Brief Project Description

ThitsaWorks is a registered FinTech company that provides digital payment and data analytics solutions for financial institutions to analyze data needed to run effective operations and manage risks. ThitsaWorks is Myanmar's leading technology solution provider for microfinance institutions (MFIs).

In this project, we aim to build an inclusive payment network for the unbanked and underbanked in Myanmar. In the previous progress report, we talked about ThitsaWorks’ Thitsa Payment Portal which connects microfinance institutions without core banking system or API capabilities to a real-time payment platform making the portal the bridge to interoperability. Well, in this final report, we have so many updates to share with you as our project evolved from the portal to an innovative inclusive payment network, namely ThitsaNet, utilizing Interledger Protocol and Mojaloop technologies.

Project Update

The innovative inclusive payment network, ThitsaNet, consists of two main components. The first component, called Thitsa Payment Portal, connects to an interoperable payment platform designed for financial institutions operating with offline systems. Leveraging Mojaloop's open-source software built upon the Interledger Protocol (ILP), the interoperable payment platform facilitates the integration of mobile wallets with MFI core banking systems. By adopting Mojaloop's blueprint, ThitsaWorks aims to overcome past barriers such as technical complexity, time constraints, and high costs associated with developing interoperable payment models. Check out the progress report here to see the details of Thitsa Payment Portal.

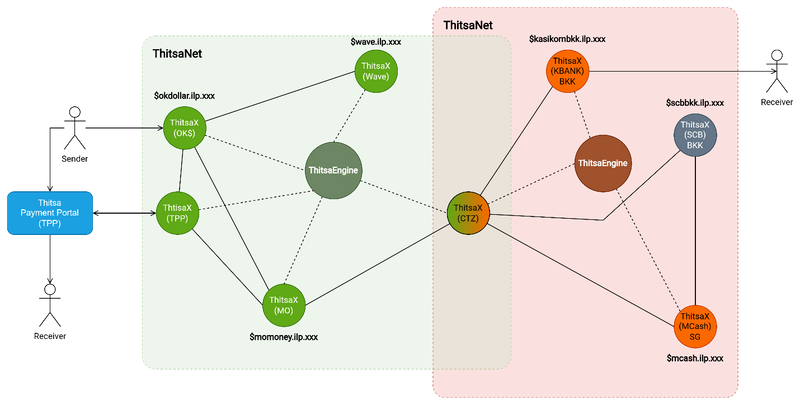

The second component of the platform is an Interledger Network consisting of interconnected Interledger connectors known as ThitsaX. These ThitsaX connectors will collaborate to enable cross-ledger transactions. Leveraging the Interledger Protocol, these nodes will route and process payments across different payment systems, facilitating the transfer of value between diverse ledgers and networks.

ThitsaX connectors facilitate secure and seamless transactions across diverse ledgers and payment networks in an interconnected network of Interledger connectors. These connectors act as intermediaries, enabling the routing of payments between different financial systems or ledgers. By establishing a decentralized network, ThitsaX ensures interoperability, allowing transactions to occur seamlessly across various systems. This promotes enhanced connectivity and accessibility in the financial ecosystem, resulting in faster, more efficient, and cost-effective cross-border transactions.

ILP ensures the security of transactions by utilizing cryptographic techniques, enabling encrypted communication and ensuring the integrity and confidentiality of the payment data transmitted between ThitsaX connectors.

System Architecture of ThitsaNet

Project Impact & Target Audience(s)

Impact on Increasing Interledger Nodes

ThitsaNet will play a crucial role in increasing the number of Interledger nodes within the payment ecosystem, thereby expanding its reach and promoting financial inclusion. By enabling more participants to join the instant payment system, ThitsaNet facilitates the growth of the network, creating a ripple effect that leads to increased efficiency in the computing and networking system.

The concept of nodes in ThitsaNet can be likened to branches of a network, where each node represents a participant or entity within the payment ecosystem. As the number of nodes increases, the network becomes more interconnected, allowing for faster and more efficient transfer of payments. This translates into enhanced transactional speed, reduced settlement times, and improved overall payment experience for users.

In a nutshell, ThitsaNet’s ability to increase the number of nodes within the instant payment system is instrumental in expanding participation, enhancing the efficiency of computing and networking systems, and ultimately enabling seamless, instant payments for a wide range of users. By leveraging the power of ILP and embracing the economy of scale, ThitsaNet paves the way for a more inclusive and interconnected financial landscape. The immediate target audience will be MFIs and their users in Myanmar.

Progress on Objectives, Key Activities

Thitsa Payment Portal: We have developed a prototype of Thitsa Payment Portal powered by Mojaloop technology, and we have tested it with the collaboration of 2 microfinance institutions. Watch the video for the prototype demonstration.

Upon their feedback, we have collected pain points and improved the prototype in terms of settlement, repayment transaction information, and user information checking. We have set a time for the settlement; streamlined the repayment recording process; enabled user information checking for repayment. These MFIs have made a few suggestions for additional features, and we will continue to work on upgrading the portal until it becomes commercial. As for more details, check out the website.

