I. Project Summary

Wallet Guru is a mobile-first, usage-based payment platform that enables real-time micropayments using the Interledger Protocol (ILP). The project set out to solve a structural limitation in today’s financial services: traditional models like subscriptions and prepaid plans don’t reflect how people actually use digital services. Wallet Guru allows consumers to pay for what they use—as they use it—across sectors like video streaming, mobile data, and utilities. This approach supports more inclusive, flexible, and transparent financial experiences, especially in regions where traditional banking access is limited.

Instant payments represent one of the most compelling opportunities today—because the need is not only global, it’s innate. Hardwired into human behavior, the pursuit of immediacy has been well documented by great psychologists like Freud, B.F. Skinner, and W. Mischel. Wallet Guru was built to meet that need—instantly and intuitively.

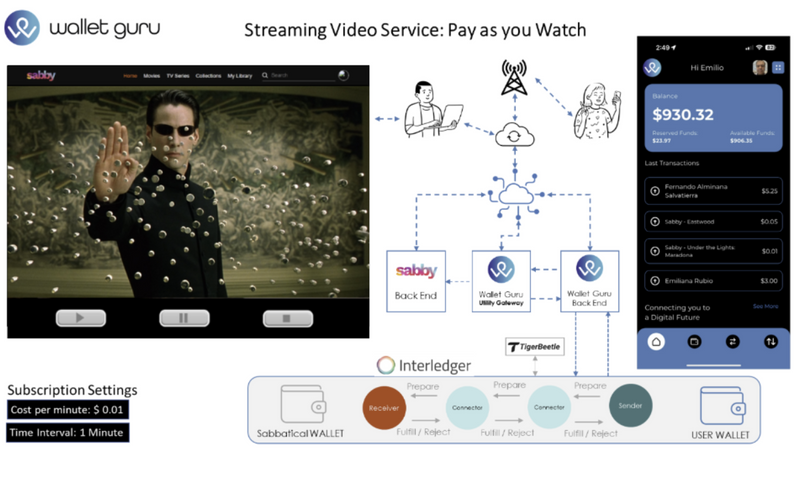

During the prototype phase, we delivered a complete minimum viable product (MVP), including a cross-platform mobile wallet, a web-based administrative dashboard, and a gateway hub for integrating utility and service providers. Our first real-world integration with Sabby, a video streaming platform, allowed users to pay per minute of content consumed—proving that real-time payments can power consumer-centric models that better reflect actual behavior and needs.

A key takeaway from our prototype phase is that integrating with utility companies and legacy service providers remains one of the most significant hurdles to modernizing payments. Many of these institutions still rely on outdated, rigid infrastructure that can’t support real-time, usage-based billing models. To address this challenge, we designed the Wallet Guru Gateway to absorb the complexity—handling tasks like protocol translation, data normalization, and asynchronous processing. This approach enables legacy systems to participate in real-time payment flows without requiring costly overhauls, unlocking broader adoption across sectors.

All core components of Wallet Guru have been published on our GitHub repository, including source code, technical documentation, integration flowcharts, and user experience designs.

As we move forward, we are developing the Paystreme Network—an open, Interledger-powered payment network designed to connect any ILP-enabled wallet with service providers integrated into Wallet Guru through a seamless interoperability gateway. Paystreme will feature a rich metadata layer that enhances every transaction with capabilities like usage tagging, transaction grouping, among others—greatly improving the customer experience. To drive adoption and sustainability, Paystreme will embed a fee-sharing model that fairly rewards every participant in the ecosystem—from wallet operators and utility integrators to consumers—helping to incentivize participation at every level.

II. Project Rationale & Status

In today’s digital economy, consumers are no longer satisfied with rigid payment structures that don’t reflect how they actually use services. Whether it’s streaming content, topping up mobile data, or paying for utilities, people want flexibility, transparency, and immediacy. Yet in many parts of the world—especially across Latin America—financial infrastructure still relies on outdated systems like subscriptions, prepaid cards, or manual top-ups. These models introduce friction for users and inefficiencies for service providers.

