The team interacting with a SACCO beneficiary

Project Update

Abbreviations:

Savings and Credit Cooperatives - SACCOs, Rotating Savings and Credit Associations – ROSCAs **(locally identified as Chamas), Micro, Small and Medium Enterprises – **MSMEs, Microfinance Institutions - MFIs

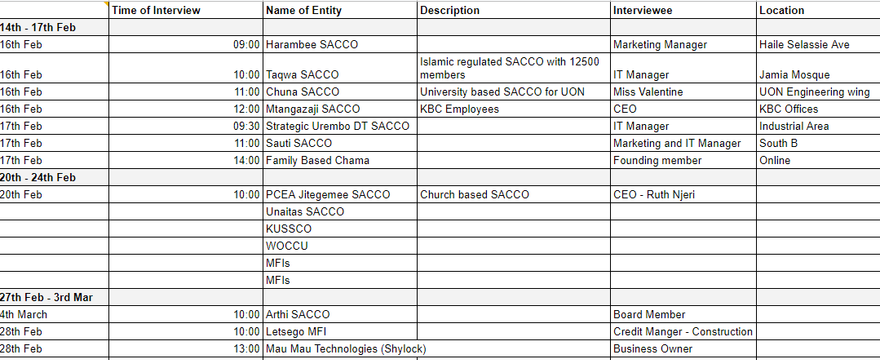

We have completed the first phase of the exercise which featured field visits, conducting interviews (both consumer-facing and business-facing), and data collection. The team comprised experts from the microfinance and social surveys sector, legal and marketing sectors, and a Web 3 developer. They have been interacting with experts in the space and various last-mile players, such as small businesses. The first draft report is almost completed and some excerpts have been posted in this initial post. The research targeted 6 SACCOs, 40 MSMEs, 10 ROSCAs/Chamas, and 6 MFIs.

Progress on objectives

The objectives include:

- Map out the microlending ecosystem for small businesses and the informal sector including Micro SACCOs (Savings and Credit Co-operative Societies), Microlenders, Shylocks, and digital mobile overdraft facilities.

- Map out the macro players funding these microlenders including banks, telecom providers, digital loans, etc.

- To investigate the credit scoring for these microlenders and map out the credit ranges, trends, and borrowing habits for their sources of credit.

- Uncover challenges that the microlenders are experiencing and how our ILP solution can address those challenges.

- Map out existing lending technologies that lenders (SACCOS, MSMEs, CHAMAS, MFIs) use to access credit.

- Determine how best ENEZA integrates with ILP

Thus far, we have collected data and conducted interviews with 9 SACCOs, 18 MSMEs, 1 MFI and 1 P2P Credit Provider. The SACCOs feature a wide range of entities representing various economic and social groups such as academic institutions, parastatals and religious entities. Valuation of these SACCOs range from KES30M-40B (USD300,000-400M) in terms of assets. On the other hand, Chamas feature group savings from family groupings, small-scale traders, women-only groups and even university-going students.

The findings also demonstrate that ENEZA could leverage SACCOs to provide an additional layer of trust and creditworthiness for borrowers. This can be achieved by integrating SACCO membership and savings data into the lending platform's decision-making process. The lending platform can assess a borrower's creditworthiness based on their SACCO membership and savings history, which could provide a more accurate picture of the borrower's financial situation and reduce the risk of default.

In addition, the integration of SACCOs can provide a channel for borrowers to access loans and repayments. Borrowers can make loan repayments through their SACCO accounts, which can simplify the loan repayment process and provide borrowers with a sense of security and accountability. However, there are potential challenges to integrating SACCOs into the lending solution. One challenge is the fragmentation of the SACCO sector, which comprises over 5,000 registered SACCOs in Kenya. Integrating all SACCOs into the lending platform may not be feasible, and therefore, a strategy for identifying and partnering with a select number of SACCOs will need to be developed. Furthermore, the integration of SACCOs will require collaboration and buy-in from the SACCOs themselves. SACCOs may be hesitant to share their member data and may require assurances that their members' data will be kept confidential and secure. The lending platform will need to establish trust and collaboration with SACCOs to ensure their participation in the lending process.

By leveraging ILP, lenders can reduce the cost of lending and provide loans at lower interest rates. ILP also provides a more transparent and secure lending process, as all transactions are recorded on the blockchain and can be audited by anyone. Moreover, ILP enables cross-border lending, allowing lenders to provide loans to borrowers in different countries.

