We're back with our Fall quarterly roundup. Over the Summer, Ambassadors and Digital Financial Services Grantees have shared a variety of reports on the current progress of their projects, and a few even shared their final report outcomes! Catch up now on anything you might have missed!

Ambassadors

Hop Sauna — ILF Ambassador Progress Report

Gavin Chait for Hop Sauna ・ Jul 16

Hop Sauna is a core technical stack aimed at developers to support implementing a federated, community-moderated web shop offering custom digital objects.

Any system permitting commercial exchange exists at the intersection of what is technically possible, ethically responsible, and permissible under the patchwork of international regulatory compliance.

Building a commercial website is relatively straightforward. Frameworks - like Django or Drupal - exist. You can integrate Stripe or PayPal quite quickly. But, once you're done, such a site offers little advantage over listing your products on Amazon or eBay, with the huge downside of being functionally invisible to the larger world. If you're already famous, moving to your own infrastructure may have advantages, but if you're less known, or just starting out?

But, what happens if you live in a part of the world not supported by these platforms, or are just tired of the ethical and business practices of the platforms?

- A functional, community-oriented commercial platform would have the following characteristics:

- A community of peers, selling similar or compatible works, where membership is a function of acceptance by that community,

- Review of business behaviour (or moderation of activity) is by the community, ensuring that members are held to agreed norms,

- Costs are kept to the minimum with members paying for shared infrastructure, but otherwise keeping their own revenue, or contributing in some agreed way to their community. Each community would also interoperate with other communities which offer similar works and where their community standards are compatible. This interoperability ensures collective discovery, much like the webrings of the early internet when search was still in its infancy. Discovering one link in the network provides access to a wider world.

A single website can be structured however the developer chooses, but the moment information needs to be exchanged between sites - federated - interoperability standards become critical. It would also be helpful if that standard already supported interactions between millions of people.

Or, to summarise, it would be nice to go where the tea is already being made.

"By Design?" The Hidden Harms Within Banking Apps — ILF Ambassador Progress Report

Caroline Sinders ・ Jul 18

The goal of my project, “Surfacing Harmful Design Problems”, which you can read more about here, is focused on surfacing a particular type of design that harms, deceives, manipulates, tricks or damages users, but specifically in financial services, banking, money lending and money transmitting apps. These types of design patterns are often called dark patterns, or deceptive design patterns, but I will be referring to them as harmful design patterns. In a much longer paper and article that I will be producing at the end of my ambassadorship, I will get into the nuances of harmful design patterns but I will do my best to summarize them in the next few paragraphs.

At present, I have been analyzing a series of different types of products and apps in the financial services ecosystem, including different types of money lending, money transmitting, traditional banking apps, and different types of wallets (cryptocurrencies, phone wallets, and finetech platforms like MoCaFi who can function as a ‘wallet’ to distribute benefits like SNAP and EBT in the US). I will dive into this in more detail below, but I have also interviewed experts including policymakers, researchers and technologists, conducted stakeholder interviews, crafted a list of individuals to interview and observe their banking habits (the list is already put together and the interview questions are already written), and I have conducted an extensive literature review.

What Are Harmful Design Patterns?

For background and context, I (Caroline Sinders) am a human rights defender and researcher, as well as a critical designer. I make art, design interventions, and data visualization alongside conducting mixed methods research focusing on technology, policy, and human rights. Design is an integral part of a technology stack; design is the ‘thing’ that often is explaining or visualizing to users how a product or a piece of technology “works.” Design is the medium where user research, product strategy and business strategy all convene; design is powerful. Design can be a truthful narrator, as often as it can be a misleading one….

Global ROSCA Users through Digital Financial Inclusion, — ILF Ambassador Progress Report

Andria Barrett ・ Jul 19

I’m really enjoying this work.

