Group photo of the Public Forum “Digital means of payment for financial inclusion” organized in April 2023 by the People’s Clearinghouse with support from the Interledger Foundation.

Brief Project Description

The People’s Clearinghouse is a technological platform for the social sector in Mexico, based on a large network of community banks and savings coops. By implementing the Interledger Protocol associated with other technologies, the People’s Clearinghouse allows clients of these social financial institutions to initiate digital transfers and also to receive remittances in their accounts from family members abroad at the lowest possible cost. This will boost local and transregional economies and empower the rural, marginalized and indigenous communities where community banks are located.

Project Update

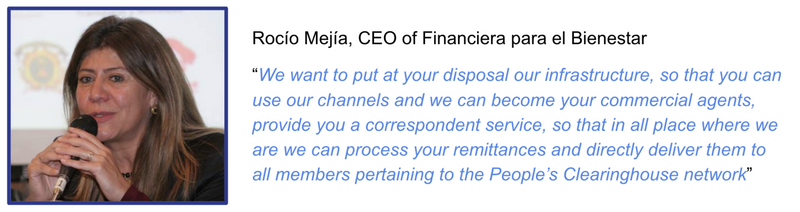

In our previous progress report we mentioned that a major win was the public validation of the project: how the Interledger Summit and the following meetings and events allowed us to realize how important this project could become, through the eyes of others. Since then, thanks to several events and foremost of all the Public Forum for Digital Financial Inclusion, that public visibility has shifted into the next level: it’s not the validation of an idea anymore, it’s the acceptance of a concrete, existing platform. The People’s Clearinghouse now exists, and is a platform that institutions and organizations can and perhaps should connect with. Take for instance the comments by the general director of Financiera para el Bienestar, the public institution in charge of disbursing remittances in its 1,700 locations:

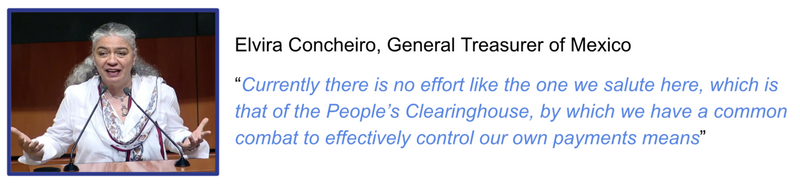

Or the comments by the General Treasurer of Mexico:

Both comments (click on the images for video extracts in Spanish) were made at the Digital Financial Inclusion Forum organized April 25th, 2023 by the People’s Clearinghouse with the sponsorship of the Interledger Foundation. Also that day, main financial organizations of El Salvador and Guatemala suggested an alliance with the People’s Clearinghouse, and national SPEI providers (SPEI is Mexico’s RTGS payment system, managed by the Bank of Mexico) openly proposed a partnership with the platform. For us it was a turning point: the People’s Clearinghouse will be in production in the near future no matter what, since the need for this platform is now more than obvious to all stakeholders and in particular to the social financial sector and to the regulators. That is the project’s biggest win until now.

Equally important is the impact that this visibility has brought for potential alliances of the popular financial sector. In the days following the forum, tens of community banks and savings coops contacted us to discuss how the People’s Clearinghouse could serve their needs and what the process would be to join. We have met with the second, third and fourth largest savings coops of the country, which are all willing to be part of this effort and invest in a platform for the social sector and by the social sector. If we’re able to successfully confirm these partnerships in the coming weeks, that would mean we could launch the clearinghouse with more than one million interconnected users. Here’s a picture of our last meeting with Acreimex’s directors: it’s the third largest savings coops in the country, based in Oaxaca, with 65 branches which all receive remittances. They developed their own core banking system, which is used by 25 savings coops.

On the other hand, with respect to the authorization process for the clearinghouse, we’ve had to face new information security requirements as a result of the enlarged scope of the project. The “Clearinghouse for Transfers between Cellphones” regulatory documentation is minimal (5 pages long) which might seem like a good thing, but it isn’t: it simply means that the level of compliance is subject to the authorities discretion. So with the considerable growth in the scale and scope of the project, we’ve had to produce additional mechanisms and the corresponding documents to ensure maximal compliance with ISO 27001. Thus our last hired technology providers were directly related to information security aspects. We’re working on the corresponding documentation, so that we can provide an updated version to the Bank of Mexico in the coming weeks and not slow down the authorization process, which must be ready before the end of the year.

