Brief Project Description

Trust-Based Banking is a research initiative focused on exploring the technical and legal pathways for granting undocumented residents access to essential banking services. Currently, in the Netherlands, only individuals with a social service number (BSN in dutch) are permitted to open a bank account. This project investigates the legal barriers and potential risks associated with this limitation.

The initiative also aims to adapt the IDNYC Matrix Identification System, successfully implemented in New York City, to the Dutch context. Additionally, the project seeks to develop a prototype wallet incorporating Interledger Protocol (ILP). A controlled pilot, in collaboration with the Municipality of Amsterdam, will be conducted to evaluate the system as part of the study.

Project Update

In the first part of our research projects, we have worked on the following activities:

Matrix identification system

We worked on comparison studies of different matrices used in different cities for registration of (undocumented) citizens. We looked at Barcelona, Lisbon, Zurich, New York and Dublin and their registration systems.

We translated the documents used in other cities to possible available documents in the Dutch context. From here we created a Dutch prototype. We made profiles of eight undocumented citizens in Amsterdam with a different background and checked the prototype matrix for their situation.

Key findings:

Most people have documents to prove their identity. Only a few individuals don't have official documents.

Stakeholders in the city of Amsterdam are willing to vouch for residency and (long term) connection to the city. NGO’s have in their own digital databases a lot of information about individual undocumented people and can trace back connections

In all cities municipal or local authorities were part of the registration process in a way. They play a huge part in validating documents. A good example of community vouching at the municipal level involves free transportation programs for children. To ensure exclusivity, municipalities collaborate with NGOs in the Netherlands to provide a dummy BSN for undocumented children, enabling them to access these services.

Table below shows our part of our proposed identification matrix:

| No | Migrant Category | Types of Documents (Primary) | Secondary Documents |

|---|---|---|---|

| 1 | Rejected Asylum Seekers | Passports, judicial decisions (in Dutch: Beschikkingen), Biometrics | Leefgeld from municipality, Letter from COA or municipality, Hospital invoices, Medical records, Letters from NGOs |

| 2 | Overstayers or Irregular Migrants | Passports, Biometrics, Consular ID, Birth certificates (apostilled) | Rental agreements, Utility bills, Remittance receipts, Bank statements |

| 3 | Illegal Entrants | Passports, Birth certificates, National IDs, Expired residence permits | Utility bills, Hospital bills, Medical records, Shopping receipts |

| 4 | Victims of Human Trafficking | Passports | Utility bills, Hospital bills, Medical records, Shopping receipts |

| 5a | Undocumented Children (Parents with Irregular Status) | Birth certificates, Passports | GGD records, Diplomas & school records, Education number, Medical records |

| 5b | Undocumented Children (Parents in Asylum Procedures) | Birth certificates issued by the municipality | |

| 6 | Stateless Individuals | None | GGD records, Diplomas & school records, Education number, Medical records |

Regulatory obstacles and legal space

One of the most critical requirements for this project is compliance with Know Your Customer (KYC) regulations. However, undocumented individuals often lack the necessary documents to fulfill these legal obligations. Another concern is privacy as protecting the sensitive information of undocumented individuals is paramount. Like KYC, Anti-Money Laundering (AML) compliance is mandatory, but implementing an AML system from scratch presents significant complexities. On the other side, the Dutch law Wwft (or translated to: anti-money laundering and anti-terrorism financing act) requires institutions to establish and verify the identity of clients using reliable documents or sources. While it is often assumed that this can only be done with passports and ID cards, the law offers more flexibility. It's mentioned that

'Verification of identity must be carried out using documents, data, or information from a reliable and independent source. [...] For natural persons, these include, for example: a valid passport, a valid Dutch or other EU member state-issued identity card, a valid Dutch or other EU member state-issued driver’s license, travel documents for refugees and foreign nationals, foreign national documents, or a sufficiently reliable means of identification ' (Reference in Dutch).

For undocumented individuals, this flexibility is crucial as it enables them to use alternative, but reliable, means to prove their identity. Beyond the mentioned documents, alternative methods are also allowed as long as they are reliable and independent. This opens the door for innovative solutions, such as a KYC desk working with a matrix of alternative documents and statements, for instance, proof of residence or identity declarations.

Technical investigation

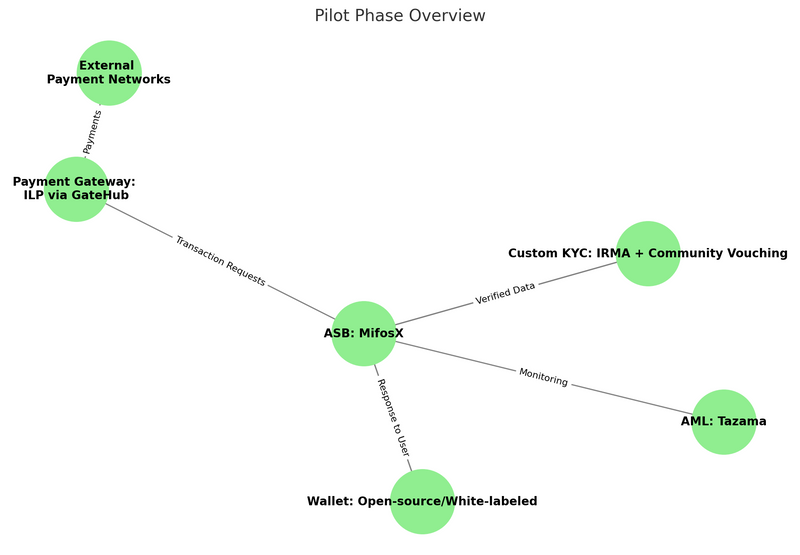

The account servicing backend is another critical component, responsible for managing user accounts for the wallet. Building such a system from scratch would require a considerable investment of time and resources. To address this, we have identified MifosX, an open-source core banking solution that meets all the requirements for a pilot project and offers much more. MifosX even includes reference implementations for wallet applications, making it a versatile option.