Field exercise-Data collection at a small business in an informal settlement in Nairobi

Key activities

A. We have completed the first phase of the exercise which featured field visits, conducting interviews (both consumer-facing and business-facing), and data collection.

B. Our participation at the ILP summit provided us with the necessary exposure to gather lessons from the ILP ecosystem and fellow grantees. The presentations served as a benchmark for some of the elements in our work.

C. Regulation

We have initiated the license application process. Conversation with some industry players on their experiences with the regulator and licensing is also ongoing. This will be important to inform our license application process.

D. Design aspects of the prototype.

One of the objectives seeks to determine how best ENEZA integrates with ILP. The design process has begun and below are the updates thus far:

System Architecture of Interledger Protocol-based Lending Solution

An Interledger Protocol-based lending solution would consist of several components, including the ILP connector, smart contracts, and the user interface. The ILP connector would be responsible for routing payments between different payment networks and ensuring the correct settlement of transactions. Overall it will feature a Front-end Interface, Middleware, Backend Systems, and the Interledger Protocol (ILP).

To connect backend lending, we propose the following:

Integration with Aave (as an example): Aave is an open-source, non-custodial liquidity protocol for earning interest on deposits and borrowing assets. By integrating with Aave, SACCOs, SMEs, and CHAMAs can earn interest on their deposits and access liquidity to fund loans.

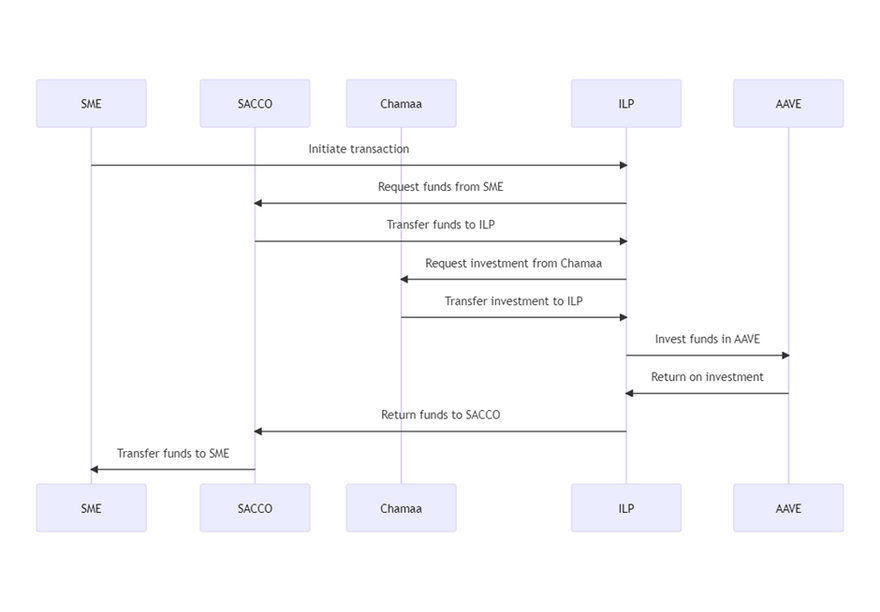

The diagram below shows the sequence of events when an SME initiates a transaction. The ILP requests funds from the SACCO, which then transfers the funds to the ILP. The ILP then requests investment from the Chamaa, which transfers the investment to the ILP. The ILP then invests the funds in AAVE and receives a return on investment. The ILP then returns the funds to the SACCO, which transfers the funds to the SME.

Sequence of events when an SME initiates a transaction.