My project is called Empowering Global ROSCA Users through Digital Financial Inclusion, but what I’m learning is that empowerment really depends on perspective. Not everyone wants to be empowered in the way we think they should be. Some ROSCA users in Canada aren’t interested in going digital at all. They’re comfortable with what they know, and they see value in keeping things small, local, and offline. But when I talk to people abroad, especially in the Caribbean, they’re much more open. They see digital tools as a way to connect, grow, and reach across borders. So now I’m asking myself: What does empowerment really mean in this context? And who gets to define it?

The primary goal of this project is to identify the needs of ROSCA users and discover what steps need to be taken to support their transition to using digital financial tools that encourage participation from users globally. Quite simply, they’re not interested. The want to keep elements of this cultural tradition private, off the radar and not on any apps.

The second goal is to introduce ROSCA app developers to opportunities within the Interledger ecosystem. They app developers are quite keen and interested in learning more about Interledger.

Throughout my interviews and research I find myself thinking a lot about two things: trust & the difference between financial inclusion, financial literacy, and digital financial inclusion.

At the beginning of this project, one of the other Ambassadors commented that “Some people choose not to be digitally included,” and honestly, I didn’t get it at first. Why would anyone choose to be excluded? But after talking to some of the banker ladies, I’m beginning to understand.

It’s not that they’re against using apps or evolving how ROSCA users can participate, they just don’t trust the technology, or the people behind it, or who might have access to their information. They seem to** ONLY** trust the people in THEIR ROSCA.

Shifting Power in the Informal Economy: Implications on Digital Financial Inclusion Strategies — ILF Ambassador Progress Report

Xiaoji Song ・ Jul 25

What is the informal economy in Europe, and how are they structured, formed, and understood by different communities who are involved in them? This was the major question that I kept coming back to in the past few months of research outreach. Despite this being the most basic question and the starting point of my research, the insights I gathered throughout my research and outreach process have continuously challenged my assumptions of what economic informality means in the European context. These assumptions not only challenge our understanding of the nature and scale of the informal economy, but also how digital financial inclusion can be done and strategized in our globalized world.

In the past months, I have conducted extensive literature research, mapped out diverse relevant civil society stakeholders, built 5 project partnership with NGOs, grassroot communities, and community-based organizations, talked to 20+ community leaders from civil society stakeholders who represent or work with 5 distinct communities who are often involved in the informal economy in Berlin and Madrid, with more talks and interviews being scheduled and conducted. In the project updates, I want to revisit some of the assumptions on informal economies and how they are challenged in the European context, with the case studies from Berlin and Madrid. By re-visiting these assumptions, I also start to rethink what strategies on digital financial inclusion can lead to a better world for those at risk.

To start with, I want to first give some context and background.

Informal Economy: What exactly do we mean?

Key Insights:

- Informal economy is economic activities, workers, and economic units that are, in law or in practice, not covered or insufficiently covered by formal arrangements.

- From the informal sector to the informal economy, the nature of the activities and their definition are defined in relation to the development of modern industrialized societies and capitalism. The informal economy involves economic activities, workers, and units not fully covered by formal arrangements, like labor laws, social protection, taxation, and business registration. The understanding of the informal economy has evolved through the work of organizations like the ILO and WIEGO, alongside academic contributions. Early ILO work focused on the informal sector as unregistered, unprotected enterprises. A significant shift in 2002 broadened the scope to the informal economy, encompassing all economic activities and employment relationships not adequately covered by formal arrangements, even within formal enterprises. The 2023 ICLS further refined this, focusing on “informal productive activities.” This evolution reflects a move from viewing informality as a characteristic of enterprises to recognizing it in diverse employment forms due to trends like globalized employment schemes.

Financial Exclusion in the Southern U.S. — ILF Ambassador Progress Report

Sheena Allen ・ Jul 21

My research project is progressing well and remains aligned with the original scope of visiting 6–8 cities to conduct in-person case studies with individuals who are unbanked, underbanked, or part of the working poor. As a reminder of my research setup, approximately 85–90% of the selected cities are in the Southern U.S., which is the primary focus of the research. The remaining cities are located outside the South to allow for regional comparison.

To date, I’ve completed case studies in two cities—Miami, FL and the DMV area—and have also conducted interviews with several fintech founders. In total, I’ve engaged with 60 participants so far across these sessions.

