Project Description & Objectives

The team behind People's Clearinghouse (PCH), a Mexico based project, has worked for decades with communities in very diverse rural areas, and we have long asked ourselves what the right path is for fostering sustainable regional development, in a way that doesn’t build any sort of dependency, but rather strengthens communities and promotes their self-sufficiency.

AMUCSS, for instance, the main stakeholder of PCH, has decided that the right path is to help build people-owned community banks in those regions. But the growth of a community bank in a non dynamic economic region can be complex and slow. Others have seen remittances, a massive injection of capital into these regions, as the way to promote regional development. However, remittances often bring well-being to specific recipients only and have very narrow uses, which do not foster regional development.

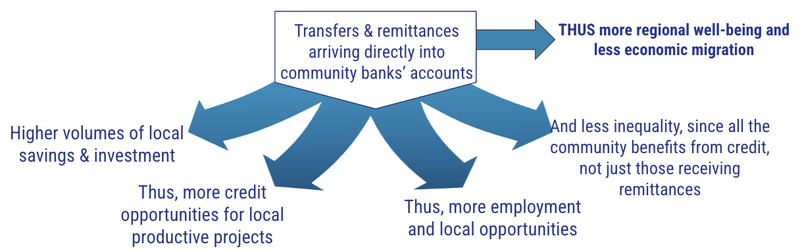

PCH, first as an idea, was our bet for the possibility of bringing together these two concepts: community banks and remittances, in such a way that we could foster sustainable development in a systematic way in many communities. Indeed, when remittances reach a community bank with a well-planned development strategy, that financial institution will have the capacity to invest and offer loans that support that development strategy.

Sadly enough, there are no direct connections between community banks and international financial systems that would allow remittances to be transferred and deposited directly into community banks. Remittances solutions that exist nowadays involve first and foremost cash delivery, which is more expensive, has higher risks, and doesn’t involve any form of financial intermediation by local community banks.

So PCH, with AMUCSS’ lead and support, had to find a way to solve that technical problem: how to connect community banks to financial systems, so that these communities banks could access account-deposited remittances transferred from abroad?

