Project Update

This second half of the grant period has been extremely insightful on the one hand, on the other hand we have faced challenges and were forced to readjust the project strategy. The launch of Rafiki has helped us advance with the technical developments and requirements. We have made great strides in understanding and tackling the regulatory challenges as well as determining the resources needed to prepare for phase 2.

Several key findings emerged from our research.

- There is a growing focus on utilizing African-led tech solutions on the continent, voiced by the African Continental Free Trade Area (AfCFTA) and Smart Africa initiatives. This presents a significant market opportunity for African led businesses to provide innovative payment solutions that cater specifically to billions of Africans and have the scalability to reach African diasporan consumers.

- There is a significant market gap in creating an interoperable payments system for the African continent and this points to the need for the Interledger Protocol infrastructure and network. The for an interoperable payment network that is capable of combining the messaging as well as the trust layer of a reliable payment system. There is a unique opportunity to provide enterprise grade solutions for existing banking and ecosystem partners, who are building new solutions to decrease friction amongst the different payment systems within the AfCFTA.

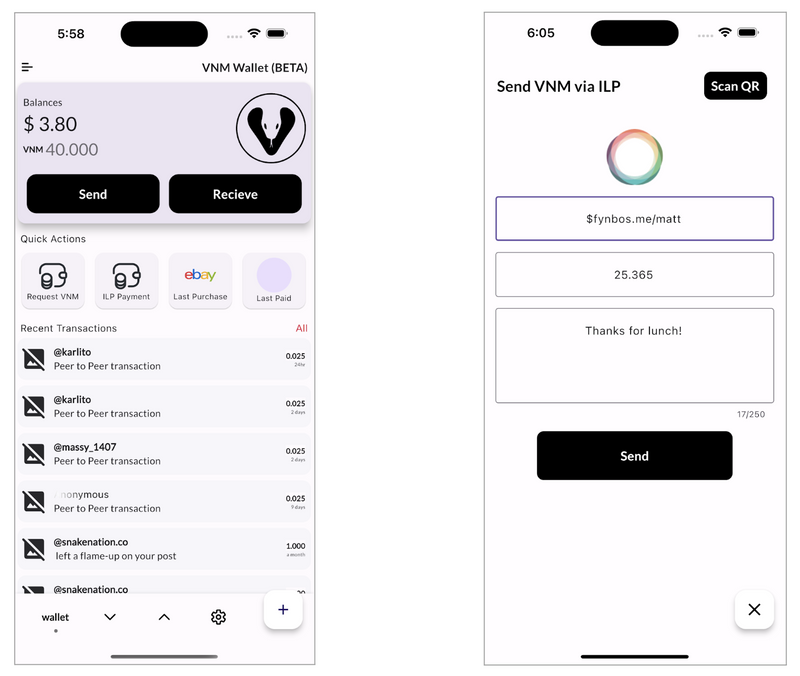

- There is a need for an interledger capable wallet to facilitate seamless transactions, cross border and local trade, and peer to peer. The VNM Wallet is uniquely positioned to play this role, across our member base.

- Another important finding is the need to educate regulators and traditional financial service providers on how to navigate decentralized networks like ILP. Early interests in exploring participating with central bank sandboxes to ask novel regulatory questions are welcomed as the terrain is rapidly changing.

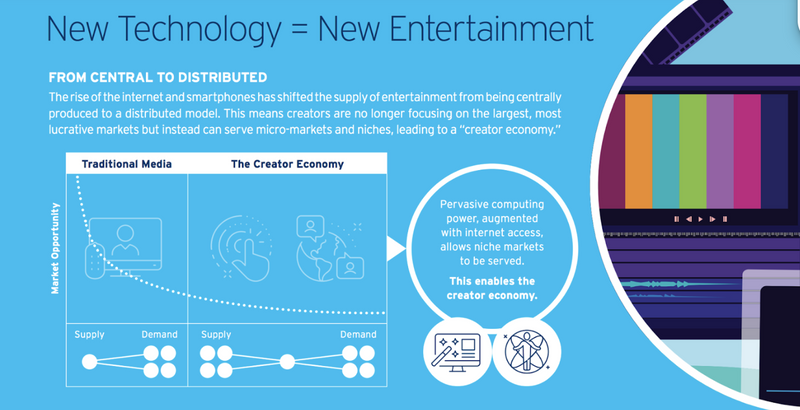

- Lastly, Web monetization offerings warrants further exploration. From our research, discussions and feedback at conferences, it presents a potential avenue for further growth and expansion in the creative industry and has a unique potential for enterprise level and individual impact for emerging and established creatives.

Progress on Objectives, Key Activities

Research and Surveys

To gain a comprehensive understanding of the market, we conducted extensive desk research and interviews with partners and advisors. This exercise proved valuable in identifying potential risks and opportunities. We initiated the process of registering for a Financial Services Provider license in Mauritius, which is a critical step towards complying with regulatory requirements. We have begun communications exploring relevant sandboxes with banks and regulators, which will enable us to test the service and gain learnings in a controlled environment.