A major highlight has been the session in Washington, D.C., which reinforced my belief that many national datasets misrepresent underserved communities due to a lack of culturally competent and trust-based engagement. Participants shared that they likely wouldn’t have been as open or honest if someone less relatable had asked them the same questions. That moment validated the importance of a grassroots, community-centered approach.

One challenge arose in New York City, where I was unable to secure a local partner organization that would have been able to help gather a significant number of participants within the timeline needed. After reassessing, I shifted that planned session to Memphis, TN, where I have stronger local relationships and better alignment with the research goals. This pivot allows the project to stay on schedule without compromising research integrity.

Overall, the project remains on track to be completed within the timeline of my ambassadorship, and I’m encouraged by the depth of insights gathered from both participants and fintech leaders as I head into the second half of the research period.

Researching Financial Inclusion in the Global South — ILF Ambassador Final Report

Smriti Parsheera ・ Sep 2

As a 2024 Research Ambassador, my aim was to study the impact of digital technologies on society and contribute to deepening the state of knowledge on issues of financial inclusion, access, and digital equity. As the ambassadorship draws to a close, I am pleased to update the community on the key activities that were undertaken towards pursuing these goals. This report summarizes the findings of my research project to understand the state of digital and financial inclusion in the Lahaul & Spiti region of India, which was previously discussed here. In addition, it provides the details of a few other initiatives that I was involved in, such as the launch of Interledger's new Call for Papers grant to support research on financial inclusion and payments interoperability.

Research Project -- Pinging Paradise

My research project, 'Pinging Paradise', sought to study the lived experiences of digital and financial inclusion in the remote district of Lahaul & Spiti in the state of Himachal Pradesh in India. The project's name was inspired by the breathtaking landscape, poetic isolation, and rugged terrain of the region, and the desire to understand how its residents 'ping' or interact with the digital world.

The motivation for this study stemmed from two main factors. First, my personal connect with the area as a native of the region. Second, the general gap in knowledge about digital and financial inclusion among India's tribal or adivasi (original inhabitants) population. The majority of Lahaul & Spiti's residents belong to the notified Scheduled Tribes (STs), a group that constitutes about 8.6% of the India's population. Tribal regions are often characterized by their geographical seclusion, unique cultural traditions and slower pace of development. Notably, the data shows that ST households formed the most financially excluded social group in India. This makes it relevant to understand the contours of digital and financial inclusion in tribal regions while also locating that inquiry in the local context and customs of each community.

Digital Financial Services Grantees

BessPay ILF Interim Report

BessPay for BessPay ・ Jul 20

Across the Global South, micro and small businesses are the heartbeat of local economies. Yet when it comes to getting paid online or expanding across borders, too many are left behind—facing high transaction fees, slow settlements, limited local currency options, and inaccessible payment systems.

There are over 440 million MSMEs in emerging economies employing billions of people, but the majority remain excluded from modern financial systems. This exclusion limits their ability to participate in global digital trade and stifles economic growth.

The BessPay Plugin is our answer—a new kind of payment solution that is open, affordable, and designed for entrepreneurs in emerging markets. Built on Interledger Open Payments and piloted through the SouthLink Marketplace, BessPay connects marketplaces to faster, cheaper, and more inclusive cross-border payments.

Our vision is simple: enable any MSME—from a craft seller in Jamaica to a freelance developer in Nairobi—to get paid instantly, in local currency, from anywhere in the world.

Our Journey to date

The first months of this journey were about establishing a strong technical and collaborative foundation. Working closely with the Interledger's tech team and Chimoney’s engineers, we refined our architecture to support secure, scalable, and currency-flexible integration.

On the technical side, backend APIs are developed and User Interface components are functional. We began sandbox integration with Chimoney's wallet infrastructure. Even with a leadership transition following our Technical Lead’s departure in July, the team adapted quickly and remains on track to deliver the MVP by September 30, 2025.

