Project Update

The name of our project was rebranded from ENEZA to EZA. You can catch up on our previous report here

This last phase of the project has been exciting in a myriad of ways, including the breadth of experience we amassed managing the numerous challenges we faced. Regulation still remains a teething area as there have been some new developments in the local financial sector, following recent legislation which will require all financial and digital entities to make several adjustments.

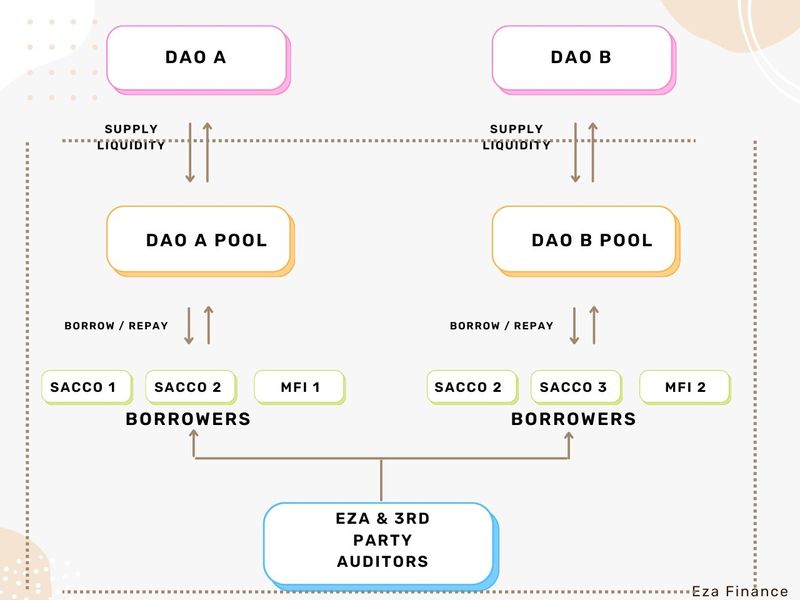

We have refined our approach towards attaining our greater vision of empowering individuals and small businesses in Kenya to achieve greater financial inclusion and access to credit. EZA will now interact directly with SACCOs and MFIs for a greater reach towards impacting our targeted last mile (women, youth, and unbanked, etc.).

Progress on objectives

Key activities

A. We have completed the research phase and business modeling exercise.

B. Design aspects

We have reworked the design aspects since our last update, informed by our data analysis and stakeholder consultations. The major aspects have evolved around risk and collateralization, user interaction and regulation.

C. Regulation

The new Finance Act, 2023, which was passed in July comprises new taxation obligations that will impact our target clients. For instance, the new Digital Asset Tax, a first of its kind, will be applicable at a rate of 3% to income derived from the transfer or exchange of digital assets, in addition to other existing tax obligations. This will potentially have some implications on our business model but we've devised means of mitigating it.

Some findings on regulation

Some of the major findings include:

Capital Markets Authority (CMA) Sandbox

The CMA Regulatory Sandbox and the NIFC have played an active role in supporting fintech and have shown a proactive engagement with blockchain, Web 3, and crypto start-ups. One of the eligibility criteria is for one to have a comprehensive risk management plan that identifies and assesses potential risks and outlines mitigation strategies. However, the Sandbox official mentioned that they have yet to fully onboard and support a Web3/crypto-based product for the entire 6-month project duration. Once the prototype is completed, EZA will submit an application to the CMA Sandbox.

The Nairobi International Financial Centre (NIFC)

The NIFC has been established to create a more efficient and predictable operating environment in order to attract increased finance, investment, as well as support green growth and innovation. The NIFC framework provides firms with the conditions to flourish in Kenya and offers an efficient gateway into the Sub-Saharan Africa region. More broadly, the NIFC will help to deepen local and regional capital markets, catalyse sustainable development in Kenya and contribute to Africa’s economic transformation. Once the prototype is completed, EZA will submit an application to NIFC.

During an interview with a former SEC Nigeria official, it was emphasized that capacity building and constant engagement are essential for the development of the blockchain and crypto industry. The official highlighted their efforts in Nigeria, which included training programs for all regulators, hosting policy round tables, and advocating for more discussions and engagement activities. These initiatives have significantly contributed to creating a thriving environment for blockchain and crypto in Nigeria.

Findings on Chamas, SACCOs and MFIs

Chamas:

They exist in two forms: the merry-go-round model (rotational contributions) and the savings and loan model (Members of this Chama model save periodically daily, weekly, or monthly. They have access to loan facilities informed by the Chama structures drawing down from the deposits held which members use for various needs including small businesses). Most of the unbanked and low-income households belong to Chamas. Some Chamas are formed within various industries esp. within the informal sector, e.g. vendors. Some of the chamas save and bank with SACCOs and MFIs. some of the challenges they face are too many manual reconciliations, defaulting members, and inconsistency.