We’ve also had to struggle with the complexities of a Mojaloop deployment and those of a Rafiki-Mojaloop interoperability model, all of which is discussed in the Progress on Objectives section. We’re counting on the wonderful Rafiki team to get to a final Rafiki model that we can work on intensively in the coming months to implement a realistic and powerful remittances’ channel in the first semester of 2024.

Project Impact & Target Audience(s)

AMUCSS, the organization behind the People’s Clearinghouse, is itself led by an indigenous woman, and its network of community banks serves around 200,000 people, of which 60% are women, 54% are in marginalized/very marginalized regions and 63% belong to indigenous communities (in fact 34 indigenous languages are spoken in all of AMUCSS’ community banks taken together). By providing innovative and low cost technologies, the People’s Clearinghouse will have a direct impact on these communities.

To illustrate our purpose in this section, the following image portrays some of the leading indigenous women in charge of the very humble community bank SMB Mujeres de la Lluvia (“Women of the Rain” or “Kinal Anzetik” in the Tzeltal language), which is part of AMUCSS’ network and actively supports the People’s Clearinghouse.

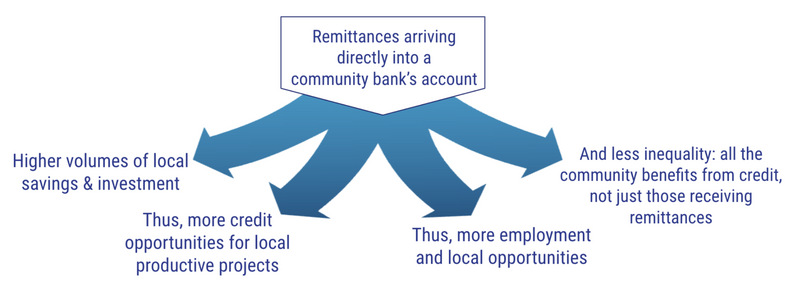

If we also take into account the alliances that are being negotiated at this moment with most of the 10 largest savings coops of Mexico, then the expected impact goes well beyond 1 million account holders benefiting from the People’s Clearinghouse from day 1, mostly from rural, marginalized regions (what we call “deep Mexico”), all of which receive remittances. If we’re able to implement our remittances model on this whole network, it will be a game changer for the future of the impact of remittances in communities, since account remittances (accounts that are credited into community banks/savings coops accounts, instead of arriving in cash) can have a major impact in local development, as is explained in the following chart:

We believe this process is consistent with the Interledger Foundation’s mission: real financial inclusion from below, through innovative open-source technologies that reduce dependency on mainstream financial actors (which is required to keep costs as low as possible). At the same time, the philosophy guiding the People’s Clearinghouse process is that real empowerment can only come from within and cannot be imposed on any community or individual; our role is to provide tools that facilitate that empowerment and to promote communities’ self-awareness and self-engagement as agents of change, but it is those community that bring change. We believe this philosophy to be consistent with that of the Interledger Foundation.

Progress on Objectives, Key Activities

Our main objective was and still is to be able to provide, for the social sector, both a sound digital payment/transfer platform and a platform for routing fast and cheap remittances directly into accounts of community banks’ account holders. During the grant process, our research brought us to the conclusion that a “Clearinghouse for Payments between Cellphones” combining Mojaloop and ILP is a powerful solution for that goal, as long as we can use the public rails between the Fed and the Bank of Mexico (“FedGlobal”) for settling remittances, which we’ve confirmed is indeed possible (another private solution could also be used, but the advantages of the public rails are indisputable, even from a compliance point of view for issuing banks in the US).

Concerning the remittances’ side, we’ve progressed on several grounds (the first two of the list were part of the previous progress report):

- Our survey to 23 community banks has allowed us to confirm the perceived importance account remittances have for these financial institutions: less cash management reduces risk and cost of transportation; more savings in accounts augment their lending capacity.

- Our research at remittance stores in California has allowed us to refine the business model for our proposal, also comparing costs, delays, risks involved.

