Yay, you stuck it through!

Thanks for reading The Intro (part 1) of this blog post. If you haven’t read the first part, you can preview it here:

A Reflection, Money 20/20 Conference - The Intro!

Julaire Hall ・ Dec 4 '23

In the United States, we saw an increase in skepticism and scrutiny about the nature of digital assets, which caught the attention of everyone. As a result, legislation outlining the nature of digital assets was drafted, and a series of dialogues about the growth of the fintech space and the lack of enabling regulations to fuel its growth.

Since then, the USA launched two Bills to establish a digital assets regulatory framework: Financial Innovation and Technology for the 21st Century Act and the Responsible Financial Innovation Act. Other countries such as the UK, Singapore, and Hong Kong have long taken the lead in regulating the activity of payment services, and recognizing that one doesn’t have to become a bank to offer payment services. The passing of the abovementioned Bills puts the US back into the game at a global level, signaling to the fintech space that they support open, digital businesses which also influenced a greater appreciation and understanding of the trade-off between the need for enabling policies/regulations by the players in the industry.

I know we can agree that most emerging financial technologies are led by non-bank entities without extensive knowledge of the traditional financial regulatory framework. All in all, companies know what they want to do with the technology. However, they require an enabling environment conducive to fostering innovation with some latitude to test and grow. So I do believe firms, fintechs specifically, are not opposed to regulation, they simply need greater clarity on what entails which will only influence the scale and adoption of those policies by these companies; they will continue to innovate services in accordance to be compliant. Therefore, a prescriptive grooming approach is better than implementing guardrails to get stakeholders to comply. There must be engagement, dialogue, and collaboration amongst regulators, data scientists, auditors, companies, and other stakeholders.

This then brings us to the conversation around the role central banks must play in regulating emerging industries whilst enabling their ability to thrive. We are well on our way from the thinking that emerging fintechs and payments services should be regulated the same way as banks even though they don’t function the same way the bank does. In some territories, successful fintechs have access to the central payment system. In some instances, central banks have taken to lead in driving innovation to achieve financial inclusion. Take the instant payment ecosystem created by the Central Bank of Brazil for instance, and its rise as the model system being replicated by other countries. The US launched its new instant payment infrastructure developed by the Federal Reserve, FEDNOW earlier this year.

The infrastructure to enable financial inclusion is lacking, people of color are marginalized and the same people are benefiting from the traditional systems in place. I’ve learned that there are three important concepts critical to financial inclusion and they are: capital formation, fair policy formulation, and equity. With that, there are simply not enough people with the knowledge at the table with new thinking on capital formulation with inputs to the policy formation which continues to result in blocked access and exclusivity.

When it comes to financial inclusion, the question of consumer protection comes into play where the notion exists that most attention is placed on consumer protection at the expense of financial inclusion. A historical review of the Consumer Financial Protection Bureau (CFPB) shows that it was born out of the 2007/8 crisis and focuses primarily on regulatory aspects, lacking a balance between ensuring consumer protection and enabling financial inclusion. In recent years, they’ve taken on the role of educating consumers about financial literacy which is a step in the right direction.

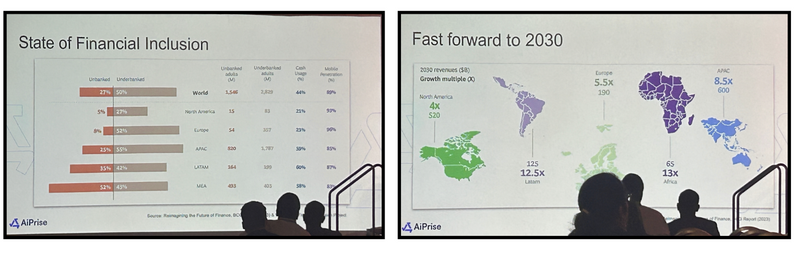

When you speak about the regional state of play - LATAM, Africa, and Southeast Asia are making significant strides in improving financial inclusivity. However, it doesn’t exist without its fair share of challenges.

Take a look at these slides by Rishabh Shah, Founder of AiPrise. A pictorial presentation of the percentage of unbanked and underbanked adults, per region. Alternative financial services providers are using the rise of technology (mobile phones, internet, etc.) to engage those excluded from the services offered by traditional financial institutions. Providing avenues to address the main determinants of costs, lack of trust, and lack of accessibility. KYC and eKYC innovations are mobilizing access and addressing the challenges of financial inclusion. Is the entire KYC flow focused on minimizing friction across the transaction journey? Or are there still hurdles to overcome? India’s Aadhaar has become a standard digital identification system. With a population of 1.4 billion people, 10% of which own a passport but 99% have an Adhaar card speaks volumes and is certainly a model worth understudying.

In LATAM, it was cited that 4 out of 10 cross-border transactions get rejected and this is attributed to lack of standards and high fraudulent cases. There’s a call for an improvement in the coverage in emerging markets, more investments in global compliance infrastructure, and greater attention to local regulations. There lies an opportunity but interoperability is key. The LATAM market is growing, and there’s a young demographic seeking various digital payment options. The region is exploding in not only payment options but also technology. In the case of Brazil with its open finance PIX is attracting global attention and is often seen as a benchmark for other countries.

Africa consists of 54 countries with roughly 35 markets. The payment landscape in Africa is fragmented, varying different payment methods. Bank transfer it was noted is the most ubiquitous type of payment system. In Northern Africa, it is still a cash-led economy, Algeria is mostly cash-out and Nigeria is big on direct deposit. When looking at the African market, context is critical. There’s a high fragmentation of payment types across the continent and cultural nuances of each location must be taken into consideration. In the instance like Francophone Africa which uses the same currency, a regional approach can be supported. Think global, act local!

There's been a great demonstration of partnerships in African countries, which have resulted in successful alternative payment systems. Arrangements that use telcos to accept payments/mobile money wallets have seen to thrive. The more the telcos market is competitive, the better enabling it is. take the case of M-Pesa, now operating in some 10 countries, as an example.

At Interledger Foundation, we recognize that bringing the underbanked and unbanked population into mainstream financial services is crucial for financial inclusion, the foundation of economic growth. It was such a great experience learning about what countries and companies are doing globally to bridge the gap and enable financial inclusion.

Now this wouldn't be a complete reflection if there was no mention of AI. Artificial Intelligence (AI) is the latest emerging technology becoming increasingly prevalent in our daily lives and while it has the potential to revolutionize, it also raises significant concerns around privacy, including data use and security. On a wider scale, people appreciate the possibilities of using AI technology to innovate things that can solve human challenges. However, the AI/Tech revolution also raises a concern of truth dystopia which forces us to fact-check information. We live in an era where the wave of individuals using platforms such as ChatGPT is increasing whether it is for school assignments, work and I dare say grant proposal writing. Should we be worried about the rise of ChatGPT, for instance? Will AI technology influence elections in countries? I guess these are some things to think about.

This is all for now!:-)

Please feel free to drop your comments and bring more perspectives to the conversation.

Cheers!

Top comments (0)