Project Summary

Chimoney’s Phase 2 prototyping project aimed to expand access to seamless global financial services by using Interledger Protocol (ILP). The objectives were to:

- Simplify cross-border payments

- Simplify developer access to ILP-based financial tools like Rafiki

- Empower individuals and businesses in underserved markets or those who serve underserved markets

Throughout the project, Chimoney built and deployed a suite of ILP tools, including deploying Rafiki v1.1.2-beta (latest version at time of implementation), APIs for sending payment to a Payment Pointer, and for Payment processing, and Multicurrency Wallets, enabling issuing of Interledger Payment Pointers from a consumer App and via API by Businesses to their users. These tools enabled programmable money movement across countries and currencies and made sending payments as easy as sending a text. The Chimoney Dev Portal and API documentation were launched, with a focus on developer experience and ease of integration. Integrations with third-party services like Mobile Money providers and local banks in various countries were expanded. Chimoney also rolled out user-facing features, including a lightweight app that allows users to receive, send, and manage payments using Interledger Payment Pointers, Email, or Phone number.

Key outcomes include the creation of numerous Interledger-enabled Payment Pointers and the signing of new integration agreements with key organizations, alongside the successful launch of Chimoney's first-ever direct-to-consumer (B2C) product, the Chimoney App, positioning it as an ILP-powered consumer wallet for Canada & diaspora. Contributions were also made to the open-source community through SDKs, documentation, and active participation in events like Hacktoberfest, which saw substantial contributions via GitHub.

Chimoney plans to scale its ILP infrastructure and enable more companies to issue, accept, and transact with Payment pointers through our Interledger Infrastructure as a Service (IIaaS) project, which is being developed and will be launched at the upcoming Interledger Summit. For Licensed entities, our IIaaS provides a self-hosted and managed offering, and for other companies, they use Chimoney’s existing Interledger deployment to embed Interledger, without the need to get licenses. Finally, we are expanding user acquisition through partnerships and grassroots campaigns in Africa, Latin America, and Asia. The goal is to become a flagship ILP-powered platform and ILP infrastructure provider that enables borderless payments at scale while contributing to the growth of the Interledger ecosystem.

With our infrastructure now live and regulatory foundation secured, Chimoney is poised to become a flagship ILP-powered financial infrastructure provider.

Project Rationale and Status

Chimoney set out to solve the problem of fragmented, expensive, and slow cross-border payments, especially for companies looking for an easy-to-integrate fintech-in-a-box solution. Existing systems require complex onboarding, fragmented integrations with multiple payment partners, hold funds in proprietary wallets, or are locked into specific payment partners. Chimoney aimed to solve this by building a modular, interoperable, and developer-friendly compliance-first platform with Interledger built in.

The urgency was amplified by the rising gig economy, the imminent demand for AI agents to have their own Wallets and Verified ID, and demand for global, inclusive financial services that are fast, affordable, easy-to-use, and local.

Progress-wise, the team completed the deployment of Rafiki v1.1.2-beta and its integration into Chimoney’s existing wallet infrastructure, and made it available via easy-to-use APIs, a developer portal, and a consumer App. New live payout routes were added for Canada (eg, Interac), Nigeria (eg, Airtime), Mexico (via SPEI), and others. Chimoney also completed a compliance uplift and external audit, built out Know Your Customer (KYC), anti-fraud, and compliance tools. While there were minor delays due to third-party integration timelines and team bandwidth, all core technical milestones were achieved.

The Chimoney App was soft-launched and is already being used in live campaigns and community disbursements. This demonstrated real-world utility and paved the way for scaling.

Key Activities and Outputs

Objective 1: Complete Compliance Audit and Compliance, legal, and regulatory Program Update

In support of Chimoney’s integration of Interledger-enabled wallets and broader financial inclusion goals (1. simplify cross-border payments and 2. Support individuals and businesses in underserved markets), we have made substantial progress in strengthening our compliance program during this grant phase. Our efforts were anchored on aligning with Canada’s Retail Payment Activities Act (RPAA), enhancing region-specific regulatory coverage, and promoting ecosystem-wide transparency. The following key results reflect measurable improvements across our internal controls, legal readiness, and external stakeholder engagement, laying a robust foundation for future regulatory approvals and interoperability.

Key Results

1. External Audit, Policy Uplift, and Product Refinement

A cornerstone of our compliance program enhancement was proactively engaging external experts for an independent review. We completed a comprehensive due diligence review conducted by an external auditor.

Hired an External Compliance Consultant to Implement Recommendations: To execute on the audit's findings, we engaged an external compliance consultant to comprehensively revise and enhance our policies and procedures. This work, completed in September 2024, directly addressed the Compliance approval and Refinement milestones of our grant plan.

Developed and Updated Core Compliance Documents: The compliance uplift resulted in a suite of new and revised documentation, including a new FINTRAC Reporting Procedure, an updated Sanctions Policy, and an enhanced KYC Policy and Procedure.

-

Implemented Product and Process Refinements: Based directly on feedback from the external compliance consultant, we enhanced the Chimoney platform and wallet functionalities:

- Enhanced KYC/KYB Processes: The Customer Onboarding and KYC Policy was significantly updated to include distinct verification procedures for individuals versus entities, and to formalize processes for Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD), which is critical for verifying users of the new Interledger wallets.

- Improved Wallet Integration and Controls: The Transaction Monitoring Policy was updated to integrate risk-based payout limits directly into the wallet functionality. Wallet integration and controls were improved, with risk-based payout limits now dynamically set according to client risk ratings, ensuring robust risk management.

2. Establishment of a Formal Governance and Quality Control Framework

To ensure the sustainability and effectiveness of our compliance program, we established formal oversight and quality control mechanisms.

Established the Compliance Governance Committee: We formalized the creation of a committee responsible for all compliance-related oversight, including policy approval, risk management, and the review of suspicious transactions. The committee is composed of key leadership representatives from Compliance, Operations, Product, and Sales.

Implemented a QA/QC Process: We drafted and implemented the Compliance QA/QC Processes and Procedures document, which outlines a multi-layered system of checks and balances for both client onboarding and transaction monitoring, with defined review frequencies and responsibilities.

3. Alignment with Canadian Regulatory Framework (RPAA & FINTRAC)

A primary focus was on ensuring readiness for new Canadian regulations and strengthening our existing reporting structure. To achieve this, we developed a comprehensive RPAA readiness framework supported by key documentation and processes:

Operational Risk & Incident Management: We established a detailed Operational Risk & Incident Response Framework, supported by a step-by-step Internal Incident Response SOP and an Incident Report Template. This ensures rapid detection, classification, containment, and reporting of operational issues in line with Bank of Canada expectations.

Technology, Data Privacy & System Resilience: We implemented an IT Security Testing and System Uptime Policy to ensure system resilience, mandating annual penetration tests, quarterly vulnerability scans, and a 99.9% uptime SLA. A Data Retention and Deletion Policy was also formalized to govern the lifecycle of user data.

Third-Party Risk Management: We developed a comprehensive Third-Party Risk Management program (named PSP Connect) to oversee critical vendors and payment service providers. This includes a formal PSP Connect Monitoring Protocol, an Annual Vendor Review Checklist, and a Vendor Risk Register for ongoing oversight.

