Project Update

Trust-Based Banking is a research initiative focused on exploring the technical and legal pathways for granting undocumented residents access to essential banking services. Currently, in the Netherlands, only individuals with a social service number (In Dutch: BSN) are permitted to open a bank account. In the initial phase as described in the progress report, we compared different identification systems, looking at models in cities like New York, Barcelona, and Zurich, and made a Dutch prototype Matrix1. Key findings from this research showed that most people actually possess documents to prove their identity, and local NGOs and stakeholders in Amsterdam are willing to vouch for residency and long-term connections to the city. We also found that the Dutch AML law (Wwft) offers flexibility, stating that identity verification can use documents, data, or information from a "sufficiently reliable means of identification" not just passports, which opens up the path for an alternative Know Your Customer (KYC) solution than what already exists.

We assessed whether community-based vouching could provide access to financial services in compliance with Dutch Anti-Money Laundering (AML) and KYC regulations. Along the way, and in alignment with the Interledger Foundation team, we have shifted the focus of the project from access to banking to the path to registration. This shift happened because we determined that registration is the first crucial step towards access to banking and essential financial inclusion. We have looked at cases such as The Residence Scheme for Surinamese Former Dutch Nationals (In Dutch: Suriname regeling) where a temporary scheme successfully provided residence permits to those who had lost their Dutch nationality, requiring them to prove at least 10 years of residence in the Netherlands including unofficial evidence such as old medical letters, rent receipts, school records, or statements from landlords and community organisations to prove their long-term residence.

In our research we worked out a prototype based on a lived experience, called Rea’s Path to Trust-Based Financial Access. This prototype shows how an underdocumented resident, Rea, can potentially achieve access to basic financial services using alternative evidence such as community-based validation. Rea uses a points-based validation matrix to verify her identity and residency using existing documents and endorsements from local NGOs, which are reviewed through a standardized validation matrix at the custom KYC desk.

At last, we have prototyped a demonstrator2. This demonstrator showcases an end-to-end trust architecture using verifiable credentials and community vouching. It consists of several sub-applications, including the HTR Desk for creating and managing client dossiers and calculating points, and the Here To Register (HTR) Wallet for clients to store and selectively share their verified credentials. This software is designed in such way that the underdocumented person retains full control over who sees their data. You can see the walkthrough3 of the demonstrator in the reference section.

Project Impact & Target Audience(s)

The core impact of this project is to examine and experiment alternative, trust-based routes for underdocumented migrants to access essential services like banking. This work aimed to inspire local authorities, municipalities, and NGOs with alternative methods for inclusion. The research documented international models, such as IDNYC, and explored community vouching systems operating in other European cities. We established a path for other researchers to expand on this research. We developed the Here to Register (HTR) software prototype, which acts as a modular, end-to-end demonstrator of a custom KYC system for underdocumented people. This demonstrator provides a framework for future implementation and for advocacy.

Progress on Objectives, Key Activities

The Residence Scheme for Surinamese Former Dutch Nationals (In Dutch: Suriname Regeling)

The Residence Scheme for Surinamese Former Dutch Nationals was created to offer a residence permit to people who were born as Dutch citizens in Suriname before its independence in 1975, but who lost their Dutch nationality at that moment. Many of them had lived in the Netherlands for years without papers and were unable to access basic rights. A key requirement was proving at least 10 years of residence in the Netherlands. Because many lived undocumented, they often had no official registrations. Instead, they had to collect alternative evidence: old medical letters, rent receipts, school records of their children, bank statements, or statements from landlords, employers, churches, or community organisations. These pieces together formed a picture of their long-term presence in the country. People had to physically register at the registration desk, which was specifically opened only for this group, during January- June 2025, by the Amsterdam based NGO ASKV. The caseworkers at this desk had to validate all these documents by hand and support the applicants to gather enough proof of identity and residency for qualification. For those who qualified, the scheme finally offered legal security, access to essential services, and recognition after decades of living in uncertainty.