We introduced Thitsa Payment Portal at PI-21 Mojaloop Community Meeting in March this year and elaborated a bit on how MFIs can overcome the gap and the costly budget in implementing a core banking system. Watch here for the abstract from the meeting.

ThitsaX: This is where we start to evolve in ThitsaNet. Back in the progress report, we mentioned that we would add a cross-border use case in Thitsa Payment Portal with Rafiki as the settlement. Nevertheless, after intensive sessions with the whole team discussing on the cross-border transactions, we have come up with a blueprint to design ThitsaX, Interledger connectors, dedicated to enhanced connectivity and accessibility in the financial ecosystem, resulting in faster, more efficient, and cost-effective cross-border transactions.

Business Engagement: The financial projections of Thitsa Payment Portal have been evaluated for 3 years. In the initial year of launch, we anticipate the onboarding of 14 microfinance institutions (MFIs), all of whom will contribute through onboarding registration fees. As we progress into the second and third years, a quarterly increase of 2 new MFIs joining Thitsa Payment Portal is expected, reflecting the expanding adoption and growing confidence in our platform. The addressable market in Myanmar is 2.2 million clients from 35 MFIs but Thitsa Payment Portal will not be restricted to domestic market only. It is applicable to any market where a real-time payment platform is in operation. In fact, Thitsa Payment Portal will be one of the connectors in ThitsaNet connecting with Interledger connectors. Based on our financial model, the Portal is expected to break even within a year after its launch. The projections for ThitsaX Connector will be incorporated into the business plan in the future, as the development and implementation progress.

Communications and Marketing

We will actively reach out to the Mojaloop and Interledger communities, ensuring our continued efforts to promote real-time payment switch technology solutions. Thitsa Payment Portal will be introduced as a complementary offering, further enhancing our engagement with these communities. The positive feedback from two MFIs that tested the product has already generated buzz within the MFI community in Myanmar. Once ThitsaWorks' real-time payment switch becomes operational, Thitsa Payment Portal will be launched at full scale, possibly even before mid-2024.

With a focus on ThitsaX connectors, our audience includes individuals worldwide involved in inclusive payment networks driven by open-source technologies. We will introduce the concept of ThitsaX, which facilitates the connection of Interledger nodes and enhances the efficiency of cross-border transactions through the Interledger Protocol.

What’s Next?

So, What’s next? We will continue to enhance the features in Thitsa Payment Portal by upgrading the prototype and will test the portal with real-time data of participants in ThitsaWorks’ real-time payment switch. We’re already thrilled and preparing to pitch for commercial deals in both domestic and regional markets.

Our whole team is excited to build ThitsaX connectors in ThitsaNet which will be a breakthrough in cross-border payment transactions. The purpose of incorporating the Interledger Protocol (ILP) is to enable more participants to seamlessly connect and transact within the instant payment system. ILP serves as the bridge that brings together different financial institutions, wallets, banks, and mobile payment solutions, fostering interoperability and facilitating seamless transfers across various platforms.

By incorporating ILP into ThitsaNet, ThitsaWorks ensures that P2P transactions between Digital Financial Service Providers (DFSPs) are executed securely, efficiently, and cost-effectively. The utilization of ILP provides a standardized, interoperable framework that fosters trust and enables the seamless movement of funds within the ThitsaNet. As ILP continues to evolve and new versions are released, ThitsaWorks remains committed to staying up to date with the latest advancements, ensuring that ThitsaNet leverages the full potential of ILP to deliver a robust and transformative digital payment experience for MFIs and users within the Myanmar financial ecosystem.

Naturally, the cost of establishing the ThitsaNet Inclusive Payment Network is substantial, and the required time and human resources are vast. The tentative timeline for MVP development is set to one year and we are ready to start working on it. Along with the development, we will ensure regulatory compliance to ensure the ThitsaNet prototype complies with relevant regulations, standards, and security measures.

Community Support

We are eager to collaborate with community members who share an interest in ThitsaNet, and we invite them to join us on this exciting journey. If you are involved in building an inclusive payment network and have financial institutions within your ecosystem that require core banking systems and API capabilities, the Thitsa Payment Portal is perfectly suited for your needs. We welcome suggestions for the development of Interledger connectors and the integration of nodes across diverse payment systems.

We are delighted to announce that we have signed a memorandum of understanding [(MOU)] with The People's Clearinghouse, a fellow grantee, to join forces and collaborate on their remarkable initiative aimed at delivering efficient cross-border remittance services to rural communities in Mexico.

Additional Comments

We extend our heartfelt gratitude to the Interledger Foundation and the entire community for their invaluable support throughout the research and development phase, which has culminated in the creation of the design and roadmap for ThitsaNet. In order to gather feedback and gain insights from the community, we will present our work during one of the community calls. We are eagerly looking forward to the launch of ThitsaNet, as it will enable us to assist millions of unbanked and underbanked individuals in Myanmar.

Relevant Links/Resources

ThitsaWorks Website: https://www.thitsaworks.com/

Thitsa Payment Portal Website: https://www.thitsaworks.com/paymentportal

ThitsaWorks LinkedIn: https://www.linkedin.com/company/thitsaworks/

ThitsaWorks Facebook: https://www.facebook.com/Thitsaworks?mibextid=LQQJ4d

Top comments (0)