience(s)

Challenges

Regulatory and Compliance

- Stringent AML/CFT Requirements: Anti–Money Laundering and Counter–Terrorism Financing checks are necessary but slow down onboarding and transaction approvals.

- KYC Delays: Manual Know Your Customer (KYC) processes often result in significant delays, especially for customers in remote areas without formal identification systems.

Operational Limitations

- Legacy Banking Infrastructure: Many institutions still depend on outdated core systems that are not optimized for real-time international settlement.

- Limited Rural Coverage: Restricted branch networks and low digital adoption make it difficult to serve rural and unbanked populations effectively.

Customer Experience Barriers

- Cumbersome Processes: Traditional remittance channels require multiple steps, excessive paperwork, and in-person branch visits during limited business hours.

- Delayed Settlements: Cross-border payments can take up to five business days or longer, depending on intermediary bank efficiency.

- High Transaction Costs: Average transfer fees hover around 7%, with an additional 2–3% lost due to poor exchange rate margins.

- Lack of Transparency: Customers have little to no visibility into where their funds are during the transfer process—whether they’re in transit, pending, or received.

- Collection Inconvenience: Even after funds arrive, recipients must often visit a branch in person to withdraw the money, adding travel and time costs.

Financial Exclusion

- Unbanked and Underbanked Population: A significant percentage of Pakistan’s population remains outside the formal banking system, limiting access to regulated remittance services.

- Dependence on Informal Channels: Many senders and recipients continue to rely on informal mechanisms such as Hawala or Hundi, which, although faster, pose risks related to compliance, security, and transparency.

These challenges underscore the need for a secure, transparent, and accessible remittance platform like RafikiRemit. One that combines regulatory compliance with a frictionless digital experience.

Target Audience

RafikiRemit has been developed to serve a diverse ecosystem of users and stakeholders within Pakistan’s remittance landscape:

- Overseas Pakistanis: Millions of expatriates who send money home regularly to support families, education, and small businesses.

- Local Recipients: Individuals and households who depend on these inflows as a primary source of income, often located in semi-urban or rural areas with limited banking access.

- Financial Institutions: Banks and fintech providers seeking to modernize their cross-border payment systems and adopt interoperable, digital-first infrastructure.

- Regulators and Policy Makers: Institutions interested in advancing national goals for financial inclusion, compliance, and innovation.

Impact

- Speed: Instant transfers compared to traditional 3–7 day processing

- Cost: 60–70% reduction in transaction fees

- Transparency: Real-time payment tracking and notifications

- Accessibility: Digital wallet interface eliminating branch visits

- Institutional Benefit: ABL’s transition into a node on the ILP network, improving efficiency and competitiveness

RafikiRemit positions Pakistan as a regional leader in digital remittances and contributes to national goals for financial inclusion.

Progress on Objectives and Key Activities

| Objective | Status | Key Achievements |

|---|---|---|

| Network Integration with ILP | Completed | ABL successfully registered payment pointers with Rafiki |

| Cost and Speed Optimization | Achieved | 60–70% lower fees, near-instant transactions |

| Core System Development | Completed | CBS, OC, and Wallet fully operational |

| Secure Webhook Processing | Completed | Implemented idempotency, HMAC verification, retry logic |

| Digital Wallet Deployment | Completed | Real-time wallet with QR code and pointer sharing |

| Compliance and Security | Completed | JWT, and rate limiting implemented |

| Documentation and Testing | Completed | API documentation, integration tests, and UAT finalized |

Communications and Marketing

The announcement of our partnership and the launch of the RafikiRemit project have been very well received by the fintech community, generating significant engagement and positive feedback across multiple platforms.

Industry and Community Engagement:

- Paysys Labs Official Announcement: We shared the project launch on our Paysys Labs LinkedIn Page, which received strong engagement from professionals across the banking and technology sectors.

- Media Coverage: Fintech News Pakistan — one of the country’s leading fintech publications with over 27,000 followers — featured our collaboration with Allied Bank Limited in a dedicated article highlighting its innovation and impact: Fintech News Pakistan LinkedIn Post.

- Official Website Feature: A detailed overview of the project was also published on our website: Rafiki Remit – Advancing Seamless Remittances in Pakistan.

Global Representation:

We had the privilege of representing Paysys Labs and the RafikiRemit project at the Interledger Foundation Summit 2025 in Mexico, where we showcased Pakistan’s progress in open payments innovation. The event and our participation were highlighted in this post: Paysys-Inteledger Mexico Summit Post.

These communications have substantially raised awareness of RafikiRemit and strengthened its visibility within the global fintech ecosystem. The response from industry peers, partners, and the broader Interledger community has been highly encouraging, reflecting strong confidence in our approach and the project’s potential to transform remittance services in Pakistan.

What’s Next?

During the remainder of the funded grant period, our efforts will focus on delivering the next set of core project components. These include the following key deliverables:

- Submission of Source Code and other supporting documents like user guides, admin manuals, and API Documentation.

- Provide a Lessons learnt document along with proposal for consideration in Rafiki APIs. Conduct Training Sessions for internal team and partners

These deliverables will be submitted progressively, in alignment with the project timeline. Our final report will be submitted by April 14, 2026.

Community Support

The RafikiRemit initiative has been made possible through strong collaboration:

- Interledger Foundation: Technical support and protocol guidance

- Allied Bank Limited: Infrastructure, operational readiness, and customer insight

- Paysys Labs: Engineering, design, and innovation leadership

This partnership demonstrates the strength of community-led innovation in transforming financial services for emerging markets.

Additional Comments

RafikiRemit marks a significant milestone in Pakistan’s journey toward digital financial inclusion. It demonstrates that established banks and fintech innovators can collaborate to deliver secure, scalable, and user-centric payment systems.

The project team remains committed to expanding ILP-based capabilities, driving financial inclusion, and ensuring that families across Pakistan can receive money instantly, safely, and affordably.

Top comments (0)