Formalized FINTRAC Reporting: The newly established FINTRAC Reporting Procedure provides our team with a clear, step-by-step guide for identifying and reporting suspicious and electronic funds transfer activities, ensuring adherence to our obligations under Canadian anti-money laundering regulations.

4. Practical Application & Market Expansion Readiness

The strengthened compliance program was immediately applied to support our strategic growth and product goals, demonstrating its practical value.

Completed Compliance Onboarding with a Regulated Partner in Mexico: Our enhanced KYC, AML, and risk-rating frameworks were instrumental in successfully completing the compliance onboarding process with Bitso, a regulated payment processor in Mexico. This milestone enables Interledger-connected wallets with seamless local MXN settlement, enhancing financial access for users in Latin America.

Launched a Comprehensive AML/Compliance Training Program: To ensure company-wide adoption, we launched a quarterly AML/compliance training program, achieving a 100% completion rate across engineering, support, and operations teams.

5. Educational Content & Ecosystem Engagement

To promote transparency and share our learnings, we actively engaged with the broader financial technology and Interledger communities.

Published Public-Facing Blog: We published the article, “The Role of AML and KYC in Modern Fintech: Chimoney’s Approach to Compliance”, explaining our identity verification, transaction monitoring, and sanctions screening practices to support transparency and alignment with Interledger’s financial inclusion goals.

Featured in Interledger Community Call: We were featured in the Interledger Foundation’s March 2025 Community Lunch & Learn, where we presented Chimoney’s compliance and KYC architecture, our alignment with RPAA, and our readiness for deploying regulated, Interledger-enabled wallets. Here is the video link: Lunch and Learn: Compliance & KYC at Chimoney

Objective 2: Deploy Rafiki in Production

To ensure the seamless rollout of the newest version of Rafiki into the production environment, we focused on improving system performance, integrating new features, fixing bugs, and ensuring reliability and scalability to support new use cases. This is in alignment and indeed, a prerequisite of our achieving our goal of simplifying developer access to ILP-based financial tools like Rafiki.

Key Results

- Enhanced Webhook Security: To protect against spoofed or malicious requests, we implemented HMAC signature validation for all incoming webhook payloads. This critical security feature ensures that our system only processes verified communications from authorized Account Servicing Entities (ASEs), safeguarding transaction and account processing logic.

- Improved Fee Calculation: We resolved foundational issues related to fee calculation, particularly for payments sent via payment pointers. By deploying targeted fixes, we ensured the correct application and deduction of network fees, which is crucial for accurate ledger settlement and maintaining trust in our payment processing.

- Greater Transaction Reliability: The upgrade introduced more robust transaction lifecycle management. For instance, the addition of a distinct failed state for outgoing payments allows our system to handle unsuccessful transactions more gracefully. Furthermore, outgoing payment webhooks now include more detailed payment information, enhancing our ability to monitor and finalize fund flows efficiently.

Objective 3: Enable Money Movement using the Interledger Protocol

At Chimoney, our goal is to revolutionize global payments by making them more accessible and efficient. A cornerstone of this mission is our integration with the Interledger Protocol (ILP), a technology that allows for seamless value transfer across different payment networks and currencies. To achieve this, we've built a robust system that connects our digital wallets to the broader Interledger ecosystem. Here’s a look at how we manage the flow of funds both into and out of this network.

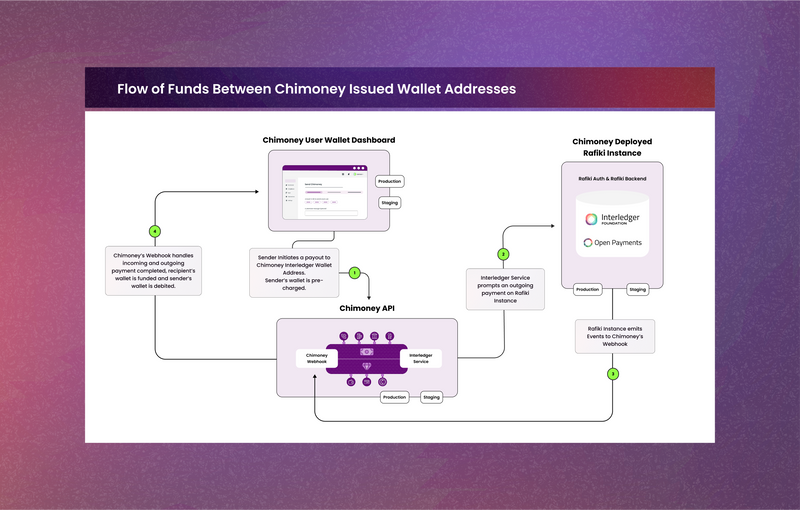

Our entire integration is powered by three main components: our Chimoney API, which serves as our core account service; our own Identity Provider for secure user consent; and our deployment of Rafiki, an open-source Interledger connector that acts as our gateway to the network. This setup allows us to act as a financial node within the Interledger network, facilitating smooth cross-border transactions.

Moving Money into the Interledger Network (Outgoing Payments)

When one of our users wants to send money from their Chimoney wallet to an external account on the Interledger network, a carefully orchestrated process unfolds to ensure the transaction is secure and efficient.

The journey begins when our user initiates a payout from their Chimoney wallet dashboard to a specific Interledger Wallet Address. The moment they do, our system places a temporary hold on the funds in their wallet, a step we call a "pre-charge". This ensures the money is available for the payment. Our Chimoney API then communicates with our Rafiki instance to get a quote for the transaction and officially creates an "Outgoing Payment".

This creation of the outgoing payment triggers a crucial webhook event (outgoing_payment.created) that signals our system to deposit the funds into the Interledger network. This liquidity, backed by the user's pre-charged wallet, is now ready to be routed to its destination.

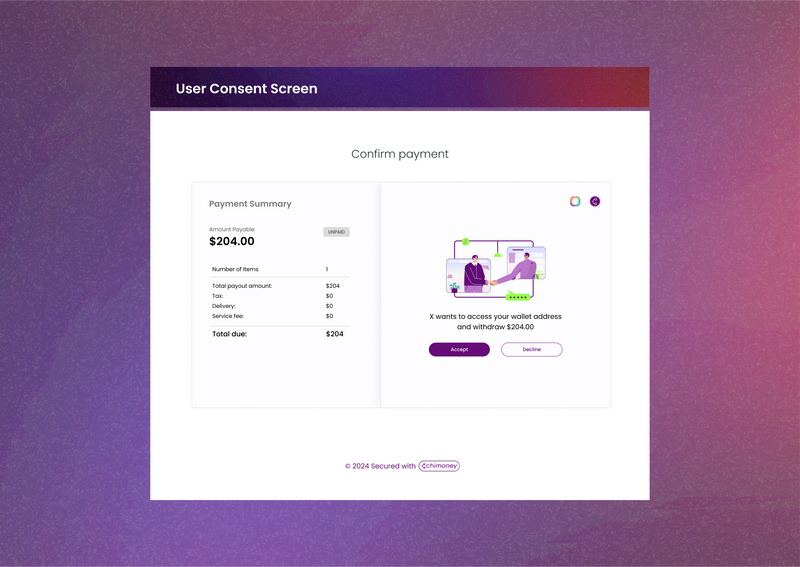

For payments initiated by a third-party application, we've added a vital layer of security: user consent. Before any funds are moved, the user is presented with a clear consent screen detailing the transaction amount and the party requesting the funds. The payment only proceeds after the user explicitly accepts the request.