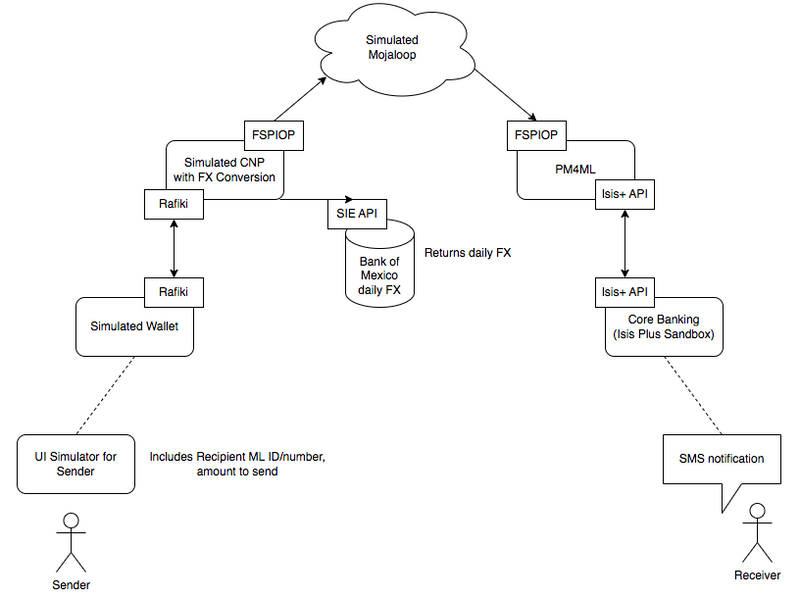

- We’ve set up a working group with the wonderful Rafiki team, and Michael Richards and Vijay Kumar Guthi from Infitx, meant to define the interoperability process between Rafiki and Mojaloop, so we can use a “cross-network provider” that both implements Rafiki and participates in a Mojaloop scheme, and thus serves as a translator between both models. The working group is still in progress, concentrating on the three main issues of routing (Rafiki identifies individual accounts, Mojaloop identifies scheme participants), quoting (Rafiki quotes are at least in part defined by the accounts, Mojaloop quotes are defined entirely by the scheme) and transferring (funds reservation and management of rejected transfers, for example).

- With that group and under Richards’ lead, we were able to prepare a PoC of that interoperability process meant for remittances, that was presented at the Mojaloop Community Meeting last March in Rwanda (see video of the presentation below), which was very well received and has been very helpful for us to understand the remittances’ messaging process.

- We’ve defined a US-based BaaS provider as our key ally in this process, which has been actively supporting the People’s Clearinghouse and is willing to implement Rafiki to actually take our model into production.

- Research on FedGlobal is important as it is our intended settlement solution (Rafiki and Mojaloop are meant to record and transfer remittances-related obligations: actual cross-border settlement is another issue). We’ve been discussing with several experts on FedGlobal’s flexibility for interacting with our model, including James McAndrews (ex Fed NY) and Elizabeth McQuerry from Glenbrook Partners (who worked in designing FedGlobal at its inception). We have the certainty that the model is viable and the next steps should directly involve the Atlanta Fed. Advantages for FedGlobal is that we could boost its market considerably; advantages for the People’s Clearinghouse is that we could offer the lowest fees and the best FX, for the benefit of migrants and their families.

- Two important things that we would have liked to do and will take place this summer are: visiting the Atlanta Fed to discuss both technological and regulatory aspects that will eventually need to be determined before planning a production phase; and visiting several remittances-sending communities in the US which also have community banks connected to FedGlobal, to discuss implementation both with community leaders and the local community bank (as is the case of Durham, North Carolina, in which lives more than half the population of San Pablito, a small town of Central Mexico with its own AMUCSS’ sponsored community bank).

To know more about our platform and its use of Rafiki, please check this presentation from March, 2023:

Basic model of the Rafiki-Mojaloop PoC for remittances

- SIE API=returns daily Bank of Mexico’s FX

- CNP=Cross-network provider (a Mojaloop participant that implements Rafiki)

- FSPIOP=Mojaloop’s APIs

- PM4ML=Payment Manager=Adaptor from Mojaloop’s APIs to an institution’s Core’s APIs

-

Isis+=A Core banking system developed by AMUCSS

Concerning the Clearinghouse side, we’ve also made good progress (the first two of the list were part of the previous progress report):

- We incorporated the social company that is being authorized as a clearinghouse. The organization AMUCSS is its main shareholder, which itself is owned by tens of community banks, which themselves are owned by communities. This sounds good, but is a burdensome process, as KYC and AML procedures had to be enforced for each individual member! We’ll also be bringing onboard major savings coops as shareholders of the company, so that the clearinghouse fully represents the social sector.

- Determining the ideal legal structure for the project was a hard choice between an “Electronic Payment Funds Institute” (IFPE) and a Clearinghouse, which are governed by two different public institutions. In the end, we chose the Clearinghouse as it allows us to create an ecosystem where different IFPEs, community banks, and savings coops can co-exist as part of a “social switch” in which an ILP solution is not only our solution, but can become the solution of the whole social sector. So the authorization process is ongoing, with constant discussions with the Bank of Mexico.