MFIs

We identified MFIs and segmented the most promising MFIs and Saccos in Kenya based on their size, location, and industry, as well as their efforts towards impacting our targeted last mile (incl women in rural areas, youth, and Chamas). We have also formed relationships with them and are finalizing discussions on our collaboration and partnerships. Some of the limitations they face include collateral limitations in lending to MSMEs, especially women, who traditionally do not or are not allowed to own assets such as land etc. This has led to initiatives such as the Pay-as-you-Go (PAYG) financing models. For SACCOs, as MSME lending grows, additional challenges in the foreseeable future include SACCOs maintaining deposit ratio as per the regulator's (SASRA) guidelines, yet MSMEs are not savers, affecting deposits.

Licensing

We are in the process of obtaining the key licenses needed for our operation. Some will need a completed MVP as a requirement for application. They include:

- Digital Credit Providers License (DCP)

- Payment Service Provider (PSP) License.

- Data Controller and/or Processor License

- Letter of No Objection from the Central Bank of Kenya

- SASRA Approval for digital solution providers to SACCOs

Technological Requirements

EZA Flow Chart

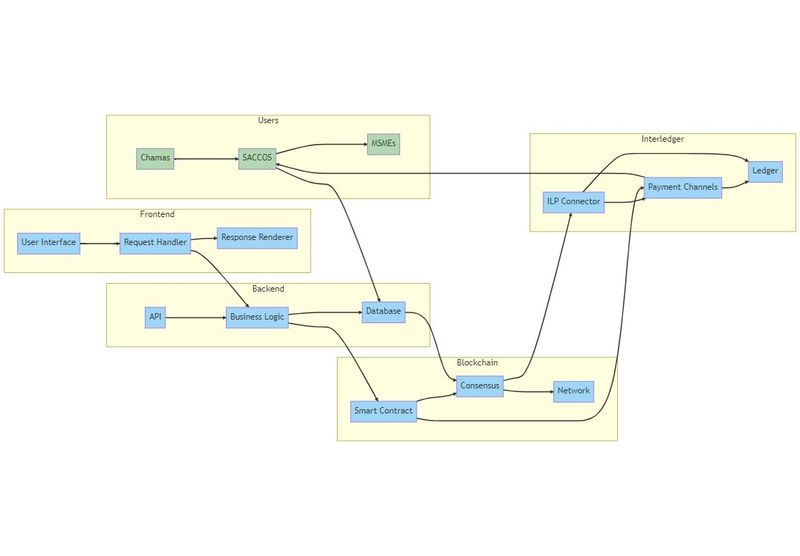

An Interledger Protocol-based lending solution would consist of several components, including the ILP connector, smart contracts, and the user interface. The ILP connector would be responsible for routing payments between different payment networks and ensuring the correct clearance of transactions.

Smart contracts would be used to automate the lending process, including loan origination from lenders e.g. DAOs, repayment, and interest calculations. The smart contracts would be programmed to enforce the terms and conditions of the loan, such as the interest rate, repayment period, and collateral requirements.

The user interface would provide a seamless and intuitive way for borrowers and lenders to interact with the lending platform. It would allow borrowers to apply for loans, view their loan status, and make repayments. Lenders would be able to launch tranches with loan terms, view loan applications, approve or reject loans, and receive repayments.

Front-end Interface: The front-end interface will be responsible for providing a user-friendly experience for EZA Admins, SACCOs and DAO pool managers. The front-end interface will include features like registration, pool creation/funding, loan application, approval, disbursement, tracking, repayment, due diligence reports, account management, ILP pointer configurations.

Middleware: The middleware will act as an intermediary between the front-end interface and ILP. It will be responsible for processing user requests, validating data, and sending data to the appropriate backend systems.

Backend Systems: The backend systems will be responsible for managing user data, processing loan applications, disbursing funds, tracking and managing repayments. The backend systems will include smart contracts, ILP integration, and credit score partner integrations.

To connect backend lending, we are proposing the following:

Integration with investment DAOs.

API Integration: APIs will be used to integrate the lending backend systems with select DAOs. This will allow for seamless communication between the systems, enabling SACCOs to access liquidity and manage their loans more efficiently.

Smart Contracts: Smart contracts will be used to hold funds, manage loan terms, interest rates, and repayment schedules. This will enable SACCOs and DAOs to automate the loan process, reducing the need for manual intervention. Smart contracts will trigger actions to ILP when disbursing payments.

