Project Update

The goal of my Interledger project ‘Pinging Paradise’, which I had introduced here, is to understand the experience of digital financial inclusion among the people of district Lahaul & Spiti in Himachal Pradesh, India. As a researcher who studies issues of access, connectivity and digital rights, it has been a long-standing desire to explore these issues in the context of my home district and I am most grateful to the Interledger Foundation for their support in enabling this work.

This interim report presents an overview of the activities that I have undertaken as part of this project over the last five months. Being a research-centric exercise, this has involved activities such as literature review, interaction with experts, design of the questionnaires and implementation of the interviews. Below, I explain these events in more detail, classifying them under the heads of – a) scoping the landscape, b) research design and planning, and c) field experience.

In terms of key highlights, the workshop on digital and financial inclusion and the field trip to the Spiti region for the first phase of the interviews have been the two most enriching experiences in the journey so far. These events led me to interact with two very different communities, both of which have played an instrumental role in the distillation of the research plan and gathering of insights. The first was the community of researchers, policy professionals and practitioners who participated in the workshop and provided valuable guidance on how to fine-tune the project’s scope and methodology. The second community, which is the focus of my study, consisted of the warm and generous people of Spiti, who enriched the study by sharing their stories and digital experiences.

Progress on Objectives, Key Activities

In the initial project plan, I had broken down the process of understanding the state of digital connectivity and financial inclusion in Lahaul & Spiti into five steps. These were – 1) desk research and design, 2) brainstorming workshop, 3) fieldwork, 4) analysis and report writing, and 5) dissemination. Standing near the half-way point of the project, I am happy to report that a good part of the first three activities have been completed during the project’s first phase, which lasted from April to August.

Scoping the landscape

The first step in the process was to understand the breadth and the depth of the existing knowledge on this research subject. Accordingly, I began by gathering the relevant literature on the topics of financial inclusion and the state of digital connectivity, focusing mainly on research papers, reports, and policy initiatives that spoke to the Indian context. While there was a reasonably sized body of work on these issues at the national level, the information became scarcer at the sub-national/ state level and even more so at the district level. This was a useful reminder of the under-researched nature of some of these issues, particularly in the context of remote and underdeveloped regions like Lahaul & Spiti.

Alongside the literature review, I worked on identifying other useful sources of information, such as data put out by the Reserve Bank of India and the Finance Ministry on financial inclusion and by the Telecom Regulatory Authority of India on Internet access. I was also keen to learn about the distribution of telecommunication towers in district Lahaul & Spiti and how that compares with other parts of the state. The website containing this information (maintained jointly by the government and the telecommunication industry) did not provide this information in a easily accessible format. I reached out to the community for help and Interledger Ambassador Santosh Viswanatham was kind enough to guide me through the process of navigating this resource more efficiently.

Research design and planning

Next, I began to flesh out the research methodology and formulate the interview questionnaire. I presented these ideas at the workshop on digital and financial inclusion that was organized in May. In addition to offering rich insights on the policy and practice of financial inclusion, which were discussed in my last post, the workshop helped me in sharpening the research design in several ways. One of the important suggestions that came up was regarding the scope of the project. Some of the participants pointed out that instead of trying to capture the whole gamut of digital and financial experiences, which would be challenging to do in practice, it may be better to focus the interviews on a smaller set of financial services. Building on this feedback, I tailored my questions to concentrate mainly on the use of banking and payment services.

We also had a useful discussion on the subject of participant compensation and related issues of fairness and incentives. This was in response to my initial idea of offering an entry-level mobile phone to each of the surveyed households. The idea was that this could be a compensation for their participation while also serving as an intervention that could be used to gauge how the mobile phone was actually being put to use and by whom. However, taking into account the feedback from the participants and legitimate execution challenges, I decided to exclude this idea from the project design.

Field experience (Phase 1)

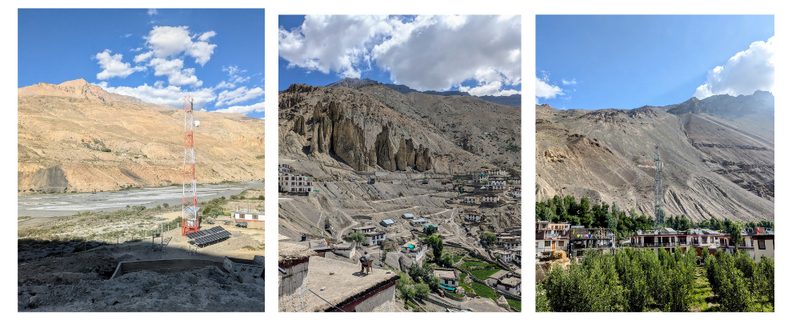

Lahaul and Spiti are two separate administrative divisions with significant distances between them. I therefore decided to divide the field work into two phases, the first part of which was carried out in the Spiti region in July. The journey by road from Manali, in district Kullu, to Spiti’s divisional headquarter, Kaza, took about 10 hours. Most of this time was spent on unmetalled roads (or at times, no roads) and with no mobile connectivity. While the spectacular landscape more than made up for this discomfort for the occasional traveler, it was impossible not to think of the safety concerns and inconvenience that it spelled for local residents.