Main takeaways

“The volume of transactions on the African continent is immense and continuously increasing as more and more people are striving to join the digital economy. Existing traditional payment systems have not been designed to handle these micro transactions.” (Alex Lakatos, Interledger Foundation)

Identified players and potential partners

There are however several public initiatives and private companies whose aim is to bridge the gap between regulators and financial service providers. We have had conversations with:

Regulatory Policy Insights:

Global Policy House (GPH)

Michelle Chivangu, Global Policy House

“Some Central Banks are interested in digital currencies, others not at all. The timing is really important when you approach them as they might be busy with other things such as inflation.”

The GPH is a policy think tank that focuses on the African continent. They work on topics related to e-commerce and digital trade, discussing regulations and creating working groups. GPH has observed that some central banks are interested in moving towards providing and servicing digital currencies CBDC, while others are evaluating the current regulations. GPH informed us that the African Union focuses on regulations and foundational work, and they advise that the AU consider interoperability as a key in introducing digital currencies instead of everyone doing their own thing. They also informed us that timing is also crucial when approaching central banks, as they may be preoccupied with other pressing issues, such as inflation and political climate. GPH aims to connect Snake Nation with government and policy makers in the CBDC space and assist with central banking discussions.

Mauritius FinTech Hub

Additionally, we have become a member of the Mauritius FinTech Hub, which provides us with guidance on obtaining the necessary VASP license. This will help facilitate building trust within their community including finance, tech and government sectors.

The Mauritius African Fintech Hub, registered as the Mauritius Fintech Association, was launched in October 2018 with the objective to promote Mauritius as the Fintech Innovation Hub for the African continent. This initiative was pioneered by the Mauritian government, through the Economic Development Board (EDB) of Mauritius with a launch grant, alongside the private sector.

Better Than Cash Alliance

“They want African led solutions, there is a massive opportunity for African led tech companies.” - Lucy Mbabazi, Better Than Cash Alliance

Better Than Cash Alliance is situated with the UN and focuses on advocacy and partnerships to promote responsible digital payments across continents. Digital payments have become an important driver for financial inclusion, especially for women and youth. The Better Than Cash Alliance also works with the AfCFTA and provides advisory services on digitization.

EmTech

"We want to bring money to everywhere where we do business, bringing access to everyone, decentralizing." - Carmelle Cadette, EmTech

They aim to bridge the gap between central banks and regulators who are struggling to comprehend the new innovations being developed. They want to decentralize and bring access to everyone, everywhere. They built a platform that enables central banks to digitize their processes and create a regulatory sandbox for FinTech companies to check with the CB. They realized that FinTech companies also don't have enough expertise to understand the regulations. To address this, they built APIs to standardize the regulator's requirements to ensure that there is a lower risk of going to market. Our goal is to partner to explore regulatory requirements and testing of transactions cross border.

FINASA

The Fintech Association of South Africa (FINASA) is a non-profit organization dedicated to promoting and supporting the growth and development of the fintech industry in South Africa.They have been helpful in gathering regulators to participate in the conversation with South African regulators and the Intergovernmental Fintech Working Group (IFWG) which includes participation from National Treasury, the Financial Intelligence Centre, the Financial Sector Conduct Authority, the National Credit Regulator, the South African Reserve Bank, the South African Revenue Service and the Competition Commission. Our goal is to leverage their regulatory knowledge and Fintech matchmaking for our local licensing partnerships.

Cross Border

PAPSS

Currently, PAPSS (Pan-African Payment & Settlement System) a product of Afrexim Bank is the most promising cross-border initiative for the continent, backed by central banks and commercial banks. Nonetheless, the main implementation barrier remains: interoperability. PAPSS is an example of a hub and spoke network that is having trouble connecting. The central hub must understand 27 systems, and there are still issues connecting within countries. Interledger, on the other hand, is like an international language and can connect systems much more easily.

Uchi Nick Uchibeke, Chimoney

“Each country [in Africa] has different preferences: mobile money, cash out at banks etc. The biggest challenge is to support all of these payment methods.”

In Africa, cash continues to be the preferred payment method and there is not enough trust in digital payments. Mobile money has failed in many countries due to excessive regulations, and the existing software designed to handle micro payments is not able to keep up with demand. Interoperability is also an issue as people do not like having to switch between payment systems. SWIFT is globally the most popular payment system as it is trusted and contains many features, however the ILP network has great potential due to its ability to move money and not just serve as a messaging layer.

In terms of risk, human error is the main reason why transactions fail in the traditional banking system. With ILP, the liability is on the hub and not the individual banks, and there is no risk of lost transactions as the money always travels with the request.

Miora Randriambeloma, Chipper Cash

“Interoperability is a major challenge due to fragmented networks within the payments sector [...]. The question is how to overcome this gap and integrate different providers.”

Companies like Chipper Cash are interested in interoperability, as fragmented networks exist in mobile money, cash, and other providers that need to be bridged (Chipper Cash).