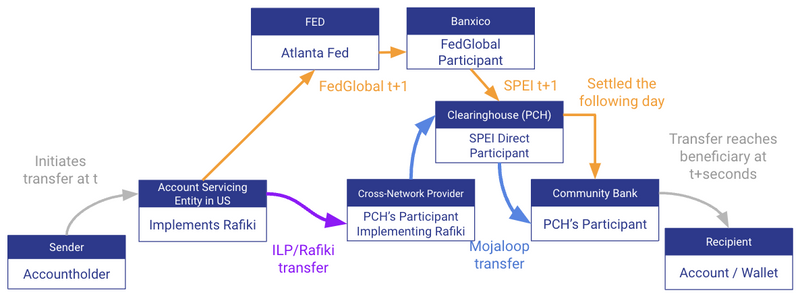

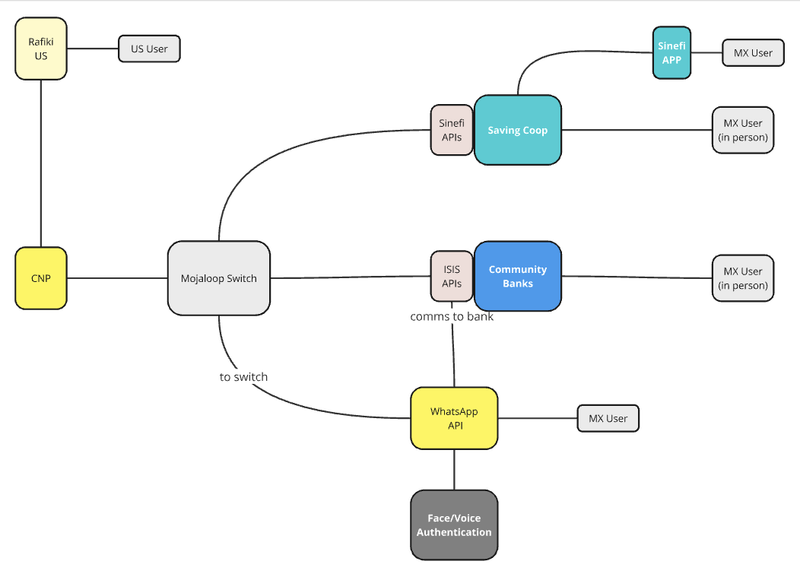

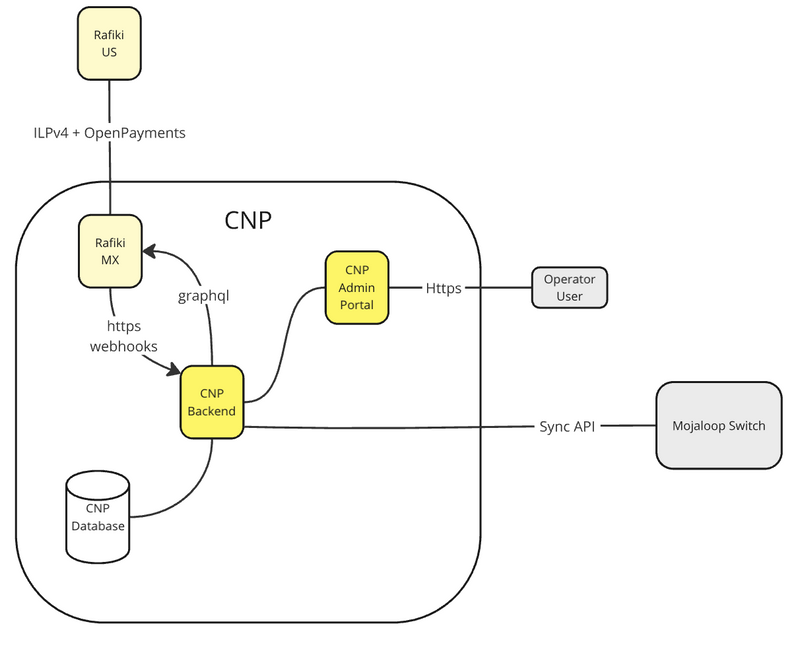

Today, PCH includes Rafiki and a Mojaloop switch as part of its solution, for interconnecting small financial entities: a) among themselves, b) with the national financial network, c) with international networks, thanks to an authorized money transmitter, managed by PCH, that we have defined as a “cross-network-provider” (CNP) in PCH's context, because it functions as a participant in the PCH network and as a bridge to other networks through Rafiki.

Together, the switch and the CNP constitute PCH's digital payments ecosystem. Because it uses open source fintech solutions and speaks directly to the people and community banks it pretends to serve, PCH can be considered a grassroots, social tech organization.

Here's a 3 minutes video introducing PCH (from January 2024):

Project Update

To get where we had to, we needed to give shape to an effective team of developers that would be capable of transforming the PCH idea into a concrete platform. For that, they had to understand very well the open source technologies being used (Rafiki, Mojaloop) and be comfortable enough to integrate them through a new, intermediary entity that had to be created (what we have called the CNP), both in an efficient way and following the Mexican regulatory framework for transfers and remittances.

We could have hired a group of specialists to do it, or a local fintech company. Instead, we chose to replicate our social perspective also in the way we would build our team: we closed an agreement with the Technological University of the Mixteca region, based in a small indigenous town in the middle of Oaxaca, which has a very good record of students joining high level projects in Mexico. With their guidance, we did a long selection process to determine the ideal candidates, who had to be very good developers familiar with TypeScript, with enough proficiency in English and with a frank interest in social justice.

Once selected, we initiated a one-month training process, where the candidates became familiarized with the Interledger Protocol, Open Payments, Rafiki, and Mojaloop through a series of training sessions and materials. The team, formed today by 8 great developers from Oaxaca, has given excellent results, creating an atmosphere of fraternal collaboration and constant learning.

In that sense, the first very important milestone that was achieved in this phase, was to build a functional, successful team that is committed to the project and willing to change the lives of many communities through the use of open source innovative solutions. That team today has become very confident in deploying Rafiki and Mojaloop environments, in working with their APIs and their transfer flows, in testing them, and more recently even in proposing new features to these technologies, so they may better serve their purpose.

