Brief Project Description

Kanzu Microloans is an ILP-enabled digital infrastructure that allows SACCO members to access instant microloans through mobile and web self-service platforms. By integrating with the Rafiki network and leveraging ILP, we aim to automate credit scoring, disbursement, and repayment, allowing SACCOs to scale affordable lending with minimal friction.

Target Audience & Expected Impact

Primary Target Group: Unbanked and Underbanked SACCO, VSLA & MFI Members

- Context: Uganda’s population is approximately 48 million.

- Financial Exclusion: 89% of Ugandans are either unbanked or underbanked, meaning they lack reliable access to formal financial institutions or products.

- Demographic Composition: Over 82% of SACCO and VSLA members are women, especially from low-income and rural households.

Secondary Audience: SACCO, VSLA & MFI Administrators - These are the decision-makers and operators of the financial cooperatives. The infrastructure will enhance their ability to serve members more efficiently by automating loan workflows and enabling instant disbursement.

Tertiary Audience: Growing Middle-Class SACCOs -The project also targets more financially sophisticated SACCOs, such as staff and institutional SACCOs, that are often overlooked in financial inclusion programs. These groups are well-positioned to adopt advanced tools like data-driven credit scoring, interoperable payments, and are increasingly capable of transacting across borders, especially in response to the needs of mobile or diaspora-linked members.

Additional Statistics for Context

- Mobile penetration: Over 70% of Ugandans own a mobile phone, but digital financial literacy varies.

- Access to financial institutions: In rural Uganda, only 14% of people live within 5 km of a bank.

- Informal lending prevalence: Due to barriers in traditional finance (collateral, paperwork), 40%+ rely on high-risk informal loans.

- Gender credit gap: Women receive 20–30% less in formal credit than men on average, despite higher repayment rates.

Why the ILP Microloan Program Matters

- It provides instant, digital, and inclusive credit access, especially in emergencies.

- It supports financial resilience and economic empowerment for grassroots communities.

- It also supports data-based credit scoring, so those without formal histories (like rural women entrepreneurs) can build trust-based financial footprints.

Expected Impact

- Improve access to credit for over 50,000 SACCO members, 70% of whom are women

- Reduce loan disbursal time from days to minutes

- Lower barriers to credit for informal workers, border traders, and youth

- Enable data-driven lending, reducing default risk while increasing inclusion

- Transact across financial systems without needing a traditional bank account

Project Update

We’ve made strong progress on the backend implementation of the entire loan lifecycle, from loan product creation and credit scoring to disbursement and repayment integrations. The frontend for self-service loan application is still under development, but once live, users will be able to request and repay microloans entirely through the Kanzu Finance mobile and web apps.

Key updates:

- The Rafiki adapter is under development to support disbursement and repayment processing via ILP.

- The MoMo integration for mobile money disbursement is complete and tested.

- The team is 90% staffed. We are still working on the sales department.

- Talks and consultations with the Bank of Uganda and the Ministry of Finance are underway regarding obtaining the NPS and the digital lending licenses.

- The board profiles for the new board are complete, and candidates have been put forward.

The technical stack is nearly ready, and we are gearing up to begin end-to-end user testing in the next development sprint.