Partnerships

These partnerships are currently in discussion as part of the initial research phase.

| Partnership Type | Organization |

|---|---|

| Payments partner | Xago, World Remit, Chipper Cash |

| Mobile money partner | Africa's Talking (MOU signed) |

| Banking partner | Varo, Afrexim-PAPSS, African Development Bank |

| Regulatory partner | Global Policy House, EmTech, Smart Africa, FINASA, IWFG, Mauritius FinTech Hub, -AfCFTA |

| Education Partner | CPUT (MOU signed) , THENSA, AASU (MOU signed), Manchester Metropolitan University (MOU signed) |

| Cloud Partner | Liquid Intelligent Technologies (MOU signed) |

| Government Partner | TIA (MOU signed) |

| USAID, British Council (MOU signed) |

Currently, we have a partnership with CPUT (Cape peninsula University of Technology) through their program BIIC to work with incubated startups in integrating payments through ILP.

The Technology Innovation Agency of South Africa (TIA) has signed an agreement to support Snake Nation in the ILP skills development in universities across South Africa. They will assist in the Innovation Skills Development and Enterprise Development. We are already working with the SETAs (Skills Education and Training Authorities) to fund for learnerships, internships and skills programme training focusing on the sustainability of technology businesses, the impact will be measured against the SDG’s (Sustainable Development Goals) and the triple challenges (Unemployment, Inequality and Poverty).

In addition, through our partnership with the Technological Higher Education Network South Africa (THENSA) we can roll-out the infrastructure to all the universities of technology in the country. The THENSA is the representative body for technology focused member institutions in Africa. It exists to enable its partner institutions to respond to the challenges and targets set in the UN SDGs and the Africa 2063 Agenda through Technological Education, Research and Innovation.

In partnership with AASU and TIA the Africa 4.0 is a university tour led by Snake Nation promoting the adoption of the 4th Industrial Revolution by young Africans. The tour will kick off in May 2023 at Bushfire in Eswatini, run through 8 African countries (Eswatini, Reunion Island, Zambia, Egypt, Kenya, Rwanda, Zimbabwe, South Africa) and will finalize in December of 2023. Africa 4.0 will be utilized as a channel to introduce ILP to students through hackathons and training in partnership with TIA and the BIIC. Once kicked-off we are creating ongoing programs: We are building an open payments curriculum into our FinTech societies at the top layer and utilizing our SN app to distribute interledger payment pointers through our wallet, which is interledger capable. Additionally, we are providing training to students on how to build economies that incorporate e-commerce, competitions and media with an open payment paywall.

Snake Nation will be leaving Technopreneurship programs behind in universities, focusing on upskilling students in new technology and venture building. This is a commendable move towards equipping the younger generation with relevant skills needed in the ever-evolving tech industry. By prioritizing hands-on experience and research, Snake Nation is not only helping students develop practical skills but also encouraging innovation and entrepreneurship. With the increasing demand for ILP technology and its potential to revolutionize various industries, this move by Snake Nation is timely and necessary. The skills and knowledge gained by students through Snake Nation's programs will undoubtedly make them valuable assets in the job market and the tech industry as a whole.

Regulation and Licensing

The regulatory landscape around financial service providers and payments providers is extremely diverse. There have been efforts within the different African regions (East, West, North and South Africa) to work towards interoperable payment systems and multilateral regulatory agreements for regional cross border payments. However, Regulatory requirements and licensing remains an industry challenge. Cross-border transfers between those sectors still remain laborious and costly (AfricaNenda, 2022).

“Your Modus operandi should be: How do we track and trace a transaction through the traveler rule in a decentralized network like ILP?” - Jurgen Kuhnel, Xago