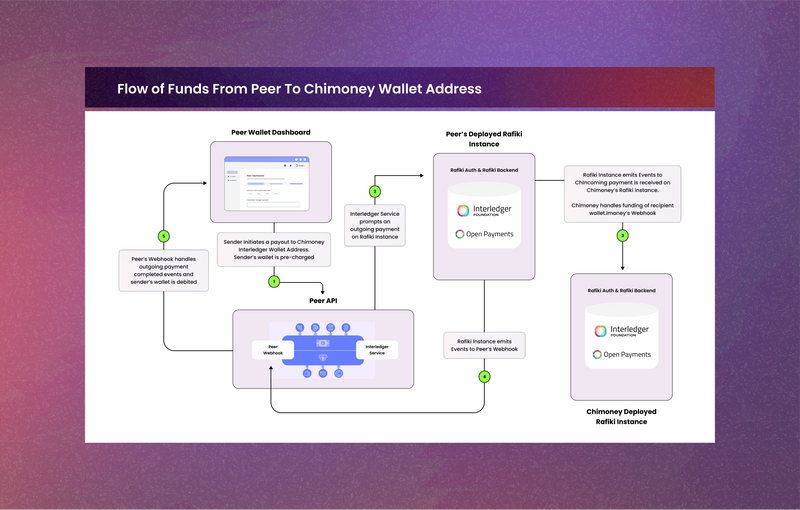

Moving Money out of the Interledger Network (Incoming Payments)

Receiving money from the Interledger network is just as seamless. When another participant in the network, what we call a "peer", sends funds to a Chimoney user, our system is designed to process it instantly.

The process starts on the peer's end. They create a payment destined for a Chimoney Interledger Wallet Address, making sure to include specific metadata that identifies them as the sender. This information is critical for us to correctly route the funds on our end. When their payment reaches our Rafiki instance, it triggers an incoming_payment.completed event, which is sent to our Chimoney API via a webhook.

Our API uses the metadata from the event to identify the transaction and the intended Chimoney recipient. With this confirmation, we withdraw the liquidity from the event and immediately fund the corresponding user's wallet. The peer is also notified that the payment was successfully completed, and they can then finalize the transaction on their end.

By carefully managing these incoming and outgoing flows, we provide a reliable bridge between our users' wallets and the vast, interconnected world of the Interledger network, taking another step toward making global payments truly frictionless.

Key Results

- Improved Interoperability: Chimoney’s wallet now supports value exchange across traditional systems and Interledger-enabled platforms and is ready to peer with other licensed Account Servicing Entities (ASEs).

- Broader Ecosystem Support: Other ASEs that peer with Chimoney can interact with our payment infrastructure through ILP-compatible channels.

- Expanded Use Cases: Enabled new scenarios like micropayments and streaming payments for developers and end-users.

- Simplified Integration: Reduced technical complexity for teams looking to connect to Interledger through Chimoney.

- Aligned with Financial Inclusion Goals: Supports a wider range of participants in accessing cross-border payment tools.

Objective 4: Enable Open Payment Consent on Web and Mobile

In line with our updated compliance policy uplift, we have fully implemented a comprehensive identity authentication and verification system that enables both businesses and individuals to authorize Interledger Protocol (ILP) Open Payment transactions. This is a pivotal development in our mission to empower the creator economy and enable new forms of Web Monetization.

This is a very key step, especially with regard to enabling individuals to monetize the web.

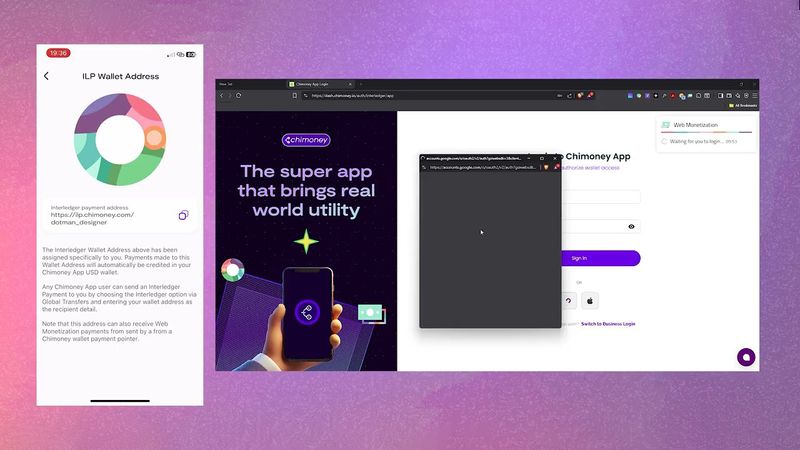

With this system, Chimoney App users who choose to monetize their content by adding their Wallet Address directly to their websites or digital content can receive payments from visitors (Other Chimoney App users) via the Interledger Web Monetization browser extension. Visitors can then seamlessly support these creators by streaming micropayments at a set rate or sending tips of specific amounts. This entire interaction is secured by our new authentication flow, which ensures explicit user consent for every transaction.

Key Results

-

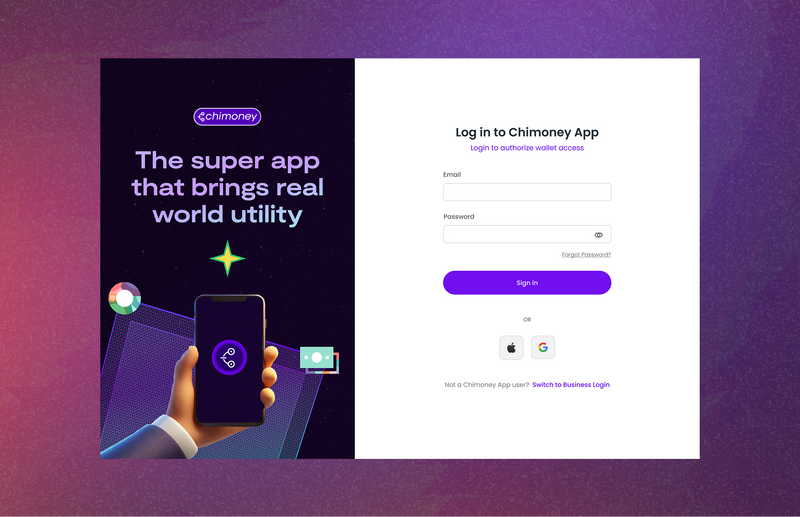

Launched Dedicated Authentication Portals: We have deployed separate web authentication pages for Chimoney App users and Business clients, enabling both groups to grant consent for Open Payment transactions.

- Enabled Web Monetization Use Cases: The completed consent flow now allows all Chimoney users (individual & business) to confirm their identity and participate in Open Payment transactions. This functionality is the foundation for services like Web Monetization transactions on Chimoney using open payments. See the demo video attached: https://youtu.be/REYYNl_L5Dw.

