As one of the 2024 Interledger Community Ambassadors, my project has evolved and expanded. Before starting, I recognized that access to technology was not the only reason people in the United States remained unbanked and underbanked. I proposed a project to explore the key factors contributing to millions of households being unbanked and underbanked in the U.S.

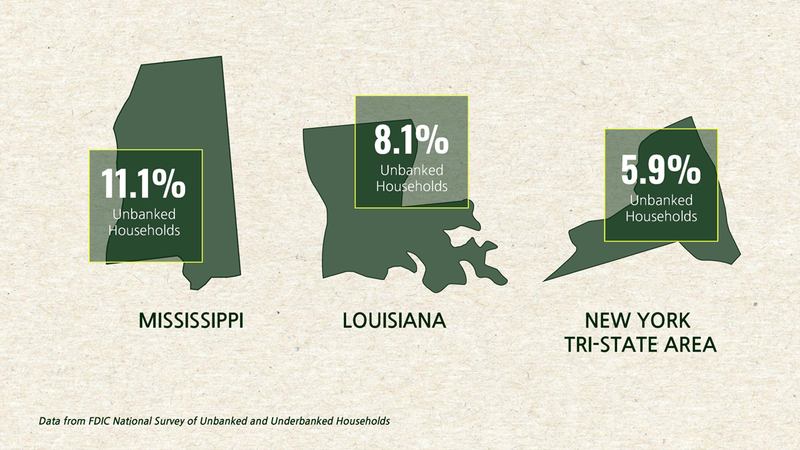

To inform my research, I leveraged data from the "2021 FDIC National Survey of Unbanked and Underbanked Households" and then selected three cities with the largest populations of unbanked households: Mississippi, which had the highest unbanked population at 11.1%; New Orleans, with 8.1%; and the New York (Tri-State) area, at 5.9%. According to the same report, across income levels, Black and Brown households were nearly three times more likely to be unbanked compared to their white counterparts. This statistic motivated me to focus my research predominantly on Black and Brown communities.

To refine my focus further, I decided to avoid the complex issues faced by formerly incarcerated individuals and undocumented individuals. While these groups encounter a variety of unique challenges that deserve careful consideration, I felt it was best to concentrate on different aspects for the purposes of this project.

The Process

My goal was to create a documentary showcasing the key factors that prevent individuals from having access to banking services in the United States. I identified five key challenges that unbanked populations face: financial literacy, the digital divide, low wages and unemployment, banking deserts, and financial trauma. Then, I looked to interview individuals based on their experience with the subject matter, including financial institutions, economic development organizations, and industry experts. I began by conducting outreach to various contacts in the three cities. I had the opportunity to interview individuals from a Mississippi-based law firm that supports unbanked populations and a representative from an organization that is helping solve the digital divide in the Appalachians.

My first public interview was with Sheena Allen( who has since become a 2025 Interledger Ambassador). Sheena has a breadth of experience in the financial services industry; she founded the fintech Capway. She is also a Mississippi native who understands the complex landscape and why it remains the largest population of unbanked households in the United States. Recently, I interviewed Dr. LaTanya White about financial trauma. Dr. White is a scholar-practitioner and the founder of Concept Creative Group.

Although my final output is not a documentary, I will be sharing those interviews as a part of a podcast series showcasing my research and providing a deeper understanding of why individuals are unbanked in the United States.

Mentoring the Next Generation of Ambassadors

This year, Interledger started a mentorship program to help onboard the newest cohort of ambassadors. I was able to support Caroline Sinders, who is currently working on a project titled By Design? The Hidden Harms Within Banking Apps. I believe that having ambassadors pass the torch and support each other fosters a stronger community and potentially better outcomes because of the deeper network it creates.

Presenting at HBCU Engage

This spring, I attended the HBCU Engage Conference in North Carolina, where I was joined by Julaire Hall, the Interledger Program Officer, Dr. Andrew Mangle, a professor at Bowie State University, and Sheena Allen. During the conference, I had the opportunity to discuss the Interledger Foundation and share information about the Interledger-NextGen Higher Education Program.

Participating in the conference allowed me to gain insight into how higher education institutions develop new initiatives. Staff from Historically Black Colleges and Universities (HBCUs) came from across the country to attend, many seeking innovative ways to support their organizations amid financial cuts. While numerous HBCUs expressed interest in the Interledger-NextGen program, a prominent challenge emerged: they need assistance in integrating Interledger's technology into their curriculum. Professors who wish to implement a program like Interledger-NextGen also need to get buy-in within their organizations effectively.

Attending the 2025 Inclusiv Conference

I also attended the Inclusiv Conference in April. Inclusiv is a 50-year-old non-profit organization that operates a network of credit unions, with a primary mission of promoting community development and financial inclusion. It is the only certified Community Development Financial Institution (CDFI) exclusively dedicated to investing in the community development credit union movement.

The conference provided an in-depth learning experience about CDFIs and credit unions. CDFIs help promote access to capital and support local economic growth in both urban and rural low-income communities by offering a variety of services, including banking and loans. These institutions are often community-led and focus on helping underserved communities gain access to essential financial services.

The work of CDFIs aligns closely with Interledger's mission. I see great potential for collaboration between Interledger and CDFIs in the future and have recommended that the Interledger Foundation explore ways to partner with them.

What’s Next?

The completion of my ambassadorship is not the end of my work with the Interledger Foundation; I will continue to support initiatives and programs and help create pathways to increase financial inclusion in the United States. Please stay on the lookout for my two upcoming podcast episodes for Interledger's "Future Money" podcast, featuring interviews with Sheena Allen and Dr. LaTanya White.

Final Thoughts

This ambassadorship has been so fulfilling, and I'm excited for what's next. I want to thank the Interledger Foundation team, especially Lawil Karama, Ayesha Ware, and Chris Lawrence, who continue to provide support to ambassadors and create a safe space to explore, learn, and grow.

If you want to learn more about my journey as an ambassador, please check out these previous reports:

Top comments (1)

Amazing work, Victoria!! 👏🏽 Thank you for sharing the journey — all that you discovered along the way that served as a light for the new directions you’d take. Cheers to continued success and impact!