There’s no better time than now to amplify the conversations around technological innovations and their impact on the evolution of money. Let’s continue to highlight and contribute to the discourse on how “fin-tech” innovations are disrupting global financial systems, reshaping the banking and the payments landscape via this Digital Money Blog Series.

The future of global finance is evolutionary and irrespective of your geographical location, innovations within the finance and payments landscape are inciting some thought and/or action concerning a shift from fiat currencies to their digital counterparts. As more governments, companies, and individuals embrace these advancements, the conversation isn't just about why we need digital currencies, but how can we ensure these systems are connected and able to work seamlessly across borders and platforms.

Digital Currencies have emerged as a transformative force in the global financial landscape, offering a novel approach to financial transactions and payments. Emerging digital currencies ranging from cryptocurrencies to Central Bank Digital Currencies (CBDCs) to stablecoins are designed to operate in silos; meaning each system has its own set of protocols and infrastructure which inhibits the exchange of value amongst them.

The Rise of Digital Currencies

In recent years, digital currencies have become an increasingly hot topic, capturing the attention of financial institutions, governments, and individuals alike. With the advent of Bitcoin (a cryptocurrency) in 2009, the concept of a decentralized, digital-only currency has evolved from an obscure idea into a transformative force in the global economy. Fast forward to today, we’ve witnessed a nation like El Salvador encouraging the use of Bitcoin nationally. There have also been other cryptocurrencies like Ethereum which utilized the concept of “smart contracts” setting the foundation for decentralized finance, stablecoins like USDC pegged to a nation’s traditional currency, and central bank digital currencies (CBDCs), which are digital forms of national currencies issued by governments.

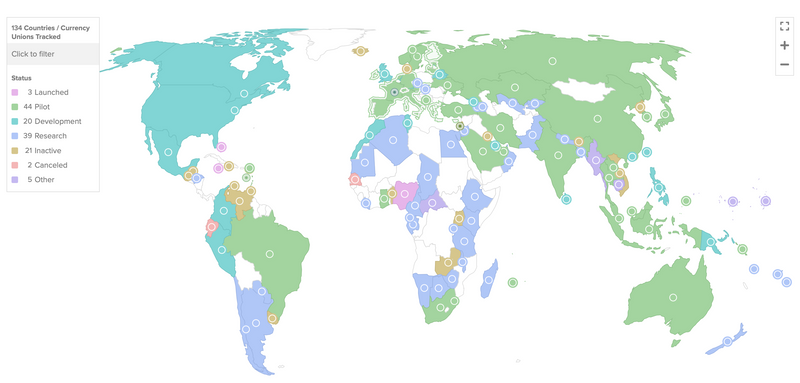

There’s no debate about it, the world is adapting as digital currencies continue to unfold in a new way in how we interact with money. And since governments, via their central bank, really enable or impede how a nation’s financial system advances financial inclusion, the growing interest by countries in developing CBDCs comes as no surprise. To date, some 66 countries are in the advanced phase of exploring CBDCs; 3 of which have successfully launched, 44 countries are currently in the pilot stage, and 20 are still in their development phase. (Source: Atlantic Council). Here’s a pictorial view of countries exploring the development of CBDCs. To get a sense of the status of each country, you may visit the website and preview the interactive map. Worthy to note is China’s Digital yuan (e-CNY) being the largest CBDC pilot in the world having transacted over 7 trillion eCNY across 17 provinces up to June 2024. The European Central Bank is developing its digital euro; whilst several Asian countries are exploring a multi-currency platform under Project mBridge aimed at enhancing cross-border payments through the use of participating central bank digital currencies.

Because the future of money is becoming more digital, more accessible, and more inclusive; the eradication of technical, regulatory, and infrastructural barriers is essential for a functioning global payments system. Fragmentation amongst digital currencies, whether they are decentralized or issued by central authorities, creates barriers, limiting the potential of digital currencies to drive true financial inclusion, streamline cross-border payments, or enable efficient global transactions. To unlock the full potential of digital currencies, the issue of interoperability must therefore be addressed.

The Need for Interoperability

From businesses managing international trade to individuals sending money to loved ones overseas, the modern global financial ecosystem demands interoperability — the ability of different systems and institutions to communicate and operate effectively with each other. Without interoperability, the digital economy will remain fragmented, with each currency isolated in its bubble. For example, if a person in the U.S. wants to pay someone in Europe using a CBDC or cryptocurrency, they may face complications due to incompatible systems. Whether it's different blockchain protocols or the absence of a universal standard, these barriers to cross-border payments hinder the ease and efficiency of digital currency transactions.