Objective 5: Pair with and go live as another Licensed Account Servicing Entity in the ecosystem

One of the objectives we set out to achieve was to peer with another Licensed Account Servicing entity. Due to evolving compliance updates in Canada and key partner onboarding delays, this objective is rescheduled for Q4 2025–Q2 2026 in alignment with ILF’s phased scaling recommendations.

Objective 6: Deploy Chimoney Wallet for Businesses and Individual Users - Via the Chimoney App

We have made significant progress in expanding the capabilities of our Interledger-enabled Chimoney multi-currency wallets for individuals and businesses. Our focus has been squarely on building robust, user-centric solutions that genuinely make collecting and disbursing funds more seamless for everyone.

By integrating a diverse range of options – like instant bank transfers to Mexico and innovative real-time payment systems such as SPEI transfers directly to debit cards and phone numbers in Mexico – alongside traditional bank transfers and mobile money in many other countries across APAC (Asia-Pacific), EMEA (Europe, the Middle East, and Africa), LATAM (Latin America), and NA (North America), we're actively enhancing the accessibility, efficiency, and global reach of our financial ecosystem, truly paving the way for frictionless cross-border transactions that benefit all our users.

Key Results

-

Expanded the capabilities of Interledger-enabled Chimoney multi-currency wallets for individuals and businesses with regard to collecting payments via a host of user-friendly options tailored to users' preferred pay-in and payout currencies.

Collections are currently available for:- 1. USD wallets via:

1. Wire and International ACH 2. CLABE (Payer pays equivalent MXN quote with Mexican Pesos bank transfer to a Mexican bank account issued specifically for the said transaction) 3. Interledger (Other users can pay using their payment pointers and consent to fulfil the payments)

- CAD wallets via:

- Interac

- NGN wallets via:

- Bank Transfer

- Debit Card (a Nigerian bank account issued specifically for the said transaction)

- CAD wallets via:

- 1. USD wallets via:

-

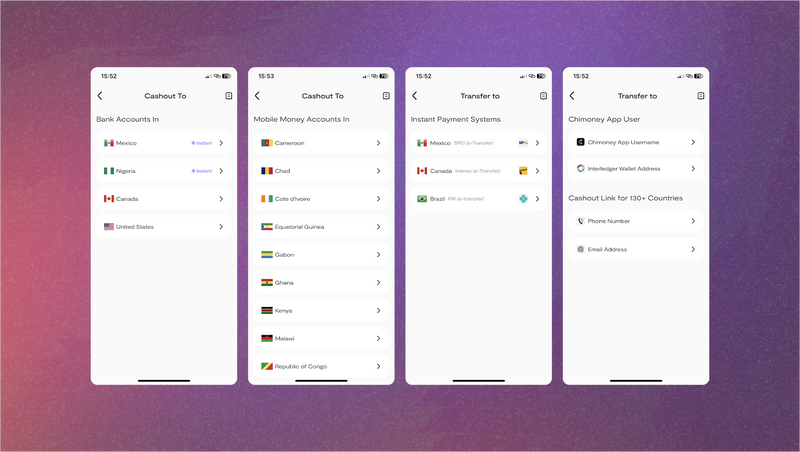

We added support for faster payouts to a lot more destinations.

Users of Interledger-enabled Chimoney multi-currency wallets for individuals and businesses will enjoy the ability to send payouts via:- 1. Bank Transfers to

1. Mexico (Instant)

2. Nigeria (Instant)

3. United States (1-3 days)

- P2P to Chimoney & Chimoney App Users via

- Interledger Wallet Address (USD only)

- App Username (USD, CAD, NGN)

- Mobile Money to

- Cameroon

- Chad

- Côte d'Ivoire

- Equatorial Guinea

- Gabon

- Ghana

- Kenya

- Malawi

- Republic of Congo

- Rwanda

- Senegal

- Tanzania

- Uganda

- Zambia

- Real-Time Payment (RTP) Systems or Instant Payment Systems:

- SPEI transfer to debit card and phone number (e-transfer in Mexico)

- Interac transfer to email address (instant e-transfer in Canada)

- Pix (instant e-transfer in Brazil) (Releasing by Q.4 2025)

- Chimoney Global Transfer:

- Via phone number (redeem link sent to phone number and redeemable to banks in 130+ countries, MoMo in 13 countries, airtime in 7 countries, and more via Chimoney infra)

- Via email address (redeem link sent to email inbox and redeemable to banks in 130+ countries, MoMo in 13 countries, airtime in 7 countries, and more via Chimoney infra)

- P2P to Chimoney & Chimoney App Users via

- 1. Bank Transfers to

1. Mexico (Instant)

2. Nigeria (Instant)

3. United States (1-3 days)

Objective 7: Interledger Advocacy, Marketing, and Promotion

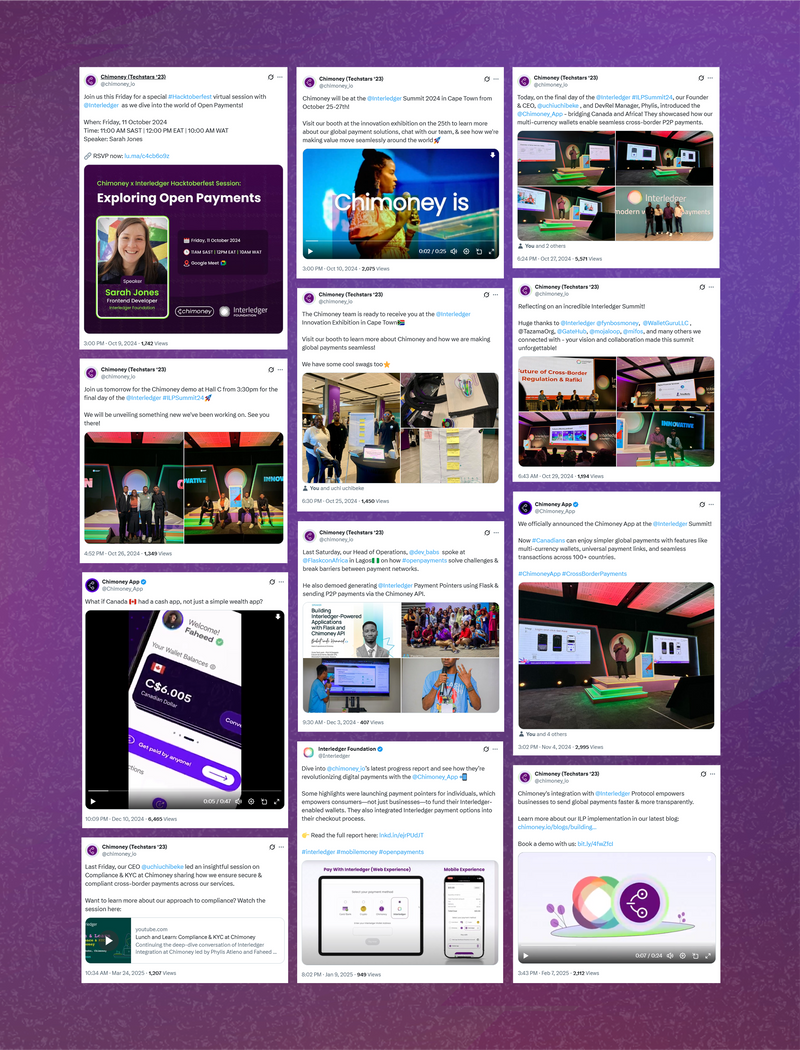

To support Interledger growth and awareness, we implemented a strategic advocacy and marketing plan that spotlighted Chimoney’s integration of the Interledger Protocol (ILP) across developer communities, fintech stakeholders, and potential adopters. Through educational content and targeted campaigns, we built trust, increased visibility, and fostered meaningful engagement with key audiences across Africa and Canada.

