Image/Banner

Brief Project Description

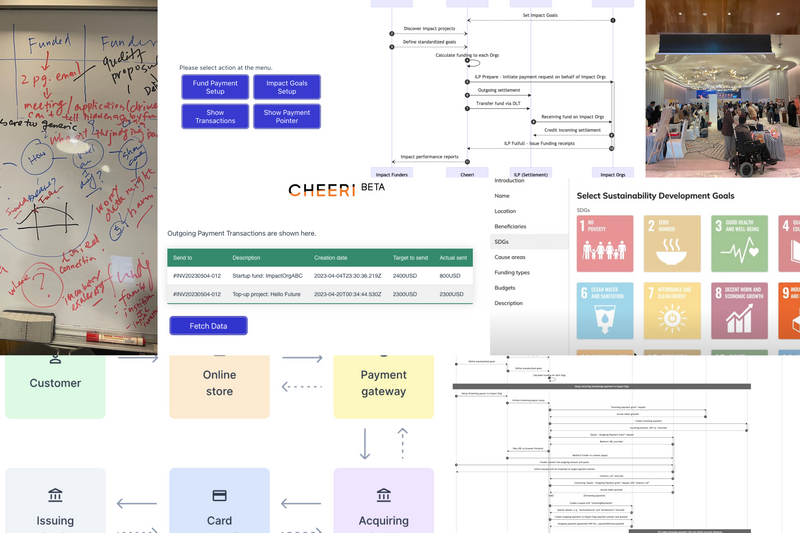

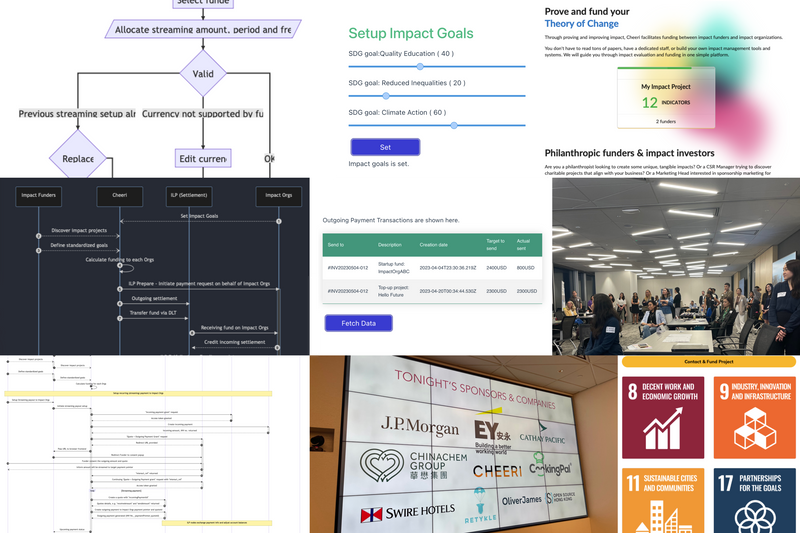

Cheeri is an APAC-focused SaaS platform that facilitates funding between impact funders and impact organizations through proving and improving their impact.

Through making it easy for impact funders and impact organizations to measure impact and manage funding, Cheeri aims to level the playing field as well as enhance collaboration between funders and funded, in support of UN Sustainable Development Goals and positive social change for our customers’ beneficiaries.

See our progress report published in May 2023.

Project Update

In the last 6 months of 2022, we have conducted in-depth user research with 20+ social enterprises, nonprofits and impact funders. Our research shows that the majority of social-purpose organizations want to diversify their funding sources and obtain sustainable funding by attracting funders such as corporations and impact investors. However, they don't have expertise in measuring and conveying their long-term outcomes using standardized indicators that impact funders employ as benchmarks. Cheeri attempts to answer the above needs by providing a SaaS platform that facilitates funding between impact funders and impact organizations through proving and improving their impact.