Wallet Guru was created to bridge that gap. By integrating the Interledger Protocol (ILP) and Open Payments into a mobile-first platform, Wallet Guru enables real-time, usage-based payments in multiple currencies. Our mission is to build an inclusive financial ecosystem that aligns with how people live and consume today—giving them the ability to pay for what they use, as they use it.

This need is not only driven by user frustration—it is backed by data. A 2022 Deloitte study, based on interviews with 9,000 consumers, found that over half of respondents prefer pay-as-you-go models over subscriptions. The same study noted that consumers often forget about their subscriptions, spending an average of $219 monthly while only being aware of about 40% of that expenditure—highlighting the potential appeal of more transparent, usage-based models. Wallet Guru directly addresses this disconnect by replacing rigid billing cycles with real-time microtransactions that give users full control.

Demand isn’t limited to consumers alone. Our first integration partner, Sabby OTT, conducted its own market research in the content creation space and found strong support for Wallet Guru’s model among producers, distributors, and tech partners. What consistently generated excitement was Sabby’s “pay-as-you-watch” innovation—made possible by Wallet Guru’s real-time microtransaction infrastructure. Industry stakeholders called this model a game-changer for accessibility, especially in emerging markets and among casual viewers who prefer commitment-free engagement.

Our prototype phase focused on proving this concept in the real world. Over the past nine months, we built and deployed a complete MVP: a cross-platform mobile wallet, a web-based admin dashboard, and a gateway hub for service provider integrations. Our first implementation with Sabby OTT demonstrated Wallet Guru’s potential by allowing users to pay per minute of video watched—an experience that felt natural and intuitive to users. We delivered all planned milestones on time and without deviation, and performance testing across QA teams and early adopters validated the system’s scalability, accuracy, and usability. With a working foundation in place, our focus now shifts to enabling companies to adopt more flexible, consumer-centric business models through the Paystreme Network—models that reflect how people actually use and value digital services.

III. Key Activities and Outputs

The Wallet Guru Prototype Phase release was structured around three core components:

- Wallet Guru Customer Application (iOS & Android) – A user-friendly mobile wallet for users to manage their accounts, set up payments, and track transactions.

- Wallet Guru Web Administrative Application – A centralized management platform for administrators to oversee transactions, compliance, and integrations.

- Wallet Guru Gateway – A backend payment infrastructure that enables real-time, usage-based billing for service providers like Sabby OTT.

Each component was developed following rigorous technical and functional specifications to ensure scalability, security, and compliance. Below is an overview of the activities undertaken and the corresponding outputs delivered.

All documentation of the project, including all technical documents and Open-Source code of the project are located at the Wallet Guru GitHub public section:

https://github.com/WalletGuruLLC

Initial Documents referenced in this report are located in the following GitHub Link:

Wg-Docs

This GitHub folder section contains all technical and design documentation related to the Wallet Guru project. The individual documents reference the various components of the Wallet Guru platform and link to additional folders where each component is organized. Detailed information on system prerequisites, along with step-by-step instructions for deploying the Wallet Guru platform as an open-source reference implementation, is available on GitHub.

System Architecture & Technical Design

Objective: Develop a scalable, secure, and efficient payment processing system supporting stream payments via Interledger Protocol (ILP).

Activities Undertaken:

- Designed and deployed a cloud-based infrastructure capable of processing high transaction volumes with low latency.

- Implemented Rafiki, an open-source Interledger node, as the core payment engine to route and settle ILP transactions.

- Integrated Open Payments APIs for account management, payment initiation, and interoperability with third-party ILP-compatible services.

- Developed a multi-tenant backend architecture to support enterprise-level scalability, compliance and secure partitioning of client environments.

- Built a real-time transaction monitoring system for financial auditing and security enforcement.