Key Results

Campaign Performance: Ran multiple campaigns across LinkedIn, Twitter, Instagram, and newsletters, generating over 10,000+ organic impressions.

ILP Community Integration: Actively participated in Interledger Community Calls, shared regular updates, and supported ILP-related grant cycles with aligned content and visibility pushes.

Content Highlights: Created blog articles showcasing ILP in action within Chimoney’s ecosystem, reinforcing both technical value and user impact.

Technical Writing Challenge (Ongoing): Launched a focused content campaign in collaboration with the WriteTech Hub, encouraging writers to create educational articles exploring Chimoney’s ILP endpoints to boost visibility and developer understanding.

Objective 8: Interledger Infrastructure as a Service (IIaaS) - new

Interledger Infrastructure as a Service (IIaaS) is an innovative initiative pioneered by Chimoney, designed to accelerate the adoption of the Interledger protocol by account servicing entities, such as financial institutions and payment service providers, while minimizing the technical complexity and overhead typically associated with the integration process. IIaaS aims to simplify the deployment, update, and scaling of Interledger-based systems by abstracting the intricate details of setup and configuration, making it easier for organizations to leverage the power of Interledger without requiring deep technical expertise.

Key Results

Seamless Deployment Across Multiple Cloud Providers (in alpha)

Developed the foundation of a cloud-agnostic web application powered by the open-source chimoney/IIaaS package.

The package supports a wide range of deployment strategies using tools like Docker, Kubernetes, and Helm, enabling rapid provisioning on AWS, GCP, Azure, and custom clouds.

Reduced time-to-deploy for early partners testing the IIaaS interface, demonstrating significant efficiency gains.

Predictable Billing with PAYG Pricing Model

Designed a flexible, tier-based billing system for Chimoney-hosted deployments, allowing users to choose plans based on their Interledger traffic volume.

Enabled clear usage-based billing, giving partners better forecasting and cost control while scaling infrastructure.

Provide Chimoney’s Interledger Infrastructure to Partners via API

- Enable partners to issue and manage Interledger-enabled Wallets and Payment Pointers via API to enable more organizations to provide payment pointers to their Users.

Objective 9: Content and Interledger Advocacy

To drive developer adoption, strengthen Chimoney’s position within the Interledger ecosystem, and raise awareness of its ILP-enabled services, we published a series of high-impact, cross-functional blogs. These efforts focused on developer enablement, ecosystem visibility, cross-border payments, and building anticipation for upcoming announcements about Chimoney’s Web Monetization–compatible wallets.

Key Results

6 Strategic Content Pieces Published: Wrote and published six thought-leadership, technical, and market-focused articles targeting developers, fintech operators, financial institutions, and B2B businesses, reinforcing Chimoney’s positioning as an Interledger-integrated solution.

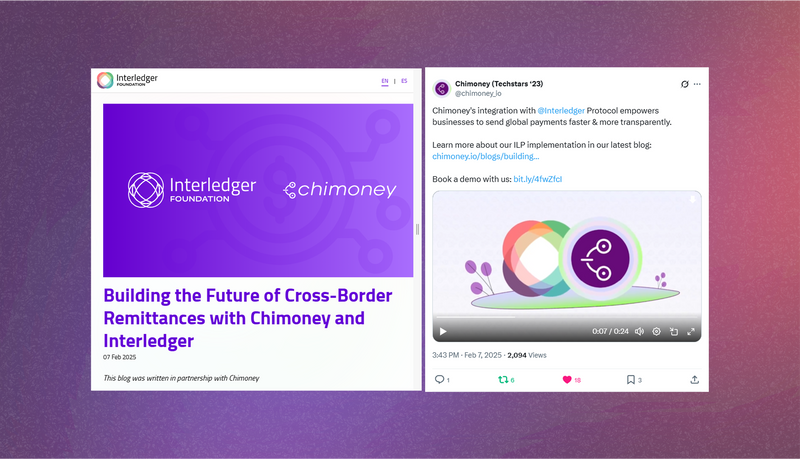

Co-authored Blogs with Interledger Marketing Team: Successfully co-authored and cross-published two articles with Interledger Foundation, increasing cross-community visibility and reinforcing Chimoney’s alignment with ILP thought leadership.

Developer-Centric Article Live: Published “A Developer’s Guide to Enabling ILP Payments with Chimoney,” a hands-on tutorial-style blog to simplify onboarding for technical users and promote developer self-sufficiency.

Case Study and Business Use Case Insights Released: Released a real-world case study demonstrating Interledger-powered P2P payments in the Chimoney App and a market-focused article outlining how Chimoney enables businesses to scale into new markets via ILP.

Support for Financial Institutions & Compliance Messaging: Delivered deep dives on integrating ILP-based infrastructure in existing banking stacks and co-authored an article on digital compliance and AML/KYC.

Pre-launch Positioning for Web Monetization: Collaborated on strategic messaging ahead of Chimoney’s Web Monetization-compatible wallet rollout, with a co-authored article currently in development.

Our Objectives and key results outlined above were in alignment with the project goals. Namely, 1) Simplify cross-border payments, 2) Simplify developer access to ILP-based financial tools like Rafiki, and 3) Empower individuals and businesses in/who serve underserved markets.

Project Impact and Target Audiences

On the consumer/payment recipient side, Chimoney’s primary beneficiaries are individuals excluded or underserved by traditional financial systems, including gig workers, developers, creators, and communities across Africa, Latin America, and Asia. Many of these individuals, including those from Black, Women, and LGBTQIA communities, face systemic barriers in accessing payments and financial tools.

Through this prototyping phase, we have already begun to demonstrate tangible impact:

- User Engagement: We successfully engaged users through targeted pilot payouts and community campaigns. For instance, Chimoney facilitated hundreds of payouts to student groups and community contributors in various regions across Africa, Latin America, and Asia, reaching thousands of unique recipients.

- Wallet Creation: Our efforts led to the creation of numerous Interledger-enabled Payment Pointers during the soft launch, indicating a strong initial demand for ILP-native wallets.

- Accessibility & Empowerment: Early feedback from recipients consistently highlighted the intuitive onboarding process and the life-changing ability to receive payments without needing a specific wallet or traditional bank account. This directly increases financial access for individuals who previously faced significant hurdles.

- Awareness & Education: The project significantly increased awareness of digital financial services and Interledger, especially among communities that typically lack exposure to these tools. Our community calls and content (e.g., "The Role of AML and KYC in Modern Fintech: Chimoney's Approach to Compliance" blog, Interledger Community Call presentation) reached an estimated tens of thousands of unique individuals across various platforms.

On the Infrastructure side, Chimoney is already serving as a foundational choice for future grantees and community members, demonstrating our commitment to scaling the ILP ecosystem:

- API Usage: Our Chimoney API and Interledger Infrastructure are powering nascent use cases for multiple integration partners, including platforms in the Caribbean, a Canadian wallet app, and community initiatives in Africa.

