Project Overview

As a 2024 Research Ambassador, my aim was to study the impact of digital technologies on society and contribute to deepening the state of knowledge on issues of financial inclusion, access, and digital equity. As the ambassadorship draws to a close, I am pleased to update the community on the key activities that were undertaken towards pursuing these goals. This report summarizes the findings of my research project to understand the state of digital and financial inclusion in the Lahaul & Spiti region of India, which was previously discussed here. In addition, it provides the details of a few other initiatives that I was involved in, such as the launch of Interledger's new Call for Papers grant to support research on financial inclusion and payments interoperability.

Research Project -- Pinging Paradise

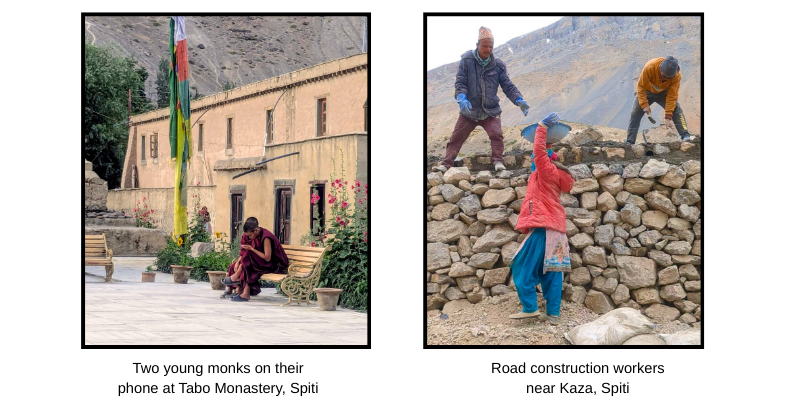

My research project, 'Pinging Paradise', sought to study the lived experiences of digital and financial inclusion in the remote district of Lahaul & Spiti in the state of Himachal Pradesh in India. The project's name was inspired by the breathtaking landscape, poetic isolation, and rugged terrain of the region, and the desire to understand how its residents 'ping' or interact with the digital world.

The motivation for this study stemmed from two main factors. First, my personal connect with the area as a native of the region. Second, the general gap in knowledge about digital and financial inclusion among India's tribal or adivasi (original inhabitants) population. The majority of Lahaul & Spiti's residents belong to the notified Scheduled Tribes (STs), a group that constitutes about 8.6% of the India's population. Tribal regions are often characterized by their geographical seclusion, unique cultural traditions and slower pace of development. Notably, the data shows that ST households formed the most financially excluded social group in India. This makes it relevant to understand the contours of digital and financial inclusion in tribal regions while also locating that inquiry in the local context and customs of each community.

This qualitative study is based on the insights gathered from semi-structured interviews with community members, small businesses, women's collectives (mahila mandals), bank officials, school administrators and the district's elected representative. The field visits were carried out in two phases, the visit to the Spiti region was in July, 2024 and to Lahaul in September. The respondents were selected through a mix of convenience and purposive sampling. The latter took into account factors such as geographic location, internet connectivity, professional profile and specialized knowledge of the issue. During these interactions, I asked the respondents about their internet usage patterns, use of online and offline banking and financial services, and perceptions about the relationship between the region's digital and physical infrastructure.

It was promising to find a near-universal penetration of bank accounts -- all the respondents and their family members had bank accounts, regardless of age, gender and educational qualifications. But when it came to the use of online banking the experience was more varied, with adoption being mainly concentrated among the younger and middle aged individuals. This was also true for the adoption of the Unified Payment Interface (UPI), India's real-time digital payments infrastructure. Almost everyone that I spoke to was familiar with the concept of UPI's mobile-based inter-bank payments although many of them were not using it themselves.

Older women were the least likely to use digital financial services. Many of them were uneducated, some had acquired basic reading and writing skills under the government's adult literacy mission. With that, they felt comfortable dialing numbers using a basic phone and signing their names but not to conduct digital transactions. Even among the younger women, who were educated and digitally savvy, many limited their use of smartphones to services like WhatsApp, Facebook and YouTube but did not undertake online financial transactions.

It was also interesting to find that users displayed differing levels of familiarity and comfort with digital services based on the nature of the transaction. For example, display of QR codes for receiving UPI payments was a common sight in small roadside eateries, shops, homestays and even for accepting donations in temples. However, some users reported that their use was limited to being a passive recipient of the payment and they did not feel confident initiating transactions on their own. The reasons given for the reluctance or selective use of digital finance ranged from comfort with traditional branch-based banking, mistrust and fear of incurring losses, and reliance on other family members who could handle online transactions.

Another useful observation that emerged was on the role of the community as a unit for understanding the status of digital and financial inclusion. Village Demul in Spiti, which runs a community-based homestay project, presents an example. The residents of the village explained that they took turns to let out rooms in their homestays and the income from that was distributed among all participating households. Notably, the village did not have internet access, which made it difficult for homestay owners to manage online bookings. This was addressed by appointing local coordinators who managed the booking process on behalf of the entire village, sometimes by visiting areas with connectivity. In doing so, Demul had created a unique model of financial empowerment relying on trust and cooperation within the community.

While not a part of the original study design, the field visits also shed light on the experiences of migrant workers who had came to Lahaul & Spiti for contractual work in farms and road construction activities. Workers belonging to other Indian states, who mostly came from the region of Bihar and Jharkhand, often asked their employers to send all or a part of their wages directly to their family through UPI. This saved them the trouble of handling cash and dealing with intermediaries. In contrast, temporary workers from the neighboring country of Nepal were still paid in cash due to the lack of an equivalent system for cross border transfers. Upon receiving cash payments from the contractor this group would visit an informal exchange agent who would facilitate the transfer to a bank account in Nepal upon payment of a commission.