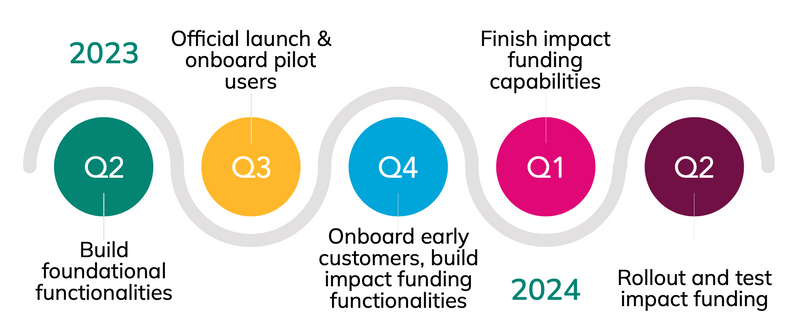

In the first 6 months of 2023, we focused on building foundations of the product as well as validating the business model with potential customers.

Finally, we have been accepted by the Founders’ Institute, Impact and Sustainability chapter, and will continue to grow a strong business using this resource.

In Q3 2023, we are partnering with ReThink Foundation, SiP and ReCube to build an impact measurement and management pilot for their organizations and fundees.

8 more foundations are in line to onboard next. And we are invited to officially launch our solution at ReThink 2023 in mid-September.

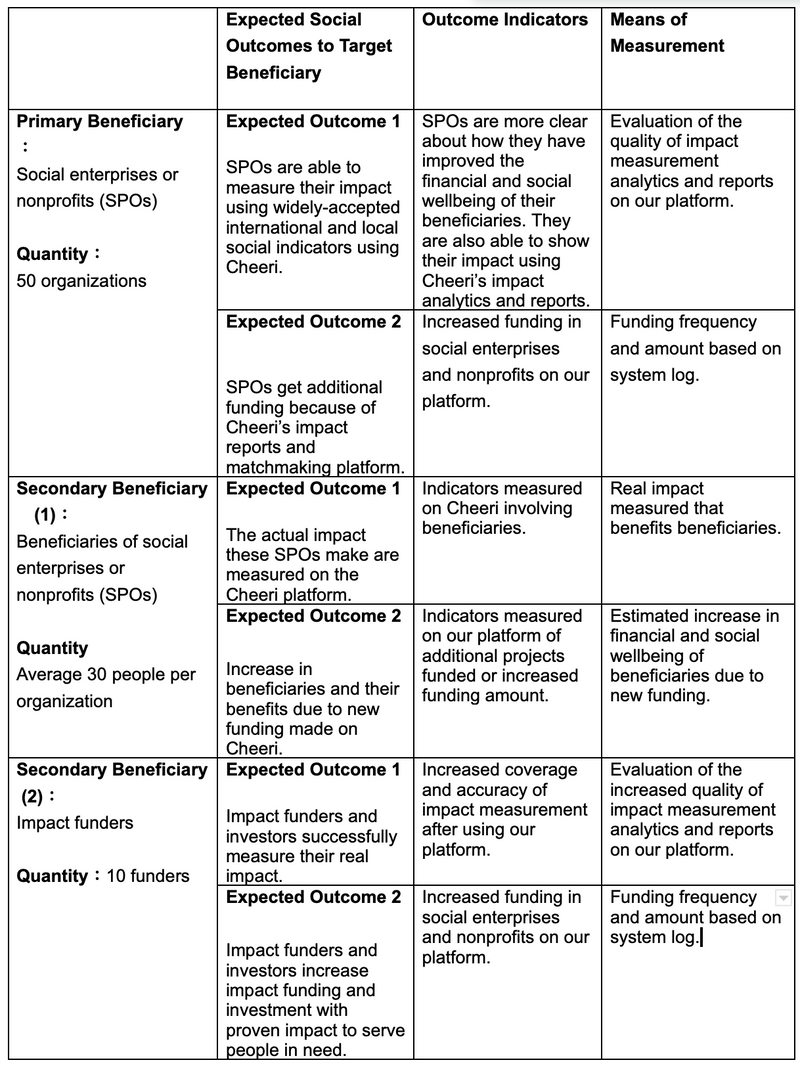

Project Impact & Target Audience(s)

Cheeri helps social enterprises and nonprofits obtain sustainable, continuous funding, and in doing so, we help to contribute to SDG 17: partnerships for the goals.