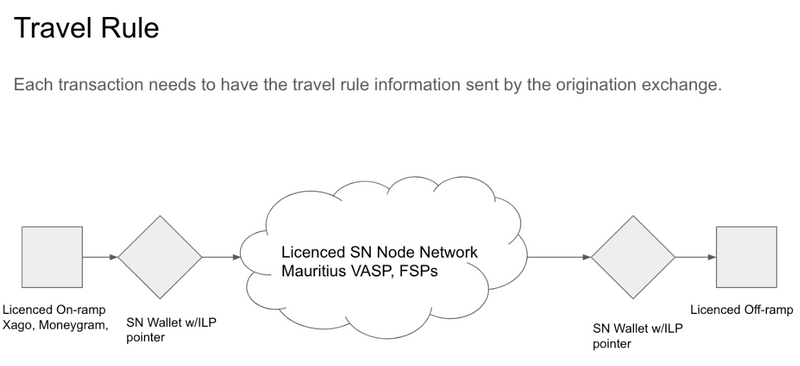

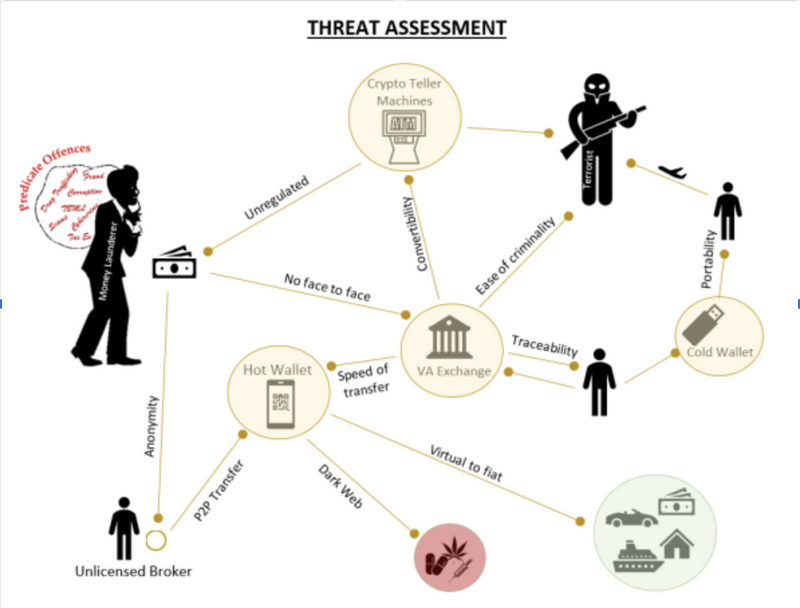

We acknowledge that the FATF traveler rule poses the biggest challenge for decentralized payment networks, and will take steps to mitigate its impact on our infrastructure. The FATF Recommendations set out a comprehensive and consistent framework of measures which countries should implement in order to combat money laundering and terrorist financing. Our compliance strategy is structured to fulfil much of the requirement and guidance at the governance, partnership, and software level.

In summary these are the following action points we have identified to move towards complete regulatory compliance:

- Firstly creating a Snake Nation node network that will be covered by our licenses, thereby reducing the impact of the traveler rule.

- Secondly, exclusively peering with partners and licensed nodes to ensure compliance with regulatory requirements.

- Lastly, designing and implementing a Compliance Server.

Licensing

We have identified the Mauritian Virtual Asset Service Provider (VASP) license to provide a comprehensive legislative framework to regulate and supervise the business activities of different classes of VASPs (such as a marketplace or exchange,

wallets, etc.) and Issuers of Initial Token Offerings (ITOs), in accordance with the

international standards to mitigate and prevent identified ML/TF risks. The VASP provides the license to do the following:

- Exchange between virtual assets and fiat currencies;

- Exchange between one or more forms of virtual assets;

- Transfer of virtual assets;

- Safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets; and

- Participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.

Partnering

Partnering with local payments partners has an important enabling pieces of for local settlement such as Ghana’s branchless banking guidelines (2008), the Electronic Money Issuers Guidelines (EMIG), and AML-CFT Act (2020), which has introduced the concept of digital customer due diligence (CDD). While in the USA, we may require a Money Transfer License for each State, and in South Africa, we have Identified settlement partners with Financial Services Providers (FSPs) License. A key takeaway is that it is essential we partner with off-ramp partners who can provide Know Your Customer (KYC) and AML as last mile licenses and compliance. A consistent cause of concern with off-ramp partners is the risk of pairing with an unlicensed node. For this, we need to establish standardized node-to-off ramp compliance messaging requirements. We are in discussions with potential partners, including money license holders and mobile money providers such as Afrexim, Xago, Varo, African Development Bank and Africa's Talking, to explore opportunities for collaboration and obtaining the necessary licenses.

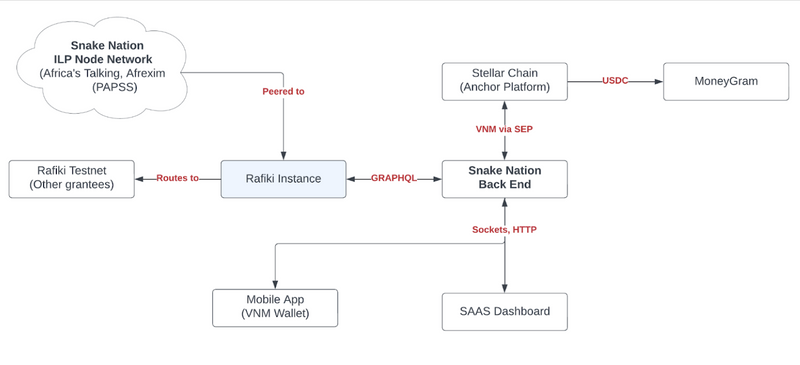

Compliance Server

We are designing a compliance server starting with Stellar Sep:0031 Cross-Border Payments API. This API defines a protocol for enabling payments between two financial accounts that exist outside the Stellar network. It provides checks for on/off ramp entities who have the necessary licenses in their respective jurisdictions.

Governance

Our current governance planning includes Incorporation in Mauritius, with a Global Business License. The company will hold a FSC Virtual Asset Service Provider License allowing for multiple classes of operations (Class O, R,S and ITO)

- Virtual Asset Wallet Services (Class O) - An entity that provides a VA wallet for holding, storing and transferring crypto currency or other VAs. A wallet provider facilitates participation in a VA system by allowing users, exchangers, and merchants to conduct virtual asset transactions more easily. The wallet provider maintains the customer’s virtual asset balance and generally also provides storage and transaction security.

- Virtual Asset Custodian (Class R) - An entity engaged in the Safekeeping of virtual assets or instruments enabling control over virtual assets Administration of virtual assets or instruments enabling control over virtual assets.