Outputs Delivered:

- System architecture diagrams outlining ILP flows, Rafiki components, Open Payments integration, and backend service orchestration.

- Technical whitepaper on Wallet Guru’s ILP integration

- Source code repositories (GitHub repo).

- Security and compliance documentation detailing encryption, authentication, and data protection measures.

All documentation is available in the root GitHub repository: WalletGuruLLC/wg-docs. Some documents may contain references to other detailed technical Documentation.

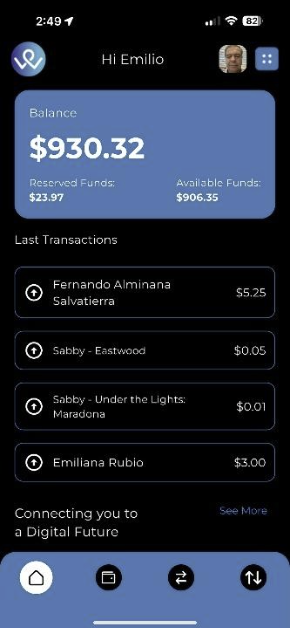

Wallet Guru Customer Application (iOS & Android)

Objective: Provide a user-friendly and secure mobile wallet that enables real-time, usage-based payments and stream payments for digital services.

Activities Undertaken:

- Developed a cross-platform mobile wallet using native development frameworks for optimal performance.

- Implemented user registration and authentication with Sumsub KYC integration, requiring ID verification and biometric face scans. KYC Solution can be replaced with another provider at any time.

- Designed a secure login mechanism with two-factor authentication (2FA) via email.

- Enabled users to:

- Create a Wallet Guru account and generate a unique wallet address.

- Link external service providers (e.g., Sabby OTT) and set stream payment preferences.

- Fund wallets and execute real-time payments using USDC.

- Monitor transaction history and receive alerts for successful and failed payments.

- Implemented responsive UI/UX design principles to ensure seamless app navigation and intuitive user experience.

Outputs Delivered:

- Wallet Guru mobile app beta version (iOS & Android): GitHub - WalletGuruLLC/wg-mobile

- UI/UX design documentation with wireframes and prototypes: Wallet Guru Technical Doc - User Histories.pdf

- User flow diagrams outlining account creation, payment setup, and transactions: Wallet Guru Technical Doc - User Histories.pdf

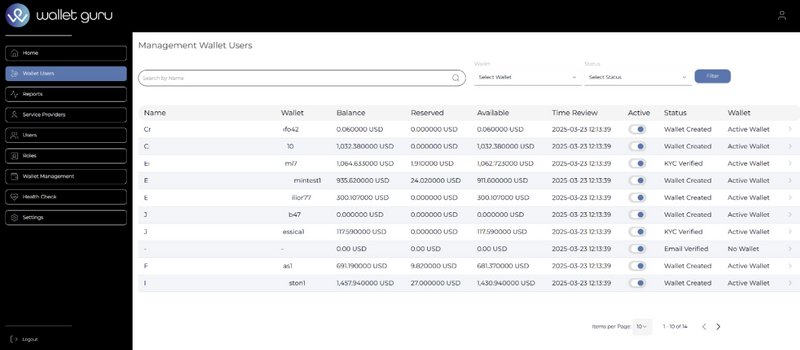

Wallet Guru Web Administrative Application

Objective: Provide platform administrators with a centralized dashboard for managing users, transactions, and compliance operations.

Activities Undertaken:

- Developed a web-based administrative panel with real-time transaction tracking.

- Implemented role-based access controls (RBAC) for different administrative Utility Service for Wallet Guru Staff and utility companies.

- Dedicated Monitoring of transaction of utility services integrated to the platform.

- Built real-time analytics dashboards for financial reporting and performance tracking.

