## Project Update

I've officially launched the interactive article for my ambassadorship project for By Design!How Design Harms and Confuses Consumers in Digital, Finance Products I would love any feedback from community members. It's an in-depth report on how harmful design patterns can already acerbate a stressful area of a user's life. To quote from my article:

"Finance is one of a user’s most intimate, important, and often, confusing areas of their lives

This brings us to the question “why focus on finance and financial service platforms and harmful design patterns?” The answer is, how could we not? Finance is one of a user’s most intimate, important, and often, confusing areas of their lives, and that’s even before we get to the software and companies they are. Drawing on what could be described academically as ‘anecdotal data’ but these are real observations and conversations from our friends, communities and colleagues, which is finance is so difficult to understand, and most people we spoke to felt like they didn’t have enough guidance, advice or knowledge in navigating their own finances and financial futures. Finance can feel difficult to understand as there are so many moving components to it, like what are the best banks to bank with to save money, how is the best way to save money, what pension plans are open to me, how can freelancers and artists best save money, what are the best ways to send money internationally with low cost fees, what are normal fees for banking generally, when should I start investing in stocks, how much money do I need to invest in stocks, what should I invest in, is crypto a good way to make and save money, what’s the best app for budgeting when I’m underpaid and clients are delayed in fulfilling invoices, and the list goes on and on. Financial service platforms, including traditional banking, are wrapped up in this ecosystem of worries, concerns, questions, and advice our communities are seeking in regards to finance generally. Similar to navigating any tax, medical, or other bureaucratic systems, the design of any financial service platform is a part of this complex, emotional and very thorny part of a real user’s life, which is their money, and their financial habits...Any design on top of these domains is already going to be complex for users to understand, even with the best design and the most user friendly company." That being said, I did surface a variety of unintentional pain points (so design that is NOT harmful design), and then harmful design patterns, which are especially prevalent in predatory apps. I don't want to give away too much here so please, please read my interactive article to learn more!

## Progress on Objectives, Key Activities

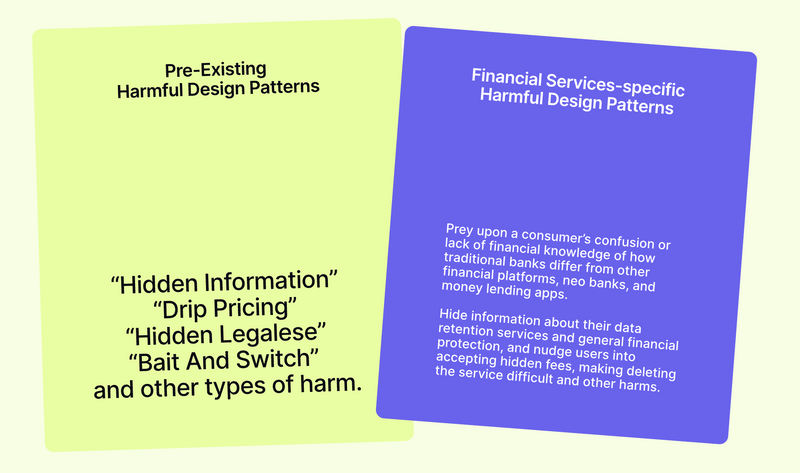

My objectives were to uncover pain points, and then specific harmful design patterns, within the domain of finance, which is an understudied area in the general landscape of harmful design patterns (harmful design patterns are often called 'dark patterns' or 'deceptive design patterns). You can read more about harmful design patterns in previous blog posts of mine from here, here and here. I'm happy to say that I've delivered on these objectives! This work has surfaced types of harmful design patterns, pain points that can be harmful design or turn into harmful design, and general pain points across the financial technology ecosystem. Relatedly, in workshops at the Interledger Foundation Summit, we brainstormed with community members different types of interventions for these pain points that I hope to, in future projects, explore more!

Within the project, I outlined some specific requirements for myself: to conduct an extensive literature; interview policymakers, regulators (current and former), financial experts, designers and technologists; conduct financial experiments if possible such as sending and receiving money from different accounts and apps; and interview and observe four different participants from a specific user group, which are immigrants in the UK. I'm happy to report that I completed all of these tasks! All of this desk research and qualitative research work enhanced the project, grounding it in a multi-pronged reality of academic, policy and design focused research that center real people, our users.