Commercially, we've formed milestone-based partnerships with Chimoney (for digital wallet and financial processing and settlements) and Journey Horizon, Sharetribe’s premier implementation partner, to support the development of the BessPay Marketplace Template. Journey Horizon, founded in 2018, has grown to a team of over 50 professionals, delivered 100+ Sharetribe-powered marketplaces, and continues to support 20+ live platforms through maintenance and enhancements. Their experience and strategic support are integral to our marketplace readiness.

We also benefit from the personal support of Juho Makkonen, CEO of Sharetribe, who continues to champion the project’s mission to provide easier. Cheaper and faster payments for MSMEs globally.

Maria Gorrettie Namuddu for Kanzu Finance

Kanzu MicroLoans — ILF Grant Progress Report 1

Maria Gorrettie Namuddu for Kanzu Finance ・ Jul 12

Project Update

We’ve made strong progress on the backend implementation of the entire loan lifecycle, from loan product creation and credit scoring to disbursement and repayment integrations. The frontend for self-service loan application is still under development, but once live, users will be able to request and repay microloans entirely through the Kanzu Finance mobile and web apps.

Key updates:

- The Rafiki adapter is under development to support disbursement and repayment processing via ILP.

- The MoMo integration for mobile money disbursement is complete and tested.

- The team is 90% staffed. We are still working on the sales department.

- Talks and consultations with the Bank of Uganda and the Ministry of Finance are underway regarding obtaining the NPS and the digital lending licenses.

- The board profiles for the new board are complete, and candidates have been put forward. The technical stack is nearly ready, and we are gearing up to begin end-to-end user testing in the next development sprint.

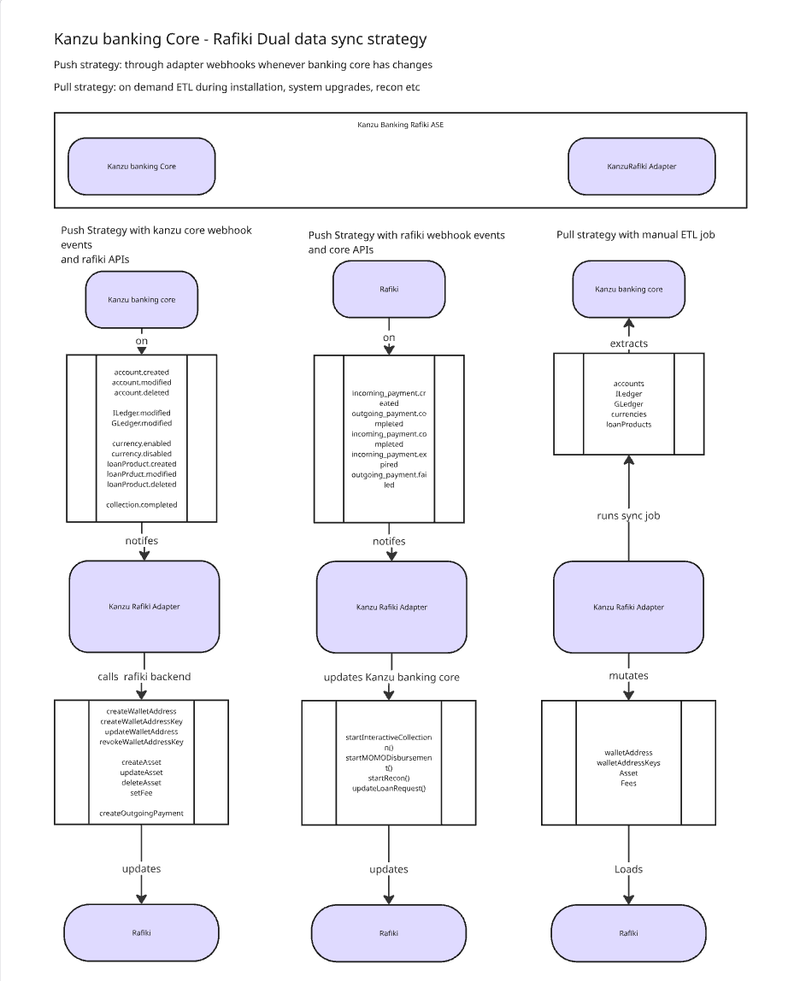

Kanzu Banking Core-Rafiki Dual Data Sync Strategy

The solution empowers financially underserved populations, aligns with the Interledger Foundation’s mission to foster open payments, and brings real-world ILP adoption to grassroots financial systems.