Outputs Delivered:

- Admin platform UI/UX documentation: Wallet Guru Technical Doc - User Histories.pdf

- Wallet Guru Web Admin demo version: Admin Frontend (frontend-admin)

- Compliance reporting and security protocol documentation

- Wallet Guru Gateway (Service Provider Integration: PENDING)

Objective: Enable real-time, usage-based billing for service providers like Sabby OTT.

Activities Undertaken:

- Developed an API-based payment gateway for service providers to:

- Request real-time payments from Wallet Guru users.

- Track payment status and user balance availability.

- Manage billing cycles and adjust rates dynamically.

- Integrated Sabby OTT’s streaming platform with Wallet Guru to allow:

- Per-minute, per-session, or per-view content billing.

- Automated balance deductions from user wallets.

- Real-time access control based on payment validation.

Outputs Delivered:

- Wallet Guru Gateway API documentation

- Sabby OTT payment integration flowchart.

- Demo showcasing live pay-as-you-watch transactions.

Sabby – Wallet Guru system integration flow

Compliance & Security Implementation

Objective: Ensure adherence to regulatory standards and enforce secure financial transactions.

Activities Undertaken:

- Integrated Sumsub KYC verification for identity validation and fraud prevention.

- Implemented token-based authentication and OAuth security mechanisms.

- Enforced secure data encryption protocols (AES-256) for user data protection.

Outputs Delivered:

- KYC verification process guide

- Compliance roadmap for AML, KYB, and transaction monitoring

- Security and encryption framework.

Jurisdiction-Aware VAT Handling for Digital Services

To ensure compliance with international tax regulations, including value-added tax (VAT) for digital goods and services, Wallet Guru includes a modular, jurisdiction-aware taxation system. This allows service providers using the platform—such as content and utility operators—to define and manage tax rates based on customer location and service type.

Key Features:

- VAT Configuration: The Wallet Guru admin console enables service providers to configure tax rates tied to the customer’s billing address and IP geolocation.

- Automatic Tax Application: At the time of transaction, the system automatically applies the appropriate VAT rate when applicable.

- Allocation & Reporting: VAT amounts are allocated during processing and made available through provider-level dashboards and exportable reports for compliance and remittance purposes.

Sabby OTT Example:

In our initial deployment with Sabby, a U.S.-based video streaming service, VAT does not apply under U.S. federal tax law. However, the Wallet Guru platform is fully VAT-ready for global use and will support Sabby’s compliance if the service expands to VAT-enforcing regions.

Testing, Prototyping & User Feedback

Objective: Validate system functionality, performance, and transaction reliability through ongoing controlled testing with QA personnel, Sabbatical team members, and selected users.

Activities Undertaken:

- Conducted daily testing cycles involving Wallet Guru’s internal Quality Assurance team, the Sabbatical Entertainment team, and a limited group of test users.

- Testing focused on:

- Repeated wallet-to-wallet transactions to evaluate processing speed, transaction accuracy, and consistency.

- Content consumption via Sabby OTT, using Wallet Guru to make real-time, pay-as-you-watch microtransactions.

- Monitoring the payment flow, including transaction start, execution, and confirmation.

- Generated daily test reports to verify that all transactions were completed correctly and to proactively identify any anomalies or delays.

- Used test findings to guide minor adjustments in platform performance, including improvements in:

- Transaction reconciliation.

- UI clarity for transaction status.

- Platform responsiveness during concurrent activities.

Outputs Delivered:

- Daily transaction validation reports documenting testing activity and results.

- Feedback logs from QA and test users, identifying minor enhancements.

- Performance insights contributing to the updated Wallet Guru Phase 2 Roadmap.

IV. Project Impact and Target Audiences

Wallet Guru was created to serve individuals historically excluded from formal financial systems—particularly in regions like Latin America, where more than 550 million mobile users rely on prepaid services to access basic connectivity and utilities. These prepaid plans often come at a higher cost per unit than postpaid alternatives, penalizing low-income users who can least afford it. Prepaid services tend to involve additional processing fees, third-party intermediaries, and advance payment structures, all of which introduce inefficiencies that result in higher prices per unit of service.