- Also concerning the authorization process, we’ll have to test and present a working Mojaloop-based clearinghouse platform in the coming months. While we’ve been able to effectively work on test ambiances with two powerful tools (Testing Toolkit and Miniloop), the actual deployment of a Mojaloop hub is proving to be quite harder than we expected. This is a key element that we’ll be working on in the coming weeks and months, and we’ll probably be requiring some external help from more experienced Mojaloop deployers.

- By law, the clearinghouse must start its SPEI connection process right after being authorized. SPEI is Mexico’s real-time gross-settlement payment system. The goal of that regulation is to make sure that any clearinghouse is not completely autonomous from the national banking network. So we have worked for the last 4 months with two main SPEI providers to determine the interoperability between their SPEI systems and our clearinghouse platform, so that we can be ready before the authorization process is over and quickly carry on the SPEI certification process. We’ve decided to partner with such a provider, instead of using our own platform for SPEI, as SPEI is overregulated (more than 300 pages of rules and 800 pages of manuals) and that would considerably slow down our process. The only condition we’ve set is that the provider must understand our platform as a social project and join in as part of the project, not as an external provider. We’re in the middle of that negotiation with both providers and we’ll have good news on this front in the coming days.

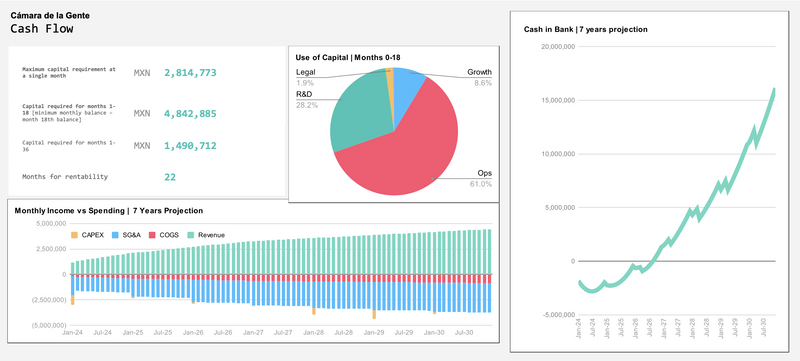

- Our business model is ready: by dividing intra-clearinghouse transfers and SPEI transfers, we can be sure we provide the lowest cost of the market to participants of the clearinghouse, while still being sustainable and capable of scaling to the whole social sector. Our initial financial model is based only on three income sources available at launch: P2P transfers (either by SPEI or intra-clearinghouse), remittances disbursement to accounts and social benefits disbursements. Additional services can and will be provided, but each will require an additional Central Bank authorization and a new use case development. Our model is concerned only with operation costs after launch (not pre-launch development) and reaches equilibrium after 22 months –but if an agreement is reached with main savings coops, as it's expected to happen this month, that number would be reduced to a few months.

- We’ve been visiting community banks and saving coops along the country for the last 3 months, to invite them to become part of the platform as participants, investors and advisors: as mentioned above, we’re about to sign an agreement with several social financial institutions, whose volume of clients is above a million and whose technology (core banking systems, apps) are also used by other financial institutions. We hope we can announce good news very soon. In any case, we’ll devote the coming months to visiting new potential participants of the clearinghouse and also potential additional investors from abroad.

- As adoption of digital means of payment is one of our main concerns at launch, we developed a basic demo that connects a WhatsappBot to a Mojaloop platform, so that payments can be initiated using whatsapp (and incoming remittances be notified by Whatsapp too). We would need to develop a more complex PoC in order to be able to eventually launch with that functionality included. You can view the video of the demo here (in Spanish… sorry about that; and more on the Forum in the next section):

Communications and Marketing

We’ve been promoting the People’s Clearinghouse in several forums and channels, including the following:

- Presentation video for the People’s Clearinghouse (already shared in last progress report)

- An article on the project published at El Economista(financial newspaper) (February 16th, 2023)

- Presentation at Mojaloop Community Meeting PI-21 (March 9th, 2023)

- Presentations at the Global Digital Development Forum(April 26th and 27th, 2023)