The support and patient advice we received from the great ThitsaWorks team in Myanmar, as well as from the awesome ILF tech team, and from the wonderful team at Break Point, and from other incredible developers like Tadej Golobic and Pedro Barreto, were absolutely essential for this milestone to become the success it finally was.

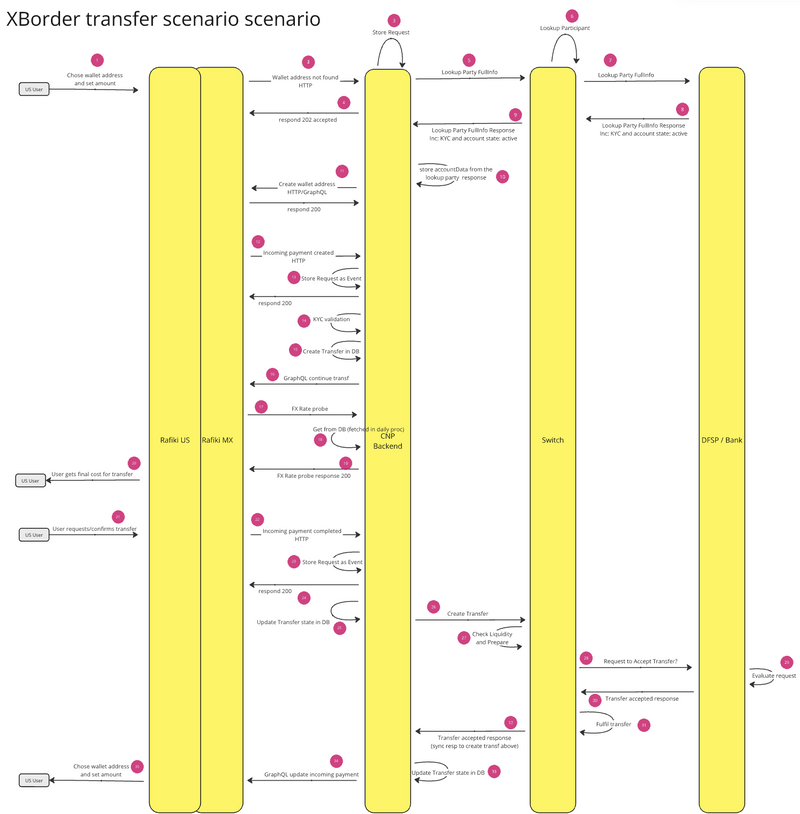

A second milestone that is worth mentioning here, is the actual development of a cross-network-provider or CNP (the term was coined by Michael Richards from the Mojaloop Foundation for referring to entities, whether only technological or also legal, whose function is to intermediate between two payment schemes). The goal was to allow Rafiki transfers initiated in the United States to reach the CNP, then be converted into a Mojaloop format so the switch is able to route them towards the appropriate community bank. In that way, we create a single entry point for Rafiki, that powerfully translates transfers into other payment schemes.

Faster said than done. Rafiki and Mojaloop have very different ways of treating transfers and information contained in each transfer. In developing the CNP, we had to make sure that we were being consistent with the way each of the transfer systems works, and that we wouldn’t have Rafiki transfers that didn’t complete, but were still completed on the Mojaloop side –or vice versa–, which was a puzzle to be daily thought and rethought.

Then, when we had the CNP doing its function, we still had to adapt it to the Mexican regulation and to the use cases that a normal money transmitter would desire for their staff. We luckily had the experience of the already authorized money transmitter from AMUCSS, so we could advance quickly based on their experience.

On the Rafiki side of things, the peering with other entities wasn’t necessarily an easy task (thanks so much to the team behind Rafiki.money for all their help!), and concerning Mojaloop we had much trouble integrating core banking systems (CBS) to the switch, made easy by ThitsaWorks' help implementing their LCC connector as an intermediary between the switch and its participants.

Finally, the day came in which we had to present an initial result of the process. That happened at the beginning of the Oaxaca Workshop PCH organized in August, with the kind participation of Max Kurapov, Jason Bruwer, Julaire Hall, Alex Lakatos, Michael Richards, Pedro Barreto, and friends from Fintecheando, Conecta and Sinefi, 3 important fintech companies in Mexico. You can read more about the workshop in this beautiful report coordinated by Max.