Learnings from the Project

This study offers caution against the tendency to homogenize the experience of digital and financial inclusion. On the one hand, there is the narrative of radical and universal digital transformation in India, enabled by the growth of services like UPI. One the other, there is another narrative about the purported backwardness of tribal populations, characterized by poverty and deprivation. The reality of Lahaul & Spiti does not fit in either of these extremes.

It is a region that demonstrates a high level of bank account ownership with mounting awareness of digital payments. Awareness and use of other financial services like insurance, mutual funds, and voluntary retirement schemes still remains low. Moreover, digital experiences within the community vary drastically based on factors such as age, gender, and education level.

Further, although large parts of the district are now connected to the internet, pockets of under connectivity still remain. The fragile ecological structure of the region, which is prone to cloud bursts, landslides and other damage during heavy snow and rainfall, also takes its periodic toll on the region's physical and internet infrastructure. The combination of these factors with the community's local practices and realities present a unique context that is cannot be boxed in universalizing narratives of digital inclusion or exclusion.

Call for Papers and Future|Money Podcast

Alongside the work on my research project, I was involved in a few other initiatives geared towards untangling the complexities of financial inclusion. This included design and moderation of a Future|Money Podcast session on Practising financial inclusion in the Global South. In this conversation with James Ogada of the Busara Centre and Susan Thomas of XKDR Forum, we unpacked the concept of financial inclusion and why it matters. The discussions covered suitable metrics for the measurement financial inclusion, the behavioral science behind inclusion interventions, and the contours of responsible digital credit.

Earlier this year, Interledger launched a new grant to support research on financial inclusion, with a focus on encouraging perspectives from the Global South. The idea behind it was born out of an ideation session with Lawil Karama from the Program Team in which we discussed possible ways to deepen Interledger's engagement with the research community, particularly in the developing world. It has been my privilege to collaborate with the Program Team in shaping and executing this initiative. This included work on planning the themes for the call and engaging with a stellar group of academics who formed the Academic Steering Committee and guided the review and selection of the research proposals.

Internet Governance Forum

In June this year, I was part of the Interledger delegation that attended the Internet Governance Forum (IGF) meeting held in Lillestrøm, Norway. IGF is an United Nations initiative designed to promoted multistakeholder conversations on building a safe and open internet and promoting human rights in the digital age. At this year's IGF, I collaborated with the Freedom Online Coalition to organize a workshop titled Universal Principles, Local Realities: Multistakeholder Pathways for DPI.

The session (available here) covered global trends in the deployment of digital public infrastructure and how implementation choices reflect broader societal contexts and governance models. The discussion was moderated by Sabhanaz Rashid Diya of Tech Global Institute and we had a fantastic line up of speakers that included Armando Manzueta from the Government of Dominican Republic, Bidisha Chaudhury of University of Amsterdam, Keith Breckenridge from University of the Witwatersrand, Luca Belli of FGV Law School, Rasmus Lumi from the Estonian Ministry of Foreign Affairs and SB Singh from the Telecom Regulatory Authority of India.

The IGF also saw the launch of the Policy Blueprint for Interoperable Payment Protocols, which was developed by the IGF Dynamic Coalition on Digital Financial Inclusion. As a member of the Dynamic Coalition, I gained immensely from the interactions with this group over the last one year. I also contributed to the development of the blueprint and was grateful for the opportunity to participate in the meeting organized by Ayden Férdeline to introduce this work before members of the IFG community.

Communications and Engagement

One of the components of my research plan was to host a workshop to seek inputs on my project proposal from the policy and research community in India and introduce them to the Interledger Foundation. This led to the organization of an in-person Workshop on Digital and Financial Inclusion in New Delhi last year, which was discussed in an earlier post.

In addition, events such as the Future|Money Podcast and the IGF meetings presented a platform to introduce key ideas from my research project to a wider audience. I was also delighted to engage virtually with the Interledger team to present the research process and findings of my project during a Lunch and Learn Session in July.

Lastly, I would like to share the details of a policy brief co-authored with Bruna Cataldo, Larissa Magalhães and Nicolo Zingales. The brief was published by the Think Tank 20, an official engagement group of the G20, during Brazil's G20 presidency in 2024. In it, we discussed the development and implementation of standardized digital payments DPIs in Brazil and India and the lessons they may hold for other countries. The ideas covered in it emerged from our discussions during a session on DPI at the 2023 Interledger Summit in Costa Rica.

What’s Next?

The next step on the Pinging Paradise project involves the publication of the research paper detailing the motivation, methodology and findings of the project. I am on the look for suitable venues for the publication of the paper, which may include a journal or a book chapter.

In addition, I look forward to the next phase of the Call for Papers initiative, as the new research ideas emerging from it are executed and published over the coming months. To begin with, I am eager to learn more about and interact with the authors of the selected papers at the upcoming Interledger Summit.

Community Support

My journey as an Interledger Ambassador has been an immensely fulfilling one, in large part due to the richness of the interactions with this community. In particular, I would like to thank Lawil Karama, Ayesha Ware, Chris Lawrence, Ayden Férdeline, and Vineel Pindi for their support and collaboration over the course of the ambassadorship. I am also grateful to the Interledger leadership and the Program Team for their enthusiastic support for my research project and the Call for Papers initiative. I trust that the Interledger community will continue to deepen its engagement with the academic and research networks and carry on encouraging lesser heard voices.

Top comments (2)

Thank you @smrpar for your outstanding contribution as an Interledger Ambassador. Your energy, ideas, and commitment throughout this year have been truly inspiring and have significantly strengthened the program. We deeply appreciate the time and passion you've shared with us.

Thank you for the kind words, @lwlkarama. It has been such a pleasure collaborating with you and everyone else from the Program Team!