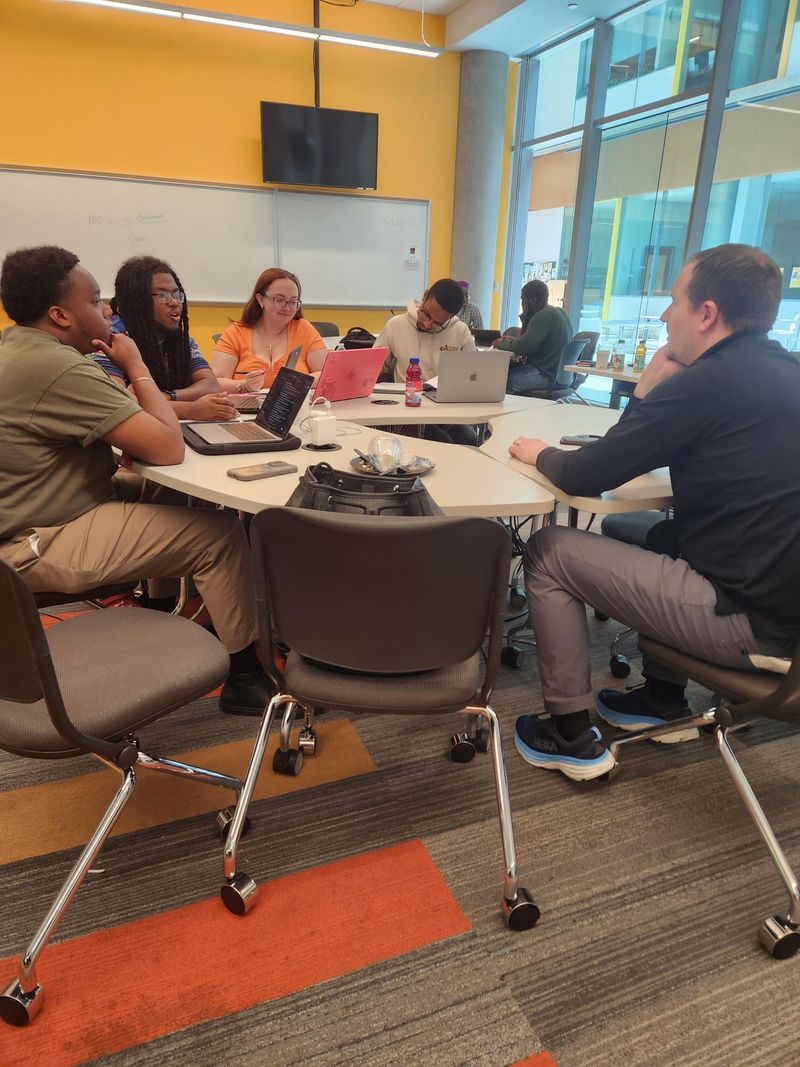

Bowie State University wrapped up an exciting and inspiring FinTech $print event, supported by our ongoing collaboration with the Interledger community. During this event, student teams explored innovative ways to leverage the Interledger Protocol (ILP) to enhance digital financial inclusion and provide accessible financial solutions for underserved populations. Using the Design Thinking model, students focused on the underbanked and digital financial inclusion. Participants led with empathy, sought to define the challenges of financial inclusion, and produced three refined ideas.