ILP-powered funding is especially suitable for cross-border philanthropy benefiting purpose-driven organizations that are under- or unbanked.

Below outlines our beneficiaries, expected outcomes as well as means of measurement:

Progress on Objectives, Key Activities

Value proposition - What problem are we going to solve?

Philanthropy sector is undergoing a paradigm shift, from a donor-led system in which “charity sponsors” distribute funds based on the fit of the applicants, to a metric-based system which “impact funders” actively gauge the effectiveness (a.k.a. impact) of the fund being spent.

Cheeri aims to make impact funding feasible and scalable, and the key is to make the funding process programmable and distribute funds through pre-defined impact metrics. A robust payment solution is paramount in order to achieve this goal.

We analyzed that the payment solution to be used by Cheeri should provide the following capabilities:

- Non-custodial: The funding process will be non-custodial, meaning Cheeri will not keep any funds on behalf of any parties in the entire impact funding lifecycle. That allows Cheeri to alleviate many possible cyber security risks, increase trust (as clients doesn’t need to “trust” Cheeri, they own their funds), and allow Cheeri to start to operate in most of the countries in shorter period of time, as it doesn’t need to apply money license beforehand.

- Frictionless onboarding: Low / no learning curve: Users do not need to acquire knowledge about finance, blockchain or cryptocurrencies prior using the service. Instant donation: Impact funders can start funding immediately once the registration process is completed.

- Traditional banking support: The solution should support a wide range of banking accounts which impact funders and impact organizations currently using.

- Asset-agnostic: Impact funders can donate through a wide range of assets / currencies / IOU purchase, and fundees can receive funding in preferred assets / currencies

- Settlement Performance: The process of transaction and conversion is simple, instant and cheap.

- Instant finality: The send and receive fundings are near-instant and are irrevocable.

- Unforgeable, verifiable proof: Impact funders and organisations have options to obtain a verifiable proof of donations, or disclose a receipt of donations.

- Micro-payment: Capabilities to establish advanced payment options like recurring payment and streaming payment.

Analyzing current Trad-fi solutions

Based on the above assessment, we've analyzed existing solutions available in the market, including several banks in Hong Kong offering API services for fin-tech startups. These banks offer API services under the initiative called “Banking Open API Standards” established by The Hong Kong Association of Banks (ref).

We discovered that while all these trad-fi banks claimed to offer APIs for other companies using their services, there are several obstacles needed to overcome before adopting banking APIs as payment solutions for Cheeri.

These include:

- Gated API by third-party SI - Majority of the banks in Hong Kong require fin-tech startups who wish to integrate to their banking system purchase service from dedicated System Integrator (SI). They assign these selected SIs to become the “intermediaries” between banking API and fin-tech. The proxy of API services between Cheeri and the banking system unavoidably increases the cost and complexity to implement the solution.

- Non-standard implementation - Unlike industry practices which use the “SaaS” paradigm to package and price their application interfaces and services, banks in Hong Kong rely on Systems Integrator (SI) to deliver “bespoke design” to connecting fin-tech startups. In this approach, banks outsourced the responsibility to maintain reliable and secure API services, and allow them to reduce the number of systems that will actually connect to their systems, However, this approach will also reduce the composability of the systems, and tends to demote a clear specification to use banking APIs across industry.

- Hurdles to verify Banking API functionalities - Among all banks in Hong Kong we have studied so far, only one bank offers their APIs (through a proprietary system run by their dedicated SI) with a well established “API marketplace”. In that they provide documentation and a sandbox environment available for clients who want to conduct integration tests with their banking systems. However, it still lacks information online about the actual pricing and implementation details, and applying for a testing account requires additional approval after corporate agreements are made.

