Brief Project Description

Kanzu Microloans is an ILP-enabled digital infrastructure that allows SACCO members to access instant microloans through mobile and web self-service platforms. By integrating with the Rafiki network and leveraging ILP, we aim to automate credit scoring, disbursement, and repayment, allowing SACCOs to scale affordable lending with minimal friction.

Project Update

The backend and frontend implementation of the full loan lifecycle is complete — from loan product creation, loan application and credit scoring to disbursement and repayment integrations. Users will be able to request and repay microloans directly through the Kanzu Finance mobile and web apps.

Key updates:

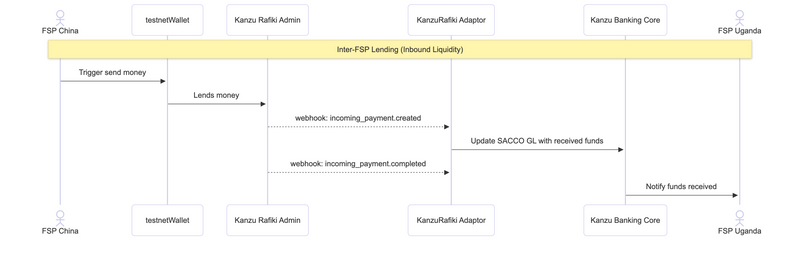

- The Kanzu-Rafiki adapter development is now complete, enabling ILP-powered disbursement and repayment processing.

Loan request flow

- MoMo integration for mobile money disbursement is fully implemented and tested.

- The sales team is 40% staffed, and recruitment is ongoing to close remaining gaps.

- ISMS setup is 90% complete and on track for full completion by the end of the month.

- We have acquired our Data Protection Certificate.

- The board still has one vacant seat; our preferred candidate had a conflict of interest due to an existing fintech board role.

- The technical stack is fully ready, and the staging environment is live, stable, and functional.

- We are now focused on settlement. At present, we’re moving digital value; the next step is enabling real money movement, including liquidation and full settlement. We are actively seeking partners to support this capability.

- We travelled to Mexico for the Interledger Summit, where we showcased our work during the demo lab and community sessions.

Project Impact & Target Audience(s)

Our project is designed to expand financial access for underserved and systematically excluded communities by enabling instant, low-cost microloans and open, interoperable payments through the Interledger Protocol (ILP). The primary beneficiaries are community-based financial institutions—SACCOs, VSLAs, MFIs, and investment groups—that serve populations traditionally left out of mainstream finance. These groups include women and girls, youth, rural and low-income households, BIPOC communities, and informal workers, all of whom rely heavily on community finance structures for savings, credit, and emergency liquidity.

The intended impact is twofold:

Practical financial inclusion — making it possible for individuals in marginalised communities to access responsible credit, repay flexibly, and participate in digital financial systems without high fees or institutional barriers.

Institutional strengthening — equipping small financial cooperatives with modern tools for loan creation, credit scoring, disbursement, and repayment, reducing operational friction and ensuring fair, transparent lending processes.

Our work supports the mission of the Interledger Foundation by demonstrating real-world ILP adoption within grassroots financial ecosystems. By integrating ILP into loan disbursement and repayment, the project helps extend open payments to populations that rarely benefit from global digital infrastructure.

Additionally, participation in the Interledger Summit and the community showcase in Mexico helped raise awareness of how open financial technologies can directly improve livelihoods in emerging markets. The project contributes both a new technical implementation and a new understanding of how open payments can drive social and economic mobility for marginalised groups

Progress on Objectives, Key Activities

Objectives

- Develop a fully functional, ILP-enabled Instant Microloans Infrastructure within Kanzu Banking that allows SACCOs, VSLAs, and MFIs to offer real-time loans to their members.

- Advance Financial Inclusion for the Underserved by providing accessible, fast, and secure microloans, especially to women and low-income communities who are unbanked or underbanked.

- Leverage Open Infrastructure (ILP + Rafiki) to ensure cross-border, interoperable payments and build the foundation for scalable, open financial rails.

- Strengthen SACCOs & VSLAs by enabling them to operate digitally, reduce costs, automate credit scoring, and scale their impact sustainably.

Key Activities

- Backend & Frontend Development - Develop and integrate the loan product engine, credit scoring, loan disbursement, and repayment modules into Kanzu Banking.[Completed]

- Complete Rafiki adapter integration and mobile/web front-end interfaces. [Completed]

- Sandbox Testing & Rafiki Peering [Pending]

- Create a developer playground to test Rafiki functionality and simulate loan operations.[Completed]

- Peer with a public Rafiki node and conduct stress testing for interoperability.[Pending]

- User-Centric Design & Accessibility - Build for low digital literacy with clear UI/UX.[In Progress]

- Community & Regulatory Engagement [In Progress]

- Align with UMRA [Ministry of Finance], BoU, and NITA-U to meet regulatory requirements.[In Progress]

- Engage with the ILP developer community and contribute to the ecosystem.[In Progress]

- Marketing & Communication - Publish blog posts, run webinars, and document impact stories.[Pending]

Communications and Marketing

We have discussed this work publicly across multiple platforms and formats, primarily focusing on open payments, digital financial inclusion, and the role of ILP in expanding access for underserved communities.