- Virtual Asset Marketplace (Class S) - An entity engaged in the business of VA exchange for fiat currency, funds, or other forms of virtual asset for a commission. The exchangers accept a wide range of payments, such as cash, wire transfers, credit cards, and other virtual assets. Individuals typically use exchangers to deposit and withdraw money from virtual asset accounts.

- Issuers of Initial Token Offering - Involve issuing and selling VAs to the public and may also involve participating in and providing financial services relating to the ICO. Further provide for services such as Security Token Offerings (STOs) offering equity in the form of tokens.

The benefit of having multiple classes is to cover the likelihood of changes to terminology and offering classifications. Through our partnership at the Mauritius Fintech Hub, we will provide a local headquarters and address for incorporation. Additionally, regulation requires at least one Mauritian Director. Additionally, a Fintech Service Provider shall, at all times, have a minimum unimpaired stated capital of MUR 600,000/USD 13,355 or its equivalent in any other currency, or such other amount as the Commission may determine.

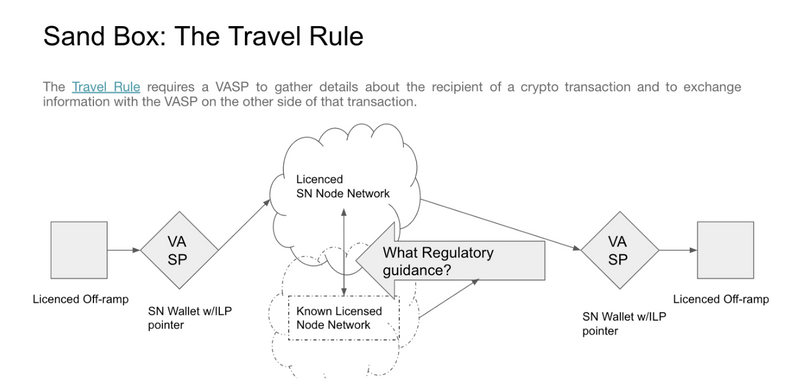

Sand Box

Sarah Ferreira, Chipper Cash

“Being close to regulators as much as possible e.g. through workshops and meetings is crucial.”

During our research we came across an interesting question that the Inteledger Foundation may want to explore. The question revolves around the regulatory framework for node infrastructures, where tangential and generational transactions may connect with a non-licenced nodes. As we move towards a decentralized network, we must ensure that unlicensed nodes do not take down the entire system. This is a risk that has to be mitigated by peering with known, licensed nodes only.

Potential Sandbox Participation

| Minimum Viable Integrations and Projects | Time Horizon | Complexity (1 Low - 5 High) | Resource | Notes |

|---|---|---|---|---|

| SA SandBox | Preparation 2-3 months / decision 6-8 months | 2 | https://www.ifwg.co.za/Pages/Regulatory-Sandbox.aspx | Not required addressing via partnership |

| Afrexim/PAPSS SandBox | Preparation 2-3 months / decision 3-6 months | 3 | https://papss.com/get-connected/#for-papss-participants | Indirect Partnership: Requires |

| Mauritius Sandbox license | Preparation 2 -3months / decision 2-3 months | 4 | https://www.mondaq.com/fin-tech/1224416/virtual-asset-and-initial-token-offering-services--new-regulatory-regime | Not Required for VASP License |

| African Development Bank | Preparation 2 -3months / decision 2-3 months | 3 | https://www.afdb.org/en/documents/understanding-importance-regulatory-sandbox-environments-and-encouraging-their-adoption | New to sandboxes with individual startups. Bullish on the creative economy and collaboration. |

| EmTech | Preparation 2 -3months / decision 2-3 months | 2 | https://emtech.com/for-fsp/ | Offer API that enables us to do regulatory compliance checks → part of our licensing protocols |

Updated technical requirements

Changes to initial requirements

Our initial approach to rolling out an ILP network across the continent was heavily dependent on community participation. We intended to launch nodes on university campuses, following the Africa 4.0 stops. Our approach involved running instances of Rafiki on-premise for each campus, with smaller form factor hardware that could be used in more remote locations. This has changed for the following reasons:

- Updated Licensing Requirement for Rafiki - we have had to revisit our node network strategy for on-campus nodes. Given the need for only licensed entities being able to run a Rafiki node, the University model will have to run through the SN Rafiki Node. Gaining greater insight into the needed rules for implementation will be part of our sandbox efforts with local regulatory bodies.

- Security Concerns around on-premise nodes - On top of KYC/AML screening, our platform is also architected on a PCI DSS V4 and ISO27001:2022 compliant framework. It was our intention to bring a level of this security to all the nodes participating in our network, and have decided to focus on cloud computing based in data centers, to mitigate any risk for on premise nodes. We will hold off on edge or on premise nodes until we have fully implemented our current plan. We will also take the time to learn more and understand security risks on the Rafiki testnet.