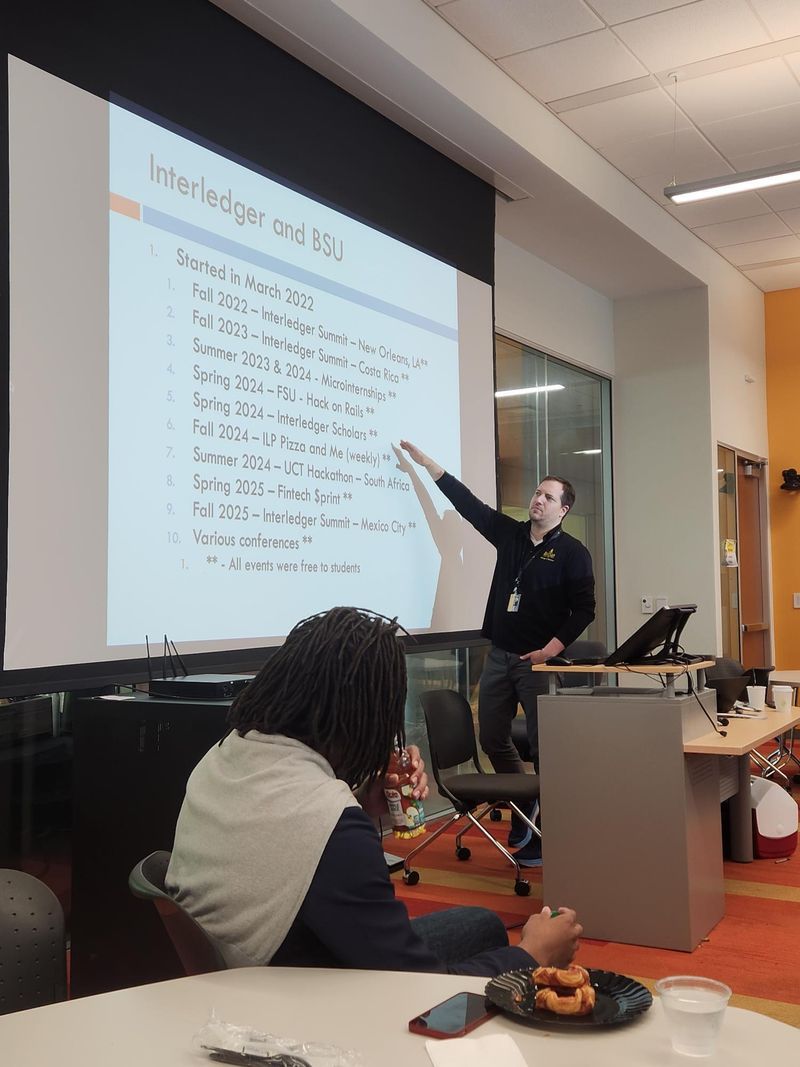

This event is part of a broader commitment that Bowie State University has made with Interledger, continuing an extensive list of impactful activities such as the Interledger Summits in New Orleans and Costa Rica, Microinternships, Hack on Rails at FSU, Interledger Scholars Program, weekly ILP Pizza and Me gatherings, the UCT Hackathon in South Africa, and the Interledger Summit in Mexico City. These initiatives collectively align with Interledger's global strategy to support digital financial research and development in vulnerable communities, fund innovative solutions for underrepresented populations, foster a transformative ecosystem in payments, and enrich talent pipelines with diverse perspectives. We are enthusiastic about expanding these valuable experiences to other campuses in Fall 2025.

The event was helpful for students to better understand the need for digital financial inclusion. For those new to the space or who want to better understand the underbanked in the U.S. and how alternative banking solutions are used, I recommend two videos - Details how millions lack access to financial services & Explains the logic (gap) behind pay day lenders

We're thrilled to share the compelling student projects that emerged from the event. Your opinion matters to us, and we greatly appreciate your vote on the project you believe holds the most potential. The grand prize was being awarded to the team that got the most votes from the Interledger community.

Below are the summaries of each team's project:

Team 1: KinFund

KinFund targets newly arrived migrants facing systemic barriers to traditional banking in the U.S. It provides an intuitive, multilingual interface enabling users to securely receive funds, manage digital payments, and build a transaction history using ILP—without needing a traditional bank account or Social Security number. KinFund helps users establish a verifiable financial identity, offering tools to pay rent, save for vehicles, and apply for housing, ultimately fostering long-term financial stability.

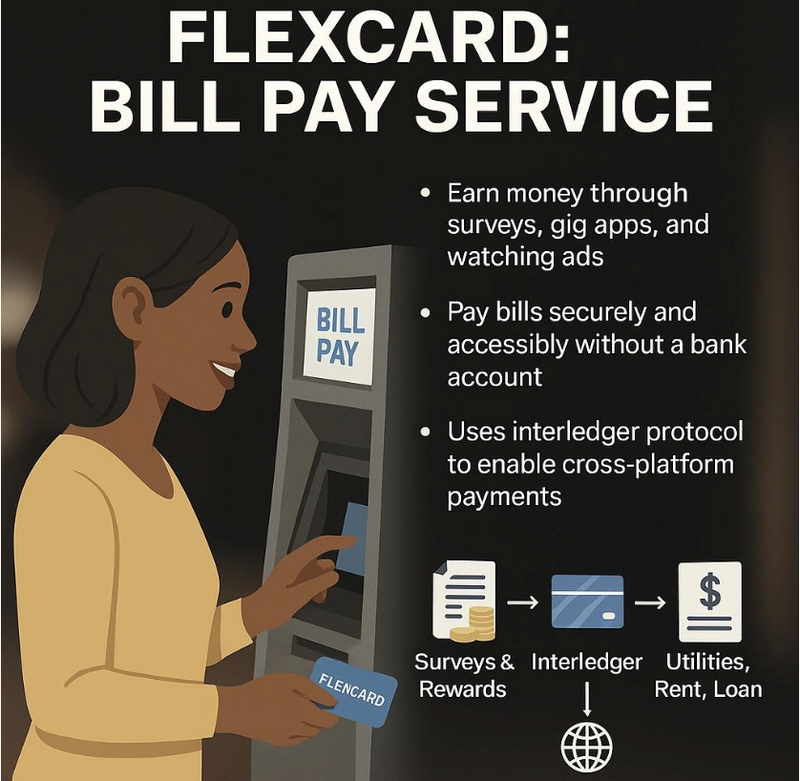

Team 2: FlexCard

FlexCard Bill Pay addresses challenges faced by cash-dependent domestic workers, such as high transaction fees and limited access to online services. Users receive a physical, PIN-protected card, reloadable via multilingual kiosks accepting cash deposits. The card facilitates fee-free bill payments and digital money management without needing a smartphone or formal identification. Users can convert various forms of value (e.g., completing surveys or exchanging gift cards) into usable funds through ILP integration, supporting financial inclusion and autonomy for underbanked communities.

Team 3: ShadowBank

Shadow Bank aims to create a point-of-sale system functioning similarly to a "buy now, pay later" service specifically tailored for underbanked individuals. It provides immediate access to funds for essential expenses, such as bills, while implementing a reward-based system for timely repayments. This project introduces a small, fixed fee rather than interest-based lending, ensuring it remains fair and accessible. The Shadow Bank operates as an innovative mutual-fund-style entity leveraging ILP to enhance global financial accessibility.

Drum roll please... The winner is... Team 2: Flexcard

Thank you for your continued support!

Top comments (1)

The clarity of the value and impact that each of these solutions offer just blows me away, in a really good way!

A BIG round of applause to each team, these are incredible!