- Lacking non-custodial solution - Cheeri needs the For-Benefit-Of (FBO) account management service, which allows Cheeri to manage funds on-behalf of their clients without actually owning their funds. None of the banks have explicitly mentioned that they will offer such an account setup in their Banking Open API services.

How Interledger Helps Impact Funding

We also analyzed how the Interledger ecosystem may fulfil the requirements of impact funding. On paper, Cheeri is considered as “Third-party” in ILP specified use case, with the help of other wallet service providers, Cheeri should be able to execute programmable fund management on behalf of the clients in a non-custodial approach.

Detail analysis is summarized as follows:

- banking API vs ILP (spreadsheet)

- banking API vs ILP (slide)

Proof-of-concept and prototyping

To verify the claims of Interledger and to estimate the efforts required to build payment solutions using Interledger protocol and OpenPayment, we developed a prototype to simulate fund transfer and account management around impact funding use cases. In the first round, we test to spin up a local Rafiki deployment to provide wallet service to Cheeri payment engine, and later we use Rafiki.money testnet to simulate the scenario in which Cheeri leverages third-party wallet service providers.

We also tested OpenPayment SDK and finished the core implementations with Rafiki wallet service, and acquired necessary experience to interact with systems using Interledger protocol.

In this practice, we acquired valuable experience to leverage the ILP stack to our use cases. We also assisted the core dev team to fix a couple of deployment issues on Rafiki.

In the context of Interledger protocol, Cheeri falls into the category of “third-party”, who need a solution so that we can transact and manage money programmatically, on the users’ behalf. It is clear that participants in the Interledger ecosystem are all working relentlessly to solve these problems.

Standards, tooling and innovations are improving

ILP foundation and the community is actively developing tools (e.g. Rafiki,money), standards (e.g. OpenPayment) and services (startups developing wallet service provider business in ILP communities) to improve Interledger. With the capabilities brought by the ILP community, we expect Cheeri can offer next-generation impact funding services to our clients in the foreseeable future.

References:

- Phase III Banking Open API Standards by HKAB

- Third party partnerships powered by Standard Chartered Open API

- Standard Chartered existing partnerships

- Contact points of banks for information of their Open APIs

- Github repository of the proof-of-concept prototype using OpenPayment SDK

Communications and Marketing

To gain deeper understanding of our target organizations as well as to promote our service, Cheeri has been publishing an "impact story" series on our Medium blog. So far, we have published 4 articles regarding the impact journeys of a socially inclusive studio catering to People with Disabilities (PwDs), a social enterprise that promotes transformative reading, an eco-education permaculture community and charity, and an intermediary bridging the business sector with social enterprises through better mutual understanding in Hong Kong. Our first posts were picked up and reposted by HKGoodPost.

What’s Next?

After validating our product idea, 2 foundations and 1 social enterprise will join our pilot release as our first users as well as testers. 8 more foundations are in line to be onboarded next. And we are invited to officially launch our solution at ReThink 2023 in mid-September.

After the launch, we will focus on onboarding early customers and finding product market fit. We also plan to finish impact funding capabilities using Interledger by Q1 2024 and roll out for testing in Q2 2024.