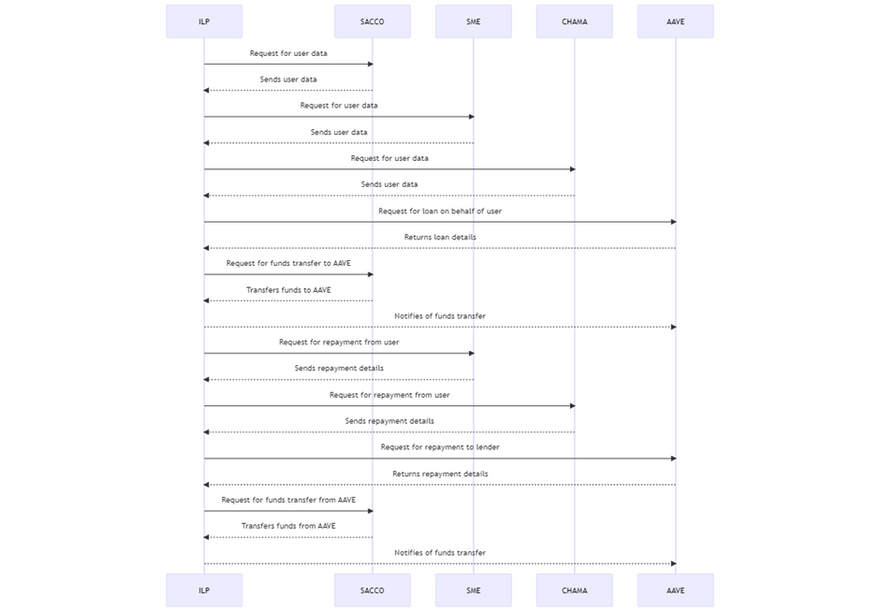

The mobile phone sends payments through the Interledger Protocol to the Sacco Payment Gateway, which then connects to the Backend Lending Platform through the Interledger Protocol. The Backend Lending Platform uses the Interledger Protocol to connect with MFIs and other lenders, and then sends the payments through the Interledger Protocol to the Payment Processor. Finally, the Payment Processor connects to the Mobile Money service through the Interledger Protocol to complete the transaction.