- Open-Source Contribution: Our participation in the October 2024 Hacktoberfest resulted in significant contributions via GitHub Pull Requests, issues, and long-form content, directly enhancing the open-source Interledger ecosystem.

With further scaling, Chimoney is poised to serve millions of people globally, providing programmable, borderless access to money movement, while maintaining cost transparency and user control. We aim to become a flagship ILP-powered platform and a critical ILP infrastructure provider, enabling borderless payments at scale and significantly contributing to the growth of the Interledger ecosystem.

Progress Evaluation

We rigorously monitored progress on activities and benefits throughout this prototyping project, employing a multi-faceted data collection and analysis approach to ensure measurable outcomes and continuous improvement.

1. Data Collection & Analysis: We tracked progress via development milestones, API usage metrics, transaction data, user interviews, and engagement analytics.

-

Transaction & Wallet Data:

- Number of Successful Transactions: Successfully processed thousands of Interledger-enabled transactions, both in testing and live environments, through the Chimoney App and API endpoints during the prototyping phase. This includes both P2P transfers and payouts to various destinations.

- Number of Interledger Wallets Created: As of July 2025, hundreds of unique Interledger-enabled Payment Pointers have been created by users on the Chimoney platform.

-

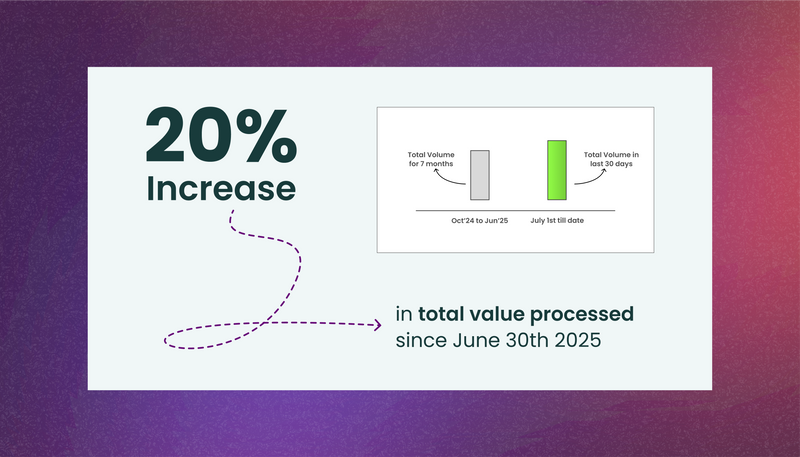

Transaction Volume & Velocity: While initial volumes are modest given the prototyping nature, we project a significant increase in total value processed since the soft launch of the Chimoney App in Q2 2025.

-

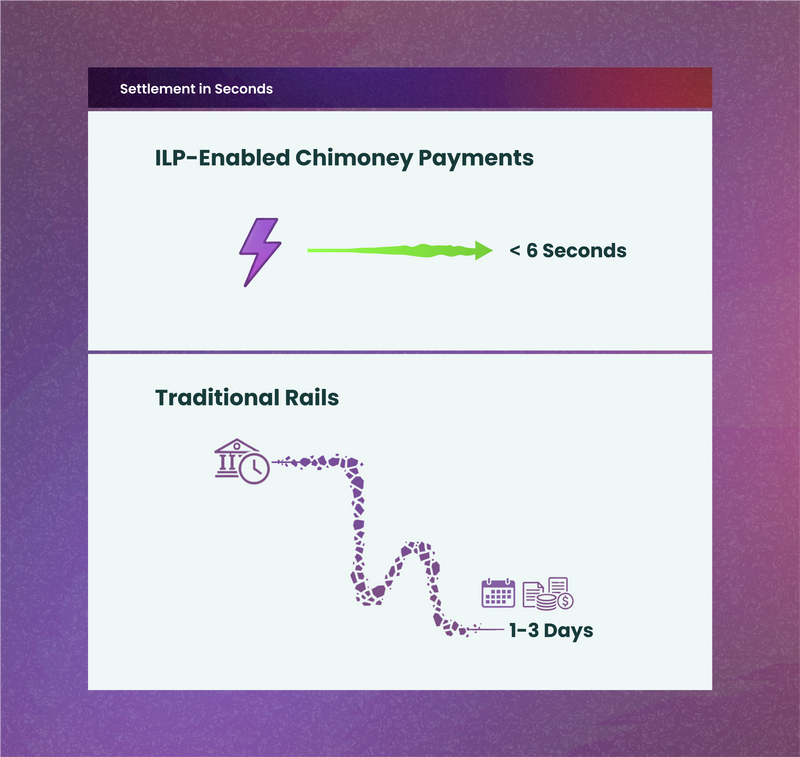

Time to Settlement: For Interledger-enabled transactions, we consistently achieved settlement times of under 6 seconds, significantly outperforming traditional cross-border payment rails, which can take days.

-

Developer & Partner Engagement:

- Developers Onboarded: Our developer portal and API documentation saw strong traction with over 5,000+ payment pointers generated on the sandbox. Our Technical Writing Challenge engaged 62 participants actively creating content around Chimoney and Interledger integrations.

- Partnerships & Collaborations: We successfully signed 4 integration contracts with external organizations (e.g., a Caribbean e-commerce platform, a Canadian wallet app, two African community wallet initiatives). A significant milestone was the successful compliance onboarding with Bitso, a regulated payment processor in Mexico, enabling seamless local MXN settlement for Interledger-connected wallets.

-

Compliance & Operational Metrics:

- AML/Compliance Training: Achieved a 100% completion rate across engineering, support, and operations teams for our quarterly AML/compliance training program.

- System Uptime: Maintained a 99.9% uptime SLA for our deployed Rafiki instance and core Chimoney API, ensuring high reliability for Interledger transactions.

Data Collection Methodology:

- System Logs & Analytics Dashboards: Automated tracking of transaction counts, volumes, wallet creation, API calls, and system uptime.

- Surveys & User Interviews: Qualitative feedback from early adopters and community partners on usability, impact, and pain points.

- Partner Reporting: Direct input and data from our integration partners on their usage and feedback.

- GitHub Analytics: Monitoring contributions, issues, and pull requests related to our open-source efforts.

- Uptime Monitory: We continuously monitor our system and infrastructure uptime to ensure reliability.

2. Stakeholder Involvement: All key stakeholder groups were deeply involved throughout the project, ensuring alignment, feedback, and successful execution:

-

Chimoney Internal Team:

- Engineering Team: Actively involved in daily stand-ups, technical design, development, and deployment of Rafiki integration, IIaaS MVP, and wallet functionalities.

- Product Design Team: Worked on designing key user-facing touchpoints from wire frame architectures to User Interface and User Experience designs across mobile and web applications.

- Operations & Support Team: Managed compliance processes, user support, and monitored transaction flows.

- Compliance Team: Led the external audit, policy uplift, and continuous monitoring, ensuring adherence to RPAA and other regulatory frameworks.

- Marketing Team: Drove global awareness campaigns, managed press coverage publications, and executed developer outreach programs for platform adoption and ecosystem growth.