No doubt, one of the most compelling reasons for building an interoperable digital financial system is its potential to drive [digital] financial inclusion. With some 1.4 billion people globally excluded from traditional banking services; digital currencies are being posited as a viable means to provide easier access to money for those currently unbanked and underbanked thereby increasing efficiency and and fostering a competitive financial ecosystem that is more inclusive and diverse.

Talking Interoperability at FiX 2025

I had the pleasure of participating at the recently held Fintech Island Experience in St Philips, Barbados in January in the deep dive session - The TECHNOLOGY of TRUST: Demystifying Decentralized Finance. Our panel focused specifically on The Digital Future of Currency: What Is the Path Forward? This session included Keniel Ledgister (Special Agent & Attaché for Caribbean Region, Internal Revenue Service; Chief Operations Officer, Blockchain Lex Group x CryptoMondays Caribbean and Africa) Kwame Oppong (Head of Fintech & Innovation, Bank of Ghana) and Carmelle Cadet (Founder & CEO, EMTECH). Our discussion highlighted the rapid growth of digital payment systems, fintech innovation, and blockchain over the past decade and the fact that despite those efforts; true interoperability remains a significant challenge.

Key highlights of the main issues are:

- Regulatory Fragmentation: the fact that countries have different financial regulations and compliance requirements, which makes it difficult for financial institutions to operate across borders or for new technologies to integrate with traditional systems.

- Legacy Systems: traditional financial institutions, especially banks, still rely on legacy technology systems that were not designed to interact with newer, digital payment systems requiring resources to upgrade and/or integrate these new systems.

- Security and Privacy Concerns: interoperability means sharing data and information between platforms, which raises concerns about data breaches, cyberattacks, and misuse of consumer information.

- Global Standardization: despite the advancements, there is a lack of globally accepted standards for how financial systems should communicate. Different payment systems (e.g., SWIFT, Ripple, SEPA, and others) have distinct protocols, which can create inefficiencies or even failures in cross-platform communication.

A critical aspect of my contribution to the conversation focused on Interledger’s capability to enable interoperability and how critical interoperability is for building trust in Decentralized Finance (DeFi), especially for cross-border transactions. Blockchain is arguably one of the most transformative solutions for achieving interoperability. With its decentralized, transparent, and secure system for transaction validation, blockchain allows different financial networks to interact in a unified way, referencing platforms such as Stellar and Ripple that have designed cross-border payment systems that aim to streamline global finance. Similarly, the Interledger Protocol, although not a blockchain, acts as a universal protocol for connecting multiple types of ledgers, enabling cross-border and cross-network payments. Its architecture operates on top of multiple payment networks including traditional bank systems, cryptocurrencies, or digital wallets, facilitating the exchange of payment instructions between the different ledgers. Not only does it [Interledger] allow the transfer of value between users on systems without requiring the networks to be directly compatible but it utilizes connectors that are trusted intermediaries that can route payments between different ledgers. The Interledger Protocol ensures trust through a two-phase transaction process. Instead of receiving money and passing it along, each connector in the path through the network first commits to the transaction. The recipient is the first to claim their funds from the last connector in the chain, who is temporarily out of pocket. They are then reimbursed by the participant before them, and this continues step by step until the sender completes the payment and everyone is square. This ensures that no one is ever ahead of their balance, and the correct incentives are in place for money to move.

A Vision for the Future

Imagine a world where digital currencies, regardless of whether they are issued by a central bank or a decentralized network, can flow seamlessly across borders, payment platforms, and ecosystems. By fostering collaboration between financial institutions, regulatory bodies, and technology developers, we can unlock a future where digital currencies serve as a universal, efficient, and inclusive form of money.

As we continue to push the boundaries of what's possible in the digital financial landscape, one thing is clear: interoperability will be the key to unlocking the true potential of digital currencies and creating a more interconnected, efficient, and accessible global economy. The evolution of these systems will be fascinating to watch as we move closer to a future where digital currencies and financial platforms can seamlessly connect and work together for the benefit of users and the global economy.

Top comments (1)

Love this. Also, so happy you had a chance to connect with EMTECH. Looking forward to seeing more.