I anticipated some objectives 'evolving', or rather, coalescing over time in response to the research I was conducting, which I explore further in the next section. My objectives where to interview and observe four users, better understand barriers to financial literacy and financial equity, and create foundational knowledge about financial design norms, and financial design patterns to then understand where do harmful design patterns occur, and how do those patterns function? For example, friction can acerbate a harmful design patterns in a domain like shopping; but friction is a necessary safety mechanism in finance. Thus, using 'friction' as a cue to then find a harmful design pattern would not be helpful in the financial sector, even if that can be a helpful clue in surfacing harmful design patterns in other domains like e-commerce, social networks, privacy related apps, etc.

Additionally, finance walks a particularly regulatory space, including language usage, descriptions, ways to send money, etc. These norms have to also be identified and understood, and some of our qualitative research highlighted how these norms are visually designed can confuse users, even if it's not a harmful design pattern- that confusion is a pain point.

Lastly, I wanted to surface the needs, wants and desires of our qualitative users-- what is their financial reality really like? How does technology play into that, and what are the barriers and constraints they face generally? Our article really dives into the emotional reality of the users, so I suggest reading the article to really understand those nuances!

## What impact does the project have on your perception of digital financial inclusion?

I anticipated some objectives 'evolving', or rather, coalescing over time in response to the research I was conducting, which I mentioned in the previous paragraph and I will explain further here. For example, I anticipated that certain design constraints, like friction, would become major themes in the work, even if at the beginning of the project, I didn't know what those themes would be. What I mean is, very often in a project like this, especially related to harmful design, other types of design norms and design pain points become a part of that harmful design conversation and analysis. This is because harmful design patterns subvert pre-existing design patterns, and it can turn a 'neutral' or good pattern into one that harms users. In this case, friction is a big part of financial apps, and its a helpful pattern to protect consumers. Sometimes that friction can confuse users; that doesn't mean friction is a harmful design pattern, but its a part of creating a pain point for users. That pain point needs to be identified, acknowledged, and improved upon in order to increase digital financial literacy and digital financial equity. Pain points can be improved while also combatting harmful design patterns at the same time. Understanding how pain points interact with harmful design patterns is key, because all of the design 'types' or patterns in an app, and in the ecosystem of finance, does impact users because it's a part of their collective experience.

I will say I went in expecting finance to be a very emotional space and that is very much reflected in the qualitative research, so this research really reinforced my own reflections and perceptions of digital financial literacy. This work has only caused me to care more about digital financial equity, and digital financial literacy, and my belief that digital financial inclusion must be a human right. There's so many things to learn and know about finance, and often people are left on their own to figure this out, with very little support. For example, in this work, 'hidden fees' or unexpected fees came up a lot. Hidden fees have real, disastrous impacts on users, but especially the users I interviewed. One interviewee mentions this in my interactive report, but that for her visa to the UK, she needed to transfer what was effectively her life savings (an amount an around 10,000£ and needed to be at 10,000£ for her visa requirements), so any unknown fees could have be catastrophic for this user and her visa. This is a very real world concern, and it was also a very emotional and intense experience for the user, just waiting to see if her lifesavings would come through and come through at the right amount. A person shouldn't have to worry about this; they should have enough visual cues, explanations, and consistency to understand how the app works, and when something happens, why it is happening.

## Project Impact & Target Audience(s)

I observed four users who are creatives and freelancer immigrants in the UK and who send money back home to South America, and who were very new to financial literacy. Some lived pay check to pay check but all lived very much within a financial budget, so things like unforeseen fees had major impacts on their daily lives. Some of my users are LGBTQIA+ and are BIPOC. While, this project focused on the immigrant experience for creatives, and those from South America, I think it can speak to a variety of different types of people immigrating. It can be hard, regardless of background, to navigate the bureaucracies of immigrating, especially to a country on a different continent and with a different language. That being said, I think their experience of understanding and navigating all different types of financial apps will resonate with audiences who are also 'new' to understanding finance, or don't have generational knowledge or support to navigate the financial sector as a whole. A lot of my findings I believe will resonate with audiences who still find finance generally an opaque space and process.

## Communications and Marketing

I did a workshop at the Interledger Foundation Summit on my findings, and I am in the process of pitching multiple articles to general press outlets to summarize my findings. I am also looking at different conferences to submit talks and workshops to on this subject.

## What’s Next?

Now that the ambassadorship is over, I am looking for new funding opportunities and collaborations to continue this work, especially to explore actionable ways to mitigate confusion in financial apps, and encourage legibility and safety for users! This will build on key points and next steps mentioned in my interactive article.

## Community Support

If you'd like to collaborate on next steps, please let me know!

Top comments (1)

Really enjoyed reading your final report @carolinesinders!! Thank you so much for your time and efforts as an Interledger Ambassador.