A little over a month ago, I had the opportunity to attend the TechBeach Retreat in the US Virgin Islands and networked within a regional tech ecosystem that is strong on building an inclusive future. Dubbed “Innovation in Paradise”, TechBeach USVI showcased St Thomas's beauty and demonstrated a true reflection of thought leaders and innovators gathered with a focus on building solutions for a more inclusive future.

The event sought to highlight USVI as a center for innovation with a thriving tech ecosystem and business climate amenable to varying high-growth sectors. Hosted by the Research and Technology Park at the University of the Virgin Islands, the event catered to potential investors, startups, and those looking to develop tech talent. I was particularly interested in the focus on enabling innovations in the fintech space and cultivating a cadre of tech professionals focusing on new, open-source technologies.

If you have been following this Digital Money Blog Series or are familiar with the work at Interledger Foundation, you’d recognize that our modus operandi is about collaborating with innovators in open-tech and financial ecosystems to develop low-cost, innovative digital financial services; and working with institutions focused on upskilling youths for jobs of the future. In this blog, I’d like to focus on the importance of developing inclusive financial services, emphasizing lessons learned from my participation at the TechBeach Retreat.

Building Inclusive Financial Services

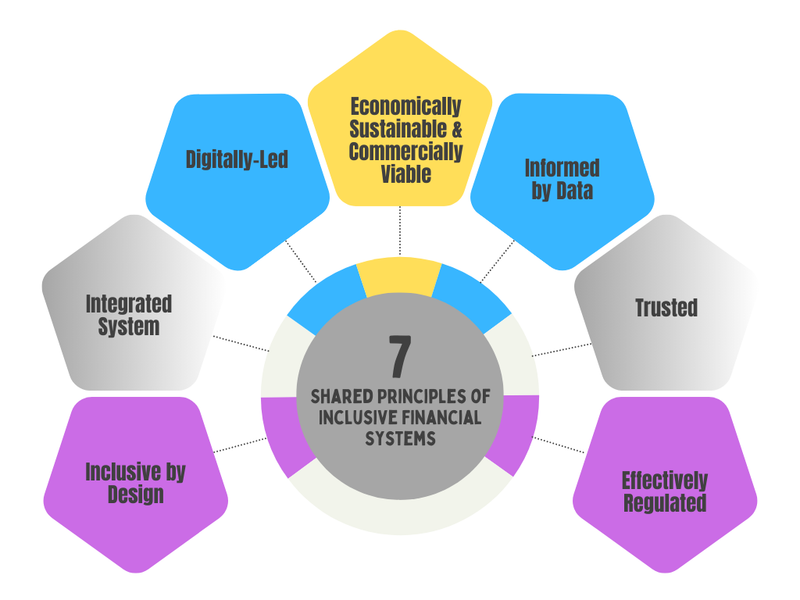

Innovation and mobility in financial services are key to attaining financial inclusivity. There’s been continuous discourse on developing financial services that are accessible and affordable by all guided by several principles of inclusive financial services. World Economic Forum’s EDISON Alliance has published a White Paper outlining the Shared Principles for an Inclusive Financial System which outlines seven principles three of which I’d like to highlight in this series:

- Inclusive by Design - reaching the maximum number of people and businesses with mainstream financial services and supporting specialized financial services to include the rest.

- Digitally Led - expanding digital access as a leading channel for the delivery of financial services while maintaining robust physical access channels.

- Informed by Data - creating relevant financial solutions and maintaining security by using data responsibly

The session, “Open Finance: Scaling FinTech Solutions to Mainstream Impact” centered around the millions of individuals across the globe who are “credit invisible” and are virtually invisible to the financial system. Featuring representatives from Visa, TechCrunch, FinCapital, and the Trinidad & Tobago Financial Centre, the conversation; identified open finance as a transformational enabler to increase financial inclusion, especially for low-income earners, young people without established credit profiles, and even migrants. The reasoning behind this is that financial inclusion cannot exist without underscoring the role big data plays in providing insightful customer behavior analytics which can serve as a key driver for creating inclusive financial services. India and Brazil have pathways to open finance and have essentially served as key benchmarks that have adopted three important building blocks supporting open finance.

- Enabling access to Digital Accounts builds confidence in the digital systems.

- Implementing Fast Digital Payments which drives the usage of digital accounts and expands customers’ data trails.

- An enabling environment that facilitates the Diversity of Providers of digital financial services.

From the discussions had at TBR, it is evident that not all countries that have a vested interest in attaining financial inclusion are ready to fully capture the benefits of open finance. In many Caribbean territories that served as the locale of the conversation, it was noted that the monopoly of commercial banks inhibits open finance as such the central banks must lead the drive and ensure the requisite regulations are in place. Another critical barrier noted was the culture of the people and the level of trust in the current financial institutions. So the question remains on how we can narrow the gaps in these territories to aid the development of inclusive digital financial services.

Last Blog post, the focus was on the importance of lessening the digital divide which impedes a significant majority of low-income communities from benefiting from financial services. In the blog, I highlighted that financial literacy is a key necessity in ensuring new users are onboarded to access financial services as well as ensuring the requisite telecom infrastructure is available to power the devices for people to access financial services. If you’d like to take a read of that previous blog post, here’s the link:

Bridging the Digital Divide to Improve the Underserved and Unbanked Financial Lives.

Julaire Hall for Interledger Foundation ・ Jun 19

If we think of India, Brazil, and even China’s journey in developing inclusive digital financial services, there's merit in highlighting the importance of digital identification including biometric systems; the rationale is that if people can prove who they are with some form of historical data then financial institutions are more likely to engage them in accessing services. Regulations must also be in place to recognize and permit non-banks to access national payment infrastructure thereby facilitating a competitive ecosystem conducive to inclusivity.

Top comments (0)