Interledger Summit 2025 – Mexico City

Participated in the Demo Lab and Community Showcase, presenting our ILP-powered microfinance and microloan infrastructure.

Link to presentation

Media Mentions & Write-ups

We are pleased to share that Kanzu Finance Limited has progressed to the finals of the MEST Africa Challenge 2025.

Maria represented the Kanzu Finance at the semi-finals, and Peter will be representing us in South Africa for the finals next week. This recognition underscores the potential of Kanzu Finance to scale digital financial inclusion across underserved communities, highlighting our continued commitment to innovation in financial technology.

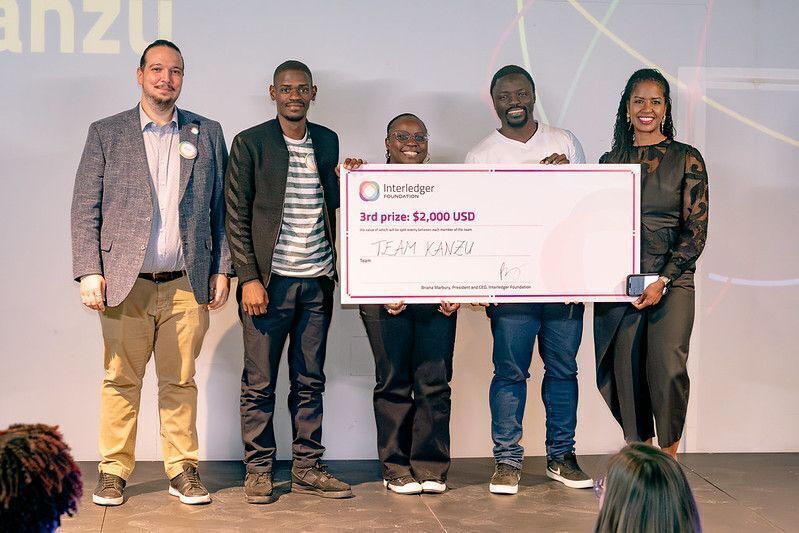

The recent Interledger hackathon demonstrated the power of collaboration, open technology, and visionary thinking.

Our project, Shabaha, goes beyond a simple plugin—it represents an innovative approach to integrating learning and earning, creating new opportunities for students to access education and financial rewards simultaneously.

Winning third place at the hackathon in Mexico City was a significant recognition of the team’s efforts. This milestone marks only the beginning, as we continue to explore how digital payments, educational tools, and opportunity can be connected to empower learners worldwide.

We are especially grateful to the Interledger Foundation community for their mentorship, guidance, and inspiration throughout the event, which has helped shape the ongoing development and impact of Shabaha.

Link to presentation

What’s Next?

In the next phase, our focus is on moving from validated prototypes to fully operational, real-world deployment.

Finalise Settlement & Liquidity Partnerships - Our immediate priority is securing partners who can support fiat settlement, liquidity management, and compliant money movement. While digital-value transfers are functional, establishing regulated settlement rails will enable us to transition to full end-to-end money flow, including liquidation and reconciliation.

Complete Licensing Processes - We will continue engagements with the Bank of Uganda and the Ministry of Finance to advance the NPS license applications. This remains a key milestone for moving into a production environment.

User Testing & Pilot Launch - With the technical stack and staging environment fully ready, we will run comprehensive end-to-end user tests in the coming sprint. Pilot onboarding with selected SACCOs and VSLA partners will follow.

Team Structure - We will complete hiring for the remaining sales roles, ensuring the team is fully positioned for market engagement and early customer acquisition.

Information Security & Compliance Completion - With the ISMS already 90% complete, we expect full implementation by month-end, reinforcing our readiness for regulatory and enterprise-level partnerships. The data protection certificate already obtained strengthens this posture.

Product Refinement Based on Community Feedback - Insights gained from the Interledger Summit in Mexico City, the demo lab, and the community showcase will inform upcoming feature refinements and roadmap prioritisation.

Community Support

We welcome any guidance or collaboration opportunities the community may offer. If there are insights, partnership avenues, or forms of support that could help us accelerate our work, especially around liquidation, settlement, and real money-movement infrastructure, we would be deeply grateful.

We remain open to collaborating wherever our expertise or networks can accelerate your progress. Should you require technical input, problem-solving support, or curated introductions, we are available and ready to assist.

Top comments (0)