Technology plan

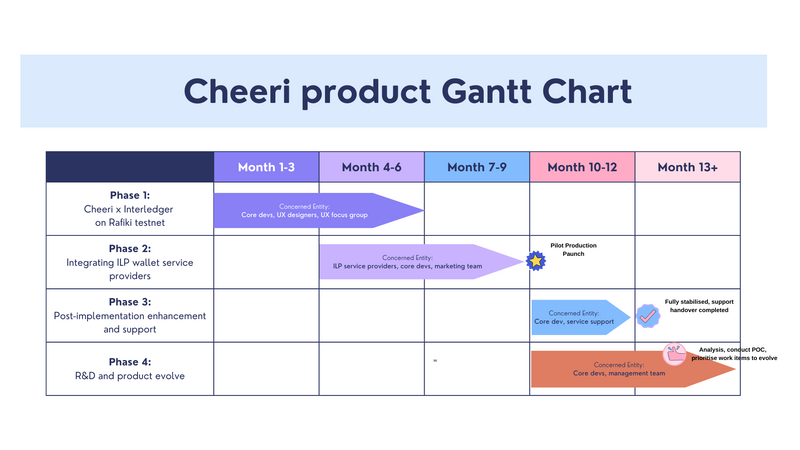

We have devised a 9-month implementation plan to rollout the Cheeri web and iOS app and 3 months of post-implementation enhancement period.

And during the post-implementation period, there will be 3 months of “R&D and realisation POC Phase”, seeking to further explore and evolve Cheeri over Interledger integration.

Production implementation plan (9 months)

Phase 1: Cheeri x Interledger on Rafiki testnet

We will build a pilot version of Cheeri that utilises Interledger protocol as the payment solution. The pilot will integrate with Rafiki.money running on testnet and to carry out user onboarding and impact funding user flow.

In the later stage, we will invite institutional impact funders and impact organizations to participate in the pilot run, gathering opinions to streamline the UX.

Key Milestone: Pre-production pilot ready to be rested with select pilot users

Phase 2: Integrating with Interledger wallet service providers

As a “third-party” wallet service user in the Interledger paradigm, selecting a right wallet service is paramount for the success of Cheeri. Given that multiple startups in the Interledger community are actively building wallet service in different regions, we will take the initiative to participate in their product design by sharing our understanding of real-world use cases in the subject of impact funding and non-custodial charity fund management.

Key Milestone: Cheeri x Interledger wallet service pilot production launch

Phase 3: Post-implementation enhancement and support (3 months)

In this period, the core dev team will conduct 12 one-week iterations to conduct code refactoring, refine cloud formation, CI workflow, clear up technical debts, develop necessary monitoring alerts and supporting tools, to prepare to handover the production support to second tier, outsourced customer support personnels. During the period, we will also prepare to undergo 2-3 rounds of stress tests and failover tests, to ensure the system is in production quality and supporting personnels have the necessary knowledge and SOPs (Standard Operating Procedures) to assist customers during the distress period.

Key Milestone: Cheeri apps are fully stabilised and ready to scale and support 100x more users.

Phase 4: R&D and evolving Phase (3 months)

This phase overlaps with the previous Post-implementation phase, and the objective is by analysing the data and feedback gathered during and after pilot launch, we explore new ideas and verify whether these ideas can help Cheeri evolve and meet the market needs.

Candidates of R&D phases as of today includes:

- “Cheeri charity wallet” for individuals

- Incorporating Web3-style web/iOS app and expanding Cheeri from focusing on institutional-user to individuals.

- Micro-payment for “individual impact funders'' using Cheeri SDG metrics

- Once Cheeri allows users to set up recurring donations for a small amount with ultra-low fee, we can promote the “philanthropic lifestyle” to the general public.

- SGD metrics for individuals

- Cheeri can allow individuals to submit “charity projects” under SDG metrics and get funded. This feature may help to boost adoption in 3rd-world countries as more people can launch funding project to seek for fund matching

Key milestone: to identify and prioritise worklogs for the following 12 months.

Community Support

Cheeri is eager to collaborate with community members who are working on ILP wallet service and integration to local banks. We are happy to exchange ideas, design the UX workflow and conduct integration tests with our communities about the use cases of global settlement, non-custodial funding management and streaming payment.

Also, if you are a social enterprise, nonprofit, philanthropist, impact investor or CSR manager looking to define, measure, analyse and manage impact, join us today!

- Sign up to our newsletter

- Follow us on LinkedIn or Twitter

Top comments (0)