Proposed Prototype

As a Tier 1 ILSP, we will be providing ILP access to organizations and users interested in real time currency agnostic global payments. An Interleger gateway, servicing from creatives who simply need payment pointers to routing services for licensed account servicing entities running Rafiki. We identified the following requirements:

SN ILP Network

After remodeling our hardware strategy, we removed the on-premise requirement for network nodes and focused on cloud hosting through our strategic partnership with Liquid Intelligent Technologies across the continent. Liquid Intelligent Technologies is one of the biggest connectivity providers on the continent. Keeping the ILP nodes on the cloud will help mitigate any security concerns described above. We will use the prototyping period to help identified FSPs integrate their systems with the assigned nodes.

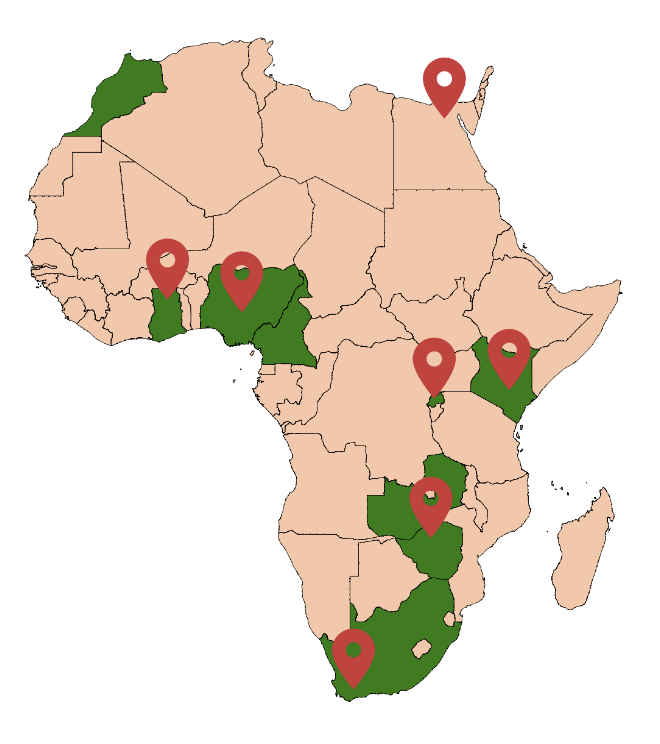

Highlighted on the map in green are the Africa 4.0 tour stops, the red pins in contrast show identified Data centers on the continent with PCI DSS and ISO27001 certifications. We will launch Rafiki instances, peered with our Rafiki, which will be the basis with which our partners (e.g. banks, central banks, wallet operators) integrate from. Each partner identified will be assigned a node.

Local nodes. This will help further local engagement and participation in ILP by end users and FSPs alike.

Ultimately we will be providing routing services for our network nodes on to the Rafiki testnet, with other partners and grantees. This will allow us to experiment with cross border payments and remittance capabilities, as well as understanding more what it takes to be Tier 1 ILSP.

Integration with partner FSPs

For our ILP node network, our approach will involve assisting our partners launch their own Rafiki instance, as well as integrating Rafiki’s APIs for managing settlement. We will peer their instance with ours, with the intention of testing ILP capabilities between their users and ours. For example, in our sandbox efforts for PAPSS; successful integration opens up ILP to millions of account holders across Africa.

ILP Capable Digital wallet

Our integration with Rafiki enables us to issue payment pointers to all users. Our immediate use case will be Web Monetization, with 1000 users from our Beta user base. As part of the use case, users will be able to copy their payment pointer from their wallet to utilize web monetized experiences on the testnet.

Users will also be able to make payments from their wallet to users outside of Snake Nation using their payment pointer. The same is true for incoming ILP payments which they can receive as VNM, should they be coming from participant nodes on the Rafiki testnet or from our partner Node network and sandbox initiatives.

Project Impact & Target Audience(s)

Project Impact

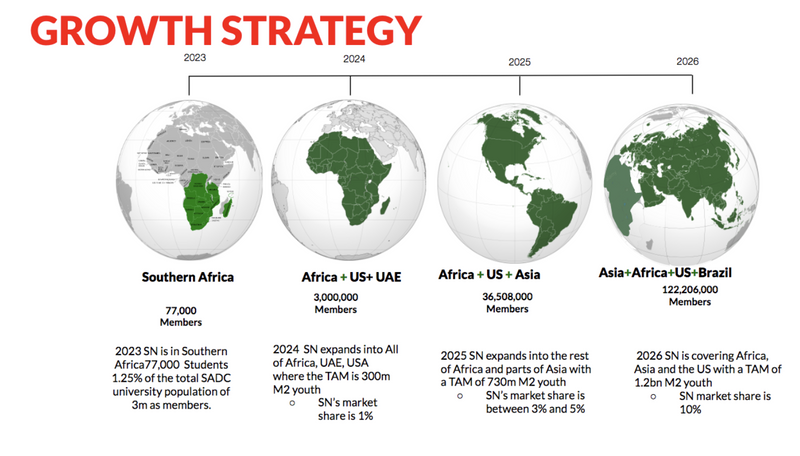

Snake Nation focuses on engaging communities of multicultural millennials (M2). The M2 generation is the largest and most diverse generation to date and consti- tutes over a $3.4 trillion economic community globally. In their quest for financial freedom and creative independence, this generation selectively creates, watches, and distributes creative content in their own time on a global scale.