The demo of the CNP was successful in that it demonstrated that the integration between both transfer flows (Rafiki and Mojaloop) is possible, and that it can be done in an efficient, transparent way that is consistent with the regulation. The demo showcased actual end-to-end transfers that went across Rafiki and Mojaloop, ending in the community bank account of the expected recipient.

The workshop represented the accomplishment of an important milestone, but one which we will keep on working on to bring our solution to production in the near future. We have continued to refine our prototype at the amazingly useful Cluj Work Week (report coordinated by Ioana), where 4 developers from PCH contributed to the Rafiki APIs and the Rafiki deployment documentation, and worked on CNP-related issues with the ILF team. In the near future, the Cape Town Interledger Summit will offer PCH and key allies the opportunity to present the current state of the CNP and the entire ecosystem around it.

While several other milestones could have been presented in a similar fashion, we have chosen these two because they represent very palpable achievements. If we had to summarize in two key concepts the process of giving shape to a successful open source dev team in Oaxaca and of them building a successful prototype for the CNP, those two words would be: collaboration and perseverance. Thanks to all who have contributed in one way or another to PCH’s ideals becoming more and more concrete each day.

Key Activities & Outputs

Several key activities of PCH for this phase have focused on the Rafiki-CNP process, following the pre-established timeline:

- We created several Rafiki environments, for dev and testing;

- We defined a global Rafiki-CNP-PCH architecture;

- We specified a CNP transfer flow that is now working correctly;

- We developed a CNP admin platform that allows operators to update CNP information, produce compliance reports and (soon will) manage liquidity, on the basis of the current regulation and processes for our active money transmitter;

- We built and showcased a working prototype for the CNP;

- More recently, we've introduced idempotency in the CNP treatment of transfers, along with several improvements that were necessary;

- Of the outstanding features, we're currently working on the error handling flows for faulty transfers at the CNP. While our prototype is almost ready, we hope to be producing a real-money-handling pilot early next year.

Other key activities have involved the deployment and configuration of a Mojaloop system:

- We have finished parametrizing the oracle/ALS for adequate routing using MSISDN as aliases;

- We have deployed dev and staging Mojaloop environments in AWS, with help from ThitsaWorks, and more recently we've deployed an all new dev cluster in GCP (traditionally Mojaloop deployments only run in AWS), so as to standardize environments used in our different processes;

- We had already integrated AMUCSS' core banking system (CBS), called Isis, to the switch, with ThitsaWorks support, using their LCC connector for that purpose. Now we have integrated three CBS in a new fashion that allow us to connect them directly to the switch: Isis (done), Mifos (almost done), Sinefi (in process). That was only possible thanks to connections (clients) produced by Pedro Barreto in TypeScript and C# ;

- We have been able to test P2P transfers and we are now working on error handling mechanisms for switch-participant connections;

- We are also in the process of building a prod environment in GCP for our hub that would be powerful enough to run all needed services, without being more expensive than it should;

- Other important features are confirmed or in the process of being completed in our version of Mojaloop: a synchronous API production-level solution that avoids the need for connectors, duplicate checks/idempotency, third-party IAM integration, liquidity management supporting MongoDB & TigerBeetle, certificate exchange between participants, and 3PPI. All this, under the lead of Pedro Barreto.

Additional key activities concern the authorization process with the Central Bank. In an effort to render the switch more efficient and accessible, we have adapted the architecture and transfer flow on the Mojaloop side to the most advanced architecture. This has leads us to the necessary task of updating documents and manuals presented to the Central Bank, which should take two to three months. Once the new, essential switch features are ready and well documented, we will be close to finalizing the authorization process for PCH. While this process has taken longer than expected, we're in a good path to a successful implementation, and for that we have to thank the Central Bank's insights into the project, including the need to have the most efficient switch possible on the Mojaloop side so that transaction costs transferred to community banks and their members are as tiny as possible.

While on the more technical aspects our platform is gradually approaching production-level status, on business and operations' grounds there are still some important decisions to be taken on the cross-border side: there's an analysis phase that will become a priority in the coming months and also involves some outreach activities with the Atlanta Fed and several Money Transmitters based in the United States. Key questions concern US compliance for Rafiki implementors and the definitive settlement model that the CNP will implement with US-based account-servicing financial institutions and/or money transmitters.