In contrast, postpaid services typically offer lower rates but are inaccessible to many consumers due to a lack of credit history, documented income, or access to banking infrastructure. This systemic exclusion disproportionately affects underbanked and unbanked populations, locking them out of more affordable, reliable service options.

By enabling real-time, usage-based payments in local currencies, Wallet Guru introduces a flexible alternative that can help utility companies lower the cost of prepaid access, reduce payment friction, and improve service reliability for underserved communities. This model directly supports the Interledger Foundation’s mission of increasing access to digital financial services by lowering consumer and merchant costs and enabling inclusive participation in the financial ecosystem.

The platform was intentionally designed to benefit a wide range of marginalized groups, including women and girls, BIPOC communities, informal earners, and those with limited access to traditional banking. Our mobile-first approach, combined with intuitive UX and real-time feedback, ensures accessibility for users with low digital or financial literacy. During our Prototype Phase, we engaged directly with underbanked individuals through our collaboration with Sabbatical Entertainment, testing Wallet Guru in real-world scenarios and gathering feedback that shaped improvements to user flows, onboarding, and transaction clarity. The results were encouraging: users responded positively to having more control over their spending, and partners saw potential to adopt fairer, more sustainable pricing models.

Beyond payment flexibility, Wallet Guru also expands financial inclusion by supporting high quality crypto stablecoins like RLUSD and USDC in the future. This will open the door for additional benefits such as cross-border remittances, instant settlements, and access to a stable store of value—features that are especially relevant in countries experiencing inflation, currency devaluation, or lack of financial infrastructure. These capabilities give users greater financial agency while helping service providers unlock new markets through digital payment rails.

Looking ahead, Wallet Guru’s modular design and interoperability roadmap position it to reach a much broader population. By enabling any Interledger-enabled wallet of the Paystreme Network to interact with utilities and digital services, Wallet Guru helps eliminate the structural barriers that limit access to affordable financial tools. Its support for local currencies, real-time payments, and open APIs empowers service providers to reach users traditionally excluded by the banking system, while giving individuals more control over how and when they pay. This approach doesn’t just lower costs—it extends participation and financial agency to communities often left out of digital finance.

V. Progress Evaluation

To ensure accountability and alignment with project goals, Wallet Guru adopted a milestone-based evaluation framework throughout the development process. At the outset of our Prototype Phase, we established clear success indicators tied to technical milestones, platform integration, and system performance. Progress was monitored regularly through internal tools like Jira, structured QA testing, and weekly team reviews. This approach allowed us to track development velocity, identify friction points early, and make real-time adjustments based on findings from both technical and user feedback loops.

Key deliverables were completed on time and within scope, including the mobile wallet MVP, a fully functional administrative web application, and the gateway hub designed for third-party service integrations. Integrations with the Interledger Protocol (ILP) and TigerBeetle were successfully achieved, and usage-based payments were executed in real time through our pilot with Sabby OTT. Testing was conducted daily across multiple teams—including Wallet Guru’s internal QA team, Sabbatical Entertainment staff, and early users—focusing on transaction accuracy, platform responsiveness, and reconciliation consistency.

Feedback from these sessions was used to refine the user experience, with special attention given to onboarding, payment transparency, and transaction clarity. Testers consistently cited ease of use and instant feedback as core strengths of the platform—especially among those less familiar with digital wallets. All findings were logged in daily QA reports and shaped updates to the Phase 2 product roadmap.

Stakeholders played an active role throughout the evaluation process. The Sabbatical Entertainment team collaborated closely on the integration and testing of the Sabby OTT platform, while Wallet Guru’s core team conducted sprint retrospectives to ensure alignment across engineering, design, compliance, and partner relations. By embedding evaluation into the workflow and prioritizing responsiveness to real-world testing, we’ve not only validated the technical feasibility of real-time payments—but also built a product grounded in user behavior and partner needs.