The M2 generation has been instrumental in the global acceptance of change in media consumption, which has evolved from traditional means (television, radio, static website) to on-demand, online and mobile dynamic platforms. This subsequently supports global creative communities. It is thus imperative to enable more M2 creators to converge in the pursuit of sustainable careers, by solving the lack of efficient value creation in creative content. The new equitable creative economy will be defined by the direct connection between creators, their audience, and value creation opportunities within the platform.

Target Audience

Snake Nation will be an Interledger tier 1 one service provider as well as providing the ILP enabled VNM wallet. Which means we will be able to serve different target audiences:

B2B (Banks, Central Banks)

Our B2B focus is on serving financial institutions, such as banks, financial service providers, as well as businesses that require the ability to send and receive payments across various payment networks and ledgers at volume. Examples of our partners in this space include banks and tier-1 payment companies.

Obinna Ejimofo, Afrexim Bank

“There’s a desire to sort out low value payments, to make them instant. This solves for: bringing SMEs into the formal economy and bringing the informal into the formal economy.”

B2B2C (Wallet Operators)

Our B2B2C focus caters to wallet operators and payment processors, including remittance as well as on-/off-ramp services. Some examples of our potential partners in this space include Xago, World remit and Universities. For this audience we offer managed cloud ILP instances through Infrastructure-as-a-Service (IAAS), which allows for easy integration with existing payment systems. We also provide an ILP Wallet Operator Platform accessible through a Software as a Service (SAAS) dashboard, to help wallet operators manage their operations and provide services to their users.

B2C (Snake Nation users)

Our B2C focus is on serving Snake Nation users who are interested in using our platform to earn from their creations via web monetization, send and receive payments and utilize their VNM value in their ILP enabled VNM wallet. This is our strategic approach in reaching a base of users who are interested in peer to peer payments. Given the amount of remittances happening between key corridors (In 2022, remittances to Sub-Saharan Africa grew to $53 billion in 2022. World Bank, 2022) and the cost associated with existing payment methods, we expect that the ILP utility will be well received by our community of African and diaspora youth. We will utilize our existing community within African colleges and creative communities as a starting point for our growth.

However, we also cater to third-party developers and businesses that are seeking an API to build their own payment applications and services. This includes brands, developers and influencers/super users of the VNM wallet. For this audience, we offer an ILP account that is accessible through a Software-as-a-Service (SAAS) dashboard. In addition, we provide API integrations that can be billed separately to allow for easy integration with other platforms and applications.

API integrations for developers, which will enable developers to access the ILP ecosystem via VNM Wallet APIs and SDKs. This service will help attract more developers to the ILP ecosystem and increase adoption.

Potential Business Models based on the Interledger:

| Type | Description |

|---|---|

| Transaction Fees: | Transaction fee for each payment made through the SN Interledger service Network. This fee is based on a percentage of the transaction amount or a fixed fee per transaction. Fee= .002%+ 0.00002 TBD |

| SAAS Subscription Fees: | Subscription tiers for clients based on their usage requirements. The subscription fees are based on the number of transactions or the volume of payments processed per month. Competitive Analysis needed. Bulk payments, Bulk collections, Portfolio & Analytics Reporting, |

| API Access Fees: | API access for Third-party developers and businesses to its Snake Nation Interledger API. • Micro-payment: pricing model based on Web Monetization billing |

Communications and Marketing

Meetups and Events

Advertising Week Africa 2023 - Snake Nation was present at Advertising Week Africa and took part in the Building the Future discussion as well as the society hack (Video).

Smart Africa Transform Africa summit - Snake Nation recently attended the Smart Africa Transform Africa summit and engaged in discussions with various ecosystem stakeholders. The summit focused on leveraging technology to transform Africa and featured high-level speakers from across the globe.

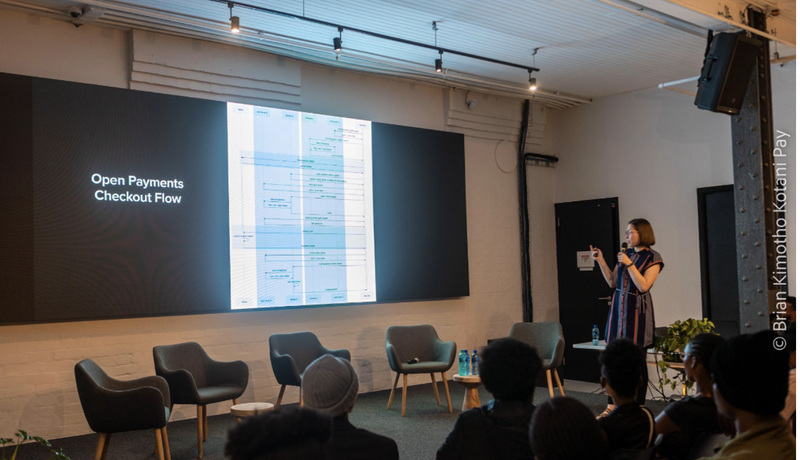

ILP developer meet-up - The Interledger Foundation hosted a developer meetup and Rafiki v1 Alpha launch on March 23, 2023, in Cape Town in collaboration with Snake Nation. The event included a panel discussion on the Global Creative Economy + African Diaspora Youth, and panelists included the CEO of the Interledger Foundation, Briana Marbury, and Tawanda Brandon, CTO of Snake Nation. The launch of Rafiki v1 Alpha was also presented at the event.