While these points are out of PCH's national scope, they are key to a successful binational ecosystem. A very interesting panel at the ILF Summit will precisely address part of these points, and we're looking forward to its results.

Project Impact & Target Audience(s)

PCH is meant to benefit first of all the 200k users of AMUCSS’ network of community banks, distributed in hundreds of communities along rural Mexico. ⅔ of these users are women and at least half of them are speakers of one or more indigenous languages. The symbolic importance of giving priority to this population lies in the possibility of prioritizing the impact the project can have in those communities that are always left out by technology and innovation. We want to start the other way around.

For PCH to be viable in the long term, we also had to build alliances with several social financial institutions beyond AMUCSS’ network, and first of all, with the most innovative saving coops of the country. By now we have onboard 4 or the 5 largest saving coops of the country, one of whose CBS is finalizing integration with the switch.

PCH is meant to become the payment network of the social financial sector, currently corresponding to a universe of 17 million users of saving coops, community banks and “social banks” (by their legal names: SOCAPS, SOFINCOS, SOFIPOS), which tend to cover rural and semi-rural regions, as well as small urban areas where commercial banks are less frequently found.

Indirectly, too, PCH will be serving millions of migrants working in the United States who regularly send money to their families back home and will benefit from our innovative remittances’ solution, as they will be able to make cross-border transfers from their US account to the regional community bank or saving coop, by means of the CNP and using Rafiki.

A project as PCH, dedicated to the underserved, the migrants, the indigenous groups, and women foremost, is certainly in agreement with the Interledger Foundation’s mission, because innovative, open source technologies should always be meant for everybody’s enjoyment, with no exceptions. (The following image shows the everyday's users of an AMUCSS' community bank)

Monitoring & Project Evaluation

The construction of PCH’s ecosystem is advancing well, and is expected to complete all its milestones by the end of the grant period, including a viable prototype for the CNP, very close to production status, and an authorized clearinghouse ready to change the lives of many communities.

But several risks need to be considered, among them:

1) The technology available at community banks is not optimal for real-time transfer systems. We have solved this problem by creating our own APIs that interact with the core banking system of entities and with the switch. However, an important mid-term objective for the success of PCH’s proposal is to lead the upgrading of current technological solutions that community banks implement internally, so that in the longer term PCH can push forward an innovation process that includes them fully, rather than dragging them behind.

2) While the authorization process with the Central Bank officially began a year ago, there has been constant upgrades in the Rafiki, Mojaloop and now the CNP side. The documentation of these changes and upgrades has to be very well planned and explained in norms, guidebooks and manuals, so that we do not delay the authorization process that is needed for a successful implementation in the expected regions.

3) Essential aspects of the cross-border transfer fall on the side of account servicing entities and regulators in the US, out of PCH’s proper landscape. While we will be discussing and advancing an all-encompassing solution, that considers settlement and compliance, a big chunk of these points is managed in the US, so we cannot control its progress and correct implementation. A key task will therefore be to work with the ideal allies in the US, those who can manage its complexity and make the most of this binational project's potential.

4) Transitioning from tech innovation only to a tech innovation-operation model will not be easy. That will imply growing the team and strengthening particular areas that aren’t tackled on a daily basis in the development phase (liquidity, compliance validation, risk management). Human resources management will become very important once PCH is authorized to operate.

PCH is ready to tackle these and other challenges that will have to be faced, and ILF’s active support of PCH's mission gives our team the confidence and determination needed to never stop in the process.

Communications and Marketing

PCH's platform has been discussed in different forums this year, including an interview with El Economista newspaper from January, a Payments Canada conference from July, the Oaxaca workshop in August, and the Annual saving coop association congress in September. However, until the authorization process with the Central Bank is dully completed, PCH has decided to keep a relatively low profile in the national context, in the goal of facilitating a continuously fluid discussion with the Central Bank.

Most international press exposure has been the result of a collaborative process with ILF's great PR team, and has led to very insightful publications from media such as The Banker, PaymentsJournal, The Papers, and Citybiz (a list of publications with links is attached at the end of the report).