Project Update

Our project is progressing as planned and remains on track with the proposed timeline. So far, we have successfully submitted the following information for establishing a strong foundation for project alignment, communication, and stakeholder engagement.

- Project Charter

- Stakeholder Map

- Initial Project Timeline

In the next phase, we delivered the following documents which outlined key user needs, remittance service flows, and regulatory compliance obligations for RafikiRemit.

- Customer Needs and Remittance Service Flows for the customers in Pakistan

- Regulatory Compliance Plan (KYC-AML-CFT for Inward Remittances to Pakistan)

- Technical Specification Document & Architecture

A key milestone achieved has been the clear articulation of both the customer needs and compliance scope early in the project, which has helped streamline cross-functional collaboration.

We are now entering the next stage, focused on design, development and testing-related deliverables.

Progress on Objectives, Key Activities

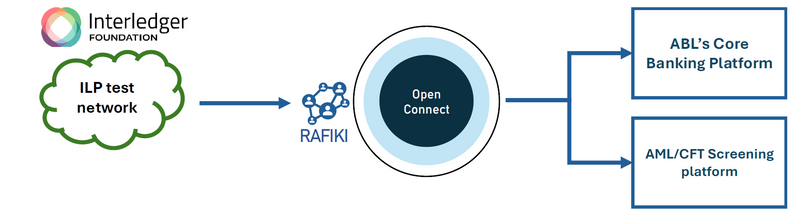

Our use case is around implementing a node of ILP Test network which enables ABL’s consumer accounts to become available as Wallets on the global ILP network. This enables the ABL account holders to receive remittances from other registered and regulated financial institutions on ILP network.

The envisaged high-level architecture of Rafiki integration with ABL’s systems involves the Rafiki Instance connecting to the ILP network and interfacing with ABL’s core banking through the Open Connect middleware, which also integrates with the bank’s compliance systems.

Integrate Interledger to Chimoney Wallets: Prototype — ILF Grant Final Report

Uchi Uchibeke for Chimoney ・ Aug 5

Chimoney’s Phase 2 prototyping project aimed to expand access to seamless global financial services by using Interledger Protocol (ILP). The objectives were to:

Simplify cross-border payments

Simplify developer access to ILP-based financial tools like Rafiki

Empower individuals and businesses in underserved markets or those who serve underserved markets

Throughout the project, Chimoney built and deployed a suite of ILP tools, including deploying Rafiki v1.1.2-beta (latest version at time of implementation), APIs for sending payment to a Payment Pointer, and for Payment processing, and Multicurrency Wallets, enabling issuing of Interledger Payment Pointers from a consumer App and via API by Businesses to their users. These tools enabled programmable money movement across countries and currencies and made sending payments as easy as sending a text. The Chimoney Dev Portal and API documentation were launched, with a focus on developer experience and ease of integration. Integrations with third-party services like Mobile Money providers and local banks in various countries were expanded. Chimoney also rolled out user-facing features, including a lightweight app that allows users to receive, send, and manage payments using Interledger Payment Pointers, Email, or Phone number.

Key outcomes include the creation of numerous Interledger-enabled Payment Pointers and the signing of new integration agreements with key organizations, alongside the successful launch of Chimoney's first-ever direct-to-consumer (B2C) product, the Chimoney App, positioning it as an ILP-powered consumer wallet for Canada & diaspora. Contributions were also made to the open-source community through SDKs, documentation, and active participation in events like Hacktoberfest, which saw substantial contributions via GitHub.

To read grant reports and updates from our last quarterly roundup, you can find them here. Be sure to read our September Newsletter to learn more about Interledger, and don't forget to sign up to get our news directly to your inbox!

Top comments (0)