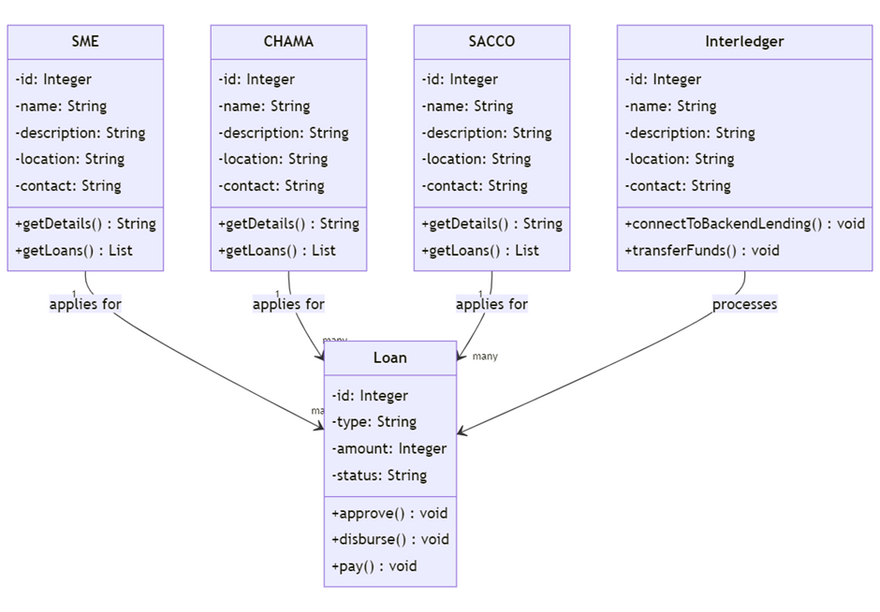

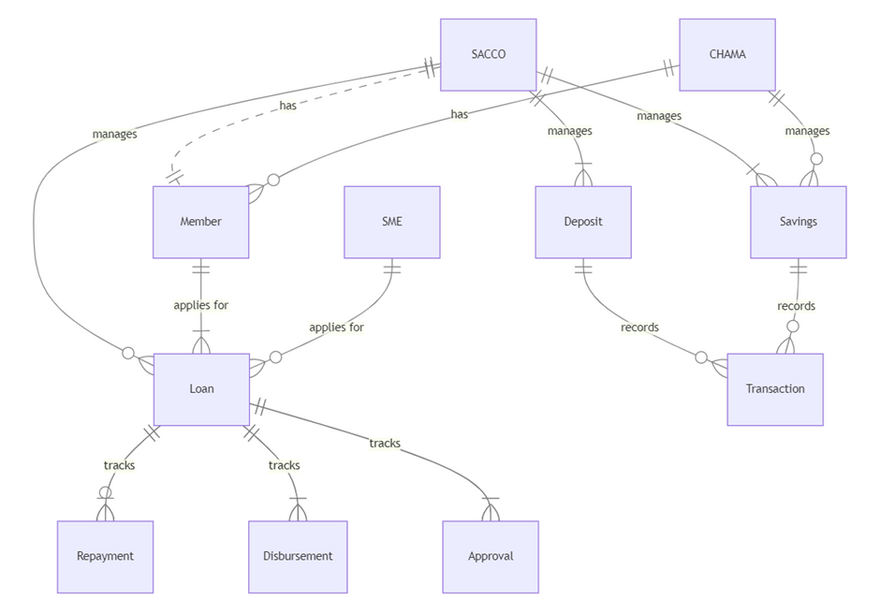

The image below is a representation of the following: The SME entity represents the small and medium-sized enterprises that will be borrowing money from the SACCOs and CHAMAs. The SACCO entity represents the savings and credit cooperative organizations that will be providing loans to SMEs. The CHAMA entity represents the investment groups that will be providing loans to the SMEs. The Loan entity represents the loans that will be provided to the SMEs by the SACCOs and CHAMAs. The Loan entity has foreign keys referencing the primary keys of the SME, SACCO, and CHAMA entities, allowing us to track which SMEs have borrowed from which SACCOs and CHAMAs.

There are four main entities: SACCO, CHAMA, MFI, and Interledger Payment. The SACCO entity is connected to the CHAMA entity with a "has a" relationship, indicating that each SACCO can have one or more CHAMAs. Similarly, the CHAMA entity is connected to the SME Account entity with a "has a" relationship, indicating that each CHAMA can have one or more SME Accounts.

Representation of the lending and borrowing entities and the accompanying relationships

This architecture diagram depicts a payment hub at the center that uses the Interledger Protocol (ILP) to facilitate payments between different payment networks, such as SACCOs, SMEs, and CHAMAs. The payment hub connects to the backends of SACCOs and SMEs/CHAMAs through APIs, enabling them to participate in the payment network.

Connecting Backend Lending with Interledger Protocol-based Solution

One way to connect backend lending with an Interledger Protocol-based solution is to integrate the lending platform with a decentralized finance (DeFi) protocol, such as Aave. Aave is a lending protocol built on the Ethereum blockchain that allows users to lend and borrow cryptocurrencies. By integrating with Aave, the Interledger Protocol-based lending platform can leverage the existing liquidity pool and provide loans in cryptocurrencies. The ILP connector would be responsible for routing payments between the lending platform and Aave, ensuring the correct settlement of transactions.

Moreover, the lending platform could use smart contracts to collateralize loans with cryptocurrencies, such as Bitcoin or Ethereum. This would provide an additional layer of security and reduce the risk of default. The smart contracts would be programmed to automatically liquidate the collateral in the event of default, ensuring that lenders are protected.

In conclusion, Interledger Protocol provides a promising framework for developing a more efficient, transparent, and cost-effective lending solution.

Communications and marketing

Most of the discussions have been held in open formal and informal settings such as roundtable discussions with other Web 3 players in the space. We've attended meetings where we have made contributions reflecting on our work, while receiving feedback that would enrich our work. The next steps would be to target fora where we'll participate as main speakers. The reports from the field visits are a huge resource for a number of blogs and articles that are in the pipeline.

[(https://twitter.com/BitcoinKE/status/1628033224101306374?s=20)]; [https://twitter.com/JamboTechnology/status/1623621849945985025]

What’s next?

The next step would be to conduct a comprehensive data analysis from the data obtained during the field exercise. We will also engage in conversations with a few relevant fintech initiatives to obtain insights into their experiences handling bottlenecks, especially those related to regulation.

Drawing up designs for the prototype.

We will roll out updates about our work via blogs and potentially via our local dailies. We have also put in place a social media strategy for publishing via our pages.

We are earmarking key upcoming events in the space and submitting our interest to participate as speakers.

What community support would benefit your project?

Introductions to builders further along in bridging off-chain collateral into the on-chain lending space would be very beneficial to our research/project.

We are also open to introductions/suggestions of SMEs/lending institutions in Africa who might be interested to acquire on-chain credit on behalf of their customers.

Top comments (0)