VI. Communications and Marketing

Throughout this phase, our primary focus was dedicated to building a robust, end-to-end prototype of the Wallet Guru platform and laying the groundwork for the broader Paystreme Network. While we did not allocate budget or resources specifically to marketing, we did engage in two strategic communications efforts to begin publicly sharing our vision and progress.

First, Wallet Guru was introduced at the Interledger Foundation Summit in Cape Town, where we presented our real-time, usage-based payments platform and discussed the broader behavioral and technical trends driving the need for innovation in digital financial services. This presentation served as the official debut of our prototype and long-term roadmap.

Watch the presentation: Interledger Summit 2024 – Wallet Guru

Additionally, our Founder Emilio Rubio was interviewed by PYMNTS, a leading fintech publication, to discuss how Wallet Guru’s usage-based model can help Latin American consumers overcome the limitations and hidden costs of traditional prepaid systems. The article helped raise visibility around our mission and technology within a broader financial and payments audience.

Read the interview: PYMNTS – Pay-as-You-Go Options Help LatAm Consumers Battle Prepaid Fatigue

VII. The Future

With the core Wallet Guru platform successfully prototyped, our focus now turns to launching a fully operational product and laying the foundation for scale. While our long-term goal is to expand across Latin America—particularly in sectors like utilities and telecoms, where Wallet Guru can have the greatest inclusive impact—our immediate priority is to establish credibility, revenue, and product maturity by launching in the United States.

The next critical milestone is completing our on/off-ramp integration in the U.S.. These ramps are essential for onboarding consumers and businesses, providing users with familiar financial access points, and launching our first commercial deployment with Sabby OTT. They will also support onboarding of mobile service providers targeting underserved users in the U.S. market.

In parallel, we are building the interoperability gateway that powers the Paystreme Network—an open, Interledger-based streaming payment network designed to support real-time, usage-based transactions across multiple industries. This gateway will allow any ILP-enabled wallet to connect with utility companies and digital service providers integrated with The Paystreme Network, fostering open participation and reducing vendor lock-in. By embedding fee-sharing incentives into the network, Paystreme will reward all actors—wallet operators, integrators, and even consumers—for their role in powering financial flows.

Our go-to-market strategy is rooted in pragmatism. Although the greatest need for Wallet Guru’s flexible payment model exists in Latin America—where prepaid users often pay more for basic services—we recognize that building trust through real integrations, revenue, and usage in a live market is essential. By starting in the U.S., we can demonstrate economic viability and product-market fit while preparing for broader international expansion.

From a compliance perspective, we are evolving from basic KYC/KYB and data protection to full AML monitoring and regulatory partnerships in both U.S. and LatAm markets. Operationally, we are expanding developer documentation, improving internal tooling, and strengthening system observability to support increasing transaction volume and service diversity.

The success of this prototyping phase confirmed both the technical readiness and market demand for real-time, usage-based payments. With Wallet Guru as the tech provider and Paystreme as the open payment network, we are now positioned to scale across borders and industries—bringing inclusive, on-demand financial access to the people and services that need it most.

VIII. Lessons & Recommendations

Lessons Learned

Utility and Service Provider Integration Is Inherently Complex: A key takeaway from the Prototype Phase is that integration with utility companies and legacy service providers is often challenging. Many of these entities rely on outdated or rigid platforms that lack the flexibility to support modern, real-time payment flows. To address this, the Wallet Guru Gateway was designed to absorb most of the integration complexity—handling protocol translation, data normalization, and asynchronous processing to deliver seamless user-facing experiences.

User Experience Is Critical to Adoption in Underserved Markets: Early testing confirmed that ease of use, real-time feedback, and clarity in transaction flows are essential to building trust—particularly among first-time digital wallet users in underbanked communities. Streamlined navigation, immediate balance updates, and transparent payment histories proved especially valuable.