Once authorized, just as planned in our timeline, we'll follow up with a specific outreach strategy that will focus on three different levels:

1) strategies for binational communities, including physical visits and digital outreach, to grow visibility at the grassroots level;

2) adding new saving coops and community banks as allies, to grow adoption among potential participants;

3) working with regulators and MTOs in the US, to define the binational strategy with our US counterparts.

Additionally, training workshops will be carried out with community banks, so they can better understand the complexities of PCH, and serve as regional replicators of PCH's outreach effort.

What’s Next?

Aside from the outstanding elements already mentioned (prod environments, error handling flows, settlement model specifications, final changes to CNP and Mojaloop, updated operational guidebooks), PCH will start working on new, key elements such as:

- SPEI (Mexico's RTGS system): The connection between PCH and SPEI requires a previous analysis, including AML procedures compatibility with PCH, data center procurement, and the building of an interoperability POC between PCH and SPEI. Once all this is ready, we will have to test our PCH-SPEI solution in the Central Bank's sandbox for that purpose.

- Outreach: training workshops with community banks, launch strategies (in Mexico and binationaly), and scouting for additional funds to support launch strategies.

- Rafiki-CNP: We will have to finish several outstanding features and prepare our Rafiki-CNP instance to run in an ad hoc production environment that will support all features developed by PCH for making the CNP a very robust system.

Community Support

The Interledger community has been amazingly supportive all along the grant period. We have been able to collaborate with amazing developers, devOps and software architects that have helped us bring our work to the next level. Without such a community, nothing could have been achieved!

The next phase is a complex one, because we will be facing a non technical challenge: working with US regulators, money transmitters, real accounts. While our project is based in Mexico, soon we'll need to put in motion the binational dynamics that will allow PCH to successfully introduce itself into the largest remittances' corridor in the world, the US-Mexico corridor. Any advice, recommendations, connections or comments of any sort that would allow us to better surf this cross-border, binational environment, will be more than welcome.

Additional Comments

We would like to thank the Interledger Foundation for believing in PCH's mission, and thank all those who have helped us bring PCH's platform to life, first and foremost the ILF dev team and management team who have been patient and tolerant with PCH's staff, as well as all the Break Point team, and Tadej, and ThitsaWorks, and our local partner in Mexico, Fintecheando, and Michael Richards from the Mojaloop Foundation, and Pedro Barreto and Rui Rocha, and all others who have been part of the process at one stage or the other, for all your advice and insights for PCH's team.

Relevant Links/Resources

Here is a list of recent publications about ILF and PCH, prepared under the lead of ILF's wonderful PR team:

- The Global Treasurer, US-Mexico Remittances Initiative Empowers Mexican Rural Banks

- Connecting the Dots in Fintech, Newsletter

- MUJER ES MÁS, U.S.-MEXICO REMITTANCE INITIATIVE EMPOWERS MEXICAN RURAL BANKS

- The Banker, New US-Mexico payments system to connect rural communities / REPRINTS: Germanic Nachrichten, Neues US-mexikanisches Zahlungssystem soll ländliche Gemeinden verbinden ; Credit and Collections News, New US-Mexico payments system to connect rural communities

- PaymentsJournal, Cross-Border Payments Are Heading for Rural Mexico

- Finextra, New US-Mexico payments pathway will tap rural community banks / REPRINT: NewsJani, The new payment route between the US and Mexico will open up rural community banks

- The Paypers, People's Clearinghouse partners with Interledger Foundation / REPRINT: BayPay Forum, People's Clearinghouse partners with Interledger Foundation

- Fintech Finance News, People’s Clearinghouse and Interledger Foundation Launch Digital Infrastructure Project

- Citybiz, People’s Clearinghouse and Interledger Foundation Break Ground on New Payments Pathways Between the USA and Mexico

- The Green Sheet, New payments pathway between USA, Mexico underway

- Financial IT, New USA-Mexico Payment Pathway Launched by People’s Clearinghouse & Interledger Foundation

- Crypto Reporter, People’s Clearinghouse & Interledger Foundation Launch Digital Infrastructure Project

Top comments (0)