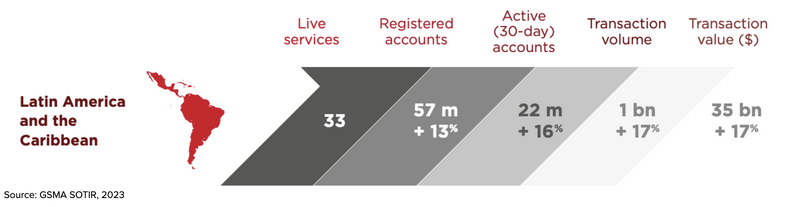

Latin America and the Caribbean have witnessed a steady increase in the availability and adoption of mobile money services since 2019. At the end of 2022, the region was highlighted in the GSMA’s State of the Industry Report on Mobile Money, a rising hub for mobile money services, after Africa and Asia. The growth in adoption and ongoing evolution of fintech services and telecom expansions have cemented the region’s status as a high-growth region, with promising potential to be game-changers in the digital financial services space.

Like the regions explored in this series, the transition to digital wallets and contactless payments marks a new era for financial inclusion. If you have not yet seen the previous blogs where I explored the mobile money ecosystems in Africa and Asia-Pacific regions. Form your perspectives and feel free to share any insights you may have below each post:

The Mobile Money Ecosystem, Asia-Pacific

Julaire Hall for Interledger Foundation ・ Mar 13

LAC, a Rising Region for Mobile Money Services

The existing payment landscape has continued to evolve over the past few years with significant investment in infrastructural development, regulatory reforms, and the influence of digital transformation on fintech innovations in several countries including Brazil, Mexico, Chile, and Columbia, just to name a few.

With an increasing focus on customer-centricity and digital transformation, innovations via private and public sector initiatives have sought to disrupt the financial space with the development of neobanks, open finance, and other open payment schemes. Brazil’s Nubank and Mexico’s Albo are examples of neobanks that have initiated changes such as removing the onerous account opening requirements. On a higher level, country-led initiatives have seen the introduction of national payment platforms being piloted to provide interoperable national mobile systems enabling financial inclusion like Modelo Perú. Brazil’s Pix launched by its Central Bank has been a benchmark for many other territories and has amassed over USD 90 billion in transactions for 110 million customers since its launch in 2021. The Central Bank of Mexico in 2019 launched its Cobro Digital instant payment retail platform with over 10 million accounts processing some USD 100 million in transactions. Belize launched its E-kyash, the country’s first digital wallet, an example of an innovative financial solution removing barriers and enabling inclusion. Large merchants in the e-commerce space, like OXXO, have invested in their own payment systems providing clients with an omnichannel experience.

Remittances & Instant Payments: the evolutionary forces driving change in the LAC’s financial space.

As with e-commerce, the focus on cross-border and instant payments has also influenced the growth of the mobile money ecosystem in LAC. Latin America and the Caribbean (LAC) is the second region in the world to receive the largest amount of remittances after Asia. During 2021 Latin America and the Caribbean (LAC) received 127.6 billion dollars in remittances, which constitutes an annual growth of 26.0%, the highest registered in the past 20 years (IADB Blog, 2022).

LatAm’s governments, with the Caribbean following suit, have been adopting pragmatic and enabling fintech regulations. To this effect, the adoption of mobile wallets in the region has gained momentum and is estimated to represent a 10% share of the volume transacted in the region's digital commerce over the next few years, growing at an estimated 20% annually through to 2025, per EBANX's Beyond Borders study. Countries such as Mexico launched their fintech legislation in 2018 which aimed at providing space for electronic payment providers, crowdfunding platforms, and fintech entities to operate. Similar practices followed in other territories such as Chile and Columbia. Argentina continues to drive its prominence in digital wallet payment with its e-commerce giant Mercado Libre’s fintech arm, providing users the means to execute payments on the marketplace from their smartphones.

Despite the region’s high share of global remittances, there’s still a great opportunity to use mobile money for such transactions. Despite the inroads gained over the past few years in the digital finance space, money transfer operators still maintain dominance in the space as digital transactions are very costly. In order to compete with cash, innovators within the fintech space focused on it reducing costs, eliminating unnecessary steps, and increasing the value of clients’ money through digital wallets.

At the core of the mobile money evolution is the ability to serve the unbanked and underbanked populace in the region. Within our ecosystem, we have innovators and change markers piloting initiatives and advancements aimed at enhancing financial inclusion. Here’s an opportunity to learn about one of the ILF-funded projects that seeks to provide a technological platform for the social sector in Mexico, based on a large network of community banks and savings coops. The Mexican Association of Credit Unions of the Social Sector leads an initiative - The People’s Clearinghouse - that will enable digital payments for marginalized and indigenous communities where community banks are located.

To learn more about this initiative, you can review project updates here:

Where to next?

Stay tuned for more insights on the landscape of the mobile money ecosystem.

Top comments (0)