- People’s Clearinghouse Youtube channel and other social media

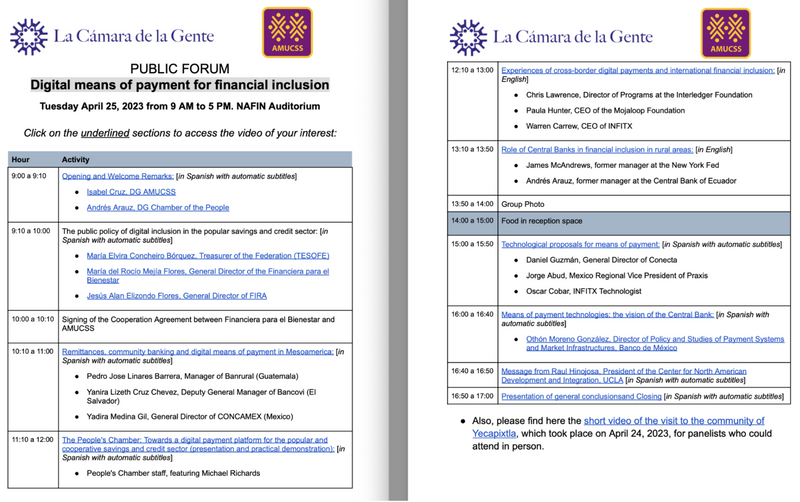

We also organized the aforementioned Financial Inclusion Forum to promote the People’s Clearinghouse. The forum, titled, “Digital Means of Payment for Financial Inclusion “, involved the participation of the General Treasurer of Mexico, the general director of Financiera para el Bienestar (explained above), the general director of FIRA (national public fund for agriculture projects), the gerente of Guatemala’s Banrural, the deputy general manager of El Salvador’s Bancovi, the general director of CONCAMEX (the national association of savings coops), Chris Lawrence from the Interledger Foundation, Paula Hunter from the Mojaloop Foundation, Warren Carrew from Infitx, James McAndrews who was at the NY Fed, two of the three main SPEI providers in Mexico, a UCLA specialist on migration and remittances, and the director of SPEI and clearinghouses of the Bank of Mexico. This combination of public, social and private perspectives brought forward a very interesting discussion that was a great omen for the public launch of the People’s Clearinghouse. You can find here a short video of the visit to a community bank and its members (Yecapixtla, Morelos), organized for panelists at the Public Forum:

You can view the full agenda of the Public Forum with links to each panel by clicking in the following image:

What’s Next?

In the coming months we’ll be following up on the authorization process with the Bank of Mexico, so we can finalize it as soon as possible. We’ll also continue scouting for potential investors, both among international foundations and regional stakeholders. And most important of all, we’ll make sure to get all of the major savings coops of Mexico onboard this project, something that is now a very realistic scenario thanks to the alliances being discussed precisely at this moment.

In the near future we’ll visit the Atlanta Fed and Durham, North Carolina, for purposes related to the Remittances model, as explained above. As part of the same process, we’ll promote a collaboration between our BaaS partner and the Rafiki team, so that we can eventually ensure the expansion of Rafiki to the migrant communities served by several programs that work under our BaaS partner in the US.

The following weeks, and months, we’ll be intensively working on the Mojaloop deployment (both for the authorization process and for our own testing), the Rafiki-Mojaloop interoperability model (required for remittances), and the WhatsappBot PoC (useful for boosting local adoption of digital payments). All of these developments will require considerable resources and support, but we’re not worried anymore: thanks to the Interledger Foundation, we realized that a powerful idea can always find its ideal partners.

Community Support

We currently have a working group on the Rafiki-Mojaloop interconnectivity, under the lead of Alex Lakatos and Michael Richards, which has been very helpful in allowing us to measure the effort and time required to implement both technologies effectively. In a similar way, it would be very useful to start using the remittances group on Slack with fellow grantees to discuss remittances’ models and regulations. We’re sure we can be helpful to others, and their experience can help us ameliorate our own model before reaching a production stage.

We have signed an MOU with fellow grantee ThitsaWorks to work together in supporting our platform for remittances implementing Rafiki and Mojaloop. We’re sure this will be a powerful collaboration and we look forward to other grantees and allies of the Interledger Foundation joining this effort.

Additional Comments

The support of the Interledger Foundation has helped build trust in a platform that is meant to help the most marginalized communities of Mexico. If a Central Bank, a National Treasure, and the largest savings coops of the country now believe in it, it’s in great part thanks to that support. We can continue to help people like Gudelia López –account holder from our community bank in Ayotoxco, Puebla, in the picture discussing digital payments through her cellphone– transit to new payment technologies which actually help empower their communities and their regions.

Top comments (0)