Live Testing with Real Users Drives Product Refinement: While simulations and internal QA were important, the most impactful insights came from real-world testing. Daily transactions between the QA and Sabbatical teams, combined with real usage of Sabby OTT’s pay-as-you-watch model, provided actionable feedback that shaped performance improvements and UI enhancements.

Interoperability Offers Strategic Advantage: Leveraging the ILP has positioned Wallet Guru for broad interoperability across both local and crypto ecosystems. This foundation enables the platform to support diverse transaction types and partner integrations across regions and industries.

Recommendations

Account for Integration Complexity in Projects Involving Legacy Systems: When working with utilities or older service platforms, expect to carry the burden of integration through adaptive middleware or custom gateway solutions. Planning for this early reduces implementation friction and future technical debt.

Prioritize Human-Centered Design from the Start: Investing in intuitive, multilingual interfaces and designing with accessibility in mind pays dividends—especially when targeting users with low digital or financial literacy.

Engage Ecosystem Partners Early and Continuously: Collaborating with partners like Sabbatical Entertainment during development helped align features with real-world use cases. Early and sustained engagement with partners and their users is critical for relevant, impactful innovation.

Maintain a Modular, Scalable Architecture: The modular system built in the Prototype Phase has enabled agility in development and integration. Continuing this architectural approach will allow Wallet Guru to grow efficiently across new services, partners, and geographies.

IX. Community Support

While Wallet Guru began as a standalone platform, it was always built with a broader vision in mind—one that goes beyond any single product. We are now laying the foundation for the Paystreme Network, an open, interoperable, internet-native payment network powered by the Interledger Protocol. Paystreme is designed to support real-time, usage-based payments across a wide range of verticals, including video streaming, telecommunications, broadband, and utilities.

At the core of this vision is an interoperability gateway that will allow any ILP-enabled wallet to connect with service providers already integrated into Paystreme and Wallet Guru. This infrastructure will ensure that value can move fluidly across the network, enabling end users—regardless of the wallet they use—to stream payments for services in real time. We are actively seeking to begin conversations with other ILP wallet operators to align on protocols, interface standards, and integration pathways. We also welcome collaboration from those working on routing, compliance, or technical infrastructure that can help make this ecosystem more robust and scalable.

Equally important are the utility integrators and domain experts who can help bring real-world service providers into this new payment paradigm. Many utility companies still rely on outdated systems that make real-time, dynamic billing difficult. Paystreme was designed to absorb much of this complexity through the Wallet Guru gateway, but trusted local partners will be essential in adapting these solutions to different markets and regulatory environments.

We envision Paystreme operating on a shared incentives model, similar to the credit card ecosystem—where wallets, integrators, and consumers all earn fees for facilitating transactions. This model ensures that every contributor to the network’s success is fairly rewarded, driving collaboration and long-term sustainability.

We’re excited to connect with builders, operators, integrators, and mission-aligned organizations across the Interledger community who share this vision. If you’re working on streaming payments, ILP wallet development, cross-border transactions, or last-mile integrations, we’d love to collaborate and help shape the future of open financial access together.

X. Additional Comments

As we continue to build out the Wallet Guru platform, we’re also exploring the development of a web monetization stack that would allow content platforms to monetize articles, media, or digital experiences in real time. This would enable websites to move beyond ads and subscriptions—connecting seamlessly into Wallet Guru’s usage-based payment infrastructure.

This initiative directly supports the broader vision behind the Paystreme Network—an open, interoperable, Interledger-powered ecosystem designed to enable real-time, streaming payments across industries. The web monetization layer will allow publishers, educators, and creators to plug directly into Paystreme, unlocking new revenue models while giving users flexible, privacy-respecting ways to support the content they engage with.

We are currently in the research and early architecture phase of this effort and welcome collaboration from others in the Interledger community who are exploring adjacent use cases—whether in monetization, interoperability, or content-based payments.

XI. Additional Resources

Paystreme Thumbnail

Top comments (0)