Other possibilities include adopting a white-labeled version of an existing account servicing solution or partnering with an established bank or wallet provider. If external partnerships are not feasible, MifosX remains the most logical choice for the pilot phase.

Establishing connectivity with payment networks and protocols is another significant challenge. Once the account servicing backend is operational, we must determine with whom we will execute transactions and which protocols will be employed. Ideally, the goal is to integrate with local, European, and international banking networks such as TARGET2, SEPA, and SWIFT, using standards like ISO20022. These are the networks used for regular transactions and payments in the Netherlands. However, gaining direct access to these networks requires extensive regulatory approval, which is unlikely to be achievable within the scope of the initial pilot.

As a solution, we propose using Interledger Protocol (ILP) payments. GateHub’s sandbox could serve as a bridge to traditional networks, and connectors like Rafiki, which integrates ILP, can facilitate this process. GateHub is currently the only node supporting euro payments for Interledger, making it a practical option. Additionally, since MifosX supports ISO20022, we have a clear path for further development once compliance with legal requirements is achieved.

Key findings:

Explored privacy-preserving technologies such as IRMA for identity verification.

Identified Tazama, an open-source transaction monitoring system, as a candidate for AML compliance.

Researched options for managing accounts, identifying MifosX as the most viable open-source banking solution.

Project Impact & Target Audience(s)

Through our research, we have gained valuable insights into the meaning and various forms of registration, as well as the latest digital technologies available for secure identification. Additionally, we explored different models of community vouching and assessed how they could be implemented in the Netherlands.

A key impact of our work has been initiating conversations with NGOs and other stakeholders like local municipalities and banks about the systemic exclusion of undocumented individuals—helping to break the taboo surrounding this issue.

Communications and Marketing

-

Shared updates about the project and key takeaways from the summit through our website and LinkedIn.

- https://waag.org/en/project/trust-based-banking/

- https://www.linkedin.com/posts/pouryaomidi_for-english-scroll-down-afgelopen-weekend-activity-7257360973882167296-zd6b?utm_source=share&utm_medium=member_desktop

- https://www.heretosupport.nl/portfolio-collections/projects/trust-based-banking

- Animation video about community vouching with stakeholders in the Netherlands, to be launched beginning of February.

Engaging with municipal departments and NGOs across the Netherlands to build awareness and support for this project.

What’s Next?

The main focus of the next phase of the project is to develop a custom KYC and validate our legal assumptions which can be served as a service for banking solutions within the ILP ecosystem and traditional banking. Developing a wallet application from the ground up is not a practical option. For the pilot, we propose either leveraging an existing application (potentially white-labeled) or building upon open-source solutions. MifosX provides a reference wallet application that could be customized to suit our needs. The focus will be on integrating the custom KYC system into the onboarding process of the Account Servicing Entity (ASE) or the wallet itself. In this phase, we focus on setting up our own Account Servicing Backend (ASB) and developing a wallet using the MifosX platform. This pilot serves a limited number of clients and prioritizes the development and validation of our custom KYC solution. Integrating this KYC process into the ASB and wallet is a key deliverable for this phase. Payments are executed through ILP using the GateHub sandbox, providing a controlled environment to test and refine the system.

Some important questions we need to validate are:

How do the requirements under the Dutch Anti-Money Laundering and Anti-Terrorist Financing Act (Wwft) align with GDPR’s principle of data minimization?

Does the bank have a legal basis to request and retain certain identity documents if a person’s immigration status is unclear?

Does GDPR (and Dutch implementing legislation) provide the same data protection rights to undocumented migrants as it does to Dutch citizens or legally resident foreigners?

Planning

February

Form a cross-departmental municipal team to examine the Matrix Identification Prototype.

Develop legal validation questions for tax law, privacy, KYC, and fraud detection.

March - April

Strengthen European partnerships with PICUM and ENAR for international advocacy.

Conduct co-creation sessions to refine the custom KYC framework.

April - June

- Build and iterate the wallet prototype in an agile manner.

July - September

Launch pilot phase to validate the custom KYC solution with a bank and a focus group.

Develop a plan for the setting up a custom KYC Desk to offer identification verification system to financial institutions.

Top comments (2)

Super interesting project! I look forward to learning more about how you approach those legal validation questions—balancing compliance with fundamental rights is not always easy. This looks like a very thoughtful and impactful initiative, and I look forward to following your progress and supporting where possible.

Thank you Ayden for this thoughtful comment. We will keep you posted on the progress!