- External Developers: Engaged through our Dev Portal, SDKs, Hacktoberfest, and the Technical Writing Challenge, providing valuable feedback on API usability and contributing to the open-source ecosystem.

- ILF Collaborators: Maintained regular check-ins and feedback sessions with the Interledger Foundation team, including the ILF CTO, ensuring alignment with open standards and global inclusion goals. We presented our progress and compliance architecture in the March 2025 Community Lunch & Learn.

- Community Partners: Engaged through pilot programs (e.g., Goodwall App), providing real-world testing and feedback on the Chimoney App's utility and impact in target communities.

Communications and Marketing

We took a collaborative and community approach in marketing. Marketing funds were primarily used for Press releases, ambassadors, sponsored posts, and design work on technical content such as developer guides and event graphics. In addition to Chimoney’s Team marketing and communications work, we collaborated with community members and the Interledger marketing team. Some accomplishments include:

-

Global Media Coverage:

- Press releases announcing Chimoney’s ILP integration, partnerships, and product launches were featured in top-tier global fintech and business publications, including Fintech Finance News, Payments Journal, Globe Newswire, Electronic Payments International, TechMoran, Fintech.ca, and Financial IT, with a global reach of hundreds of millions of impressions.

-

Blog Content & Cross-Publication:

- Co-authored and led content marketing for the blog on “Building the Future of Cross-Border Remittances with Chimoney and Interledger,” jointly published on both Chimoney’s and Interledger Foundation’s blog pages. The blog marketing generated 4,000+ impressions across social platforms.

-

Campaigns & Events:

- Created a recap campaign for the Lunch & Learn session on Compliance and KYC at Chimoney, achieving 2,000+ impressions.

- Created an awareness campaign on Interledger and Chimoney’s participation in the Payments Canada Summit, reaching 3,000+ impressions, attracting more visibility among ecosystem partners.

- Supported Interledger’s marketing team in raising visibility for the March and July Interledger Digital Financial Grants application cycles, generating 1,000+ targeted impressions through Chimoney’s ecosystem channels.

-

Newsletters:

- Featured Interledger-related updates in Chimoney newsletters (with thousands of subscribers), further amplifying reach and ecosystem visibility.

-

Live Demonstrations at Interledger Community Calls:

- Feb 2025: Demonstrated how Interledger-compatible wallet addresses can be generated and how transfers can be made between them using the Chimoney App and API. Link to Demo

- May 2025: Showcased Web Monetization using Chimoney’s Interledger-compatible wallets, demonstrating real-time micropayment flows to and from the Chimoney App, along with localized cash-out options for creators. Link to Demo

-

Developer Enablement:

- Published “A Developer’s Guide to Enabling ILP Payments with Chimoney” to walk developers through integrating Interledger-enabled payment flows using Chimoney’s API and endpoints, promoting ease of adoption and ecosystem interoperability.

- Currently running a Technical Writing Challenge with dozens of participants to drive more developer education and engagement. The challenge invites contributors to create tutorials, documentation, and guides around Chimoney and Interledger integrations, improving onboarding, and increasing developer visibility.

-

Publications

- Case Study: Released “How Interledger is Powering P2P Payments: The Chimoney App Case Study”, offering a deep dive into how Chimoney has integrated the Interledger Protocol to power secure, instant, and borderless P2P transactions via the Chimoney App.

- Business Insights: Published “How Businesses Can Use Chimoney’s Interledger-Enabled Services to Expand into New Markets”, highlighting how Chimoney helps businesses overcome payment fragmentation and scale cross-border operations using Interledger infrastructure.

- Technical Deep Dive: Shared a technical deep dive in “Optimizing Payment Infrastructure for Financial Institutions”, outlining how Chimoney’s ILP-based endpoints simplify integration for financial institutions, without requiring in-house Interledger infrastructure deployment.

- Compliance Thought Leadership: Co-authored “Digital Compliance and eKYC Pave the Way for a Safer Global Financial Ecosystem” with Interledger’s Marketing team following Chimoney’s Lunch & Learn session. The article covered Chimoney’s advanced eKYC/AML systems, regulatory alignment, and risk framework.

- Open Payments Advocacy: Ran a “30 Days of Open Payments” LinkedIn campaign, breaking down key concepts, implementations, and opportunities around Open Payments and Interledger. And ultimately published “How Open Payments Can Transform Financial Access and Innovation in Africa” in TechEconomy, a Nigerian media outlet, exploring how Open Payments can drive financial inclusion.

Web Monetization Awareness: Aligned with the Interledger Marketing team to frame the messaging ahead of Chimoney’s marketing of Web Monetization and currently co-authoring an article ahead of the launch of news on Chimoney’s web monetization-compatible wallets.

What’s Next?

Following the successful completion of our prototyping phase, Chimoney is poised to significantly expand Interledger Protocol adoption and financial inclusion globally. Our next steps are focused on transitioning from a proven prototype to a fully operational, scaled, and compliant production service.

We are committed to deepening our partnership with the Interledger Foundation to accelerate the growth of the ILP ecosystem. Our strategic roadmap includes:

- Expanding Interledger Infrastructure as a Service (IIaaS): Finalizing the development and launch of IIaaS to General Availability (GA) to enable seamless deployment and scaling for external entities, fostering broader adoption of ILP. We are actively engaging a robust pipeline of partners across various regions to integrate our IIaaS.

- Formalizing Peering Relationships: Pursuing and formalizing compliant peering relationships with other financial service providers operating as Interledger network nodes, ensuring seamless, regulated cross-border payments.

- Global Market Expansion: Scaling our operations and user acquisition efforts in key emerging markets across Africa, Latin America, and Asia, making borderless payments accessible to millions.

- Continuous Compliance & Innovation: Maintaining our high standards of regulatory compliance and continuing to innovate on our platform to provide the most efficient, secure, and user-friendly Interledger-enabled financial services.

Chimoney is excited to continue building the future of open, inclusive, and efficient global payments alongside the Interledger Foundation and the broader ILP community.

Remaining Work to Advance to Launch & Scale Phase:

-

Technical Roadmap for Production & Peering:

- Complete IIaaS Implementation: Finalize development and launch of Interledger Infra as a Service (IIaaS) to General Availability (GA), enabling seamless deployment and scaling for external entities. This includes comprehensive documentation and SDKs for easy integration.

- External Peering Readiness: Conduct rigorous internal audits and readiness tests (e.g., load testing, security penetration tests, vulnerability scans) to prepare for peering with other Interledger nodes (Account Servicing Entities - ASEs or Electronic Money Institutions - EMIs). This involves ensuring our Rafiki deployment can handle high transaction volumes and maintain 99.9% uptime.

- Multi-Asset Support: Expand Chimoney's wallet capabilities to enable multi-asset support beyond current currencies, increasing interoperability within the ILP network.

- Expanded Payout Routes: Integrate additional payout routes and partnerships, particularly in LATAM and Asia, to broaden the reach of Interledger-enabled payments.

-

Operational Roadmap for Scaled Impact:

- Multi-Region Compliance Sandboxing: Launch dedicated compliance sandboxing environments with partners in Canada, Nigeria, and LATAM to test and refine regulatory adherence in diverse operational contexts.