Developing Rea’s Journey and the Custom KYC Framework

We have developed a lived experience called Rea’s Path to Trust-Based Financial Access. The Journey prototype4, demonstrates how an underdocumented resident, Rea, can achieve access to basic financial services through community-based validation instead of relying on state IDs. The scenario shows Rea using a points-based system, inspired by IDNYC, to verify her identity and residency. This process uses a combination of official documents and endorsements from local NGOs and public services, which are reviewed through a standardized validation matrix at the HTR Desk.

Validation of the Matrix and Trusted Partners

We reviewed the developed Matrix with five staff members from various NGOs who have experience with client intake procedures and documentation. The discussions focused solely on documents that demonstrate a connection to the city (residency), not identity. A key finding from these discussions was that it is very difficult to verify the authenticity of documents issued by other organisations without an official stamp or verification mechanism. Therefore, we returned to the drawing board and designed a new validation system centred on trusted partners in a local context. These trusted partners can issue a validation, checking information directly in their own registration systems, and then issue a QR code that, when scanned, reveals only essential data. When a person collects a set number of QR codes, their total score in the Matrix can be validated at the registration desk of the new foundation. This model ensures the underdocumented person retains full control over who sees their data.

Findings on Document Verification Technology (Sarah Habib's Research)

Researcher Sarah Habib conducted a study5 focusing on different identification software tools available for document verification, using anonymized case files. This study, summarized in the report AML/KYC Software Landscape, investigates how organisations can comply with European and Dutch AML/KYC regulations when registering undocumented individuals. The conclusion was that because traditional systems often reject refugees and undocumented people, an inclusive, hybrid approach is required, which combines technological precision with human judgment. The research found that Keesing Technologies (https://www.keesingtechnologies.com/) emerged as the most suitable primary provider. This is due to Keesing's experience handling documents held by undocumented people and its cooperation with Dutch authorities. However, the report also emphasizes that Keesing alone is insufficient, and other companies could assist with biometric verification (like Simprints and IDEMIA) or quick online verification (like Jumio and Veriff). The report also stressed that success depends on collaboration among legal experts, technical teams, and people who understand the undocumented community.

Here to Register demonstrator

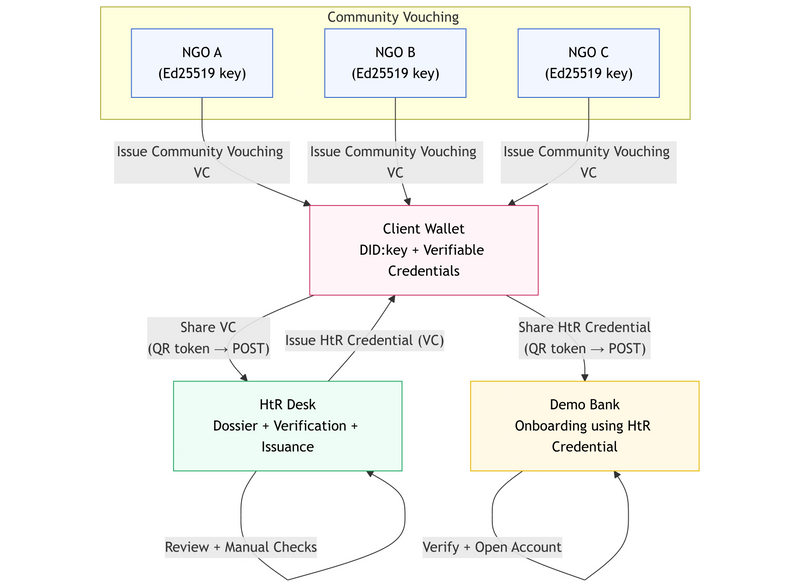

We developed the Here to Register (HTR) software prototype2, which serves as an end-to-end demonstrator of a custom KYC for underdocumented people. This demonstrator showcases an application using verifiable credentials, community vouching, and secure document validation, composed of four loosely coupled applications that communicate only over HTTP.

The core components developed include:

- HTR Desk Application: This is the main application used by case workers for intake, dossier creation, and managing clients. It includes structured identity and residency evidence collection, automatic points calculation based on a configurable document matrix, and checklist-driven verification. The Desk handles the issuance of the Verifiable Credential (HTR Credential), which is signed deterministically using Ed25519 and JCS canonicalization.

- NGO Community Vouching SPA: This standalone app simulates how NGOs can provide trusted attestations about individuals they know. It generates Community Vouching VCs signed with each NGO’s key and provides QR/link delivery for wallet import.