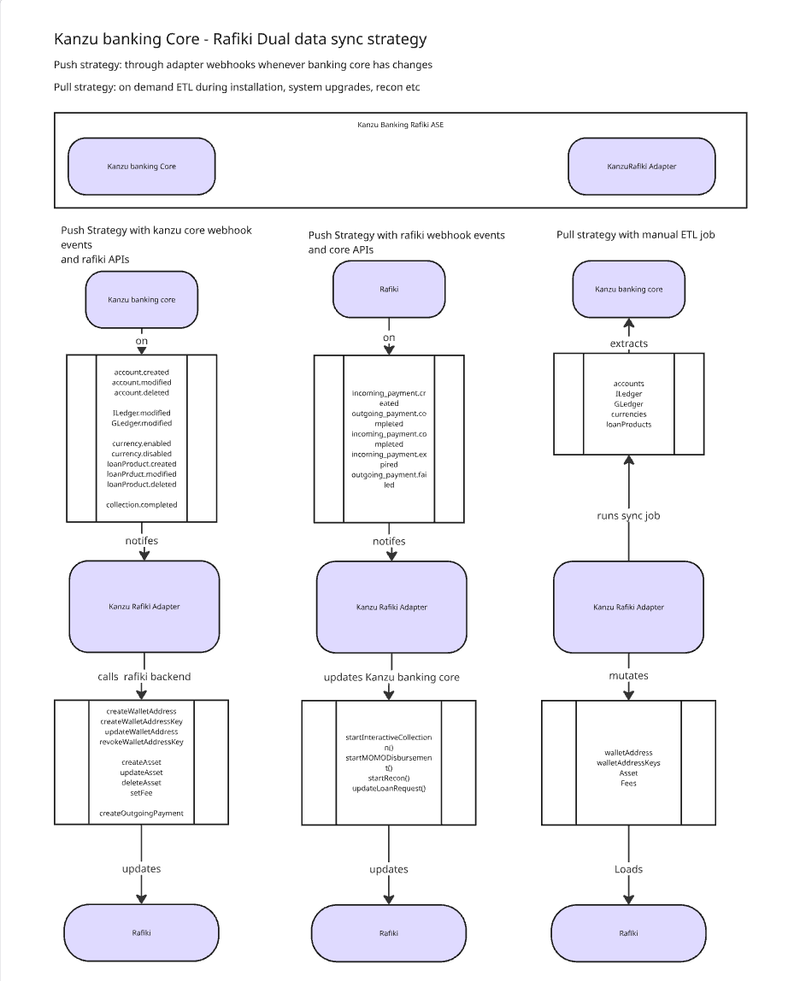

Kanzu Banking Core-Rafiki Dual Data Sync Strategy

The solution empowers financially underserved populations, aligns with the Interledger Foundation’s mission to foster open payments, and brings real-world ILP adoption to grassroots financial systems.

Progress on Objectives, Key Activities

Objectives

- Develop a fully functional, ILP-enabled Instant Microloans Infrastructure within Kanzu Banking that allows SACCOs, VSLAs, and MFIs to offer real-time loans to their members.

- Advance Financial Inclusion for the Underserved by providing accessible, fast, and secure microloans, especially to women and low-income communities who are unbanked or underbanked.

- Leverage Open Infrastructure (ILP + Rafiki) to ensure cross-border, interoperable payments and build the foundation for scalable, open financial rails.

- Strengthen SACCOs & VSLAs by enabling them to operate digitally, reduce costs, automate credit scoring, and scale their impact sustainably.

Key Activities

- Backend & Frontend Development - Develop and integrate the loan product engine, credit scoring, loan disbursement, and repayment modules into Kanzu Banking.[In Progress]

- Complete Rafiki adapter integration and mobile/web front-end interfaces. [In Progress]

- Sandbox Testing & Rafiki Peering [Pending]

- Create a developer playground to test Rafiki functionality and simulate loan operations.[Pending]

- Peer with a public Rafiki node and conduct stress testing for interoperability.[Pending]

- User-Centric Design & Accessibility - Build for low digital literacy with clear UI/UX.[In Progress]

- Community & Regulatory Engagement [In Progress]

- Align with UMRA [Ministry of Finance], BoU, and NITA-U to meet regulatory requirements.[In Progress]

- Engage with the ILP developer community and contribute to the ecosystem.[In Progress]

- Marketing & Communication - Publish blog posts, run webinars, and document impact stories.[Pending]

Communications and Marketing

- At the Seamless Conference, we aimed to engage the management team of a SACCO union representing over 500,000 end users. Our goal was to advance conversations around onboarding them to Kanzu Banking, which would lay the groundwork for broader adoption of ILP-enabled cross-border transactions once development is finalised. Notably, their board chairman was among the conference speakers, offering a strategic opportunity to align on shared priorities. The irony of tech exclusion (no WiFi at the venue) sparked powerful conversations about infrastructure and access. Check out this article for more context.

Internal blog post on the microloan use case in ILP context being drafted.

Marketing materials (video explainers and SACCO onboarding guides) are in production.

What’s Next?

- Complete frontend development for self-service microloan requests and repayments

- Finalise Rafiki adapter development for loan disbursement and repayment workflows

- Begin pilot testing with selected SACCOs and track user experience

- Launch a communication campaign to onboard more SACCOs

- Venture into new markets to promote cross-border transactions

- Acquire all the licenses needed for regulatory compliance

Community Support

We’d love:

- Feedback on building ILP use cases in credit infrastructure

- Connections to partners testing Rafiki or ILP in similar environments

- Shared insights on credit scoring engines in low-data contexts

Additional Comments

This project is showing us how vital intentional infrastructure is for true financial inclusion. By embedding ILP into everyday SACCO workflows, we’re making finance work for the last mile, not just the middle.

Kanzu Banking System architecture diagram

Micro_Loan_Disbursement_Flow

Top comments (0)