- Formalize Peering Relationships: Actively pursue and formalize payment institution peering relationships (ASE or EMI licenses where required), with negotiations already underway, to enable fully compliant and regulated Interledger operations.

- Implement Scalable Revenue Model: Implement and optimize our tiered revenue model based on transaction fees for cross-border payouts and tiered pricing for IaaS deployments, demonstrating sustainable operation aligned with lowering costs for users.

- Targeted Marketing Campaigns: Launch comprehensive marketing campaigns to attract both platform partners for IIaaS and end-users for the Chimoney App, focusing on the value proposition of borderless, low-cost Interledger payments.

-

Regulatory Compliance Details for Peering:

- RPAA & FINTRAC Adherence (Canada): Continue to bolster our robust RPAA readiness framework, including ongoing operational risk management, IT security testing (annual penetration tests, quarterly vulnerability scans), and formalized FINTRAC reporting (STRs, EFTRs). This ensures our Canadian operations remain fully compliant as an Interledger node.

- Mexico Compliance (e.g., FinTech Law): Leverage our successful compliance onboarding with Bitso in Mexico and deepen our understanding and adherence to Mexico's FinTech Law and other relevant financial regulations for operating as an Interledger node. This includes continuous monitoring of local regulatory changes and adapting our compliance frameworks accordingly.

- Cross-Border AML/KYC: Enhance our existing KYC, AML, and risk-rating frameworks to support multi-jurisdictional compliance for peering with diverse financial service providers operating as Interledger network nodes. This includes advanced transaction monitoring and sanctions screening capabilities.

How Results Inform Future Efforts: The quantitative and qualitative data collected during this prototyping phase (e.g., 170+ Payment Pointers created, 4 new LOIs signed with Companies interested in using our Interledger Infrastructure) directly inform our go-to-market strategy, product roadmap, and compliance priorities. The positive user feedback on intuitive onboarding and the life-changing ability to receive payments without traditional accounts validates our focus on underserved markets. The success in building IIaaS foundations and engaging developers proves the viability of our ecosystem-building approach. This data will be continuously analyzed to refine our offerings, optimize user acquisition, and prioritize regulatory efforts in new markets.

New Risks & Mitigations for Continued Progress:

-

Partner Onboarding Bottlenecks:

- Risk: Slower-than-expected integration or peering with external financial service providers.

- Mitigation: Prioritize developer tooling and comprehensive onboarding support for IIaaS partners; establish clear SLAs and dedicated technical support for integrations; diversify partner outreach across multiple regions.

-

Market Adoption Slower Than Expected:

- Risk: Users or businesses in new markets not adopting Interledger-enabled services as quickly as projected.

- Mitigation: Implement agile, data-driven marketing campaigns with A/B testing; focus on compelling real-world use cases (creator payouts, remittances, micro-savings); leverage community champions and local partnerships; offer incentives for early adoption.

Business Plan & Revenue Model for Sustainable Operation: Chimoney is committed to sustainable operation as a core Interledger network node, aligned with ILF's mission to increase access to digital financial services by lowering consumer and merchant costs for payments. Our revenue model is designed to support this:

- Transaction Fees: We will generate revenue through competitive transaction fees on cross-border payouts and API usage, ensuring costs are significantly lower than traditional alternatives, directly benefiting users and merchants.

- Tiered Pricing for API and IIaaS: Our Interledger Infra as a Service (IIaaS) will offer tiered pricing plans based on Interledger traffic volume, providing predictable billing for partners while democratizing access to ILP infrastructure. This complements our core Payment Infrastructure Offering.

- Wallet & Float-Related Revenue: For high-volume use cases like creator earnings, hackathon bounties, and surveys, we will generate revenue through wallet management and optimized float, especially as partners utilize our wallet features for efficient fund management.

This revenue model ensures Chimoney's long-term viability, allowing us to continuously invest in ILP infrastructure, expand into new underserved markets, and drive down payment costs, thereby amplifying ILF's mission at scale. A detailed budget and financial projections will be submitted in Airtable.

**Vision

**Chimoney aims to become a core Interledger node serving Africa, LATAM, and global users who need compliant, multi-currency payment access, all with open-source-first principles.

A detailed roadmap and business model support sustainable growth and revenue. The goal is to onboard companies to build with our Infrastructure and Interledger stack, peer with other ILP network nodes, reduce remittance and payout costs, grow adoption of our consumer App, and become a core piece of ILP’s global vision.

With our production-ready APIs, verified Payment Pointer system, and compliance integration, Chimoney is positioned to become a leading payout node for African and diaspora markets. Our infrastructure enables Interledger-aligned financial inclusion at scale, a vision we intend to accelerate in 2025 and beyond.

Our roadmap aligns with ILF’s vision of a robust network of trusted payment nodes enabling access across geographies. We’re excited to contribute infrastructure and use-case insights to this growing ecosystem.

Lessons and Recommendations

Lessons Learned:

- Regulatory compliance is foundational, not optional. Early investment in governance and KYC/AML allowed faster integration later.

- Developers want clear APIs and fast integration: our Dev Portal, SDKs, and Interledger tutorials saw higher-than-expected engagement.

- Users in emerging markets value earn-first wallets more than just sending capabilities.

- Partnerships take longer than expected. Align timelines with shared goals and legal capacity.

Recommendations:

- Start compliance planning early.

- Prioritize developer tooling and community onboarding.

- Tie ILP value props to real-world use cases like creator payouts, remittances, and micro-savings.

Community Support

To advance our work, we will benefit from:

- Introductions to ILP participants interested in peering with licensed payout processors.

- Collaborations with ILF grantees to build IIaaS use cases together.

- Feedback on our Rafiki-hosted deployments for further improvements.

- Testing and feedback on the Chimoney App

- Introductions to Mexican, LATAM, and Asia-focused NGOs and fintechs

- Integrating the Chimoney Consumer App into the Interledger Summit Experience, since we support paying to Mexican Banks and Phone numbers via SPEI

Chimoney is committed to contributing back to the ILP community, from technical insights and open-source tooling to event participation and developer onboarding.

Additional Comments

The Chimoney team is grateful for ILF’s support and looks forward to contributing to the open payments ecosystem. We welcome continued collaboration across compliance, developer enablement, and regional expansion.

Top comments (4)

It's been an incredible journey leading the product efforts on this. From a product perspective, I'm especially proud of how the team came together to integrate Web Monetization support into the Chimoney App and expand our payout options. Seeing the SPEI integration go live for instant cashouts in Mexico was a major win for us.

Fantastic work by the entire team to bring this vision to life and document it so clearly. I'm personally looking forward to putting our instant Mexico transfers to the test when I'm on the ground for the Interledger Summit in November!

Amazing Report!

It's been exciting and lots of growth on contributing to this project by ensuring that our compliance programs, customer support and operations continually evolve to aid the success of the project!

I am proud of what the team has achieved, and looking forward to feedback from fellow community members here 😊

Congratulations! The fact that non-licensed companies can use Chimoney’s existing Interledger deployment to embed Interledger without the need for them to gain banking licenses themselves is huge!

Sounds like a phenomenal 12 months!

It's been incredible supporting and contributing to this through our marketing and community-focused initiatives, developer outreach, and advocacy efforts. So proud of the team and all we've accomplished! Great work, Team!