- HTR Wallet (Client-side Demonstration Wallet): This lightweight, browser-based wallet allows clients to generate a DID, store their credentials (including the HTR credential and NGO vouching credentials), verify signatures, and selectively share credentials with the Desk or the Bank. The wallet illustrates the privacy-preserving approach where clients maintain custody of their data.

- Mock Document Verification Service: This standalone service simulates automated passport/ID document verification, mimicking services like Keesing. It allows case workers to simulate checks for security features, MRZ validity, and RFID integrity.

- Demo Bank (Bank Onboarding SPA): This minimal banking portal acts as a relying party, demonstrating how a service provider can integrate the system. It requests the HTR Credential via QR, verifies the incoming credential, pre-fills the onboarding form, and creates a mock bank account.

This graph depicts different modules of the prototype and how keys are issued and verified.

The repository structure shows that all applications are standalone. The code for the demonstrator, including documentation on how to set up the development environment, is available in the repository. You can find the code here2.

Communications and Marketing

- We gave a presentation to the sounding board/advisory group of Amsterdam on our findings.

- We held meetings held NGOs across the Netherlands to present the project and to validate the Matrix.

- We networked in Brussels with European Network Against Racism (ENAR) and PICUM, and discussions with other European NGOs to strengthen international advocacy.

- We have exchanged knowledge with The Hague University of Applied Sciences and talked about the possibility to use HTR as a use case in their curriculum.

- We held discussions with DURF (Department of University Relations and Fundraising in Vrije Universiteit Amsterdam) regarding future collaboration.

What’s Next?

The absence of access to a bank account might appear to be merely a practical problem, but in fact touches upon fundamental human rights. The next steps in our research therefore primarily focuses on Article 11 of the ICESCR, which obliges states to take measures to ensure that everyone has an adequate standard of living, including access to basic necessities (food, clothing, and housing). In a highly digitalized economy, financial access (including a payment account) could be seen as a prerequisite for providing for one’s own livelihood.

At the same time, existing Dutch and EU-implemented legislation on financial integrity, such as the Anti-Money Laundering and Counter-Terrorist Financing Act (Wwft), poses an obstacle: banks may not open an account without verifying a legally recognized identity document, something undocumented people often do not possess. This creates tension between international human rights obligations and national compliance with anti-money-laundering regulations.

The research therefore addresses four questions:

- What obligations arise from Article 11 ICESCR with respect to access to basic services for undocumented people?

- To what extent is access to a bank account a necessary link in ensuring an adequate standard of living in a digitalized society?

- What obligations do banks have under Directive (EU) 2014/92 and Directive (EU) 2015/849?

- How does the interplay between international human rights obligations, European financial regulation, and national implementation practices (including the Wwft) affect undocumented people in the Netherlands, and where do legal bottlenecks and potential solutions emerge?

In addition, further studies can examines the extent to which Dutch institutions have room to create solutions within the existing legal framework and to establish an independent administrative authority responsible for identity verification of undocumented people.

Furthermore, future attempts can collaborate with initiatives such as HealthEmove (https://healthemove.org/) to apply their learnings in areas such as customer journey in establishing HTR.

Community Support

The ILF ecosystem can help make visible the problem concerning people who lack access to banking in the Netherlands/Europe and promote further research on this topic as described in the future work section.

Relevant Links/Resources

-

Dutch prototype Matrix,

https://gitlab.waag.org/code/tbb_htr/-/blob/main/docs/matrix-undocumented-hts.pdf↩ -

Prototype code in Gitlab,

https://gitlab.waag.org/code/tbb_htr↩ -

Walkthrough Demonstrator,

https://gitlab.waag.org/code/tbb_htr/-/blob/main/docs/walkthrough.md↩ -

Rea's Path to Trust-based Financial Access,

https://gitlab.waag.org/code/tbb_htr/-/blob/main/docs/matrix-undocumented-hts.pdf↩ -

Habib AML KYC Software Landscape,

https://gitlab.waag.org/code/tbb_htr/-/blob/main/docs/AML_KYC%20Software%20Landscape_Habib.pdf↩

Top comments (0)