Loan Origination: SACCOs will be able to originate loans through the front-end interface against pools created by DAOs/ or EZA on behalf of DAOs. The loan application will be processed by the middleware, which will then communicate with the lending backend systems to determine eligibility and loan terms.

EZA Architecture

Here is the link to our prototype demo:

Communications and marketing

Events

We (courtesy of BitKE) hosted a roundtable discussion on blockchain regulation in Kenya in May, during the Bitcoin Pizza Day. Government representatives from the Central Bank of Kenya (CBK), Kenya Revenue Authority (KRA), and the Kenya Bankers Association (KBA) graced the event, amongst other esteemed individuals. The discussions featured the prevailing regulatory landscape and the proposed legislation on digital taxation and digital assets.

Earlier this year, EZA also participated in the Ethereum Community meet-up which hosted Ethereum founder, Vitalik Buterin in Nairobi, Kenya.

EZA also participated at the Global Digital Development Forum, 2023 highlighting the role of open payments in financial inclusion. The panel as titled, 'The Power of place in Open Payments: How solutions for financial inclusion are being built from within the communities they serve.'

What’s next?

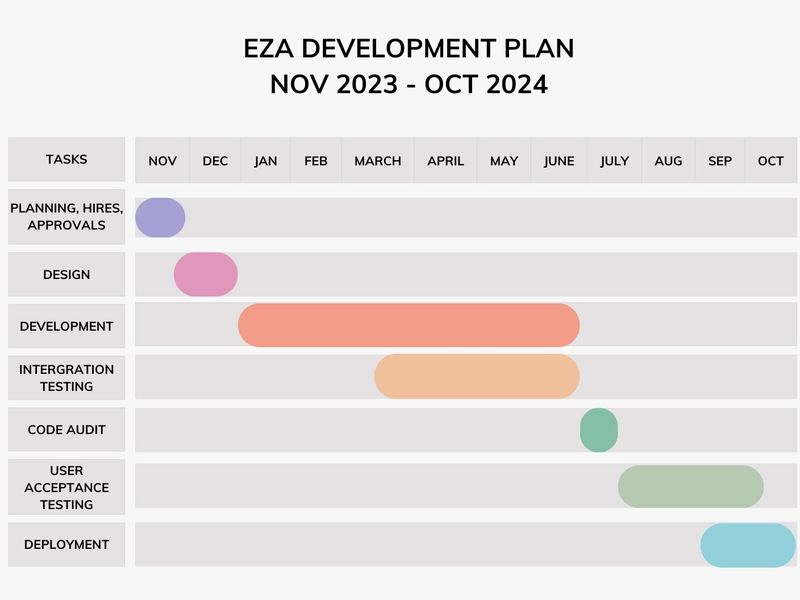

We are readying ourselves for the prototype phase which will include finalizing the licensing requirements, continuous stakeholder involvement and engagements and, initial user testing.

We are looking to bolster our team and mainstream capacity building/re-tooling skills amongst our skill force.

Below is a timeline of the prototype development phase

What community support would benefit your project?

We are reaching out to the community to share resources and links to teams/projects working to integrate blockchain and ILP.

Another way the community can help is by pointing us to people looking to support real-world assets tokenization and real-world lending on the blockchain.

Additional comments

List of Interviewed entities:

- Capital Markets Authority Regulatory Sandbox

- A former SEC Nigeria official

- Interswitch

- Ministry of Finance - Treasury

- Blockchain Association of Kenya

- Law Society of Kenya (LSK) Blockchain subcommittee

- Nairobi Finance International Center (NIFC)

- Kenya Union of Savings & Credit Cooperatives (KUSCCO).

- Nelsy Dubras - DAO Governance Expert.

- Kenya Bankers Association

- Shamba Network

List of MFIs interviewed:

- Letsego

- Boda Oil

- Caritas

- Edenbridge Capital

List of SACCOs interviewed

- Harambee SACCO

- Taqwa SACCO

- Chuna SACCO

- Mtangazaji SACCO

- Strategic Urembo DT SACCO

- Sauti SACCO

- PCEA Jitegemee SACCO

- Unaitas SACCO

- Fortune SACCO

- Qwetu SACCO

- Siraji SACCO

- Arthi SACCO

Top comments (1)

Whoa! So much work and effort has gone into all of this. Well done! Excited to see the prototype up and running!

Here is a list of other projects that have had some interaction with the ILP:

grantfortheweb.org/grantees

Also, gFam.live uses blockchain to provide monetization for social media users, and has implemented the ILP for Web Monetization if that's helpful to you.