Over the course of a week, I traveled to different villages in Spiti and carried out 15 detailed interviews. This was coupled with many shorter conversations along the way. The interviews were conducted using a convenience sampling methodology, which means that the interviewees were selected based on their accessibility and availability to participate in the discussion. The persons that I spoke to included agriculturalists, homemakers, small business owners, bank staff, and school employees. I also ended up having some interesting conversations with migrant workers from outside the state who were engaged in road construction activities along the highway. While my primary focus was on the local community, these unplanned encounters offered a window into the unique challenges that arise at the intersection of low connectivity settings and the precarity of migrant work.

I was also interested in measuring the state of internet connectivity in different pockets of the region. To do this, I procured the SIM cards of the three main telecommunication service providers that serve the region – Reliance Jio, Airtel and BSNL. The speed and responsiveness of these providers were tested across multiple locations using Ookla’s Speed Test app. The results showed that although a large part of the road from Manali to Spiti and the roads within the valley had no mobile connectivity, the situation got much better when you hit the main villages, where the mobile towers were located. Yet, there were villages like Hikkim, which boasts of the world’s highest altitude post office, and parts of the Pin valley, which still had no internet access.

Project Impact & Target Audience(s)

The people of Lahaul & Spiti belong to a constitutionally protected minority known as the ‘scheduled tribes’. This refers to communities that have been recognized as distinct tribal groups based on their unique cultural characteristics, geographical isolation, and social and economic underdevelopment. Yet, despite various affirmative measures, the marginalization of tribal communities still persists. Among other things, this is reflected in their delayed access to physical and digital infrastructures and invisibility from research studies on these subjects. The project’s aim is to dilute this pattern of invisibility by generating new knowledge on the lived experiences of the community of Lahaul & Spiti.

The study’s target audience is, however, not limited to the community itself. Rather, it can help a broader ecosystem of stakeholders, including policy planners, technologists and businesses, to deepen their understanding of how users in challenging and remote environments engage with digital financial services and the interventions that may be needed to improve that situation.

Communications and Marketing

The workshop on digital and financial inclusion was the main forum in which I discussed my project plans with domain experts. This was accompanied by a broader conversation on other aspects of the Interledger Foundation's work, its projects and available grant opportunities. Besides this, I have had many one-on-one conversations about the project and my ambassadorship with people in my network. Following the completion of the project, I will continue these communication initiatives, with a focus on the dissemination of the findings through existing networks, social media, and speaking opportunities at relevant conferences and events.

What’s Next?

In the next phase of the project, which goes on till December, I will focus on the second leg of the interviews and the speed testing exercise in the Lahaul region. In line with the original proposal, I will make best efforts to interview multiple individuals within each household in order to learn about the intra-household dynamics of financial inclusion. This is something that I was not able to achieve during the first phase of the interviews. Following the completion of the information gathering phase, I will condense and analyze the learning from the interviews and other sources to put together the final project report.

Alongside these project-specific activities, I will continue to engage with the Interledger community in various other ways. This includes participation in the meetings of the IGF Dynamic Coalition on Digital Financial Inclusion being led by Interledger Ambassador Ayden Férdeline and planning an upcoming episode of the Future | Money Podcast on ‘Practicing Financial Inclusion in the Global South’ in collaboration with Lawil Karama.

Community Support

One of the ideas that I was keen to pursue was to automate the internet speed measurement tests – to do this simultaneously using multiple SIM cards and at regular scheduled intervals while I was on the road. I spoke to a few people to figure this out but eventually settled on a manual testing method, using the Speed Test app on multiple mobile devices. While I was comfortable with this process, I remain open to any ideas on how this methodology may be improved for the next leg of the field work. I would also welcome any feedback on the research path described here and additional avenues that may seem worth exploring in the context of this project.

Additional Comments

Let me end with a few words about some of my other work, which may be of interest to those who are thinking about the field of digital public infrastructures (DPIs). I have been studying the developments around DPIs in India for the last few years. Drawing on that work, in April this year I published an article titled ‘Stack is the New Black?: Evolution and Outcomes of the ‘India-Stackification’ Process’ in the Computer Law & Security Review. This was followed by a shorter piece called ‘Digital Public Infrastructure and the Jeopardy of “Alt Big Tech” in India’ for the Center for the Advanced Study of India. I plan to present some of this work – mainly on the competition policy implications from the rise of monopolistic digital infrastructures – at the upcoming Interledger Summit. Hope to see and interact with some of you there.

Thank you for taking the time to read the report. I would welcome any questions or comments.

Top comments (1)

@smrpar Has the final project report been published? Or are you still working on it?