Final Project Update

Progress on Objectives, Key Activities

My project explored how Interledger Protocol (ILP) can be used by Rotating Savings and Credit Associations (ROSCAs), especially those that operate across borders.

During my ambassadorship, I created educational materials on financial literacy for ROSCA users, documented case studies based on conversations with ROSCA users (based in Canada), and created social media graphics for digital financial inclusion awareness to celebrate Financial Literacy Awareness month in Canada.

Many of the people I connected with were intrigued with the idea of making cross-border remittance easier. Although intrigued, the issue of security and privacy remained constant. Common questions heard included: Is it safe? Who will have access to my financial information?

For ROSCA users, many are understandably cautious about sharing details given the unregulated nature of these savings groups in Canada. Although, people were willing to talk to me about how their ROSCA operates, many asked that their identities remain private, which shaped how I approached the case studies.

Original Objectives

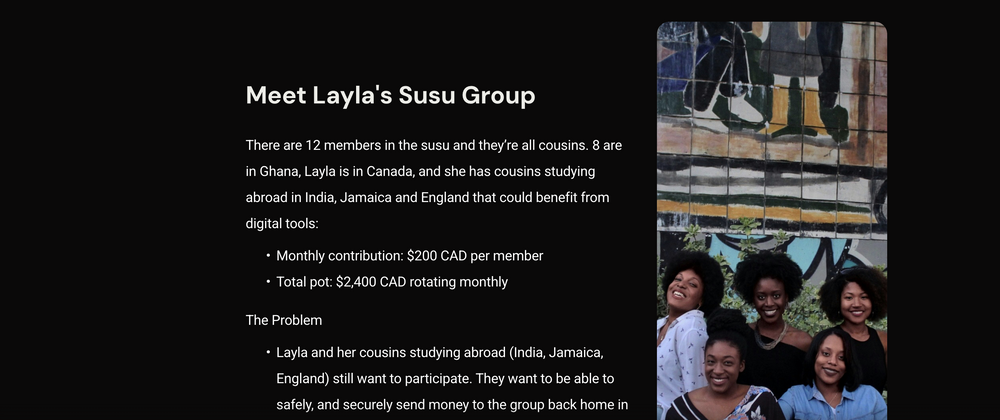

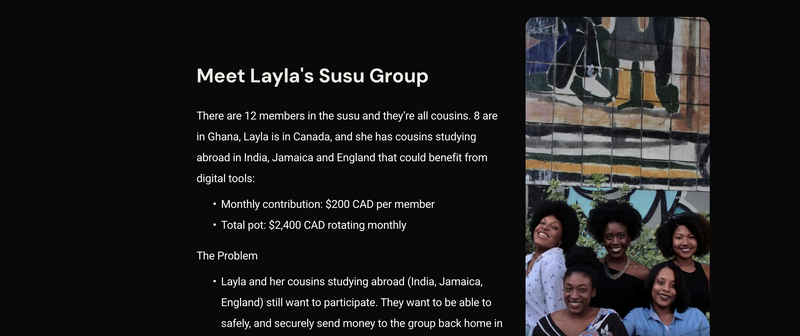

- Document Real ROSCA Use Cases I completed five case studies featuring actual ROSCA scenarios. The case studies included ROSCA users from all walks of life and professions including a Canadian politician, Personal Support workers (PSWs), entrepreneurs and stay at home parents.

What interests them about ILP is that it’s a solution to high remittance fees, losing money on currency conversion, payment delays and having the ability to participate with people from “back home”.

- Create Educational Materials for ROSCA Communities I completed financial literacy modules for ROSCA users. I used a Learning Management System (LMS) with practical examples specific to ROSCA users.

Modules included:

INTRO - Rotating Saving & Credit Associations Lessons on Digital Financial Literacy

MODULE 1 - Digital Financial Basics for ROSCAS

MODULE 2 - Understanding Cross-Border Payments

MODULE 3 - Introduction to Interledger Foundation

MODULE 4 - Re-imagining the future of ROSCAs

November represents Financial Literacy Awareness Month in Canada. I created an assortment of social media graphics to educate and inspire.

What impact does the project have on your perception of digital financial inclusion?

Privacy Concerns:

Because ROSCAs operate in a grey area in Canada (unregulated, with some cases of money being confiscated under the Civil Remedies Act), people are cautious. I learned that digital financial inclusion isn't just about access to technology, it’s also about creating systems that protect vulnerable users.

Challenges:

Trust vs. Technology: ROSCA participants need infrastructure that doesn't disrupt the trust and community accountability that makes ROSCAs successful. Any digital solution has to work with ROSCA culture, not replace it.

Currency Complexity:

One of my case studies was on the “Spinster Susu”. A group of 50 women living in different cities around the world. This case study made it clear how complicated cross-border ROSCAs actually are. When you have 50 women contributing in multiple different currencies (CAD, USD, JMD, BBD, TTD, EUR), the current banking system just doesn't work. Traditional remittance services charge too much, take too long, and are make having members in different parts of the works difficult.

Key Insights:

ROSCAs can range from something simple (3 people pooling their funds weekly) to complex, multi-person savings operations across countries without formal infrastructure. They don't need basic financial literacy as much as they need tools that match what they're already doing.

ROSCAs work because of community accountability and cultural understanding. Any platform using ILP needs to preserve these elements while solving the practical problems: high fees, slow transfers, currency conversion losses, and coordination difficulties.

Impact on Future Work:

Going forward, I'm focused on:

Connecting existing ROSCA developers with ILP technical resources so they can build solutions that serve their communities

Educating ROSCAs on what the future of digital financial inclusion can look like

Project Impact & Target Audience(s)

Project Impact & Target Audience

The case studies I wrote centered on women-led or women-majority ROSCAs, reflecting the fact that women are the primary participants in informal savings groups across cultures. The case studies featured Caribbean, Nigerian, Somalian, Kenyan, Trinidadian, Guyanese, Sierra Leonean, and Persian heritage communities.

ROSCAs tend to have strong ties to immigrant and diaspora communities. This makes sense as ROSCAs are predominantly used by women outside of North America.

Given the privacy concerns of ROSCA participants and the unregulated status of these groups in Canada, the project prioritized relationship-building and trust over public promotion. All case study participants requested anonymity, which was honored.

What’s Next?

- I plan to facilitate introductions between ROSCA app developers and Interledger Foundation.

- I also plan on offering the financial literacy workshops to ROSCA groups in Canada.

I also would like to address the regulatory grey area that makes ROSCA participants cautious about using traditional banking and advocate for recognition of these informal savings groups

Community Support

How You Can Help:

There are two asks:

Welcome ROSCA users and our informal form of savings

Contact me if you're working with ROSCAs in other parts of the world. I’d love to help.

Trust and Technology:

The most important thing I learned during this project is that technology alone doesn't create financial inclusion. ROSCAs are build on community trust and cultural understanding. ROSCAs work because people trust each other sometime more than they trust institutions.

Additional Comments

The fact that ROSCA participants requested anonymity for this project says something important about who financial systems currently serve and who they exclude. People shouldn't have to hide how they save money.

ROSCAs are described as "informal" or "unbanked" activity. This communal way of saving money has helped families buy homes, start businesses and support their families, all without paying additional interest.

What’s exciting about creating ROSCA apps using ILP is that there’s the

Working on this project was a highlight on 2025. I really enjoyed attending the Summit in Mexico and connecting with likeminded people working towards digital financial inclusion.

Thank you to the Interledger Foundation for supporting this work. Thank you to every ROSCA participant who shared their stories, especially those who had to trust me with information they don't usually share publicly.

Top comments (0)