Amplifying HBCUs and Black voices in Development Conference - Snake Nation was recently invited to speak at a conference held at a HBCU in Tennessee, in partnership with the United States Agency for International Development (USAID). During the conference, Snake Nation presented their innovative payment solutions powered by ILP. USAID showed keen interest in utilizing ILP to carry out payments.

Invest Africa Digital Assets Conference - we were invited to speak on the work Snake Nation has been doing in tying the creative industries to tech innovation in order to drive economic transformation. There we were able to talk about the work we are doing with ILP and discuss some of the gaps in current monetization for Web3 platforms. The conference introduced the team to the Global Policy House network, Digital, Finance and regulatory including government financial representatives. We were able to have candid conversations and identify current initiatives to close the gap.

ECOMAFRICA Keynote

Dre Ngare, delivered a keynote with Rashid Toefy, Deputy Director General: Economic Operations, Department of Economic Development and Tourism at ECOM Africa the Future of Commerce. ECOM Africa explores the future of commerce with a community of experts and practitioners in retail and e-commerce, FinTech and payments, cybersecurity, fulfilment and logistics, and the future of marketing.

Africa 4.0 - The Africa 4.0 tour has been promoted in several TV and radio interviews throughout the year. As of now Snake Nation’s efforts to build a Tier 1 Interledger network in Africa and the Interledger-related activities planned for the tour are part of all communications on Africa 4.0 as well.

Youth Connekt Africa Summit 2022 - Snake Nation participated in a panel discussion educating about the creative economy and innovative tools such as Web Monetization and Interledger.

Press

Coverage:

https://www.africa.com/advertising-week-partners-with-snake-nation-and-tbtm/

https://cioafrica.co/cput-snake-nation-secure-british-council-funding/

What’s Next?

- Ready for a prototype: There will still be a need for users to get an Interledger capable wallet to carry out transactions which we will satisfy by providing our own Interledger VNM wallet. The VNM wallet has already been developed and in production as a product of the first ILP grant on Web Monetization. The goal is to be able to give Snake Nation Users or anyone who has a Snake Nation wallet an Interledger payment pointer. For the upcoming grant phase we anticipate having a wallet that can compete with the existing providers.

- Deal finalization with potential partners: Xago, Chipper Cash, Afrexim PAPPS African Development Bank, (see partnerships list for detail)

- Expansion to Mauritius for inclusion in the VASP licensing and FinTech ecosystem

- We will finalize our human resources recruitment strategy and organizational structure.

Community Support

We have a few points that the ILF community can help us with:

- We are looking for members of the community that are licensed financial service providers that we can partner and integrate with

- We would appreciate any help/legal resources available for partnership, commercial, and infrastructure agreements

Additional Comments

List of Interviewed Organizations

Individual Interviews replaced ecosystem panels in our discussions with experts due to scheduling ease:

| Organization | Type |

|---|---|

| EMTech | Regulation |

| ILP Foundation | Technical |

| Silicon Capital | Technical |

| CPUT | Education Partners |

| Machnet | Business Development |

| Xago | Business Development |

| Smart Africa | Business Development |

| Chi Money | Business Development |

| Vaya | Business Development |

| Chipper Cash | Business Development |

| Africa’s Talking | Business Development,Technical |

| Liquid Telecom | Business Development,Technical |

| Varo Bank | Business Development,Technical |

| Ad Dynamo | Business Development,Technical |

| Bob Way | Business Development,Technical |

| XRP Foundation | Business Development,Technical |

| Afrexim Bank | Business Development,Regulation |

| The Global Policy House | Business Development,Regulation |

| Better than cash alliance, UN | Business Development, Regulation |

Relevant Links/Resources

Snake Nation Website: https://snakenation.co/

Financial Services Grantees, Sprint Update: https://docs.google.com/presentation/d/1_aq9zL87Cdy-i5c4Bed01tUJGYCngKSQ/edit?usp=sharing&ouid=112236276776695298518&rtpof=true&sd=true

Financial Services Grantees, Sprint Check-in & Exchange:

https://docs.google.com/presentation/d/1p4xKoCgCpsX0WhT3e_zrNE6r2MAQU1zVVZ8eiITf110/edit?usp=sharing

Snake Nation @ Interledger (ILP) Summit 2022 - Day 1: https://www.youtube.com/watch?v=Whp4RfW3K_U&t=14875s

Snake Nation @ Interledger (ILP) Summit 2022 - Day 2: https://www.youtube.com/watch?v=85OXEc

Reports:

Payment systems in sub-Saharan Africa

OPEN AND INSTANT PAYMENTS IN AFRICA

THE STATE OF INSTANT AND INCLUSIVE PAYMENT SYSTEMS IN AFRICA

UN Principles for Responsible Digital Payments

Improving access to payment systems for cross-border payments: best practices for self-assessments

Top comments (0)